Defining Car Insurance Deductibles for Dummies

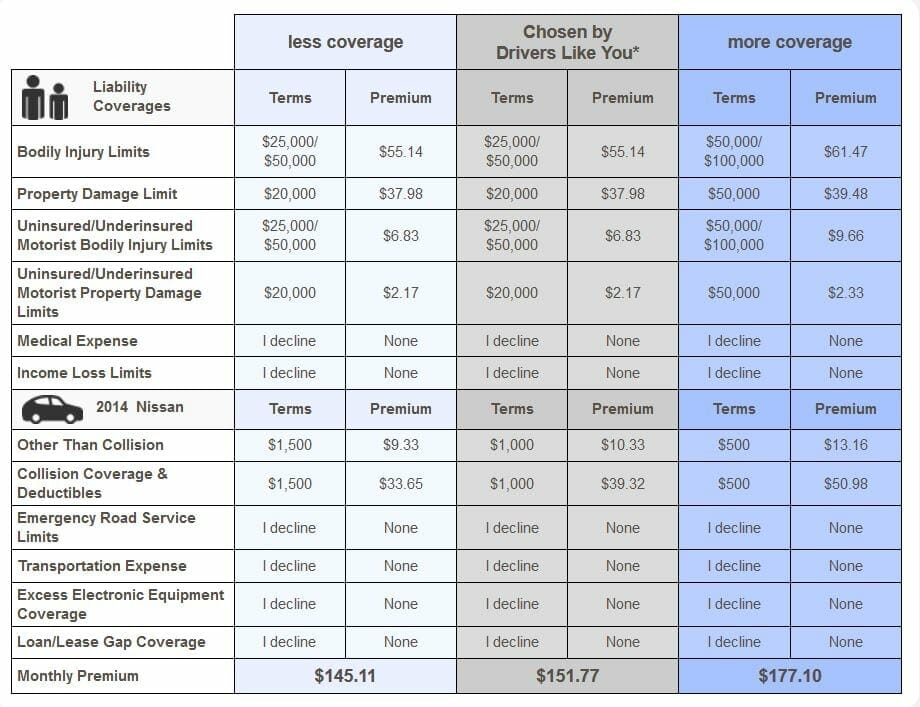

If you do not get into a mishap throughout this duration, the boost in the insurance deductible will certainly be worth it. If you do obtain into a mishap, you will pay even more out of pocket. It's best to compare vehicle insurance policy rates and talk about various other variables with your insurance policy agent to locate the appropriate service and make a notified decision.

If you invest just $300 on the protection, you would certainly require a major price cut to delight in real cost savings, specifically in comparison to the price of filing a high-deductible claim. You can save around $30 every year when you pay a $1000 insurance deductible in an insurance claim. Why not go with an option that aids you conserve $100 every year instead? It is very important to consider your circumstance and review your choices with your insurance company to identify if the annual cost savings make good sense - affordable auto insurance.

Expect an unknown driver hit your auto that led to $800 well worth of repair work price. However, you have a $1000 deductible, which suggests you will need to pay $800 yourself. If you had a $100 insurance deductible, you would only have to pay $100 and save $700. You need to figure out if you can afford to pay a greater premium.

At the same time, you may file extra insurance policy declares also. It's actually approximately you to make a decision as well as weigh all benefits and drawbacks. To resolve the high vs. low insurance deductible auto insurance policy conflict, you need to take into consideration the number of car accident declares you have made in the past. prices.

The Best Strategy To Use For Understanding Your Car Insurance Deductible

cheap car insurance cheap car cheapest car cheapest

cheap car insurance cheap car cheapest car cheapest

Make certain to consider the dangers included. While saving some cash on your costs is fantastic, it could set you back more to submit an insurance claim. So, take into consideration all the aspects, including your driving record, which mention you stay in, and also the risk of natural catastrophe or crime price in your area.

Be sure to spending plan the insurance deductible quantity in your emergency situation savings (car insured). Bear in mind that if you have to cover the repair service costs with your bank card, the high interest rate will certainly consume up the savings you could have obtained from enhancing the deductible. Develop a lasting strategy for savings and bank the cash you save from the premiums.

On the various other hand, a vehicle driver with a poor driving record must select a reduced deductible. Wondering exactly how to examine my driving document? The easiest way to check the driving record is by calling your licensing workplace or neighborhood DMV. Additionally, various states have made driving documents readily available online.

Deciding for the right deductible quantity, depending on your needs as well as financial situation, can aid you save hundreds on your auto insurance policy. If you select in between an automobile insurance coverage deductible of 500 or 1000, consider numerous factors highlighted in this article and discuss your choices with your insurance coverage agent.

Little Known Facts About Auto Insurance Faq's - Geico.

low cost dui cheapest dui

low cost dui cheapest dui

Instead, do proper research as there are various other means to lower insurance coverage premiums. Your automobile insurance policy representative can assess your scenario as well as figure out the very best possible cost savings options for you (credit score). What is much better: a greater or lower insurance deductible for vehicle insurance policy? If your vehicle insurance coverage budget is limited, a high-deductible plan could be preferable for you.

What is the best accident insurance deductible? It's best to have a $500 crash insurance deductible unless you have a large amount of cost savings.

Just how Does a Car Insurance Policy Deductible Job? After a mishap, you'll want to file a case with your auto insurance coverage provider to obtain your car repaired.

Comprehensive insurance policy covers problems to your vehicle, whether resulting from a crash or other stated causes. Without insurance residential property damage protection works hand-in-hand with your accident insurance coverage.

What Does When Do I Need To Pay A Deductible On My Car Insurance? Mean?

liability cheaper cars insurers insurance

liability cheaper cars insurers insurance

This figure represents your insurance policy company's section of obligation for a case, so when you agree to pay more out-of-pocket, your insurance coverage company won't need to spend as much after a crash. A reduced insurance deductible virtually always means higher monthly repayments. The advantage of a low deductible is that you have extra coverage from your insurance business and you have to pay much less when you submit an insurance claim.

An automobile insurance deductible is just one of the most vital aspects to consider when picking insurance coverage for Additional hints your automobile. Due to the fact that your deductible will certainly impact your month-to-month costs along with the quantity you'll pay for problems after making a case, it's crucial you choose intelligently. What is an insurance deductible and just how does it work? Right here are some points to consider when assessing cars and truck insurance policy options to choose what will certainly help your needs.

If your damages exceed your deductible, the insurance firm will cover the staying balance up to your protection amount., and also are needed to pay up to the deductible quantity prior to your insurance company actions in to cover the rest.

cheap auto insurance vehicle insurance cars auto

cheap auto insurance vehicle insurance cars auto

There are two main kinds of vehicle insurance coverage protections that generally include deductibles:: This protection helps spend for damages to your automobile if it strikes another vehicle or things, is struck by one more automobile, or rolls over.: This protection assists spend for damages to your automobile that are not created by a crash.

The Definitive Guide for What Is A Car Insurance Deductible? - Promutuel Assurance

If you have a $500 deductible and the problems to your automobile total $450, you would pay the complete $450 - cheaper auto insurance. If the problems to your cars and truck total $1,000, you would certainly pay your $500 insurance deductible, as well as the insurance policy business would certainly cover the continuing to be $500.

Nonetheless, if a driver hits your automobile and also both you as well as the other chauffeur are figured out to be responsible, then you may be responsible for paying at least a section of your insurance deductible if you sue with your own insurance coverage company. You struck one more chauffeur's auto. If you strike somebody else's automobile as well as in doing so, harm your auto, your insurer usually will pay for the problems to your auto, and you will be liable for paying the deductible.

Depending on your plan, you may have to pay a deductible. automobile. Once more, check with your insurance policy agent to verify what your protection will do. Your car was harmed in a hit-and-run.

For the a lot of part, the much more pricey your lorry, the extra it costs to insure. That can convert into higher savings if you choose a high insurance deductible. Several factors influence the cost of your auto insurance policy, however your insurance deductible will have an influence on your premiums along with on just how much you'll pay out-of-pocket for problems to your vehicle from a crash - car.

Not known Details About What If I Can't Pay My Car Insurance Deductible?

low cost auto cheap cars automobile

low cost auto cheap cars automobile

Ideally you may never face a situation where you'll have to pay a deductible, however it's essential that you be careful to choose a plan with a deductible that you can afford to pay. Your insurance policy representative can help you resolve your insurance deductible inquiries. Call Tourists for your cars and truck insurance quote.

Right here are 10 means to save on your automobile insurance. No one suches as to invest even more cash than essential on automobile insurance.

In this article: When you file an insurance claim with your cars and truck insurance provider, you might have to pay an insurance deductible. This is the quantity you pay out of pocket prior to your insurance policy coverage kicks in.

What Is a Cars And Truck Insurance Coverage Deductible? Unlike health insurance policy, with vehicle insurance coverage you don't have an insurance deductible that resets every year (vans).

<h4

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO