Things about Esurance Car Insurance Quotes & More

Our method Due to the fact that customers rely upon us to supply unbiased as well as precise information, we created a detailed rating system to develop our rankings of the ideal car insurance policy firms. We accumulated information on loads of car insurance coverage companies to quality the firms on a large array of ranking factors. Completion result was a total score for each and every company, with the insurance companies that racked up the most factors covering the checklist - perks.

Availability: Vehicle insurance provider with higher state accessibility as well as couple of qualification needs racked up highest in this classification. Insurance coverage: Firms that use a variety of options for insurance policy protection are most likely to satisfy consumer requirements. Cost: Ordinary auto insurance policy rates and discount rate opportunities were both thought about. Customer Experience: This score is based upon quantity of issues reported by the NAIC as well as consumer fulfillment rankings reported by J.D.

Along with the insurer you select, aspects such as your age, car make and also version, and also driving background can affect your costs, so what's best for your neighbor could not be best for you. You can either make use of the device belowto begin contrasting individualized vehicle insurance prices quote. Just How Much Does Vehicle Insurance Policy Expense? The national typical cars and truck insurance coverage repayment in the USA is around $1,548 per year or $130 each month.

Prior to we truly get right into the factors that can impact a premium, let's look at some average settlements just based upon reduced or high levels of protection. Normally, obtaining the minimum liability insurance is less costly than a full insurance coverage plan. Nevertheless, it may be best to spend for even more coverage as opposed to spend for high fixing costs down the line (vans).

The Of How Much Is Car Insurance? - Liberty Mutual

cheaper cheaper money suvs

cheaper cheaper money suvs

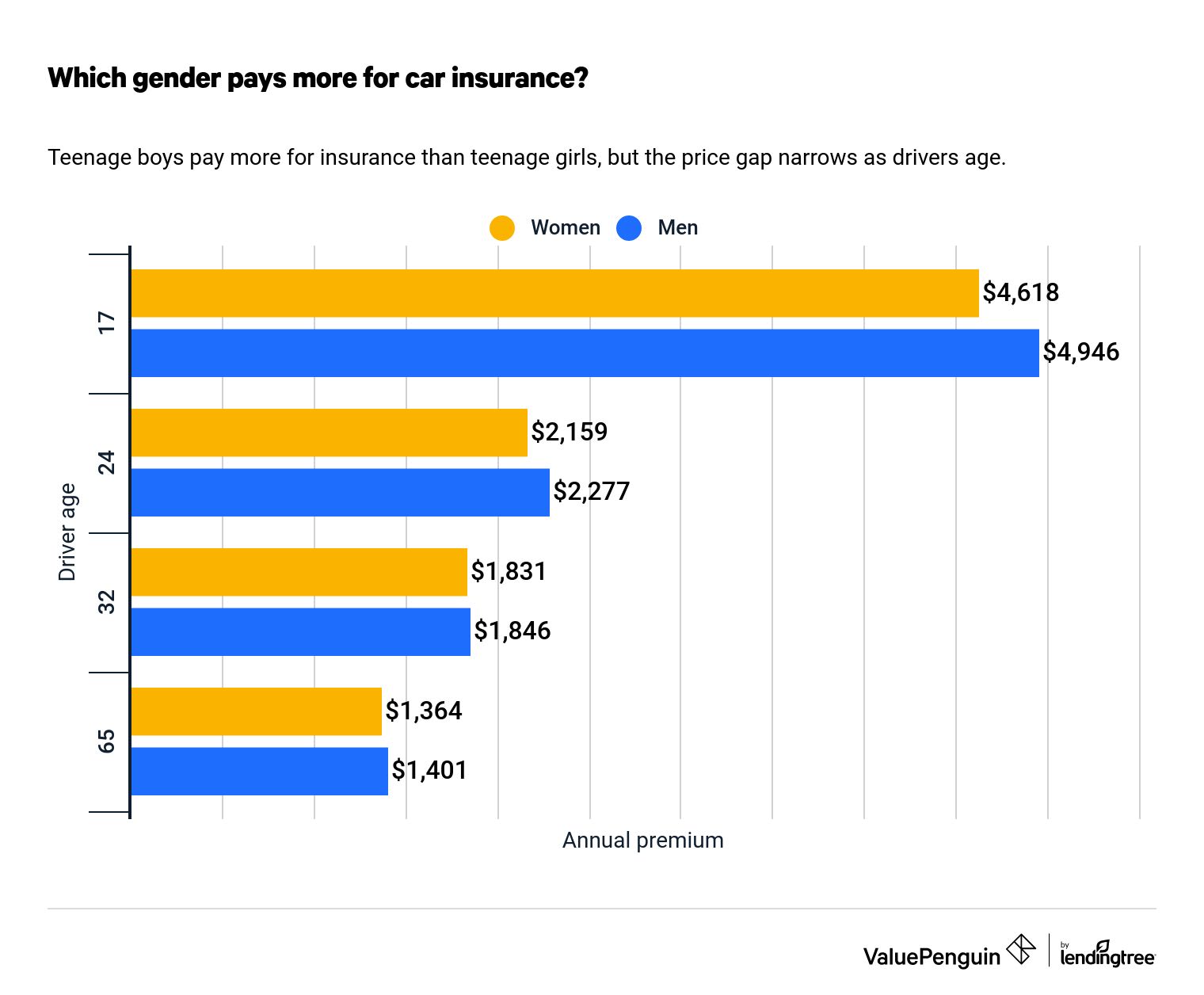

Young guys usually receive greater quotes than young females because studies by the Insurance Institute for Freeway Safety reveal more young males end up in crashes - low cost. In the same way, a research by the Consumer Federation of America discovered that older women crash more frequently than older men, indicating that average auto insurance payments for older ladies can be slightly higher.

A lot of insurance firms take your credit rating score into factor to consider when establishing exactly how much you will certainly pay for vehicle insurance. Automobile insurance policy business often readjust prices according to your work.

New vehicles cost even more to change in the event of a total loss, so accident insurance coverage is extra expensive. Every automobile on the market goes through the safety and security rating procedure. Vehicles with high safety and security ratings give a reduced chance of serious injuries, indicating your insurer will certainly have less medical bills to pay.

If your auto spends most of its time in a garage, then your prices may end up reduced. Your insurance deductible can also impact just how much your vehicle insurance policy premium expenses. Just How Much Is Auto Insurance For Different Ages And Also Genders? As we discussed, a driver's age and also sex can considerably impact ordinary car insurance policy payments - vehicle insurance.

Getting My How Much Is Car Insurance? - Nationwide To Work

These departments also choose exactly how insurance provider analyze risk and establish ordinary cars and truck insurance policy rates for state homeowners. With that said being stated, many states require that all chauffeurs bring specific quantities of obligation cars and truck insurance policy. A number of states run a no-fault system, meaning chauffeurs' insurer are accountable for any kind of injuries and also property damages no matter mistake, to make sure that influences called for insurance coverage too.

Since of this, prices vary significantly from person to individual. This is why we recommend getting quotes from numerous insurance policy companies. With that being said, numerous of the above-listed firms offer competitive prices.

As you can see from the data, USAA auto insurance coverage has several of the Click here for info most affordable average prices in the industry without a doubt. This, together with its excellent client solution, makes it among our top selections for cars and truck insurance coverage. USAA is just offered to present and also former army and their family members.

Approach In an effort to offer precise and objective info to customers, our professional testimonial team collects data from loads of auto insurance coverage suppliers to develop rankings of the very best insurance companies. Business obtain a rating in each of the following categories, as well as an overall heavy rub out of 5.

Getting My How Much Should I Be Paying For Car Insurance? - Linkedin To Work

auto insurance cheapest car insurance vehicle insurance car

auto insurance cheapest car insurance vehicle insurance car

You're possibly questioning if you can get a much better bargain on your auto insurance policy. You might think your present vehicle insurance is reasonable, yet are you paying greater than you should be? It's the Goldilocks dilemmasome drivers are paying as well much for automobile insurance, a few are paying too bit, and you desire to pay the quantity that's simply.

Numerous locals of these states will certainly pay more for car insurance, and also some will pay much less due to the fact that every driver's circumstance is unique. Auto insurance costs are not one-size-fits-all (cars). A motorist with a clean driving record, great debt, as well as no lapse in insurance coverage is going to pay less than somebody with many crashes or tickets, much less than stellar credit score, or an auto insurance lapse.

Motorists required to submit SR-22 typesor the equivalentwith their state's Department of Electric motor Cars are going to pay more in car insurance coverage. Filing the SR-22 form does not set you back that much, per se, yet it indicates that the motorist devoted some form of driving violation. This might include DUI, at-fault crashes, driving without a certificate or insurance policy, or a lot of traffic tickets in a relatively short amount of time.

If you're in a major accident as well as you're located at mistake, not having sufficient insurancemaking you an underinsured motoristmay outcome in the various other event taking lawsuit if your insurance can't cover their damages. liability insurance coverage, you will likely require accident and extensive insurance policy if you lease your auto or are still paying on it.

The Ultimate Guide To Best Car Insurance Companies Of April 2022 – Forbes Advisor

One trick to recognizing just how much cars and truck insurance coverage prices is to understand just how cars and truck insurance policy companies establish their rates. Those currently pointed out, various other factors that insurance providers consider can include: Years of motorist experience Annual mileage Marital condition Vehicle type Place of the automobile Rates might differ depending on whether the vehicle is an international or residential automobile, its worth, as well as exactly how costly it would certainly cost to change.

Just how much you'll need to pay for cars and truck insurance coverage likewise depends on whether you stay in a mistake or no-fault state. The bulk of states run under a fault, or tort, system for car insurance coverage. This implies the at-fault motorist is responsible for paying for the mishap target's clinical and related expenditures, such as shed earnings.

In no-fault states, the motorist's own insurance coverage business pays up to a certain limitation for his or her clinical expenses, no matter that was liable for the accident. The wounded person normally can not receive damages for pain as well as suffering. There are severe constraints on the right to take legal action against an at-fault vehicle driver.

These problems include serious injuries or clinical expenditures that surpass a certain financial limit. The adhering to are: Automobile insurance policy in no-fault states generally sets you back greater than comparable insurance in fault states due to the fact that drivers are needed to get Personal Injury Security (PIP) insurance, which covers medical expenses approximately a certain restriction.

3 Simple Techniques For How To Check If Your Car Insurance Payment Is Too Much - Fox ...

No-fault insurance coverage normally refers only to injuries or casualties, not necessarily to residential property damage. If you reside in a no-fault state and also obtain right into a crash, it's possible that the various other motorist will certainly pay for damages to your vehicle. If you were hurt, your cars and truck insurance should pay the expense.

Contrast our insurance coverage prices with

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO