The 5-Minute Rule for Can Your Insurance Company Drop You After An Accident?

- Typically, for car or house insurance coverage, but check your policy to see if your insurance provider consists of a poise duration stipulation. [ss. 632. 44 as well as 632. cheaper. 78, Wis. Stat.] Anniversary Termination This describes a policy written for an uncertain term or for even more than one year. These policies may be terminated on any type of wedding anniversary day if the policies have cancellation stipulations.

When money is limited, everybody looks for means to cut down. One temptation is to allow your automobile insurance end, even for a short period of time. This really isn't a wonderful idea, since an auto insurance coverage lapse can cause you some unforeseen problems. Below are several factors it is essential to stay secured as well as avoid a lapse in protection: Lawful demands A lot of states call for some level of auto obligation insurance policy.

So if you have a cars and truck as well as you have actually allowed the obligation insurance coverage on it to gap, you may be violating the regulation also if the auto is parked and not driven. low cost. If you drive the vehicle and cause an accident without being covered, you'll be mentioned as well as based on stiff penalties or worse.

If you're accountable for a crash and do not have insurance policy, you may be filed a claim against to pay for the problems and end up paying for whatever, consisting of the legal representative, expense. cheaper car. Insurance rate increases After a vehicle insurance policy gap, you might discover it tougher to get insurance policy at an economical price.

The Facts About Cancellation Of Home And Auto Insurance For Non-payment Uncovered

low cost auto money auto insurance cheap car insurance

low cost auto money auto insurance cheap car insurance

Driving document effect In some states, vehicle insurer are needed to notify the Bureau of Motor Automobiles when you drop insurance policy or modification business. When you have a gap in cars and truck insurance coverage, it may be noted on your driving record. In some situations, your auto might even be taken or your certificate suspended.

Your best goal should be to maintain your car insurance policy protection affordable and certified with state legislations. Your ideal source for maintaining you guaranteed and also safeguarded is your regional agent. They are additionally the person to count on if you do finish up with a lapse in protection. Practice obligation Vehicle insurance plans are terminated for two major factors: non-payment as well as driving offenses.

In case a gap has actually currently taken place, some carriers may additionally have the ability to restore your lapsed insurance coverage if the plan has actually just been inactive for a couple of days. Find out more regarding how Nationwide can keep you safeguarded as a motorist, safe as well as in conformity with the law - cheapest car.

The terrific news is, you have choices! Find out a lot more concerning your situation before you begin making agitated phone calls. There are lots of factors why your auto insurance firm dropped you.

All about Can I Get Auto Insurance If I Owe Another Company?

Insurer will certainly typically do this if they find disparities in your policy application, so it pays to be honest when you first obtain an automobile insurance plan. You could be able to repair the scenario immediately depending on the reason you were gone down. If you can pay your costs, pay it (vehicle insurance).

Below at Straight Car, however, we do things in a different way. Our team believe everybody should have budget friendly vehicle insurance and we urge all motorists to apply for coverage despite their driving or insurance policy history. If you're bothered with your existing insurance coverage firm canceling or not renewing your auto insurance coverage, if you're having a tough time finding insurance after a crash, or if you're simply looking around for new prices, it's time to get to out to us.

Some state insurance coverage departments are urging or buying companies to temporarily do one or more of the following: Not cost late charges or various other penalties. Create adaptable repayment strategies. Pause plan cancellations for nonpayment. Extend poise durations, typically a 30-day duration after payment schedules when you can still pay as well as will not lose protection."It is necessary to call the insurance coverage company, describe the situation and see if they can provide any kind of kind of relief.

See what you might save money on cars and truck insurance coverage, Easily contrast personalized rates to see exactly how much switching vehicle insurance policy could conserve you (low cost auto). Auto insurance coverage, Most states need vehicle drivers to have cars and truck insurance policy, which suggests losing insurance coverage is not a legal alternative unless you stop driving. You can take benefit of COVID-19 automobile insurance policy refunds or make modifications to your policy.

Unknown Facts About Auto Insurance Cancelled Ontario - What You Need To Know!

Allstate is giving a standard of 15% back to vehicle insurance customers for costs paid in the months of April, May and June. State Farm is working to enact an 11% ordinary price reduced for policies in all states. As a last resource, you can take into consideration minimizing coverage.

insurance vehicle insurance insurance company vehicle

insurance vehicle insurance insurance company vehicle

If you have an auto loan or lease, your contract likely requires comprehensive as well as accident insurance policy. If you aren't driving your auto in any way throughout the pandemic, as well as don't have a finance or lease on it, other choices include: Reducing coverage to comprehensive-only insurance, which secures your automobile from damage while it's stored.

trucks vehicle cheaper auto insurance auto insurance

trucks vehicle cheaper auto insurance auto insurance

affordable car insurance car affordable car insurance risks

affordable car insurance car affordable car insurance risks

If you have term life, you'll likely lose coverage if you can not pay after the grace duration. However, if you have a long-term life policy and also want to keep it, you have extra options. For instance, many entire life policies have built-in options to pay your costs in other ways.

Decrease your survivor benefit. This isn't always the finest choice, but it can assist you reduce your term or irreversible premium and also still maintain some type of coverage. Switch to call life. Depending on the company, you might be able to squander your permanent plan and buy term life insurance instead.

Some Ideas on What Happens If A Car Insurance Payment Is Late? You Should Know

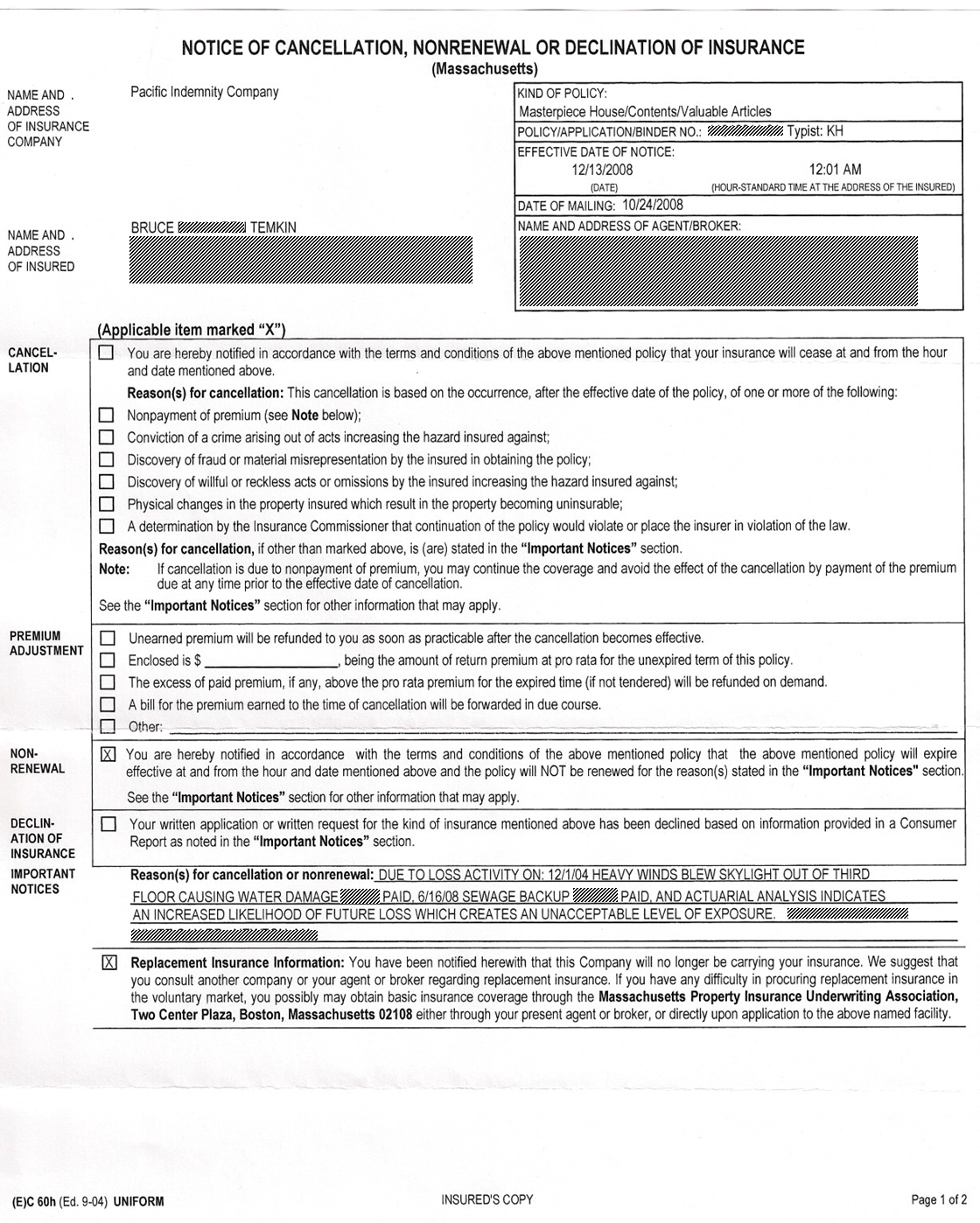

Homeowners insurance coverage, Some home insurers are prolonging poise periods, not charging late fees, as well as won't terminate home insurance policy protection for a restricted period of time, depending on states' standards. If you're struggling to pay after the moratorium, you might consider reducing protection. It's best to keep adequate insurance policy to reconstruct your residence if it's destroyed, so this must be a desperate choice.

Even without a home mortgage, canceling your policy or even reducing insurance coverage can leave you in alarming economic straits ought to you be taken legal action against or your house or residential property harmed. Medical insurance, Several states outlawed wellness insurers from canceling insurance coverage due to nonpayment, or accumulating reinstatement or late charges. Not all of these policies have been prolonged previous May check with your insurance provider for updates - cars.

It isn't uncommon that you forget to pay your bills The original source or you did not pay them for whatever factor you have. Occasionally, you might have no money, or you can have forgotten it since you are hectic. Various other costs may not have the exact same repercussions if you neglected to pay for them as contrasted to your.

Although some firms have elegance periods, paying late or not in all back to back gives you a poor record, and they may still terminate you. We are independent insurance policy agents below in Denver, Colorado that intend to impart the value of insurance in our lives. This subject is highly pertinent in continuing the solutions of your insurance company to keep your coverage.

What Does When Can Your Car Insurance Be Canceled? – Forbes Advisor Do?

Automobile Insurance Cancelation And Nonrenewal Are Different For some factor, you could want to call off your cars and truck insurance coverage (cheapest). It may be since you are relocating to a different state, or you have sold the vehicle that you insured. Whatever reason you have, there is a correct method to quit your premium.

There is one more situation where your insurance company terminates or rejects your insurance policy to be restored. Insurance policy business can not terminate your plan quickly if it has been relocating for more than a pair of months.

Automobile Insurance

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO