Exactly How A Reverse Home Loan Works In 2022

This consists of physical maintenance and payment of all tax obligations, fire insurance as well as condominium or upkeep costs. The size of loan additionally varies, with some programs offering no set term and also some offering dealt with terms varying from 6 months to 5 years. A monetary evaluation of your desire and capability to pay real estate tax and also homeowner's insurance coverage. But your partner will stop obtaining cash from the HECM, considering that he or she had not been part of the finance agreement.

In January 2021, the optimum first major limitation was $822,375. In addition to Investopedia, she has actually written for Forbes Consultant, The Motley Fool, Qualified, and also Expert as well as is the handling editor of an economics journal. If your beneficiaries can not determine a method to repay the financing making use of various other sources, they'll have to offer it instead of maintaining it. Every one of these charges can be included in your finance, however they will certainly minimize the amount you get.

The quantity of time that you or your estate has to settle a reverse home mortgage may vary. As an example, if you die after that your estate may have 180 days to repay the home loan. Nonetheless, if you relocate right into lasting care, after that you might have one year to pay it back. Ensure you ask your lender for details about the timing for paying back a reverse home loan. You do not need to make any kind of routine payments on a reverse home mortgage.

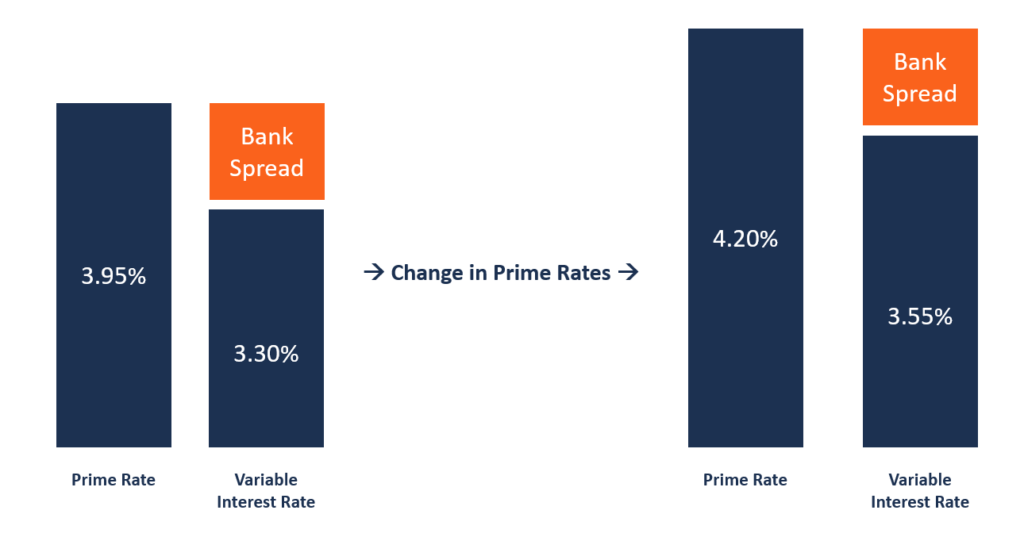

- Interest rates on reverse home loans presently rest at around 8%, which is greater than regular mortgage interest rates which are around 4-5%.

- To qualify for the HECM reverse home mortgage in the United States, debtors usually have to go to the very least 62 years of age as well as the residence need to be their key house.

- When your car loan is repaid, you're assured to have this picked portion returned to you (up to 50%).

- You do not need to make any type of regular repayments on a reverse home loan.

- These finances are backed by the private firms that give them; they are NOT guaranteed by the federal government.

Under the National Credit history Code, fines for very early payment are prohibited on new car loans considering that September 2012; nonetheless, a bank may bill a reasonable administration fee for preparation of the discharge of mortgage. Under the Accountable Lending Laws the National Non-mortgage Consumer Debt Security Act was modified in 2012 to incorporate a high degree of policy for reverse home mortgage. Reverse mortgages are additionally managed by the Australian Securities and also Investments Payment needing high conformity and disclosure from loan providers and also advisors to all consumers. For example, some vendors might try to sell you things like house renovation services-- however then recommend a reverse home mortgage as a very easy means to pay for them. If you determine you require residence https://www.businesswire.com/news/home/20200115005652/en/Wesley-Fin... improvements, and also you think a reverse home loan is the method to spend for them, shop around before choosing a particular seller. Your house improvement expenses include not just the price of the job being done-- however also the prices and also fees you'll pay to obtain the reverse mortgage.

That Should Stay Clear Of A Reverse Mortgage

Also, there are restrictions to just how much of your house's value you can extract. The borrower moves out due to a physical or mental illness as well as is gone with greater than 12 successive months. If your health declines as well as you have to move into a care center, like a retirement home, the lender can call the car loan due after you have actually run out the home for more than year. An expert will certainly explain what a reverse home loan is and take you via the application process.

Car Insurance

Miranda has a master's in journalism from Syracuse College and an MBA from Utah State. Substandard lending maintenance techniques commonly hinder what must be routine paperwork, interest calculations, and also communications with beneficiaries. An additional six-month extension is offered, occasionally much longer. We'll send your loan papers to your solicitor who need to supply you Check out the post right here with independent legal suggestions.

Reverse Mortgage Alternatives

You can pick to obtain your repayments as long as you live in the house, or you can establish an established term to receive repayments. It's even feasible to use a credit line for your reverse mortgage. Whatever type of timeshare foreclosure payment setup you pick, you can not be forced to market your home to pay off the home mortgage, and you will not have to pay till you no more live in the home. On the various other hand, however, movie critics mention that reverse mortgages often include high fees, and also financing equilibriums enhance in time. In addition, reverse mortgages that aren't made via an FHA program might do not have some customer defenses, which can leave you responsible if the home declines.

A forward home mortgage calls for the homebuyer to pay the lender to get a house, whereas a reverse mortgage is when the lending institution pays the homeowner versus the value of their house. Prior to obtaining a reverse mortgage besides a federal government or HECM financing, carefully take into consideration just how much more it will cost you. A reverse home mortgage is a mortgage that you do not need to pay back for as lengthy as you stay in your house. HomeEquity Financial institution uses the Canadian Residence Revenue Plan, which is readily available across Canada. You can get a reverse home mortgage directly from HomeEquity Bank or via home mortgage brokers.

Choosing a reverse mortgage or a reverse mortgage choice relies on your age, residence equity and what you require your loan for. If you are 62 and also up with a lot of residence equity, a reverse home loan can be for you. Keep in mind the failures of a reverse home mortgage, particularly the devaluation of house equity as well as how it could influence your estate. When you typically think about a mortgage, the very first point that may come to mind is a forward mortgage.

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO