The Ultimate Guide To Small Business Owners' Insurance - Florida ...

If you're like numerous business proprietors, you do not like buying insurance policy. You would certainly rather conserve the money you invest on costs and also utilize it to pay lease, pay-roll, or various other overhead. While skimping on insurance policy may be tempting, you ought to prevent need. An uninsured loss might cost your service many times a lot more than the cost of a real insurance plan.

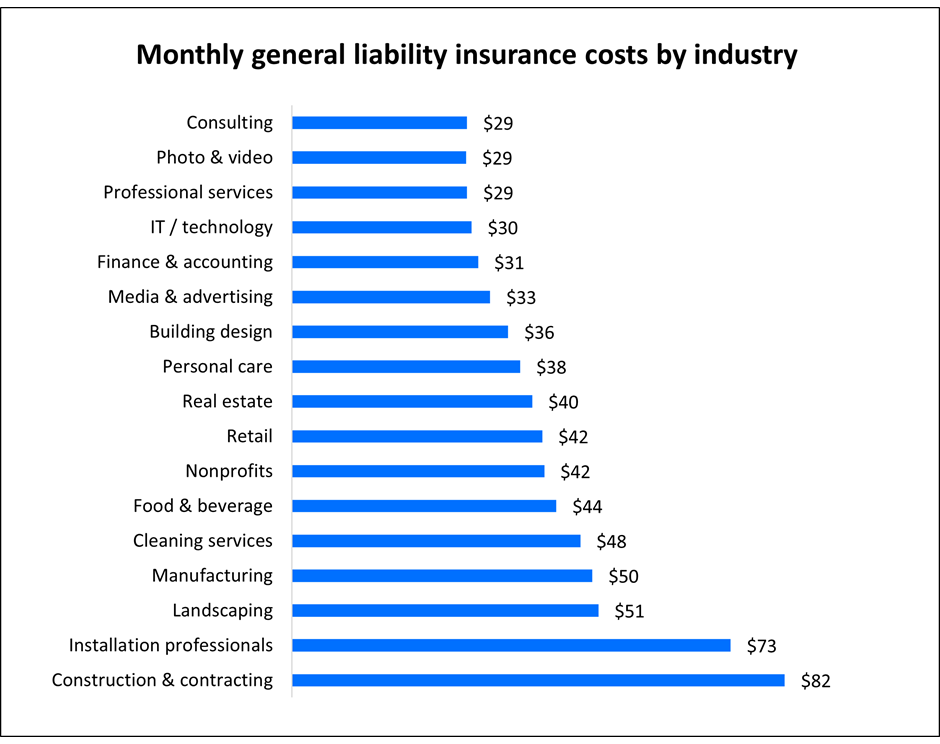

Below are some points insurance providers think about when computing your premium.: All organizations have risks and also some are riskier than others. They pay more for insurance coverage than those with less threats.

The business tracks the premiums its customers pay as well as the insurance coverages they acquire, arranged the information, as well as after that releases the outcomes on its internet site. You can use this information to estimate your cost of insurance. Price of Insurance Coverage Varies By Kind Of Coverage The cost of insurance differs by the kind of protection.

errors and omissions insure insurer commercial commercial

errors and omissions insure insurer commercial commercial

If you aren't certain what insurance coverages you need, ask your representative or broker what types and limits of insurance companies like your own commonly get - businesses.

Whether a business has one Discover more here or a hundred workers, sells products or deals services, runs from a business place or a home, there are numerous kinds of insurance coverage offered to manage the dangers of a little company. Make sure to seek advice from an accredited expert agent that can best match you with the coverages you require for your service - errors and omissions.

The Greatest Guide To How Much Does Insurance Cost For A Small Business? - Kbd

Small company proprietors that operate out of their house demand to take into consideration numerous variables. Initially, they must recognize that blending their home with their company can create protection issues. small commercial insurance. Service proprietors running out of their residences may wish to contact their homeowners insurance company concerning acquiring an endorsement to their homeowners plan to cover service tools, supply, products, the part of the home made use of for organization objectives and responsibilities arising from business.

The secret is to discuss every one of this with a certified agent to determine which choices will certainly provide the very best insurance coverage for the organization. These are several of the kinds of insurance policy a tiny organization owner should consider: gives coverage for damages to the structure as well as materials of the company building.

comes in numerous types and covers such things as the settlement, performance and also conclusion of an agreement - insurance small business.

This is partly because of the number of cases each insurance provider has gotten for every provided occupation. Data based upon around 110,000 Biz, Cover customers with less than 10 employees who purchased during the monetary year 2018/ 2019 As you can see from our information, companies that operate in the wholesale, drug stores and retail sector have the highest possible base costs, which is mainly as a result of them being possibly accountable for accident or property damage that may be caused by the products they produce or offer, under the responsibility provisions of the Australian Consumer Regulation. liability insurance.

general liability insurance small businesses insurance carriers errors and omissions insurance insurance small business

general liability insurance small businesses insurance carriers errors and omissions insurance insurance small business

Business disturbance insurance covers the expected revenue the business would certainly have earned, based on a history of financial documents, had the disaster not took place - liability. Relevant note: As pointed out over, Flood Insurance coverage is generally not covered in a standard company residential property plan.

The Main Principles Of Small Business Insurance Quotes

However, a business disruption insurance coverage may cover loss of organization connection due to the flood, or relevant occasions. Your plan must specify regarding what is covered. professional liability.

So exactly how do you figure out just how much insurance policy is enough however not also much? Utilize the complying with process to help you buy enough insurance coverage without overdoing it: Ask on your own if the insurance coverage in concern is designed to safeguard you in the event your is harmed or whether it protects you from the related to injuring other individuals and their home - errors and omissions insurance.

To help you establish the amount of residential property insurance you must carry you need to: If a financial institution or various other industrial loan provider has actually given you a car loan on the piece of residential property that you will guarantee, you must usually preserve a particular degree of insurance according to the lending contract. cyber liability.

The 2nd value is what it would certainly set you back to the building if it was lost to fire, theft, or various other regrettable conditions. If your organization might not do without the residential or commercial property in concern, you probably require to insure the home for its replacement value.

Figuring out just how much obligation insurance you need to safeguard your organization can be complicated as well as definitely not a specific scientific research. Think about the the following to assist guide you: Ask your representative or state insurance commissioner whether there are any kind of minimum insurance degrees established by regulation. Check to see whether these limits are greater if you are in a certain kind of organization, or if you need to have greater insurance coverage to do company with the state as well as strategy to do so.

Top Guidelines Of How Much Does General Liability Insurance Cost?

Take a look at the framework of your organization. If your organization is incorporated and also you comply with all the guidelines of running your service as a corporation, you can possibly escape buying insurance policy with reduced limitations. In the event you're filed a claim against and shed, just the possessions of the firm may be taken to please a judgment. cyber insurance.

As a basic regulation, if you're a small company owner, it's probably much better to be a little overprotected on the obligation side, versus the residential or commercial property side, of the insurance coverage formula. Carrying just the minimum amount of obligation insurance coverage on a vehicle that is needed in your state leaves you vulnerable.

If you have followed these steps, it needs to help you to restrict your insurance policy coverage to what you require. If the quotes from your representative still seem also high, or have you been told that particular facets of your service are uninsurable, you might wish to check out some options to insurance.

If you experience a pricey loss in your startup phase as well as do not have insurance coverage, you may not be able to afford the monetary repercussions of the loss while still keeping your organization afloat. commercial. The expense of business insurance coverage can be much more budget friendly than you think, Tru, Shield has the ability to provide local business policies beginning at just Tru, Guard's little organization plans start at as little as $42/month.

This can differ from market to industry. If you're a graphic developer, you might not have any kind of tools or devices that need insurance coverage aside from your computer. Service providers, on the various other hand, will likely have a great deal of costly devices and tools that they need covered in the occasion of a loss.

The Best Strategy To Use For How Much Does Business General Liability Insurance Cost?

insurance business cyber insurance insurance business businesses cyber insurance

insurance business cyber insurance insurance business businesses cyber insurance

Recognizing the different kinds of protections readily available to small company owners can be frustrating, yet we're here to aid (business insurance company). Our demand a quote device can provide you a fast quote on just how much your service insurance coverage would cost all you have to do is answer a couple of inquiries concerning your business.

Whatever's online. Every little thing's simple. Tap the button to start - errors and omissions insurance. Instantaneous Price quote

Coverage for your/ in the occasion of an unpredicted occasion Protecting your small company car fleet Coverage for your structure, supply or various other residential property in case of damage or theft Safeguarding your local business against suits; additionally known as Business General Liability (CGL) The tiniest of local business have distinct insurance coverage needs Insurance for your staff members Contrast

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO