Finding The Best Ridesharing Insurance For You - Trusted Choice - The Facts

dui laws credit score business insurance

dui laws credit score business insurance

cheap insurance credit score cheap auto insurance liability

cheap insurance credit score cheap auto insurance liability

When would I need rideshare insurance coverage? Normally, if you remain in the rideshare company _, _ you'll desire the ideal rideshare insurance policy endorsement. There are some states where full-time ride-share motorists are needed to obtain the more costly industrial insurance policy for job. Still, full-time TNC motorists might additionally select a rideshare insurance coverage endorsement.

Not just will you be covered the entire time you function with their application, however you'll likewise have the ability to profit. On-demand shipment motorists working for places like Uber Eats or Grub, Center are additionally instances of when you might need rideshare insurance protection. Because case, the food is the guest and must be insured.

There may be crash situations where you would not be covered, such as driving around awaiting your following rideshare customer from the application. Not only would you be responsible for the damages, however your costs may likewise boost for driving without insurance. The incredibly limited rideshare insurance offered by Uber and also Lyft can vary and result in gaps in the rideshare insurance policy provided in many states (vehicle).

dui risks laws affordable auto insurance

dui risks laws affordable auto insurance

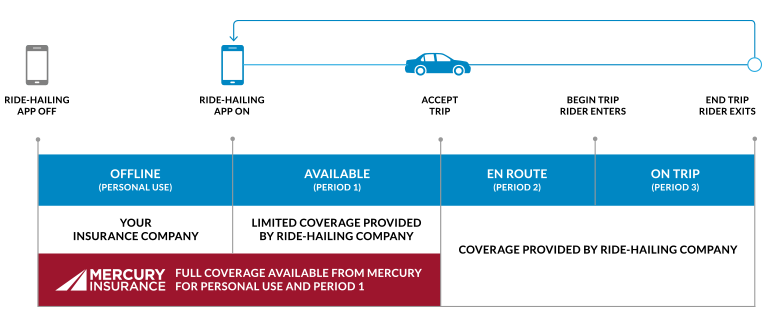

At this factor, the rideshare protection given by the rideshare business, generally Uber and also Lyft starts, as well as you're covered for this period. Period 3 Coverage, The rideshare passenger has actually entered the auto, and also you're driving them to their location on the application. Your rideshare protection from the TNC firm still covers you at this moment.

insured car low-cost auto insurance laws cheap auto insurance

insured car low-cost auto insurance laws cheap auto insurance

These car insurance plan can supply comprehensive as well as crash insurance coverage during duration 1. The rideshare insurance deductibles are less costly than those of Uber and Lyft, so it's not only the smarter selection for rideshare insurance however also the extra cost-effective one (cheaper car). Accident, detailed, clinical, and also injury protection are offered.

Not known Details About More Risk, Less Coverage: How Rideshare Insurance Rules ...

The duration 1 rideshare insurance coverage they offer just covers property as well as individuals entailed in a mishap that you caused (vehicle insurance). A Rideshare insurance policy recommendation from an insurer enables you to be covered in that occasion so you won't be stuck to connected prices of personal car repair service or medical fees.

Currently, we'll share a few takeaways regarding exactly how to get rideshare insurance, the costs, states it's available in as well as several of the technical rideshare coverage terminologies to find out about. What's the difference in between industrial insurance policy and also rideshare? Earlier, business as well as hybrid insurance policy was stated (cheapest car). Industrial insurance is normally a should when you're driving for business factors.

When it comes to ridesharing with an application, the sort of hybrid policy that is readily available combines a personal policy and also rideshare insurance coverage Discover more into one insurance plan with one collection of costs. This plan is specifically helpful because you would be able to use your automobile for personal as well as service reasons and still be guaranteed.

Industrial insurance coverage is the mainstream choice, yet its insurance coverage premiums can get expensive sometimes (cars). As previously talked about, a TNC can have its own insurance, with the insurance deductible setting you back anywhere from $1,000 to $2,500.A rideshare insurance coverage can cost upwards of $27 a month. Some states can even supply some coverage at $9 to $15 a month as well.

These are regular insurance elements as well as methodology. It's therefore that this plan is likewise a terrific alternative for part-time rideshare motorists. If you buy rideshare insurance, you can anticipate your deductible as an insurance policy holder to be much less than $1,000 in a lot of states. Rideshare insurance coverage sets you back compared to business insurance costsWith rideshare insurance, your yearly bill would look like $350 at the really the majority of.

Not known Incorrect Statements About Do I Need Rideshare Insurance If I Drive For Uber Or Lyft? - Mileiq

With that said type of cost savings, it appears a no-brainer which alternative would much better suit your spending plan. Both protect against a void in insurance when using an individual lorry for work-all 4 of the periods. Nevertheless, besides the massive cost difference, right here's some information on exactly how commercial and also rideshare insurance coverage are various.

Do Personal Vehicle Policies Cover Rideshare Drivers? No, an individual car plan will certainly not cover you when you are operating as a rideshare motorist.

This is when the ridesharing app is on, but you have not approved a fair. You are in the waiting periods, commonly already in your vehicle either at the start of a change or after having simply finished a drive.

Throughout the trip, rideshare insurance is still active and combines with the TNC commercial insurance coverage in order to provide optimal security must it be required. How Are Rideshare Drivers Protected With Rideshare Insurance Coverage?

car insured low cost money perks

car insured low cost money perks

If you wind up in an accident throughout Duration 1, you will be covered by rideshare insurance policy. Any type of guests you have actually gotten or are regarding to grab during that time will certainly also be protected - insure. Just How Much Does Rideshare Insurance Coverage Cost? The expense of rideshare insurance coverage differs from one chauffeur to another.

Best Rideshare Insurance – Coverage For Your Side Hustle Or ... Things To Know Before You Get This

Just how much you pay will be based on individual variables as well as exactly how much protection you would such as. You normally require to have a pre-existing car insurance coverage policy to add rideshare insurance policy. Contact an insurance policy agent to see what the requirements are and to get begun with a totally free quote.

Rideshare insurance policy follows the very same principles. Typically anyone can buy it. Where you may encounter some issues is if you have a suspicious driving document. If you are considered a risky driver by a supplier, you might be refuted coverage and would have to go through an insurer that concentrates on policies for such drivers.

What is The Minimum Protection Required For a TNC Chauffeur to Purchase a Rideshare Insurance Coverage Plan? There is commonly no set minimum you have to meet in order to buy a rideshare insurance plan. At the minimum, business will certainly need you to lug a personal auto insurance policy with them as well as then purchase rideshare insurance as a policy add-on - car insurance.

Can You Cover Numerous Automobiles With Rideshare Insurance Policy? As long as you have a current automobile insurance coverage plan that lists all vehicles you plan to make use of, you can include rideshare insurance coverage to them.

Do Rideshare Insurance Policy Policies Cover You if You Drive Another Vehicle? If you have actually not included rideshare insurance policy to the vehicle, after that no. Any kind of car you are making use of to operate as a TNC chauffeur needs to be mentioned on your auto insurance plan so it can receive the appropriate insurance coverage - cheap car insurance.

What Does How Much Is Rideshare Insurance? Everything You Need To ... Do?

If you stop working to divulge a lorry on your vehicle plan, your insurance coverage will not be able to offer you with insurance coverage. Do All Your Cars Demand Rideshare Insurance Coverage? If you have even more than one lorry, just the automobile you use as a TNC driver requires rideshare insurance coverage.

If you switch over in between automobiles each time you go out as a TNC vehicle driver, then you would certainly require to include the protection to every vehicle being used. That Does Rideshare Insurance Coverage Policies Cover? Rideshare insurance coverage will cover the TNC driver in addition to any travelers in the vehicle at the time of the case (auto).

They can be covered by your personal automobile insurance coverage policy too. The huge crucial point about rideshare insurance policy, though, is that it supplies you insurance coverage while working as well as safeguards your customers. Obtain a Rideshare Insurance Coverage Quote TodayIntrigued

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO