Little Known Questions About What Is A Car Insurance Deductible? - Credit Karma.

The cash we make aids us offer you accessibility to free credit report and reports and helps us produce our other fantastic devices and also academic materials. Settlement may factor right into just how and where products appear on our system (and in what order). But because we typically earn money when you locate an offer you like and also get, we try to show you offers we believe are a good match for you.

Baffled concerning just how a cars and truck insurance deductible works?, you'll likely come across the word "deductible" and also could question exactly how it affects you and your insurance coverage expenses as well as when you'll really need to use it - cheap insurance.

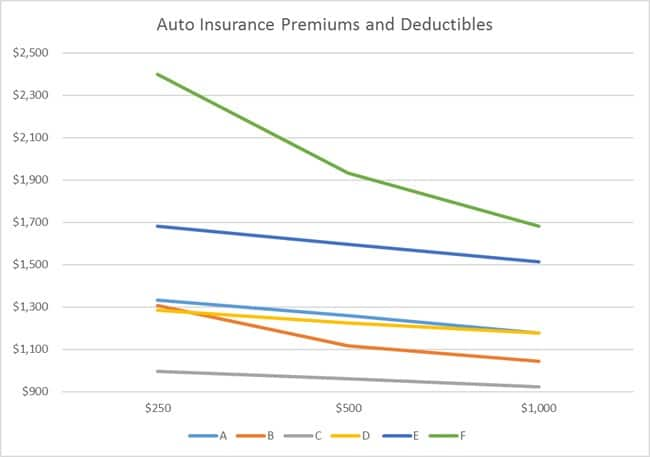

Usual car insurance deductible amounts are $250, $500 and $1,000. Fixings completed $5,000, and you have a $500 insurance deductible.

cheaper auto insurance cars low cost

cheaper auto insurance cars low cost

A vehicle insurance deductible isn't a solitary amount that you pay every year prior to services are covered, like you'll normally discover with medical insurance deductibles - insured car. Simply put, it depends upon where you live. In most states, if you're in an accident that's the other chauffeur's mistake, their obligation insurance policy is normally in charge of covering your repair work, as much as the insurance coverage restriction.

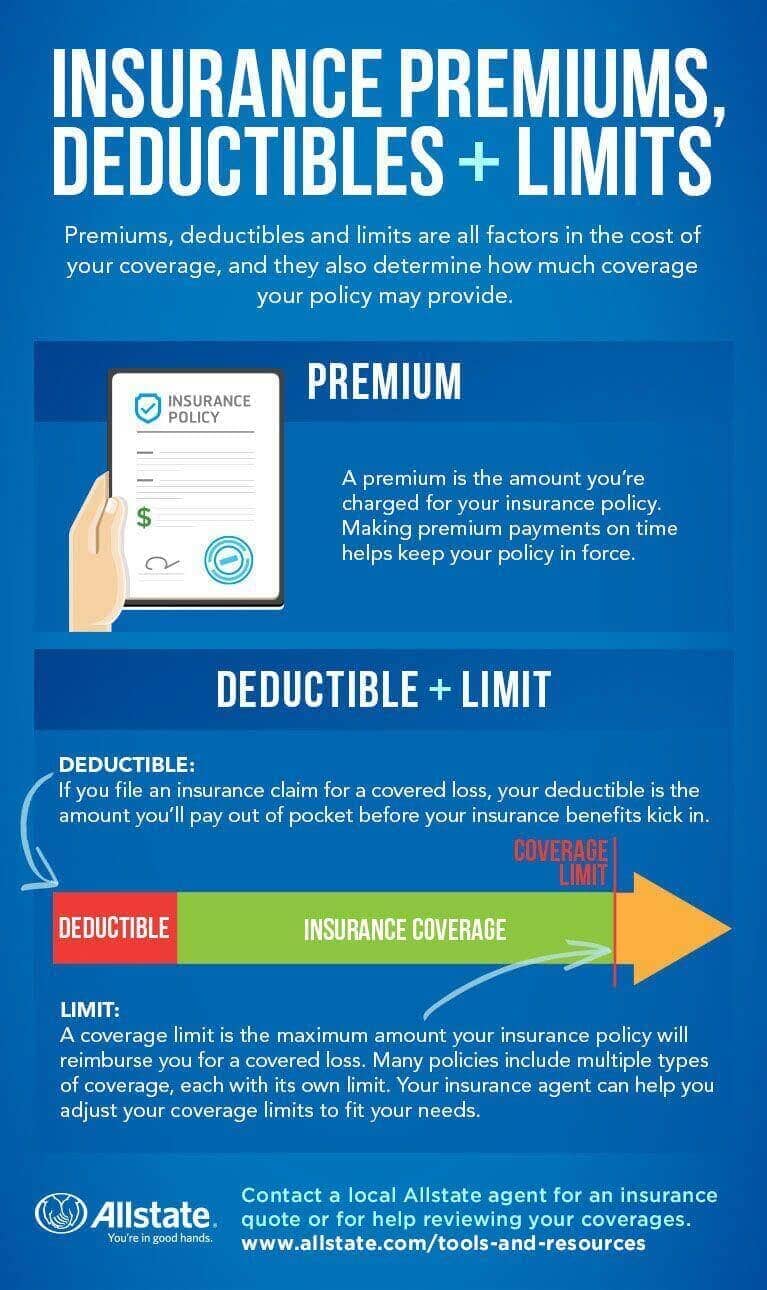

The car insurance coverage deductible is the quantity of money you will certainly initially be in charge of before the insurance provider starts to cover prices. Unlike medical insurance, auto insurance coverage policy deductibles are generally on a per insurance claim basis meaning you would certainly have to cover these prices whenever you file a case.

does not cover the damage you triggered to other individuals's building Covers damages done to your automobile in all circumstances besides a collision in which you are at fault. This includes things like falling tree limbs, or any various other kinds of damages that your cars and truck might incur. How does the deductible job? Your deductible, typically around $750 will be first put on any kind of damages.

See This Report on Understanding Auto Insurance

The remaining $2,750 would certainly then be covered with the collision insurance coverage by your insurance provider (accident). In many cases where another motorist is at fault for the crash you might want to submit a third-party claim versus their Under these situations your insurance provider might go after a process called subrogation to recoup the quantities they have already paid.

You can find out more in our article on? Picking the right auto insurance deductible amount Your first consideration when picking your insurance policy deductible is how much you would be able to pay in case of an occurrence - affordable. market you coverage for a profit, the even more danger defense you acquire the more they make money as well as the reduced your insurance deductible the more threat defense you are purchasing.

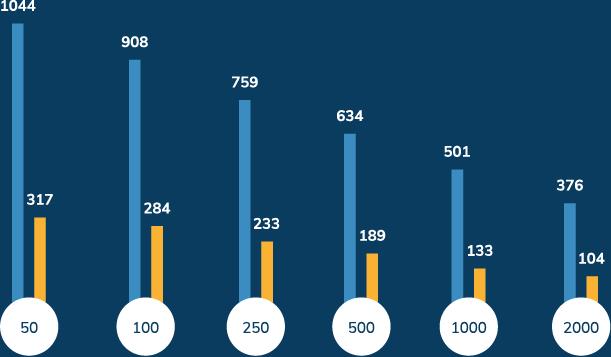

It is additionally crucial to bear in mind that given that car insurance policy deductibles get on a per-claim basis so the regularity of your insurance claims will be among the most vital factors. If your policy has a $500 deductible and you were involved in four different insurance claims of less than $500, then you would certainly be in charge of 100% of all the repayments as well as your insurance policy would have provided no coverage.

One method you can take is to take a look at your driving as well as lorry history. If your history suggests that you may require to make even more regular insurance claims, you may desire to think about selecting a plan with reduced expense expenses. On the other hand, if you have not had a background of crashes you may not need a reduced deductible strategy. auto insurance.

If you've got auto insurance coverage or are looking around for some you might have heard the term "insurance deductible." When you build a vehicle insurance plan, you'll need to choose just how much of a deductible you want, frequently either $500 or $1,000. So just what is a car insurance coverage deductible? As well as just how much should yours be? We'll assist you understand your deductible as well as what's finest for your auto insurance to aid shield what matters most.

Deductible So what's the difference between your insurance policy premium as well as your insurance deductible? The costs is what you pay each month, every six months or every year depending upon your policy's settlement strategy to maintain your insurance plan. Your insurance deductible is the quantity Click to find out more of money you'll have to pay of pocket before your insurance coverage begins and also spends for your claim.

An Unbiased View of Car Insurance Deductibles Explained - Forbes

This is due to the fact that you're essentially paying to have fewer out-of-pocket costs should you submit a claim, so your future cases payments might cost the insurance policy business even more than a person with a higher insurance deductible (auto). On the various other hand, the greater your insurance deductible, the reduced your costs will certainly be. Average Car Insurance Policy Insurance Deductible The ordinary car insurance policy deductible is $500, which, if a case is submitted, will typically be much less than whatever the price of repairs are for a major mishap.

With a $500 deductible, you would only pay $500 in the direction of the repairs, while your insurance policy company would certainly pay the remainder. Just how much Should I Select for My Insurance deductible? So, is it far better to have a $500 deductible or a $1,000 insurance deductible? That depends upon your specific financial needs. Depending upon the possible expense of repair work for damages to your car and also your budget, the size of your deductible can be bigger or smaller sized.

Cars and truck insurance can aid pay for expensive repairs and injuries after a crash. Yet it might not cover 100% of the price. A car insurance policy deductible is the amount you are in charge of paying of pocket. Some sorts of insurance coverage have a deductible, and also others don't. Whether you require to pay a deductible relies on the sort of insurance coverage claim you submit and who (if anyone) is at fault.

affordable insurance affordable insurance risks

affordable insurance affordable insurance risks

The insurance coverage business will only pay for prices that exceed $1,000. Deductibles frequently range from $100 to $2,500 (insure). If you have even more than one type of coverage with an insurance deductible, you can choose different deductible amounts for each insurance coverage type.

automobile money cheaper car auto insurance

automobile money cheaper car auto insurance

If you can not pay for to pay your deductible, you won't be able to cover all the repair services. The insurance policy firm will only pay for costs that exceed your deductible.

risks liability cheapest car insurance cars

risks liability cheapest car insurance cars

If you assume it's not likely you'll require to sue, you may think about a higher deductible. No issue what amount you pick, it is essential to make certain you can manage to pay it if you require to submit a case following a crash. Deductibles relate to some sorts of auto insurance policy protection yet not to others. trucks.

Everything about What Is A Disappearing Deductible? - Mapfre Insurance

business insurance vans cheapest affordable auto insurance

business insurance vans cheapest affordable auto insurance

This kind of insurance coverage helps pay for fixing as well as substitute prices if you're in a collision. Covers incidents that are out of your control and do not include a collision, such as severe climate, rodent damages, dropping items, burglary, as well as criminal damage - cheaper. Assists spend for lorry repairs if the at-fault vehicle driver doesn't have insurance coverage or doesn't have sufficient insurance to cover the expense of the repair services.

This sort of coverage is not offered in all states. If an insured chauffeur strikes you, you do not need to pay an insurance deductible considering that the other driver's insurance policy will cover the damages. If you ever before require to file an insurance claim with your insurance company, you will be responsible for paying the insurance deductible.

Insurance coverage providers make use of deductibles to help in reducing their risk entailing you, the insured party. What Is an Auto Insurance Deductible? When you need your insurer to spend for fixings to your vehicle, they will certainly need you to pay your

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO