Getting My Do You Need Rental Car Insurance? To Work

Charge card coverage might be thought about either primary or second automobile service insurance policy: Primary coverage indicates that the charge card's protection would apply before your very own insurance coverage coverage Additional coverage implies that the bank card's protection would use just after any type of protection from your own insurance had been used, If you do not have an auto insurance coverage policy that covers leasing cars and truck damages, additional insurance…

DoorgaanToegevoegd door January Stlouis op 12 Mei 2022 op 5.59 — Geen reacties

7 Simple Techniques For What Happens When You Total A Car In Las Vegas? - Ladah ...

car insured cheaper cars affordable car insurance dui

car insured cheaper cars affordable car insurance dui

GEICO as well as various other insurance firms also utilize their own valuation software program during this action of the process. Compute the expense to fix your damaged car First, your insurance provider will certainly connect you with an insurance claims insurer. They will certainly then examine the damage to your car and also estimate the repair prices. Just like how insurance companies utilize software…

DoorgaanToegevoegd door January Stlouis op 9 Mei 2022 op 23.05 — Geen reacties

Car Insurance For 25-year-olds - Moneysupermarket for Dummies

car insurance auto insurance money low cost auto

car insurance auto insurance money low cost auto

Automobile insurance coverage does go down at 25. The average cost of cars and truck insurance policy for a 25-year-old is $3,207 for a yearly policy.

Our evaluation located that rates drop far more at various other one-year intervals. Keep reading for more information information about when automobile insurance policy does go down. When does cars and truck insurance coverage obtain less expensive for young…

DoorgaanToegevoegd door January Stlouis op 9 Mei 2022 op 17.18 — Geen reacties

Things about Deductible - Wikipedia

cheapest car auto car low cost auto

cheapest car auto car low cost auto

If you require to sue after a mishap or problem, you might need to pay an insurance deductible - car. That's the quantity you pay prior to your insurance coverage starts, and also it's different from your costs. After you pay the insurance deductible, the insurance firm covers the rest up to the policy restriction.

, as well as the insurance business will certainly pay the staying $2,500. Whether you have to pay an…

DoorgaanToegevoegd door January Stlouis op 2 Mei 2022 op 12.06 — Geen reacties

Finding The Best Ridesharing Insurance For You - Trusted Choice - The Facts

dui laws credit score business insurance

dui laws credit score business insurance

cheap insurance credit score cheap auto insurance liability

cheap insurance credit score cheap auto insurance liability

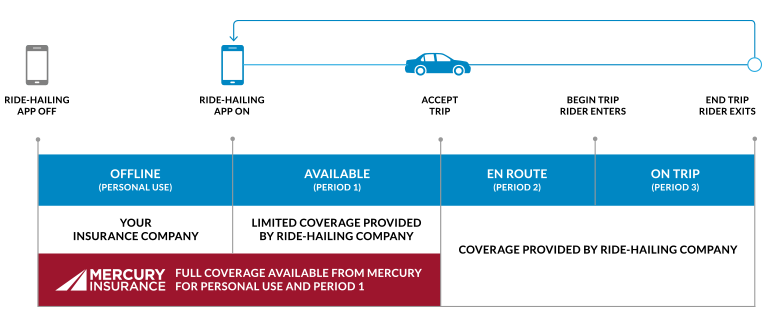

When would I need rideshare insurance coverage? Normally, if you remain in the rideshare company _, _ you'll desire the ideal rideshare insurance policy endorsement. There are some states where full-time ride-share motorists are needed to obtain the more costly industrial insurance policy for job. Still, full-time TNC motorists might…

DoorgaanToegevoegd door January Stlouis op 2 Mei 2022 op 1.31 — Geen reacties

Some Known Questions About How Much Does Pontoon Boat Insurance Cost? - Survival ....

In Texas, kids under 13 are disallowed from driving one unless an accredited operator that goes to least 18 is on board. For requirements where you live, get in touch with the boating governing agency in your state. Watercraft insurance coverage expenses and discounts Just how much you'll pay for boat insurance coverage depends on the level of insurance policy coverage you want, in addition to the size, horsepower, type as well as value of your watercraft.

Various other policies such…

DoorgaanToegevoegd door January Stlouis op 1 Mei 2022 op 12.27 — Geen reacties

Everything about Top Factors That Affect Car Insurance Rates In South Africa

Drive less, pay less! The individual features of the driver. Kind of car. Driving record. What triggers vehicle insurance coverage premiums to boost? Drivers who have an accident or moving offense (speeding, DUI, etc) on their car record are more of a risk for automobile insurers, causing higher car insurance policy prices.…

Toegevoegd door January Stlouis op 15 April 2022 op 8.16 — Geen reacties

Safeco Insurance - Quote Car Insurance, Home Insurance ... for Dummies

To discover the best low-cost automobile insurance choices it helps to comprehend how vehicle protection works. A car insurance coverage consists of six basic kinds of coverage: Liability Coverage: If you trigger a wreck, this part of your vehicle policy pays to fix the damage you caused both property damage and bodily injury to someone else - cheap insurance.

These cover most of the scenarios you might get in as a motorist and vehicle owner. Together with your driving record, these…

DoorgaanToegevoegd door January Stlouis op 7 April 2022 op 23.08 — Geen reacties

Not known Facts About Do I Need Car Insurance Before Buying A Vehicle? - Kelley ...

Constantly tell the reality about any traffic infractions you've gotten, due to the fact that the insurance provider will learn, and it will affect your premiums. Some insurance provider will decline you if you did not have at least 6 months of previous automobile insurance protection, however that's not the case with The General.

Select ... Select ... SUMMARY WHAT'S COVERED METHODS TO SAVE FAQ The Journey Begins Here With a Vehicle Insurance Estimate It fasts and simple to get a cars…

DoorgaanToegevoegd door January Stlouis op 6 April 2022 op 23.48 — Geen reacties

How How Much Does Commercial Auto Insurance Cost? - Get Quotes can Save You Time, Stress, and Money.

One of the reasons automobile insurance coverage rates differ by state is that each state has its own insurance laws. Thus, making it the most inexpensive state for vehicle insurance.

The factor these states come with sky-high premiums differs; whatever from unique insurance plans, high-density populations, heaps of uninsured chauffeurs and expensive claims will always press up premiums. When it comes to low-cost states, the top 2 stayed the very same, with Maine being the most…

DoorgaanToegevoegd door January Stlouis op 6 April 2022 op 1.01 — Geen reacties

Nieuwste blog-berichten

- Getting My Do You Need Rental Car Insurance? To Work

- 7 Simple Techniques For What Happens When You Total A Car In Las Vegas? - Ladah ...

- Car Insurance For 25-year-olds - Moneysupermarket for Dummies

- Things about Deductible - Wikipedia

- Finding The Best Ridesharing Insurance For You - Trusted Choice - The Facts

- Some Known Questions About How Much Does Pontoon Boat Insurance Cost? - Survival ....

- Everything about Top Factors That Affect Car Insurance Rates In South Africa

Populairste blog-berichten

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()