Not known Facts About Do I Need Car Insurance Before Buying A Vehicle? - Kelley ...

Constantly tell the reality about any traffic infractions you've gotten, due to the fact that the insurance provider will learn, and it will affect your premiums. Some insurance provider will decline you if you did not have at least 6 months of previous automobile insurance protection, however that's not the case with The General.

Select ... Select ... SUMMARY WHAT'S COVERED METHODS TO SAVE FAQ The Journey Begins Here With a Vehicle Insurance Estimate It fasts and simple to get a cars and truck insurance coverage quote. When you hit the road, feel great that you, your enjoyed ones and your pockets are properly protected. Let us fret about the threats of the road, while you take pleasure in the freedom of the flight.

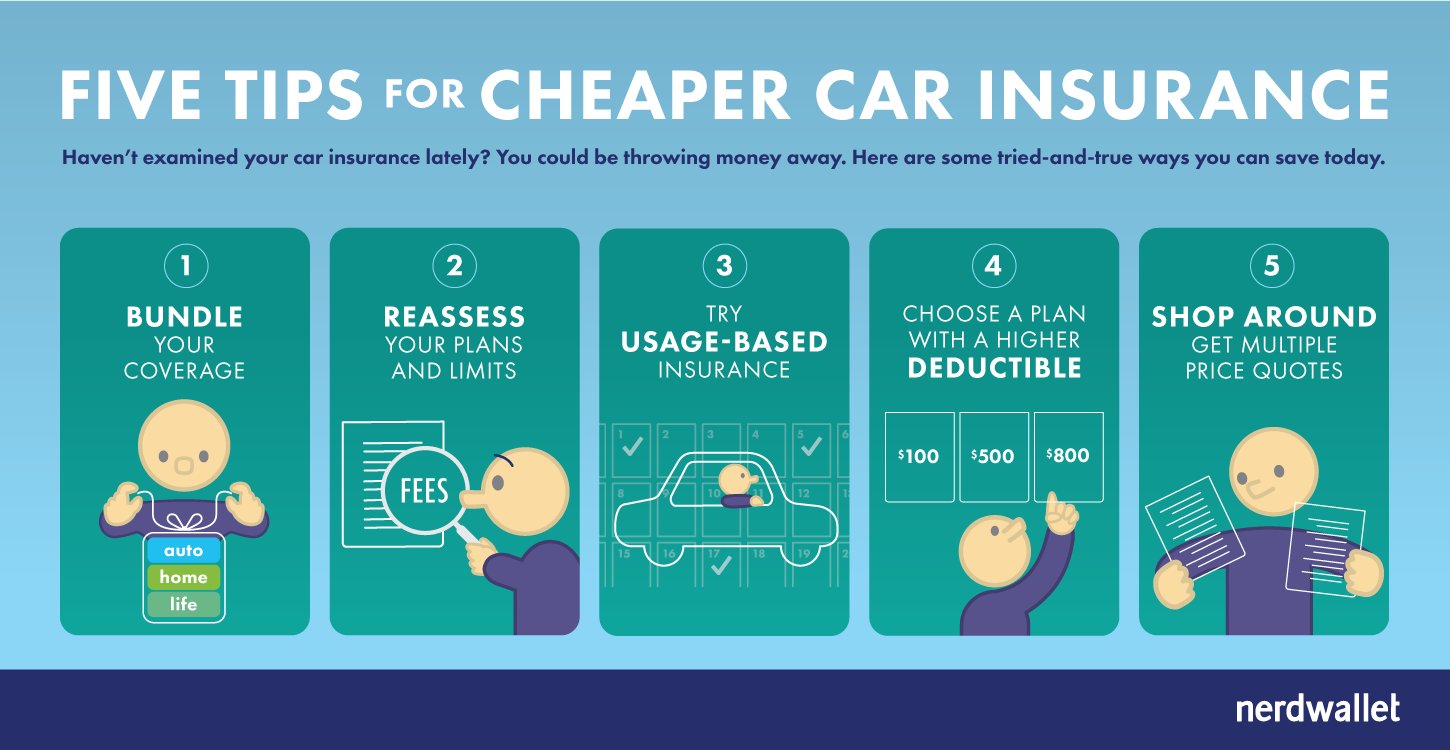

Ways to Minimize Automobile Insurance coverage Where readily available, purchasing several policies such as vehicle and home insurance with the exact same business, maintaining a safe driving history and paying through electronic fund transfer might be manner ins which you can conserve money on car insurance coverage. Bundling several insurance plan can lead to premium discount rates - credit score.

Associated Products Protect your house the method it protects you by choosing the property insurance protection that meets your requirements - car. This liability protection might exceed and beyond your vehicle and home insurance coverage to assist secure you from unanticipated occasions. Occupants insurance coverage can help to cover more than your personal property.

Select ... OVERVIEW WHAT'S COVERED WAYS TO SAVE FREQUENTLY ASKED QUESTION.

Is it much better to buy your vehicle insurance online or overcome a representative? That depends on your needs and what you're comfy doing. In this short article, we at the Home Media examines group explain where you can buy online automobile insurance coverage and when you might be much better off calling an agent. insured car.

Where to acquire car insurance online Nearly every significant insurer offers a method to get quotes for cars and truck insurance coverage online, though some require you to get in touch with an agent before you can finalize your purchase. Numerous companies, however, permit you to complete the whole process on the internet, from quote to buy.

Little Known Facts About How To Get Car Insurance Before Buying A Car - Getjerry.com.

The basic types of cars and truck insurance coverage consist of: Here are some actions to follow to get cars and truck insurance online: 1 - cheap insurance. Get an online automobile insurance coverage quote The initial step is to get a quote either through an insurance provider's site or by using a totally free car insurance coverage quote tool like the one listed below.

Compare quotes After you provide the essential details, some websites might provide instant vehicle insurance estimates that permit you to see the expense for the level of protection you pick. Other business might request your phone number or email address and have an agent contact you with your quotes and options.

3. Select coverage Insurance providers that permit you to purchase a policy online will guide you through the purchase procedure, which ought to be simple. You'll be asked to choose the protection you want as well as add-on alternatives like roadside support or accident forgiveness. 4. Pay Set up a payment method and input the necessary details.

Print your card Lastly, print your insurance card from house. Expense of online automobile insurance coverage According to our rate estimates, complete protection cars and truck insurance costs an average of about $144 per month ($1,732 per year) for good drivers.

In our January 2022 cars and truck insurance study, we found 41% of respondents had actually experienced a rate increase without an apparent cause. What affects the expense of vehicle insurance? The expense of any automobile insurance policy will depend upon a number of elements, including your: Location Driving history Credit rating (other than in California, Hawaii, Massachusetts and Michigan) Car Age Marital status Coverage selection Deductible Is it more affordable to purchase insurance online or through a representative? It is typically cheaper to purchase car insurance online, as there are no representative costs or markups.

Car insurance coverage expenses by state Even if you purchase automobile insurance online, expenses can differ significantly by area. Here are yearly and monthly cars and truck insurance expense price quotes by state. Should you purchase vehicle insurance online?

Use the tool listed below to compare online car insurance prices quote from top business in your location, or check out on to read more about two of our advised service providers, Geico and USAA. Geico: Editor's Choice In our industry-wide evaluation, we rated Geico among the top cars and truck insurance providers in the nation (cheaper car insurance).

Rumored Buzz on How To Get The Most Accurate Car Insurance Quotes Online

Discounts like those for being a great chauffeur (up to 26% off), being an excellent student (up to 15% off) and having several automobiles on your policy (up to 25% off) are just a few of the methods to save with Geico.

USAA: Low Rates for Military USAA scored the highest in every region in the J.D. Power Vehicle Insurance Coverage Study. The business is also understood for dependable claims service. It scored 909 out of 1,000 points in the, greater than all other service providers. To be eligible for an automobile insurance policy with USAA, you should be a member or veteran of the United States military or have a member of the family or partner that is a USAA member.

The end outcome was an overall score for each provider, with the insurers that scored the most points topping the list. Here are the factors our scores take into consideration: Cost (30% of overall rating): Automobile insurance coverage rate estimates created by Quadrant Info Services and discount chances were both thought about.

Automobile insurance coverage is required to secure you financially when behind the wheel. Whether you just have fundamental liability insurance coverage or you have complete vehicle protection, it is essential to guarantee that you're getting the very best deal possible. Wondering how to lower car insurance!.?.!? Here are 15 strategies for minimizing car insurance costs.

Lower car insurance rates might likewise be available if you have other insurance policies with the same business. Cars and truck insurance coverage expenses are various for every motorist, depending on the state they live in, their option of insurance coverage company and the type of protection they have.

The numbers are relatively close together, suggesting that as you budget for a brand-new vehicle purchase you might require to consist of $100 approximately each month for auto insurance coverage - car insurance. Note While some things that affect car insurance rates-- such as your driving history-- are within your control others, costs might likewise be affected by things like state policies and state mishap rates.

Once you understand how much is vehicle insurance coverage for you, you can put some or all of these tactics t work. 1. Benefit From Multi-Car Discounts If you get a quote from a vehicle insurer to insure a single vehicle, you may end up with a greater quote per vehicle than if you asked about guaranteeing several chauffeurs or cars with that company (automobile).

Our Another Pain Point For Us Motorists: Car Insurance Costs - Cbs ... Statements

If your child's grades are a B average or above or if they rank in the leading 20% of the class, you might be able to get a great student discount rate on the protection, which typically lasts up until your kid turns 25 - accident. These discounts can vary from just 1% to as much as 39%, so make sure to reveal proof to your insurance coverage representative that your teen is a good trainee.

Allstate, for example, uses a 10% car insurance coverage discount rate and a 25% house owners insurance coverage discount rate when you bundle them together, so check to see if such discounts are available and appropriate. Pay Attention on the Road In other words, be a safe motorist.

Travelers uses safe driver discount rates of in between 10% and 23%, depending upon your driving record. For those uninformed, points are normally evaluated to a chauffeur for moving violations, and more points can lead to higher insurance premiums (all else being equivalent) (credit). 3. Take a Defensive Driving Course In some cases insurance business will supply a discount for those who finish an authorized defensive driving course.

Make certain to ask your agent/insurance business about this discount rate before you sign up for a class. After all, it is very important that the effort being expended and the expense of the course translate into a big sufficient insurance coverage cost savings. It's likewise essential that the motorist register for an accredited course.

, think about shopping around and getting quotes from contending business. Every year or 2 it most likely makes sense to get quotes from other business, simply in case there is a lower rate out

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO