Why Did The Cost Of My Car Insurance Go Up At Renewal Time? - Questions

Discover how much insurance increases after a crash for different sorts of vehicle drivers in 2022., Vehicle Insurance Policy Writer, Jan 20, 2022 (cheaper cars).

Vehicle crashes take place, even to chauffeurs that intend to drive very carefully. Being associated with an at-fault crash may be demanding, yet having automobile insurance coverage can help cover home damages and also spend for clinical prices, if required, to provide you some peace of mind. After an at-fault crash, lots of drivers stress regarding the increase to their automobile insurance coverage costs.

The even more damage you carry out in your accident, the a lot more you can normally expect to see your costs boost. If you have a background of mishaps, you can anticipate an also steeper price walking because you will appear like a risky driver. Comprehensive coverage action in when your cars and truck is harmed, but it is not related to a collision.

low cost auto dui insurance money

low cost auto dui insurance money

There are both benefits and drawbacks to changing insurance coverage suppliers, so see to it you evaluate both sides before you do it. Mishap mercy programs, If you were signed up in an accident forgiveness program prior to your accident, you might be eligible to have the insurance claim additional charge waived. vehicle. Guidelines differ by supplier and state accessibility, many crash forgiveness programs are developed to forgo the very first at-fault loss that happens on your policy and will certainly waive just one loss within a defined duration, like three or five years.

However, the precise length of time depends on your state and also the severity of the incident. in New York State, an accident or web traffic infraction will certainly remain on your record until the end of the year when the case took place, plus 3 years after. In Oregon, an accident or infraction will stay on your record for 5 years.

At-fault Accidents In Ontario - Will Your Insurance Go Up? Can Be Fun For Anyone

You can check your state's Department of Automobile (DMV) internet site for details regarding driving document demands where you live. low cost auto. Decreasing your car Learn more here insurance prices after an accident, The bigger question other than exactly how much your vehicle insurance will certainly climb after an accident is exactly how do you obtain the lowest possible premium since your accident is behind you.

"You could receive discounts such as driving less miles, being an excellent pupil or having one in your household, and also operating in particular service-related occupations (such as training, medical care, or the armed forces)."Below are some ways to decrease your car insurance coverage price after a mishap: Your debt rating plays a role in determining your car insurance coverage rate, however not all states permit the usage of credit history as a rating aspect for insurance coverage. low cost auto.

It's always an excellent suggestion to shop about and discover the very best rates presently being supplied from various car insurer. insurers. It may be tough to locate a vehicle insurance coverage policy that provides the same coverage at the very same rate before an at-fault mishap, but you may likewise find that insurance business offer different price cuts and also coverage choices.

You need to always review these modifications with a certified agent, reducing the amount of insurance policy you have might lower your premium. You will still need to keep your state's minimum required protection levels, and if you have a car loan or lease, you will certainly require to maintain complete protection on your automobile, yet you may be able to cut optional protection selections (cheap).

This comes down to security ratings, products, price of repair service as well as lots of various other factors. If you require to cut down the expense of your cars and truck insurance coverage, think about getting one of these cheap-to-insure options rather. By utilizing several of these methods, you can help reduce the sting of greater rates after a crash.

Get This Report about At-fault Accidents: Driver Liability For Car Accidents - Nolo

risks liability cheapest car insurers

risks liability cheapest car insurers

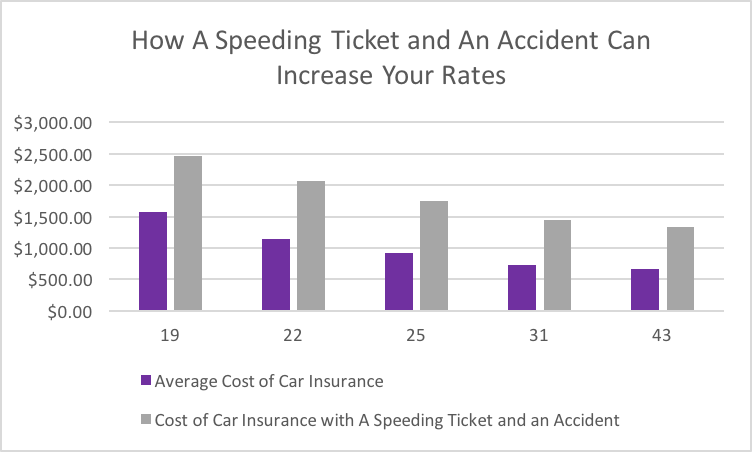

These are example prices and ought to only be used for comparative functions. Prices were calculated by assessing our base profile with the following incidents applied: tidy document (base) and at-fault mishap.

Auto insurance prices can increase 51% a year generally if you trigger an accident, Nerd, Purse's analysis located. If you switch to the least expensive insurer in your state, you might discover much better prices. See what you could conserve on auto insurance coverage, Easily compare individualized prices to see just how much changing auto insurance can save you.

low cost auto cheaper auto insurance laws cheapest auto insurance

low cost auto cheaper auto insurance laws cheapest auto insurance

Also if it was a minor crash, insurance providers perceive you as a better risk and also will nearly always enhance your prices - affordable. To give you a much better concept of just how much extra you'll pay after a crash, Geek, Wallet compared typical cars and truck insurance rates nationwide for 35-year-old vehicle drivers with a current at-fault crash to those without recent mishaps, keeping all other variables the exact same.

Nationwide, a driver with an at-fault crash pays $832 more a year typically than a vehicle driver with no website traffic violations. In 44 states as well as Washington, D.C., average yearly prices were greater than $500 greater for drivers who 'd caused a current mishap than for those who had not. In 18 states, typical rates enhanced at least 50% after an at-fault crash.

Nonetheless, these are based on average prices. Your price may vary depending upon elements like your age, area and insurance firm. The best insurance policy for you in 2022Use our Best-Of Honors list to get the year's finest auto and term life insurance policy. Low-cost cars and truck insurance coverage after a mishap by firm, Automobile insurance provider have wildly various perspectives on how much to increase rates due to an accident.

At-fault Accidents: Driver Liability For Car Accidents - Nolo Things To Know Before You Get This

perks cheaper car insurance auto insurance low cost

perks cheaper car insurance auto insurance low cost

At the other severe, we found a number of business with prices more than two times as high for a motorist who 'd created a crash than for a similar vehicle driver that hadn't. And also in a pair instances, average rates were more than $2,000 a year higher after an at-fault mishap. insured car. State Farm, Geico, Progressive as well as Allstate, the country's four biggest automobile insurer, together make up over half of the auto insurance market.

To see exactly how the biggest insurers price plans after at-fault accidents, we considered typical rates across 45 states and also Washington, D.C., where we have prices for all four of the biggest companies - laws. State Ranch returned the least expensive ordinary prices for motorists who had actually created a crash, along with for motorists who had not, as well as also showed the tiniest portion increase in prices in between chauffeurs with a tidy record as well as those with a current accident.

Economical auto insurance after an accident by state, Wondering which business are the most likely to supply inexpensive vehicle insurance policy after a crash? Discover your state listed below to see the cheapest car insurance coverage rates after a mishap on average based upon where you live. Average annual price after a crash, Southern Farm Bureau Casualty, Southern Farm Bureau Casualty, Farmers Mutual of Nebraska, See what you might reduce car insurance, Easily compare customized prices to see just how much switching car insurance coverage could conserve you.

Our evaluation reveals that searching for the least expensive possible price after a collision can potentially save you greater than $1,350 a year, depending upon your state. No solitary car insurance provider is most inexpensive for everybody. Throughout all 50 states and also Washington, D.C., 23 different insurance companies linked for most affordable alternative after a mishap.

A research by the Consumer Federation of America located that some business increase rates 10% or even more for not-at-fault crashes. car insurance. Due to the fact that of this, citizens of those states are extra likely to see rate increases after a mishap, no issue who is at mistake.

How Much Do Car Insurance Premiums Go Up After An ... Can Be Fun For Anyone

And also a couple of states, including Oklahoma as well as California, don't permit insurance companies to enhance your rates if an accident was not your fault. Some firms, such as USAA, also state they won't elevate prices if you aren't in charge of a crash. No matter of whether the mishap was your fault, it's constantly a good suggestion to contrast cars

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO