Sr-22 Car / Auto Insurance Quotes In Arizona & Indiana Can Be Fun For Anyone

See the chart listed below for a complete listing of states as well as their respective types (underinsured).

Discovering on your own in the setting of requiring an SR-22 bond means you will certainly be facing greater insurance policy costs, there are some means to decrease your SR-22 insurance rates. For beginners, drivers can pick to curtail their insurance coverage somewhat a minimum of till their rates come closer to normal.

Furthermore, numerous states can shorten timelines for major sentences. For example, one offense can have an SR-22 filing timeline cut from five to 3 years if you keep a clean driving document. sr-22 insurance. Chauffeurs can take protective driving courses. In lots of states, defensive driving programs might net you anywhere from a 5% to 10% discount.

At Highway Insurance coverage, we can aid you make the right decisions while providing you with car insurance policy alternatives that are sustainable. underinsured.

Just drivers who get stood out for a DUI will certainly be asked to add an SR-22. SR-22 is the name of the form your Department of Electric motor Automobiles asks you to include to your car insurance, it is not in fact a sort of insurance coverage. If you are convicted of Driving Under the Influence, your auto insurance policy will get a great deal extra expensive - car insurance.

What Does Cheap Sr22 Texas Auto Insurance - Statelocalgov.net Do?

SR22 insurance policy is normally needed in order to proceed driving legitimately in your state. You may be wondering or 'Just how much does SR22 automobile insurance policy expense per month?' In this short article, we will certainly address the average price of SR22, just how to get it, and how much time it requires to take into place.

This type is needed by your state to verify you have the correct quantity of responsibility protection. It is additionally often referred to as a CRF, or Certification of Financial Responsibility. If you stay in the state of Florida or Virginia your state might need what's described as a FR44 as opposed to a SR22 (underinsured).

Texas SR22 Insurance: Take a 32 hour repeat culprit course (driver's license). If you don't possess a vehicle, however need to submit an SR22 with the state in order to keep your motorists permit, you can get one of these really inexpensive plans. What Does SR22 Insurance Coverage Cover? If you are called for by your state to file a SR22 form it's most likely as a result of one of the following factors: DUI or DWIAccidents while without insurance Getting your permit withdrawed or put on hold, Major or repeat website traffic offenses, Driving with a suspended license, Needing a difficulty license, Not paying child support, The SR22 will certainly permit you to maintain your permit and also registration as well as is usually required for a minimum of 3 years, but occasionally is required for as much as 5 years.

Switch over and reduce typical $750/yr. Package and conserve much more! Contrast finest prices online in mins! Comparison quotes are quick, very easy, as well as totally free! Where & Just how Do You Obtain SR22 Insurance Policy? In order to obtain SR22 insurance, you can click on among the web links on this page and also complete the quote type.

Or you can contact your current insurance carrier. If they do not provide the choice to file a SR22 or you aren't currently guaranteed, after that you will need to find an insurer you can purchase insurance with that additionally has the choice to file a SR22. If you're unsure, a fast search online can let you know if your firm can file a SR22 on your behalf.

The Basic Principles Of Orange And Blue Apartments Gainesville. Or. Directly Across ...

The insurance policy carrier that you acquire your SR22 insurance coverage via will need your vehicle driver's permit or various other identification number. Insurance policy companies can commonly file and send the SR22 forms within the same day to your state's department of electric motor cars, but it's possible that it might take up to 30 days to be submitted.

The name: non-owner auto insurance coverage. You are a non owner, yet still have vehicle insurance coverage.

They are much less pricey because the vehicle insurer thinks you do not drive very commonly. They will submit the SR22 with your state's Division of Electric motor Vehicles and you will not shed your motorists license. Do not Choose Your Initial Quote. Compare Providers & Search For The Very Best Rate in Under 2 Minutes.

If you terminate your insurance policy coverage while you are still called for to have SR22 then your firm is needed to report you to your state and you can shed your certificate (sr-22). If you relocate to a new state that doesn't call for SR22 you still require to maintain your SR22 submitted with your former state and thus will certainly require an insurance provider that can do organization in both states.

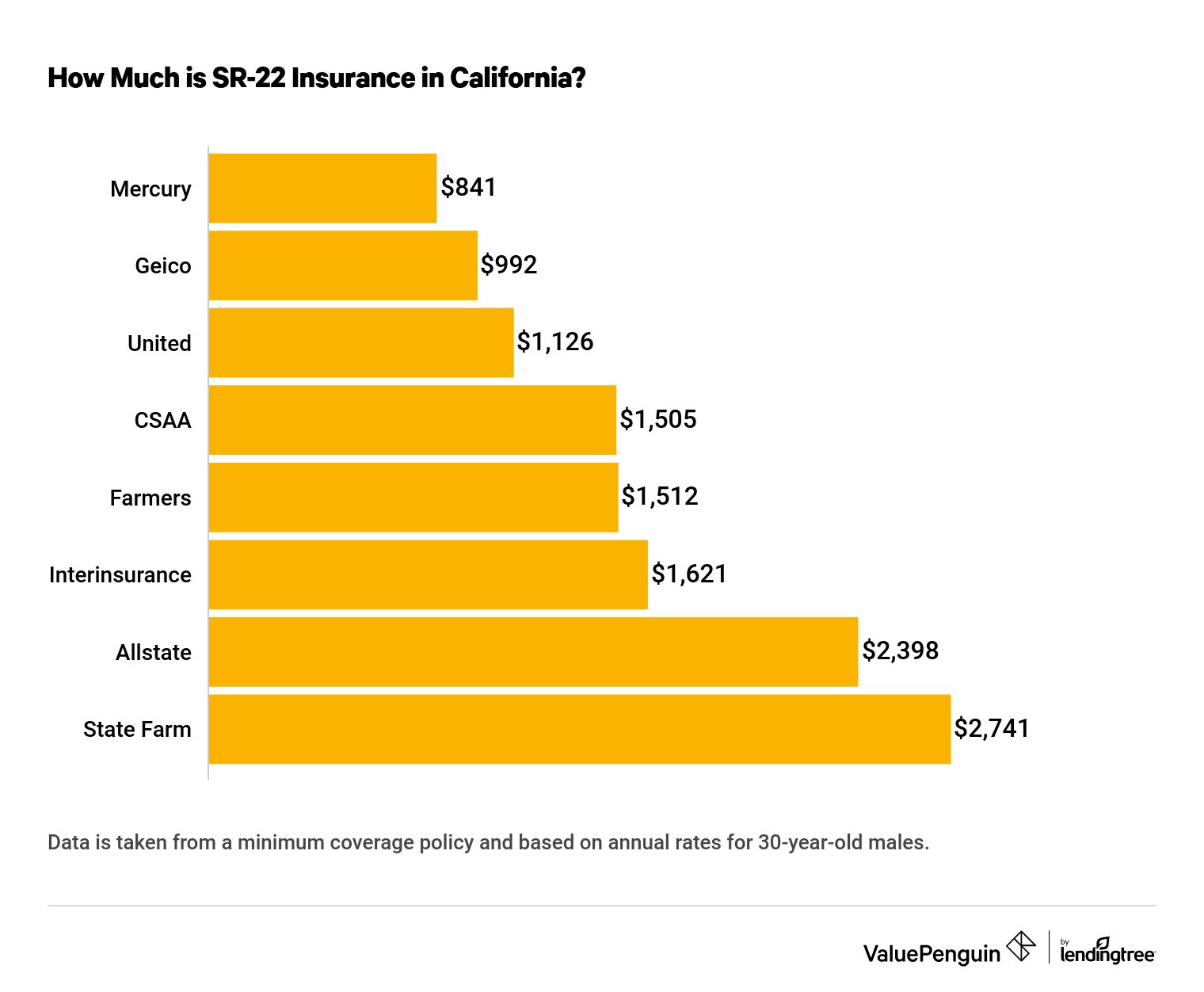

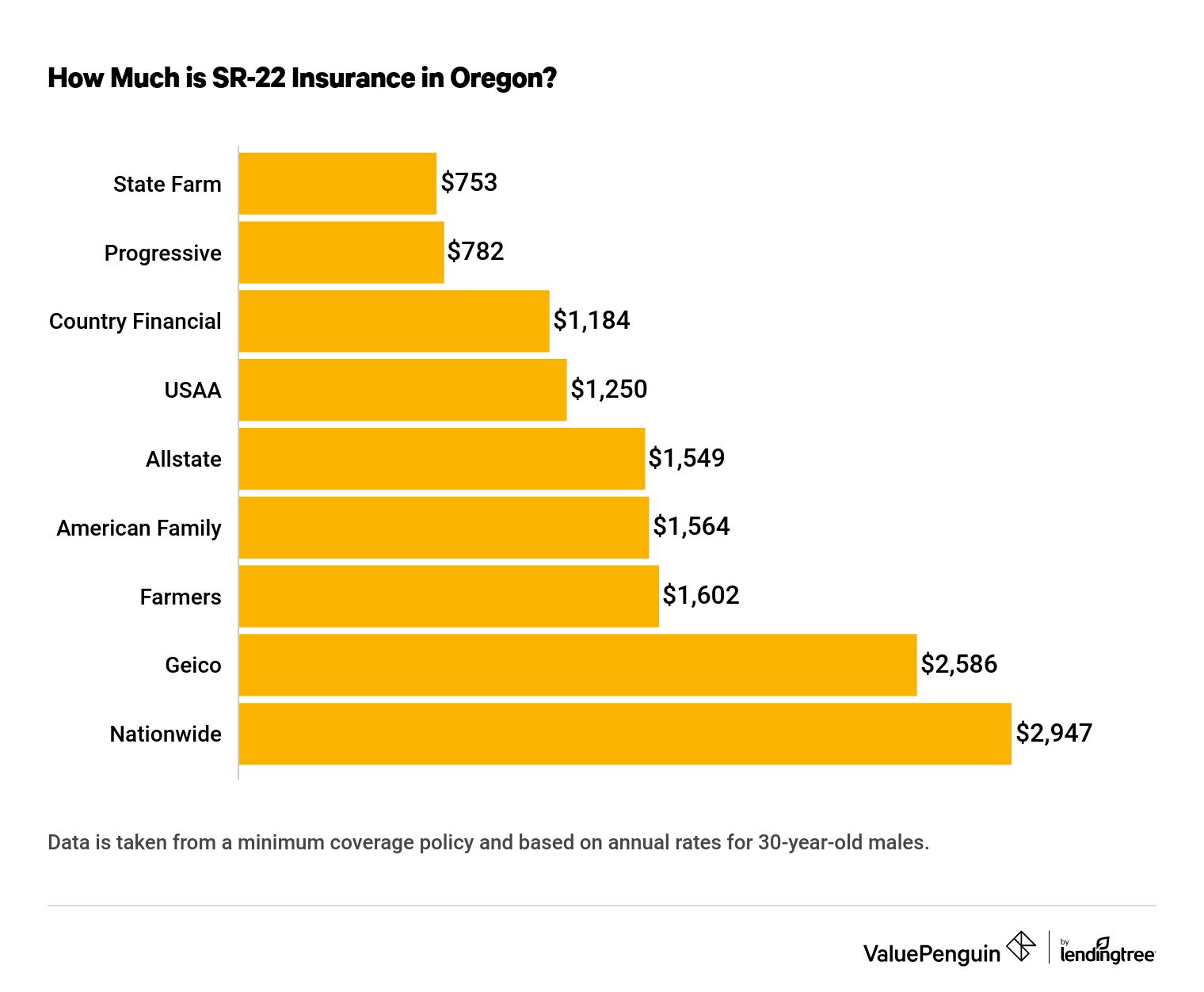

Considering that they are large insurance providers, you might be questioning just how much is the Progressive SR22 rate or the Allstate SR22 price. Let's examine a number of the lowest-cost suppliers below. sr-22 insurance. What is the least expensive SR22 insurance? Some firms will certainly submit your SR22 insurance completely free however you will still be paying higher premiums due to the fact that of what required you to file a SR22 to begin with.

Rumored Buzz on How Much Does Sr-22 Insurance Cost? - Finder.com

Is SR22 An One-Time Cost? The typical filing cost is $25, however it can be basically relying on the insurer finishing the filing. Normally it is not even more than $50 (department of motor vehicles). Once you have submitted a SR22 you don't need to file a new one every year as it will certainly last the period the SR22 is called for.

While the preliminary shock of the monthly cost is fairly worrying, if you keep your driving record tidy, the demand to carry it will at some point end.

If you require an SR-22, then the probabilities are, you possibly got that regulation from the court or your state DMV. SR-22 types validate that you satisfy a called for level of auto insurance coverage, frequently asked for after certain auto events take place. SR-22 is not a kind of insurance coverage, but functions as evidence of called for levels of insurance coverage for sure scenarios.

They are usually only needed after an occurrence that could directly lead to a car price increase; events like DUIs, for circumstances, will certainly enhance your rate and might lead to an SR-22 requirement. While they may involve a declaring fee, the real "SR-22 expense" is typically the occurrence that caused the form being needed.

If you are caught driving in a circumstance that would certainly result in an SR-22 requirement yet do not have your very own vehicle, after that you might be called for to acquire a non-owner SR-22 form. This makes certain that when you drive, you have at least the state minimum obligation insurance. SR-22 vs FR-44Depending on the state, various other types besides the SR-22 are utilized for verification of insurance policy complying with various events (insurance coverage).

Everything about Best Cheap Sr-22 Insurance Rates In California

Each of these types provides proof of obligatory insurance policy when needed by the court or the state. The scenarios that lead up to this request, as well as the state in which it occurs, determine which develop a vehicle driver will require. The FR-44 is frequently needed of vehicle drivers in Florida and also Virginia convicted of a DRUNK DRIVING. car insurance.

If you're looking for cheap SR-22's, after that you remain in good luck. The fees related to these forms are normally in the $25-$50 variety. The major prices related to these kinds remains in the quantity of cars and truck insurance policy they require. Expect you do not presently hold the state minimal auto insurance policy, or you do but the FR-44 needs you to have double the minimum needed quantity (vehicle insurance).

How long do I require an SR-22? Typically, these types are needed for 3 years.

Depending on why you need an SR-22 and also what your driving document is like, you might see a needed period that is longer than average. The courts as well as the states may select a much more extensive time needed for people who seem higher-risk vehicle drivers. Situations like DUIs, hit-and-runs and also other extreme offenses will certainly commonly see longer SR-22 demands.

Generally, these kinds are for more extreme infractions. Things like DUIs, driving without insurance policy or certificate, hit-and-runs and also other such offenses. The SR-22 does not naturally boost insurance coverage rates, yet commonly correlate to various other occasions that occur that can directly cause rates to increase. These forms offer to make certain that high-risk motorists maintain a minimal amount of car insurance coverage.

The 8-Second Trick For How Long Does Dui Affect Insurance In California?

One of our executives will assist you obtain FREE SR22 insurance coverage quotes from top insurance coverage service providers.

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO