The Expert Advice On What To Look For When Shopping For Property ... Diaries

When your plan gaps, other insurance suppliers might wrap up that you either can't make your settlements on time or are unstable. Either method, it can avoid you from obtaining a great plan at an inexpensive rate. Some business will not approve you for a policy at any kind of rate due to the fact that they see you as a danger.

Prior to you begin accumulating home insurance policy quotes, collect: Personal information like your driver's license as well as social safety and security number, Your address (if you just recently relocated or are relocating and don't recognize it off the top of your head)Information on any current fixings or remodellings to your home, including the expense of those repair services or renovations, Details concerning your home's present problem (Is the roofing old? Does the deck demand to be replaced? Is the water heater leaking?)A residence supply, Producing your house inventory, Your house supply must provide whatever you have in your residence or plan to save there.

Whenever possible, affix invoices or assessments to your house inventory to show what the items deserve. If the product has a model number or serial number, include those too. It seems exhausting to make this residence inventory, yet if you do and also you present it to your house insurance policy provider, you assure that whatever on the listing has insurance coverage (liability insurance).

The supplier will generally contact you to set up a see so you can be home to let the assessor in, however evaluations can also take place without warning. Examinations normally take a couple of minutes to a few hrs depending upon just how large your property is. Find out how to review your plan, To guarantee you have the correct amount of coverage, review your residence inventory with your agent. for home.

Many individuals only find out they don't have sufficient insurance coverage after disaster strikes. Become aware of what each section of your plan covers so that you can describe it if you need to make a case. What should my property owners insurance plan cover? According to the National Organization of Insurance Coverage Commissioners (NAIC), many house plans have at least 6 sections that specify kinds of protection.

Getting My How Much Is Mortgage Insurance? - Pmi Cost Vs. Benefit To Work

This area covers other structures on your building (home insurance). This can consist of sheds, removed garages and fencing. Section C covers the things that you keep in your residence. This can include whatever from premium stereo devices to your youngsters's clothes. Like Section A, you have some versatility right here, so select a coverage quantity that makes you really feel comfy.

Allow's claim that a fire loads your residence with smoke as well as causes extensive damage. Your household needs to relocate into a resort throughout home repair services. This area specifies just how much cash you can get for those additional costs, including your hotel costs as well as restaurant tabs because you will not have access to your kitchen area.

It can assist you cover the cost of a lawful situation if your next-door neighbor journeys as well as falls on your icy actions, as an example, or if your little girl tosses a round with the neighbor's window - lowest homeowners insurance. If someone gets harmed on your residential or commercial property, Section F of your insurance coverage safeguards you from clinical expenses.

Without added plans that cover these voids in protection, you don't have any type of security against some typical calamities. The Insurance Info Institute reported that average flood insurance claim was over $42,000 in 2018. Those protection spaces can hurt. All told, make certain you're placing various other plans in position wherever your residence insurance coverage leaves voids.

insurance premium homeowners policy insurance premium deductibles liability insurance

insurance premium homeowners policy insurance premium deductibles liability insurance

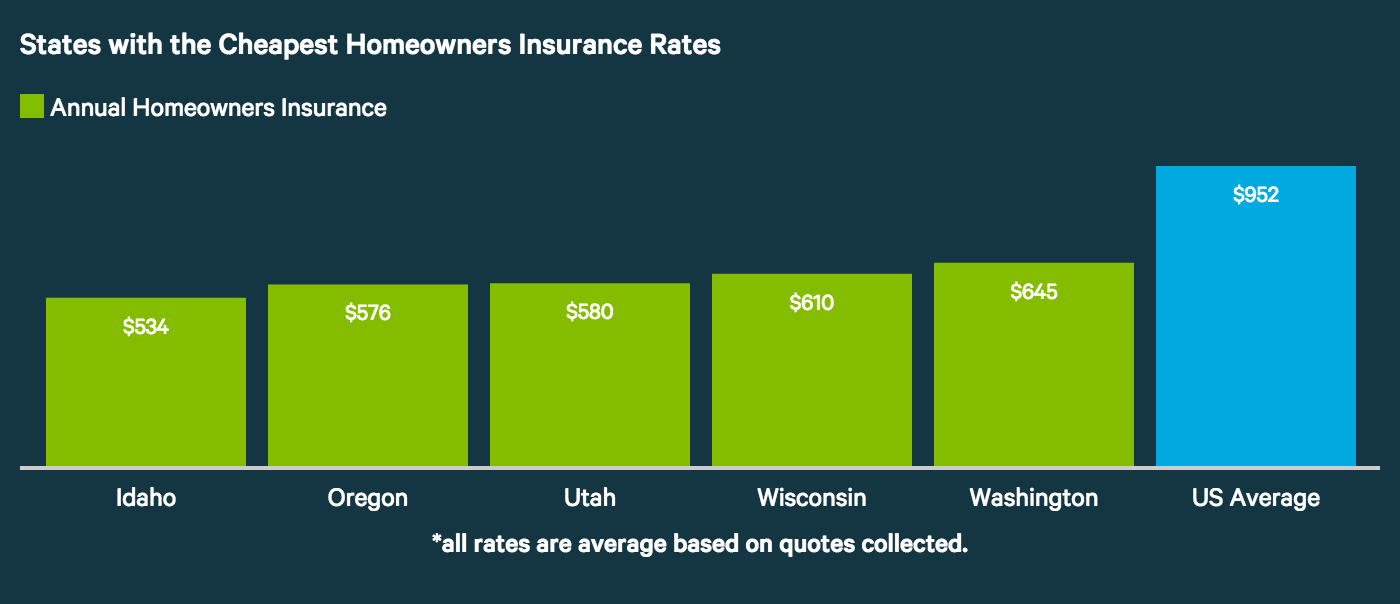

Fortunately, you can keep those costs to a minimum by contrasting home insurance policy quotes. Your home insurance price is special to you relying on where you live, your home as well as what you own. The only means to understand you're getting the very best home insurance price is to gather numerous residence insurance prices estimate from different carriers.

Little Known Questions About How Much Does Homeowners Insurance Cost In North Carolina.

Integrating plans you require like residence and auto can assist you score significant savings. Just how much does house owners insurance price? The cost of your plan is going to rely on you. That said, recognizing some standards can assist you go shopping informed. The typical homeowner in the USA pays simply over $1,220 for their policy annually.

If you can conveniently move to your various other house, you may not require this protection. Individuals who possess older homes, Do not presume that because your house is aging you don't need much protection (affordable). You desire to have sufficient property owners insurance to be able to reconstruct approximately your current top quality of life standards.

Young, solitary buyers, A young person who does not have any youngsters could not require as much protection as a family - cheap homeowners insurance. When you don't require to bother with safeguarding children as well as other member of the family, then you can typically elevate your deductible, save even more cash as well as accept higher risk. Young families, If you start a family, your insurance coverage needs might alter.

Discover a top quality company, Currently that you understand what level of coverage you need, you can start contrasting firms and also plans - and home insurance. The NAIC will tell you whether an insurance firm has obtained problems regarding things like: Case handling delays, Claim denials, Disappointing negotiation deals, Canceling plans, Poor consumer service, You can also contact your state's Insurance policy Commission to learn more concerning the insurance coverage companies that offer your location as well as to locate a listing of all licensed insurance representatives and also brokers.

You might have a few outliers (companies that bill exceptionally high or low prices), but most of them will gather in a cost range. Be cautious of business that offer exceptionally low costs.

5 Simple Techniques For How Home Insurance Premiums Are Calculated

property insurance homeowner insurance homeowner insurance homeowner insurance liability insurance

property insurance homeowner insurance homeowner insurance homeowner insurance liability insurance

Each one can have an influence on how much you pay annually. Elevate your insurance deductible, Your deductible is the quantity of cash you need to invest out-of-pocket prior to the insurance business begins selecting up the tab. Raising the insurance deductible makes you a lot more responsible and also decreases the insurance coverage firm's risk. for home insurance.

cheapest insurance cheapest homeowners insurance cheap homeowners insurance lowest homeowners insurance homeowners insurance

cheapest insurance cheapest homeowners insurance cheap homeowners insurance lowest homeowners insurance homeowners insurance

Other subscriptions reveal insurance coverage business that you are the kind of customer they desire. You do not want to miss out on any means to reduce your insurance expenses.

Insurance coverage business typically share details with each other, so they recognize that you leap from policy to plan. Never quit shopping, Remaining with the same home insurance business for many Look at this website years might lead to cheaper prices.

By comparing insurance provider every few years, you can make certain that you never ever pay much more for the protection that you require. Just don't make a practice of switching suppliers each year - affordable. The takeaway, You do not need to be an insurance policy expert to obtain a bargain on a home plan.

Fraud does exist in the insurance coverage globe. You don't wish to fall target to dishonest firms, Some licensed insurer provide far better services than others. homeowners policy. Make use of the NAIC database to see to it you select a business with couple of complaints, And to help you as you go shopping, here's a quick reference of terms: The added expenses you sustain when you can not reside in your residence due to the fact that of a covered cause and also from which your plan protects you The particular things your policy safeguards you versus The amount you pay out-of-pocket before your insurance coverage begins Your monetary obligation if a person obtains harmed on your building or your reason home damage, The quantity of coverage your plan consists of, after which you are in charge of all costs, The amount you spend for your insurance coverage, As long as you keep these basic factors in mind, you ought to have the ability to browse the insurance policy world without a lot of problems.

Some Ideas on Flood Insurance Costs Prompt Concerns; A Non-profit Discusses ... You Need To Know

Acquiring residence insurance can really

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO