The Definitive Guide for Homeowners Insurance Quotes - Usaa

An older home with obsolete plumbing as well as older wiring can raise your costs or make a house ineligible for protection - cheap homeowners insurance. While you can't change the building date of your home, you can make updates that make the home more secure and much more affordable to guarantee. If you have a vast, high-value home that is customized, it's going to set you back even more to guarantee it for its replacement cost.

condo insurance cheaper homeowners insurance a home insurance claims a home

condo insurance cheaper homeowners insurance a home insurance claims a home

Finding Cheap Property Owners Insurance Policy: Ways to Save While you can't regulate some aspects that influence your property owners insurance price, such as your house's place, its age, as well as its substitute cost, there are some points you can do to lower your rates. homeowner insurance. These suggestions can aid you get the least expensive homeowners insurance possible without compromising the quality of your coverage.

insurance liability insurance insurance premium low cost homeowners insurance credit

insurance liability insurance insurance premium low cost homeowners insurance credit

Obtain the Right Amount of Insurance coverage When you discover an insurance policy service provider you count on, this part ought to be very easy. A great insurance company will certainly assist you choose the suitable amount of protection for your home, your items, as well as your liability.

Relying on where you live, you can get a 5 to 7. 5 percent price cut on your insurance policy from Kin when you have evidence of a centrally monitored security system (landlord). Kin uses customers a discount rate when they have a system that instantly turns off the water when a leak is discovered.

, which is based on your debt rating, as a variable to determine your costs. The logic is the far better your score, the much less likely you are to make a claim (and consequently, you qualify for lower rates).

How Much Homeowners Insurance Do I Need? - Iii Can Be Fun For Everyone

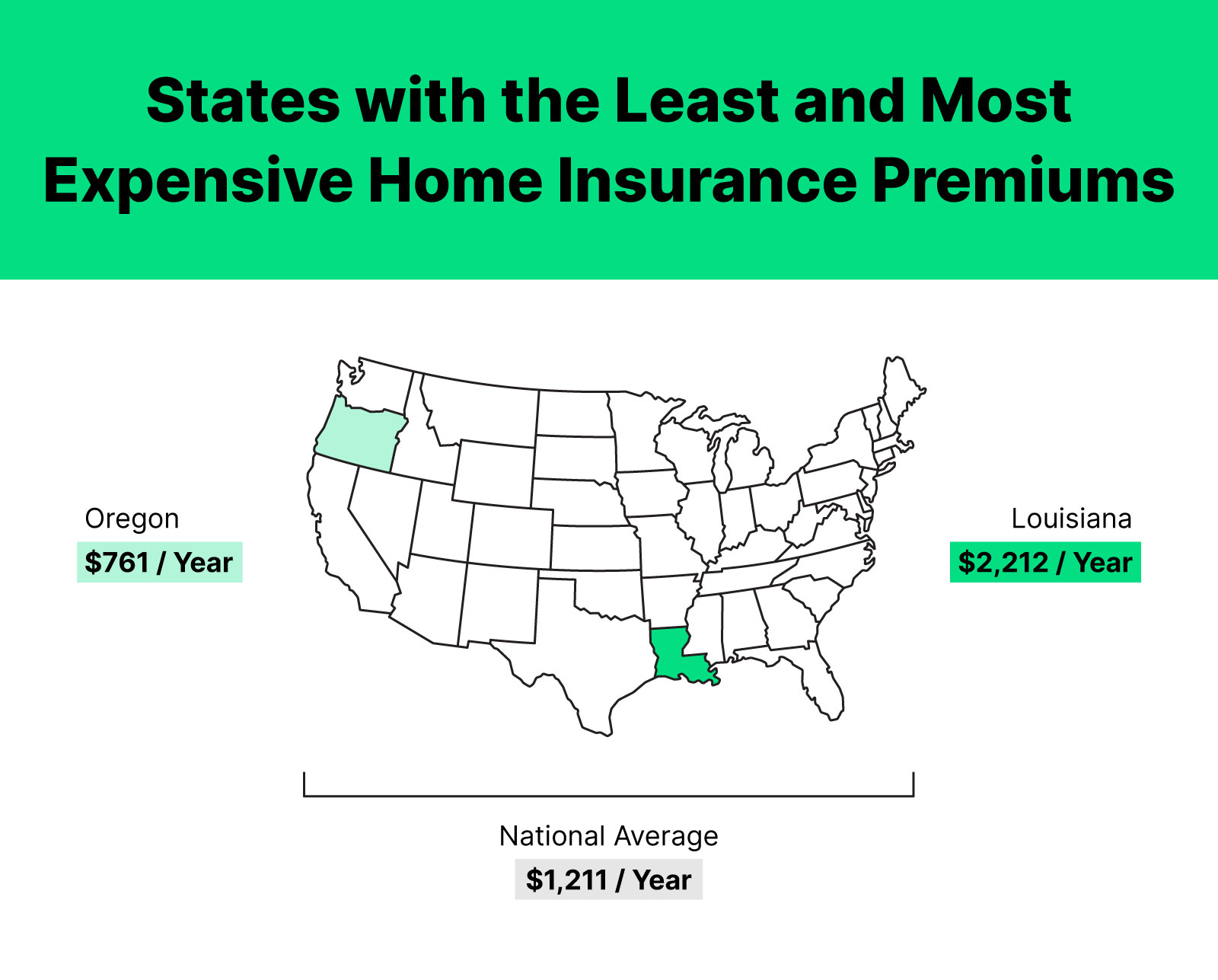

Average House Insurance Policy Expense by Coverage Amount The nationwide ordinary yearly expense of residence insurance coverage in 2018 (the most recent information available from the 2021 NAIC report) was $1,249, however arranging the premiums by the dwelling insurance coverage quantity you choose can give a much more accurate prediction of what you may pay.

In the table below, we've listed a number of home coverage arrays and each array's typical month-to-month premium: Standard Residence Insurance Policy Cost by Location Insurance policy costs likewise differ based on your area. For example, states at a higher danger for extreme weather condition, typhoons and also tornadoes will generally have higher premiums as a result of the raised risk of home damage.

cheapest insurance homeowners policy insurance companies security systems cheaper homeowners insurance

cheapest insurance homeowners policy insurance companies security systems cheaper homeowners insurance

If you live in a location with high real-estate costs, you'll finish up paying a lot more for house insurance policy because it will set you back more cash to restore your residence. Residence insurance protection is divided right into six categories (landlord).

This insurance coverage is commonly 10% of your dwelling protection. Personal effects protection (protection C) shields your individual items, both inside and also outdoors your house. If you endure a protected peril that harms or destroys your personal belongings, coverage C will pay to repair or replace your possessions. This coverage is usually 50% of your house coverage.

You will certainly generally have the option to pay added on your month-to-month costs for a higher degree of defense. Actual cash money worth This is the most affordable degree of defense and also the most affordable. With an actual cash value plan, your insurance provider will certainly pay you wherefore your possessions and/or residence is worth, minus devaluation - credit.

Fascination About Humana: Find The Right Health Insurance Plan - Sign Up For ...

Substitute cost This medium degree of defense will certainly lug a higher costs than a plan that pays real money value due to the fact that the devaluation isn't factored in. This will certainly spend for the expense to reconstruct your home or replace your possessions without devaluation. Guaranteed replacement cost This is the highest degree of protection as well as is generally more costly than the other two plans. insurer.

This degree of security will certainly restore and replace your possessions also if the price exceeds your plan restrictions. Lots of home insurance policy companies likewise use extensive limitations for a higher premium, which allows property owners to get even more coverage. What Aspects Can Impact the Expense of Residence Insurance Policy? House owners will certainly receive an estimated rate for house insurance coverage based on a range of variables. deductible.

Most home owners insurance coverage plans allow you to pick your deductible. Common deductibles are $500, $1,000, $2,500 or a little percentage of your home protection. If you can pay for a greater insurance deductible, you can save money on your regular monthly premium - homeowners. Insurance providers utilize your credit report score https://6-easy-facts-homeowners-insurance-guida.s3.che01.cloud-obje... as well as credit report history to establish the rate of your residence insurance coverage.

If you're concerning to purchase residence insurance coverage or you already have house insurance however desire to save money on your premiums, we recommend obtaining quotes from numerous carriers to contrast rates. One very easy means to compare prices throughout carriers is to call or fill up out with your ZIP Code and also some basic information regarding your residence. homeowners insurance.

If you incorporate your house insurance coverage with cars and truck insurance coverage or an additional insurance coverage type, you can conserve money on your plan. If your home was lately constructed, it's much less vulnerable to damage than a home created in the 1920s. Discount rates for newly constructed homes are the most charitable of all price cuts for property owners insurance policy, so if your residence is new, contact your insurance policy company about a possible discount. homeowner insurance.

Some Known Incorrect Statements About How Much Does Homeowners Insurance Cost? - Experian

We reach out for example quotes, both over the phone as well as online, to mimic an authentic customer experience. Right here are the variables that make up our carrier reviews: Insurance coverage (20%): We examine each provider's protection choices, policy recommendations and also protection limits to determine top quality of coverage. Customer care (15%): We additionally review each business's client service alternatives such as real-time chat, a consumer support phone line and also accessibility to agents - affordable homeowners insurance.

cheaper homeowners insurance low cost homeowners insurance landlord condo insurance homeowners policy

cheaper homeowners insurance low cost homeowners insurance landlord condo insurance homeowners policy

Companies that provide comprehensive discount rate options, recommendations, personalized protection options as well as distinct features rack up dramatically greater than those that do not, placing them towards the top of our recommendations to visitors. finances.

low cost homeowners insurance property insurance insurance homeowner insurance insurance discount

low cost homeowners insurance property insurance insurance homeowner insurance insurance discount

Determine Just How Much It Would Cost to Restore Your Residence Having property owners insurance helps cover prices from damage because of things like fire, lightning, hail, windstorms to name a few occasions - cheaper homeowners insurance. As well as if you live in a location at high danger of flooding or earthquakes, you'll wish to ensure you have insurance coverage for those, also.

A variety of factors will certainly influence the cost to reconstruct: Things like the style of your home (e (a home). g. cattle ranch, colonial), sort of materials utilized to build the framework (e. g. block, stone, frame), sort of roofing system, as well as various other special attributes of the residence (e. g. fireplaces, exterior trim) can all influence the expense to reconstruct your home.

Link with your insurance coverage representative they'll aid you compute just how much protection you'll need to reconstruct your residence - a home owners insurance.

Unknown Facts About Homeowners Insurance: Understanding What Affects The

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO