Some Known Facts About Understanding Teen Car Insurance Rates - Safeco Blog.

Getting a bargain on teenager cars and truck insurance, Our moms and dad overview to insuring a teenager offers more detail, however below we'll offer the must-know actions to take for maintaining teen vehicle driver rates as low as possible. Search, The more you spend for insurance, the extra likely you can save cash. cheaper.

It's a great concept to inspect quotes for other auto insurance coverage business when you include a teen driver to your policy. Including a teenager can increase your rates, so make sure you obtain the finest offer.

In basic,. You might likewise have the ability to get a multi-driver discount as soon as you add your teenager to your plan."If your child is presently in college or taking college classes, a lot of carriers will certainly supply a student price cut (accident). And if your youngster took a protective program before obtaining their certificate, most firms will provide a price cut for this too," Sopko notes.

"I suggest covering the teenager for responsibility only till they are around twenty years old, which is the age when insurance coverage prices tend to come down."Do I have to include my teen to my car insurance policy? State regulations vary, so it's suggested that you always alert your auto insurance provider that you have a young driver, however as a whole: All accredited vehicle drivers in a household requirement to be contributed to a policy (low-cost auto insurance).

Some states allow a licensed teen to be left out from your plan, but you need to inspect to see if your insurer likewise allows it-- couple of do. Some states allow car insurer to need you to provide teens with driving licenses-- so those that are not yet even accredited-- on your insurance policy.

The majority of states will not allow a teen to title a vehicle in his very own name. Even if your state has no age limitations on labeling a car, teenager chauffeurs under age 18 are not likely to find insurance by themselves. It's an agreement, as well as teens are not old adequate to authorize one.

The Buzz on Do You Get A Car Insurance Discount When You Turn 25?

Distant pupil, Young person drivers that reside on university for college or go to school in another state and also leave their parking lot at the household house might be qualified for a far-off pupil price cut, says Yoshizawa."Lots of insurance providers give price cuts for trainees that live 100 miles away or a lot more. Combined with an excellent pupil price cut, this might provide considerable cost savings for family members when it comes to auto insurance coverage," Yoshizawa adds.

Purchasing a brand-new vehicle can additionally mean cash money motivations and also discounts or unique leasing prices they can conserve money," Yoshizawa discusses."Keep in mind that the majority of car insurance policy plans will permit the group to drive any kind of cars and truck in the family.

Theft rates issue, and while you 'd assume a brand-new glossy automobile would certainly be more attractive to burglars this isn't the case. Of course, your auto insurance policy rate is calculated on even more than simply the vehicle you drive.

Lots of factors come right into play when insurance providers determine the expense of cars and truck insurance coverage - as well as age is absolutely one of the primary ones. If you wish to jump on the road to commute to work or university or for recreation purposes, you can find that car insurance is exceptionally costly.

Age and vehicle insurance As a basic guideline, you can expect to pay the most for your vehicle insurance policy when you're under 25. Once people are over 25, they often tend to find that the price of their automobile insurance begins to drop. The rate typically declines slowly in between the ages of 25 as well as 60.

Insurance firms do not know at this point exactly how most likely it is that such a vehicle driver will certainly make a claim, so they charge more to make sure they are covered. Risk Car insurance policy premiums are calculated by taking threat into factor to consider. Statistically, more youthful motorists make more claims, so they are higher risk.

The 25-Second Trick For Minor Accident Reddit. Minor Bike Accident Leads To $19,000 ...

Can I decrease the cost? While there's no rejecting that chauffeurs matured in between 17 and 25 pay one of the most for their vehicle insurance policy, there are some points you can do to guarantee you pay less than you require to. Telematics or Black Box Black Box or Telematics automobile insurance specifically appeals to young motorists.

If you do obtain a far better quote, you could ask your existing insurer to match it.

You may not have complete access to exactly how cars and truck insurers identify your rates. However, the process doesn't have to be mysterious. We break down the nine crucial things that influence your auto insurance policy prices. When considering your automobile insurance coverage prices, the degree of insurance you pick is one of one of the most important elements to just how much you'll pay.

insurance low-cost auto insurance cheapest vehicle insurance

insurance low-cost auto insurance cheapest vehicle insurance

cheaper cars vans perks affordable car insurance

cheaper cars vans perks affordable car insurance

03 Met, Life $223. 15 Bristol West $277. 27 $178. 48 Source: Savvy Bear in mind that there are state demands that might figure out the kinds of coverage you're required to have. Vehicle insurance coverage rates are additionally affected by your decision to select a high-deductible plan or a low-deductible plan.

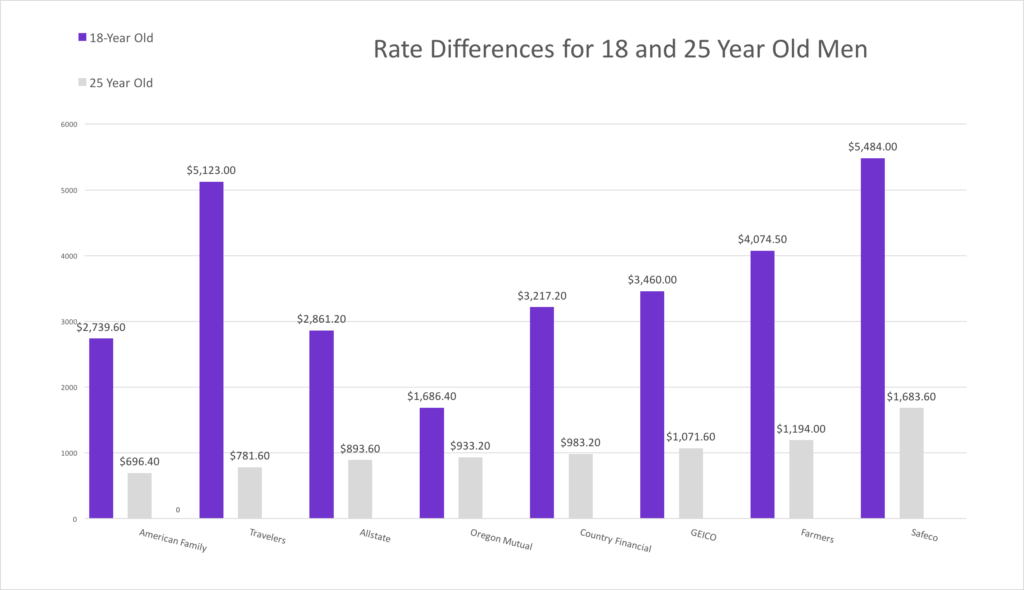

Teen vehicle drivers pay the highest car insurance rates - cheaper. The impact old is significant, with teen drivers paying a minimum of $400 even more on typical than various other age. The most affordable ordinary insurance coverage rates are for chauffeurs in between 25 as well as 34 and also rates begin to raise once again for older drivers over age 50.

While a typical credit history predicts the probability that you'll pay your costs on schedule, a credit-based insurance policy score forecasts the probability that you'll file an insurance case of a higher quantity than what you'll pay in insurance policy costs - laws. Some states have relocated to restrict or prevent auto insurance providers from making use of credit report to identify insurance coverage rates.

The 15-Second Trick For How Much Does It Cost To Add A Teenager To Car Insurance?

In one situation, an 18% boost in sticker price resulted in a 6% rise in car insurance policy costs rates. Insurance can also be higher on automobiles that are frequently the target of criminal offense. Discover out exactly how much your automobile is worth to learn how your insurance company aspects in the cars and truck you drive.

You can attempt other techniques such as telematics, which enables an insurance company to track your driving habits and also if they're good, you'll gain a discount. cheapest car.

prices cheapest car insurance auto insurance cars

prices cheapest car insurance auto insurance cars

https://www.forbes.com/advisor/wp-content/uploads/2020/05/man-laptop-car.jpeg.jpg" alt="cheapest auto insurance insurers cheaper car insurance cheap car insurance" />car insured liability car insurance affordable

A lot of people will accept the insurance prices that they are provided when they pick an Insurance coverage carrier one of the major inquiries they what a response to is when does the car insurance go down? At What Age Does Auto Insurance Go Down? Each time you restore your policy.

What it suggests is that most typically insurance companies do a review of the chauffeur before renewing their insurance policy. They will check out the chauffeur's certificate standing. For instance, has the vehicle driver obtaining insurance policy graduated from a G2 to a G permit. If so there might be a small reduction in the expense of the plan.

The driver may be eligible for one of the discount rates that the insurance business is offering. Does Cars And Truck Insurance Coverage Go Down When You Turn 25?

They will think that this is a lot more significant for brand-new drivers who are under the age of twenty-five which is mainly true. Every insurance coverage business is able to establish its very own metrics for identifying what to bill for premiums and when to increase Browse this site or lower them. This suggests some firms may minimize the costs when an insured reaches 25 however other business might not - perks.

Unknown Facts About 7 Factors That Raise And Lower Your Car Insurance Rates In Ontario

It will all depend upon the guidelines that the Insurer has actually established for itself (business insurance). Some firms intend to retain their young chauffeurs as they carry on to ending up being experienced ones. To do this they might use little incentives along the road by minimizing the insurance coverage when they reach the age of twenty-one, however when they turn twenty-five.

This might seem sexist yet they do this based upon historic

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO