9 Things Your Parents Taught You About banking security

It's an interesting time in economic modern technology.

We're running in a one-of-a-kind economic environment. Cash is inexpensive, which has motivated a collection of mergings as well as purchases in financial, with smaller players merging to achieve larger range. This enhancing rationalisation out there implies banks need systems that can help with the range of growth that they're seeking to attain.

Consumers are calling the shots. As well as they uncommitted what's happening in the back end. As Phillipou says, "It's banking advancement in front-end applications that they discover-- making it much easier transact on-line consisting of to transfer money, withdraw cash, obtain money, get a credit card, pay."

The crucial part is the interaction and interaction they are experiencing; how simple is it to open up an account and also end up being a customer electronically. A financial institution's system needs to be able to automate processes and give a smooth experience for the client.

If a bank is looking to change or adjust facets of its core banking system to resolve consumer assumptions as well as growth purposes, it's going to be https://www.sandstone.com.au a risk/benefit trade-off.

Here is where the crucial questions can be found in, according to Phillipou. "Do they see the worth in investing thousands of millions of pounds doing a improvement of that gravity? Or, if their core system can still do the essentials as well as progress using upgrades, should they be purchasing front-end applications that enable them to supercharge their growth as well as please customer assumptions?" he says.

Taking stock of systems

A core banking platform is the engine that drives the bank's main procedures, in charge of the opening and maintenance of finance and also savings account, preserving the main document of transactions, rate of interest as well as more. It's the 'source of fact' for account condition and account information which are accessed by other systems as well as feed consumer channels.

Platform, establishments have account opening/origination systems which collect customer information and also handle the application process by engaging with the core financial engine. And there are account servicing systems that allow clients and inner individuals to quiz their account status as well as transact on their account.

Both extra systems might be offered by the core financial company as well as classed as part of the core financial engine, or they might be a separate system/product that is integrated with the core financial engine.

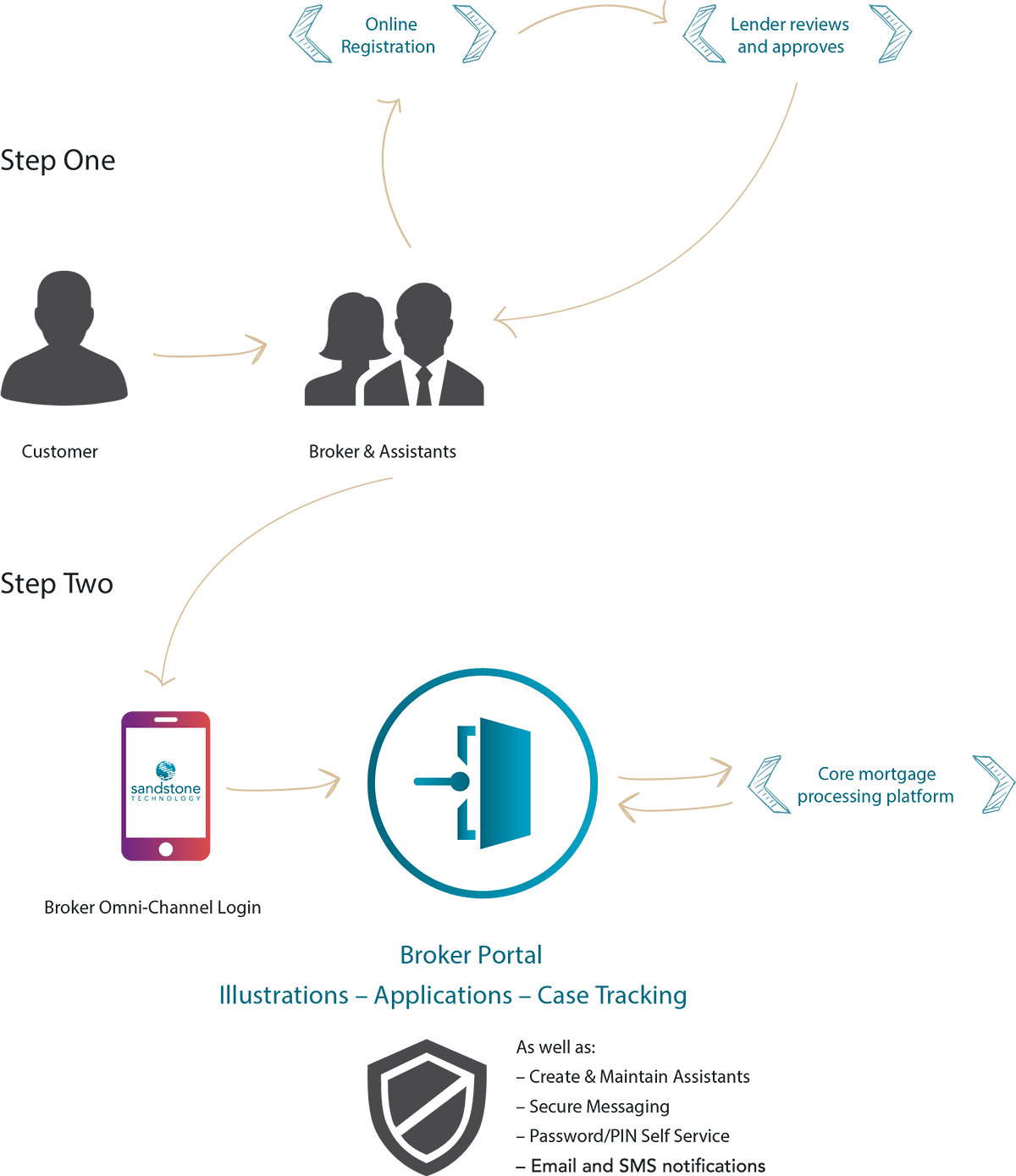

Is there a 3rd choice?: Fintech providers like Sandstone Innovation deal remedies that can be incorporated with the core banking engine after the reality. These fintech assimilations are commonly achieved by means of standard APIs which aid simplify the assimilation and allow a new provider to a lot more conveniently weave the services perfectly into those of other innovation suppliers.

City of London at sunset as well as business network connections concept image with great deals of company icons. Technology, change and innovation suggestion.

Danger, as well as why modification has actually been so slow

Many core banking systems have been in situ for several years, occasionally decades. Huge amounts of cash and sources have actually been invested. Benefits aren't immediate, they're counted over years. "Once a financial institution has actually done its benchmarking as well as decided to invest in a core banking system, they're dedicated for the longterm," Phillipou claims. "They will not be crossing out that degree of financial investment in a hurry."

Include the fact that financial institutions, by and large, are notoriously extremely risk-averse organisations. They need to be conservative, because they're custodians for people's cash. They require to make sure they have systems, procedures, and a danger cravings approach that remains in line with their customers' expectations, to make sure customer confidence as well as data protection.

However as Phillipou describes, the greatest threat they are exposed to when migrating off an older information system is execution danger. " First of all, these type of programs are complex and renowned for running over schedule which has significant implications for financial institutions," he states. "What might emerge as a engaging proposition in the tendering procedure can, when implemented, end up being an functional as well as costly problem for the financial institution."

Several CTO and CIOs get surprised when they check out core banking transformations that have gone southern, like Royal Financial Institution of Scotland, whose unfortunate software program upgrade in 2012 resulted in an failure leaving millions of consumers unable to make or get settlements. RBS was fined 56 million extra pounds by British regulatory authorities in 2014.

When CTOs, CIOs and also various other decision manufacturers decide to transform their core systems, they need to win the hearts and also minds of the board and the executive right across the organisation. It's typically not an easy sell.

Front-end integrations are the trick to development

Lots of establishments are in the hard position of being beholden to ageing, monolithic core financial systems where adjustments as well as updates to their systems are typically intricate, time consuming and pricey. Deal handling is crowded, lending processing is slow and they may not have the ability to user interface into their front-end applications to the level they would certainly like. The system can not do what they require it to do, to satisfy development goals and objectives.

In the long run, development progressively comes using the financial applications that are client facing, Progressively banks are recognising that brand-new front-end applications will obtain a higher return on investment than a significant core change.

Frontend remedies can involve overhauling the whole customer-facing design, or merely making tiny strategic changes to procedures that influence the consumer experience.

With smooth UX across electronic financial capacity with applications, "it's like opening a window to a store" Phillipou states, aiding financial institutions charge accounts swiftly, onboard clients swiftly-- every one of those retail financial demands. It's developing that digital worth proposition which provides financial institutions the ability to contend as well as win, making certain they're preserving existing consumers, growing their client base and market share, along with boosting reputation.

Quick, active assimilations with Sandstone Innovation

A financial integration expert, Sandstone Innovation can collaborate with any kind of core banking system service provider. Implementation is quick - in between 3 as well as one year relying on the intricacy of the implementation as well as the financial institution's inner procedures.

Sandstone Innovation is a relied on electronic partner to tier 1-3 financial institutions, building societies, participant area had banks and cooperative credit union with customers across Australia, New Zealand, Asia and also the UK.

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO