Not known Details About 8 Best Renters Insurance Companies In California 2022

The fire spreads throughout your area burning your ownerships and also the building. If you have Building Insurance after that the rebuilding for these problems are covered. Building insurance will typically cover not just the cost to replace your damaged content but also the price to clean up the debris from the area.

One of your employees slips on the slippery flooring and also obtains wounded. Workers Settlement insurance policy can pay for the employee's clinical prices as well as shed wages from being out of job.

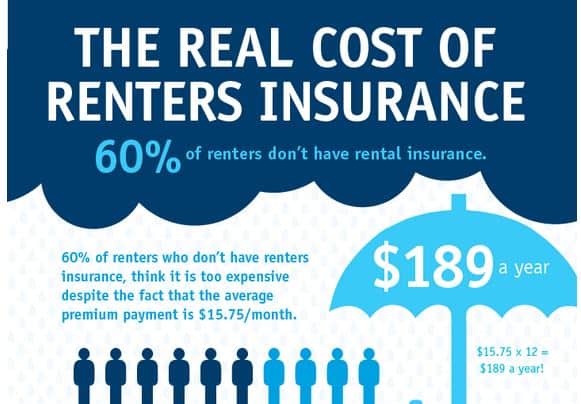

What is Renters Insurance coverage? Tenants insurance safeguards your personal effects versus damage or loss, as well as guarantees you in instance someone is hurt while on your property. The costs for tenants insurance policy average in between $15 and also $30 per month relying on the area and also dimension of the rental as well as the policyholder's ownerships.

This is seldom the situation, proprietors generally have a policy for the physical structure they have, yet not for an occupant's individual possessions. If you cope with roommates, each private occupant might require their very own occupants insurance coverage plan to protect their ownerships as some policies just cover one specific occupant in contrast to whatever in the rental itself. price.

For instance, if you lose a stereo that was acquired 5 years prior to the case, you will be reimbursed for the existing worth of the system (insure). This might result in a reduced insurance claim payment than you expect. Substitute cost coverage, on the various other hand, will certainly reimburse the amount of the new audio system after you purchase the new system as well as submit your receipts.

An Unbiased View of Renters Insurance: Is It Needed And Is It Worth The Cost? - Aol

Does Everyone Required Tenant's Insurance? It s always a good idea to take preventative measures to secure on your own and also your items. If an university student is under 26 years of ages, registered in classes and also residing in on-campus real estate, the student might be covered under his or her moms and dads property owners or tenants insurance coverage (options).

On average, a reliant is covered for approximately 10% of the parent s policy. Double check with your insurance policy representative pertaining to the specific arrangements of your policy. Other Sights Pertaining To Renters Insurance policy When a claim is reported, the insurer will ask the insurance holder for receipt for all things reported on the case (affordable).

It also is an excellent concept to take images or video footage of any type of personal belongings for documentation, making certain it is saved in a safe and secure, off-site area. low cost. When establishing just how much, if any type of, renters insurance coverage you need to buy, approximate the worth of your individual possessions. This is the quantity of insurance policy you will require to change the materials of your home if whatever were ruined.

When renters rent a house, nonetheless, most do not acquire occupant's insurance coverage., just 40% of renters have occupant's insurance coverage.

Unlike traditional homeowner's insurance coverage plans, this kind of insurance coverage does not provide any protection for the physical residential property structure, considering that the renter does not have any kind of possession in the structure. It is insurance policy of what the lessee does own: their belongings - rental. What Does Renters Insurance Coverage Cover? Every renter's insurance plan will certainly differ based upon the insurer and the kind of protection you are looking for.

The Ultimate Guide To Compare Wichita Falls Renters Insurance Rates

renter insurance property management affordable renter's insurance apartment insurance discount

renter insurance property management affordable renter's insurance apartment insurance discount

cheapest liability option rental renter

cheapest liability option rental renter

Insurance coverage may additionally consist of court expenses as well as attorney's fees. This is why it is so important to have personal responsibility protection.

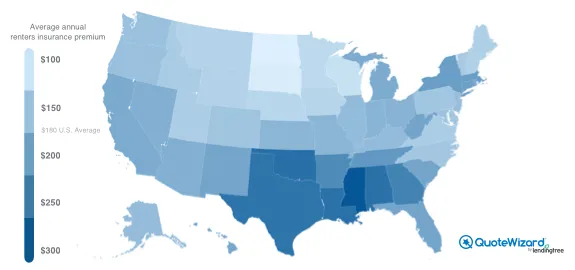

This figure is indicated to offer occupants a ball park on rate since there are unlimited variables that could trigger a plan to be basically costly than the nationwide average. discount. Aspects That Could Increase Your Rate There are a number of reasons you might pay even more for occupant's insurance: Living in an area with high crime or many natural calamities will create you to pay more for occupant's insurance policy.

If you have actually had several insurance claims or there have been numerous insurance policy asserts at the residential property where you live, your premium may be higher. If you have an inadequate credit report, you will likely pay more for an insurance plan. This sort of policies compensates you for a thing that approaches the product that was shed.

Variables That Can Reduced Your Rate There are a number of factors that can lower your tenant's insurance coverage rate: If you picked a policy with a higher insurance deductible, say $1000 rather than $500, your monthly premiums will certainly be lower - property insurance. This type of policy compensates you for what the product would deserve now, not when you bought it.

coverage apartment insurance liability renters insurance renter insurance

coverage apartment insurance liability renters insurance renter insurance

Renters insurance is concerning peace of mind. Or if you would certainly instead speak to a person about your tenants insurance choices, you can give us a phone call or obtain a quote from one of our certified independent representatives.

Facts About How Much Does Renters Insurance Cost Uncovered

rental insurance option coverage price property

rental insurance option coverage price property

Many renters are under the perception that their property manager's insurance coverage will certainly cover them in case of a disaster, which is not the instance - renter's. A proprietor's insurance only secures the constructing a renter stays in, not their personal effects. To obtain reimbursement for personal residential or commercial property damaged or destroyed, renters insurance policy can aid.

When a fire destroys your house or house, the loss can be ruining. Insurance coverage can take a few of the sting out of that loss by compensating you for the price of changing a minimum of several of your properties. Tenant's insurance typically covers residential property damages or loss caused by theft, vandalism, severe storms, hurricane, hurricanes, rain, wind, and fire.

A lot of policies likewise consist of responsibility protection, which safeguards a lessee if someone gets hurt when seeing their home or apartment or condo. The expense of renter's insurance is typically less than homeowner's insurance policy since it covers only individual residential property and also obligation, not the framework. According to the Connecticut Insurance policy Division, premiums for tenant's insurance standard between $15 and also $30 each month depending upon the location as well as size of the rental and the insurance holder's ownerships.

Like riding a bike without a headgear, renting out a house without insurance coverage is normally okay until something takes place. That's why a lot of people consider these basic safeguards to be sound judgment protection - lease. As well as while occupants insurance coverage features a price, it's a quite small one that can wind up conserving you 10s of hundreds of bucks when something fails.

You just require to decide which of the two types of coverage you want: If your 5-year-old computer is taken and also you have a cash worth policy, the insurer will certainly pay you just what it Check out the post right here would deserve today. coverage. Thinking about the decade of depreciation, that might be significantly much less than what you when paid for it.

Fascination About How Much Is Renters Insurance?

With renters insurance, though, your insurance coverage would cover your buddy's expenses because situation, or at any time someone receives an injury on your properties. What do you do if a fire bursts out in your building, leaving your home uninhabitable for a while? Renters insurance can cover any kind of out-of-the-ordinary expenses that come up as a result of that loss of sanctuary, like a resort area and food charges.

If you reside in an oceanfront building or an earthquake-prone zone, however, you may want to consider purchasing different protection for certain disasters (cheapest). Damages caused by mold and mildew can be a complicated issue for both renters and also property owners insurance coverage. Numerous policies have particular exclusions on mold and mildew damage or consist of caps on protection.

As an example, if the mold and mildew damages was created by something like a ruptured pipeline or leakage, occupants insurance policy will generally cover that unless there's an exclusion. If the mold is triggered by one

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO