Mortgage Points Calculator

This can cause the principal as well as rate of interest for your home loan to expand, causing bigger month-to-month payments. " Amongst those applying boosts were Lloyds Financial institution, where numerous fixed price items for remortgage https://www.businesswire.com/news/home/20191008005127/en/Wesley-Fin... consumers rose by up to 0.35%. At Skipton Structure Culture chose fixed rates were boosted by as much as 0.16% and a number of two-year discounted variable rates saw increases of up to 0.30%. Virgin Money likewise boosted picked dealt with prices by approximately 0.12%. For individuals utilizing unfavorable factors the recover cost date is the amount of time before the financial institution would get the much better end of the offer if they were selling lender credit ratings.

- A fund with expenses of 0.45% is said to be five basis points more expensive than one with a 0.40% proportion.

- Especially important to large-volume home loan lenders, basis points-- even simply a few-- can imply the difference between revenue as well as loss.

- A mortgage loan which maintains the second lien setting against the title of one's residential or commercial property.

- When you pay discount factors, you're basically pre-paying several of the passion on a loan.

- The lending policeman then advises you that the lender costs 50 basis points to lock your rate for that duration.

- Setting and reaching your personal financial goals is the most effective means to make sure that you can live the type of life you want, both now and also in retired life.

So if you got a mortgage price quote of four percent one week as well as it changed to 4.25 percent How To Get Out Of A Wyndham Timeshare Contract the following week, that indicates it rose by 25 basis factors. If you have a present duplicate of your individual credit rating report, just get in the record number where suggested, and comply with the directions offered. If you do not have an existing individual report, Experian will supply a cost-free copy when you submit the information requested. Additionally, you might get a totally free copy of your record once a week with April 2022 at AnnualCreditReport. No matter the basis factors or the kind of finance, you should check your complimentary Experian credit score report and cost-free Experian credit history before you buy a mortgage.

Locate The Right Home Mortgage Option For You! Tell Us What Your Objective Is

Special regulations put on assets gotten through gift or inheritance, along with to the value of supply funds held for a duration during which profits are reinvested. The term is frequently used to define modifications to interest rates. For instance, if a mortgage's rate goes from 4.63 to 4.41 percent, you would say that it dropped by 22 basis factors. This term is extra exact than stating it dropped by 0.22 percent.

Customer Makes Use Of For Basis Points

We also reference initial study from various other trusted publishers where appropriate. You can discover more concerning the requirements we follow in producing accurate, unbiased content in oureditorial policy. Though many people intend to see their home rise in value, few individuals purchase their home purely as an investment. From an investment point of view, if your home triples in value, you may be not likely to market it for the easy factor that you after that would certainly require to find somewhere else to live.

If points are involved as well as you are provided a greater rate, the home loan points act as a lending institution credit toward your closing costs. These are known as "unfavorable factors" since they in fact elevate your interest rate. To pay home loan discount rate factors, which are a form of prepaid rate of interest paid at closing in exchange for a reduced rates of interest as well as cheaper monthly settlements. A restriction on just how much a flexible rate home loan can enhance or lower, which protects the consumer from large rises in the interest rate or month-to-month repayment. Because your home mortgage settlement is a combination of major payment and your rate of interest, basis factor hikes will increase your monthly settlement.

Home Owners Might Wish To Refinance While Prices Are Reduced

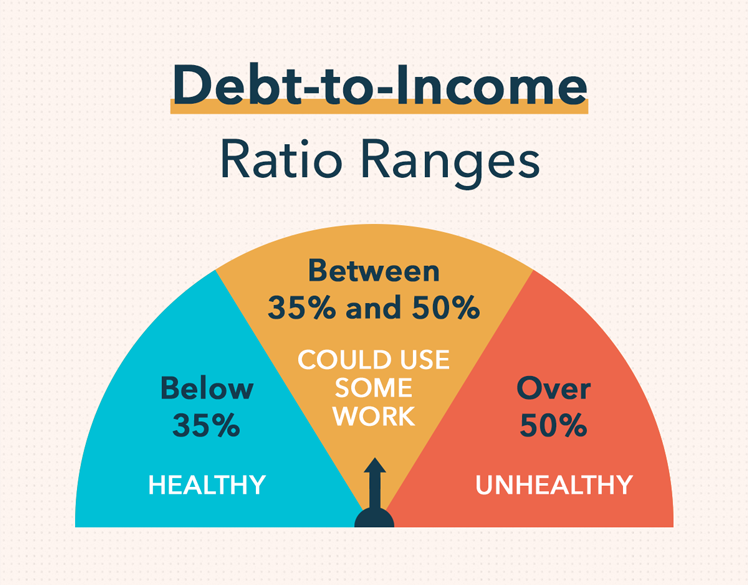

They could in fact prevent you from getting approved for the lending. While lenders make finances on buildings about their worths, they qualify you for lendings based upon your capacity to pay off. To compute this, most of them look at the funding repayment as a percent of your yearly income. If a rate of interest trek indicates that the annual mortgage payments will certainly add up to more than 28 percent of your salary, they might not approve the finance. Relying on the sort of mortgage, a change in basis factors can influence the quantity of your monthly payment along with the complete rate of interest. you'll pay on your funding.

Amounts paid to the lender along with a mortgage to lower the rate of interest. One discount point amounts to one percentage point of the lending amount. The fee billed by a broker or representative for bargaining a realty of finance purchase. A broker payment is typically a percent of the rate of the residential property or finance. The expense of either obtaining a home loan or moving realty from a vendor to a customer, including attorney's fees, survey charges, title searches as well as insurance, and also recording charges.

A basis point is a device of procedure that represents 1/100th of one percent (0.01%). For example, if rate of interest are raised by 50 basis points, it means they were enhanced by 0.5%. The term basis factor value simply signifies the modification in the interest rate in connection with a basis factor change. Suppose you're an investor in mutual funds or exchange-traded funds.

In either case, consider how much you're actually conserving with a. 125% in price renovation. Technically, a mastermind can not be paid by both the loan provider as well as the customer however loan provider credit score is common practice. Lenders give credit scores to balance out the closing costs and this features greater rates. Though basis factors might seem difficult, transforming a basis indicate a percentage factor is quite simple. A basis factor is a typical measurement utilized to specify changes in rate of interest.

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO