Facts About Homeowners Rate Comparison Guide An Online Tool To Help ... Revealed

If you still owe money on your home, your loan provider will certainly require you to have it. Even though it's not legitimately called for, house owners insurance policy is a good idea due to the fact that it helps secure your house as well as various other properties. Discover extra: 10 actions to locate the right residence insurance coverage 3 concerns to ask prior to you acquire house insurance policy Kinds of property owners protections Homeowners plans combine numerous kinds of coverage into one policy (insurer).

pays clinical expenses, shed incomes, as well as various other costs for individuals that you're legally in charge of hurting. It also pays if you're liable for destructive someone else's building. It additionally pays your court sets you back if you're sued due to a mishap. pays the clinical costs of people injured on your home.

Discover more: Do you have adequate home insurance? Watch: Guaranteeing life's prizes What threats does a house owners plan cover? Your home owners policy shields you versus different dangers, or hazards. Threats and also risks are things that could harm your house or building. This table shows usual threats that a lot of plans do and do not cover.

To be totally secured, make certain your policy has replacement cost protection. If you have to change your whole roof covering after a storm, a substitute price policy would pay for a new roof covering at today's prices.

Not known Details About Homeowners Insurance - Get A Fast And Free Quote - Geico

After your $2,000 insurance deductible, your firm would certainly pay $5,000. You 'd have to pay the rest of the price of the brand-new roofing yourself.

The Texas Cyclone Insurance Policy Association (TWIA) markets wind and also hailstorm insurance coverage for coastal locals. You buy TWIA insurance coverage from local insurance coverage representatives. Relying Additional resources on where you live, you might need flooding insurance policy before TWIA will certainly offer you a policy. You likewise may require a house examination by an engineer or a hurricane examiner.

The structure owner's policy does that. You might not require tenants insurance policy if you're still a reliant. Your parents' homeowners plan might cover your property, also if you're not living in the house. credit. covers your personal effects and also the inside of your unit. It additionally supplies responsibility defense and pays extra living expenditures.

The difference depends on whether the property owners organization has a master plan that covers the exterior. If it does, you can purchase a plan that covers just the inside. If the organization's master policy does not cover the exterior, you can buy a plan that covers both the inside as well as outside.

Getting My How Much Is Homeowners Insurance? - Bob Vila To Work

Insurer might appeal our choices. Exactly how do business determine what to bill me? Insurer make use of a procedure called underwriting to decide whether to market you a plan and just how much to charge you. The amount you pay for insurance coverage is called a premium. Each firm's underwriting guidelines are different.

It also implies that different firms bill different rates. Most firms consider these things when picking your premium: Business can't transform you down even if of your house's age or value, yet they can charge you much more. Homes with higher substitute expenses have higher premiums. Costs are greater for houses built completely of wood.

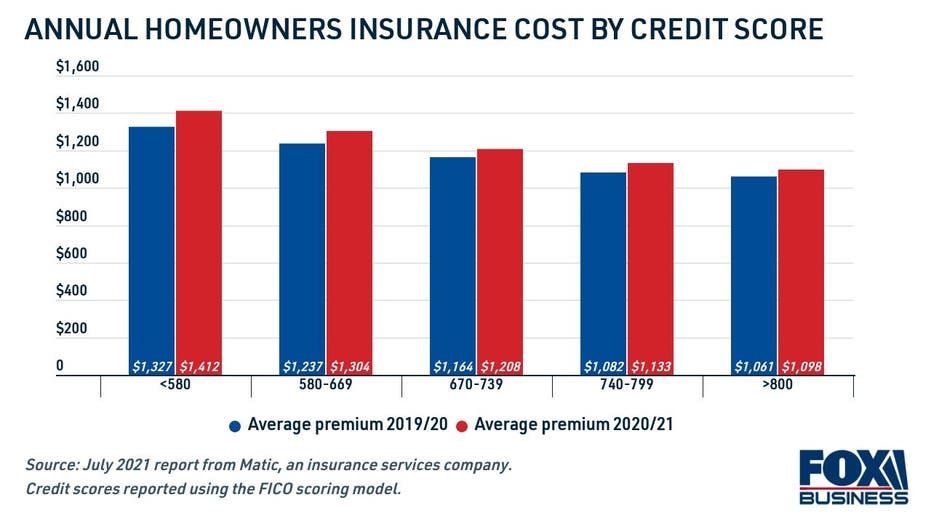

Costs are reduced for houses that are close to fire terminals. Some business use your credit report rating to choose what to bill you.

turn you down, charge you extra, or treat you in different ways than other individuals in your price or risk class unless the company can show that you're a greater risk than others. transform you down or charge you extra only since of your credit report (insurance). Saving money on your insurance Ask your agent about discounts.

Examine This Report on Property Insurance Rates Climb In Florida - Wjhg

Each business decides what price cuts to offer and the quantity of the discount rate. You could be able to get a discount if you have: a burglar alarm.

Check out Help, Guarantee. com to figure out what discount rates companies offer. Safeguard your house and building from crime. The business you selected with the very best policy and also price could not wish to sell you insurance policy if your house remains in negative shape. To aid protect your residence versus burglars: Install dead bolts on doors as well as home windows.

Write a recognition number on your residential or commercial property to help recognize things if they're stolen. Keep your house and backyard in good form. Someone from the insurance provider will check the beyond your home when you request insurance policy. Business might charge you extra or refuse to guarantee you based on what they see.

affordable insurance lowest homeowners insurance a home and home insurance low cost homeowners insurance

affordable insurance lowest homeowners insurance a home and home insurance low cost homeowners insurance

For example, state your premium is $100 a month, or $1,200 a year. If you paid for the full year beforehand, but after that cancel your policy after one month, the company would certainly owe you $1,100 in unearned costs (a home insurance). suggests a firm declines to renew your policy when it runs out.

Average Home Insurance Cost - Everquote for Beginners

inexpensive insurance premiums insurance premium lowest homeowners insurance insurance cheap

inexpensive insurance premiums insurance premium lowest homeowners insurance insurance cheap

deductible homeowners insurance lowest homeowners insurance condo insurance cheapest homeowners insurance

deductible homeowners insurance lowest homeowners insurance condo insurance cheapest homeowners insurance

Your residence is vacant for 60 days or more. A lot of companies quit your insurance coverage if your home is vacant for that long. They typically don't quit your obligation insurance coverage, though. If you prepare to be out of your home for a prolonged time, talk to your firm to make certain your insurance coverage proceeds.

It can elevate your rates. What happens if I can't find a firm eager to guarantee me? If you can't find a firm to sell you a plan, you could be able to get coverage via the Texas FAIR Plan Organization or a surplus lines insurance coverage firm. FAIR Plan as well as excess lines protection is more pricey than protection from a basic insurance provider.

You can obtain FAIR Strategy protection if you can not discover a Texas-licensed business to guarantee you and at the very least 2 firms have actually transformed you down. They don't have a Texas certificate, they need to fulfill state criteria to sell insurance policy here.

The insurance provider will certainly base its settlement on the insurer's price quote. After the business assigns an adjuster to your insurance claim, the adjuster will most likely be your primary contact with the company. If the damages ends up being worse than the insurance adjuster originally assumed, you or your contractor can speak with the insurer regarding elevating the estimate.

Excitement About Reduce Your Homeowners Insurance With These Clever Tricks

The deadline may be much longer after significant calamities. If the insurer does not satisfy the settlement deadline, you can file a claim against the company for the quantity of the insurance claim, plus rate of interest as well as lawyer costs. security systems. There are some exemptions to the deadlines: A business that needs even more time can take 45 days to choose whether to pay your claim.

You can hire a public insurance policy insurer to help you. Public adjusters function for you, not the insurance coverage business. Before you hire one, make sure you recognize what you'll have to pay (and home insurance).

The home mortgage firm will transfer the check and also release money to you as the work is done. The home loan company might ask you to find out more prior to it releases cash to you - inexpensive. You might require to provide the home mortgage company a checklist of the job to be done as well as cost estimates, info about who's doing the work, and also timelines.

If you reach your plan's ALE dollar limits prior to your residence is completely repaired, you'll need to pay the rest of your additional living expenses out of your very own pocket (affordable). Solving problems If you differ with the insurer's quote or the amount the company is providing to pay you, inform the insurance policy company why.

Facts About How To Buy Homeowners Insurance - 2022 Guide - U.s. News

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO