All about What Is Sr22 Insurance? - The Balance

Some states only need relatively modest restrictions, whereas other states need much higher limitations. Various other insurance policy legislations also vary from one state to another - auto insurance. Many states use an at-fault system of car insurance coverage, where the driver who created the accident is liable for the damages, however some states utilize a no-fault system.

All of these distinctions effect your vehicle insurance coverage prices. We run in all 50 states, and we're connected with multiple insurance business.

Just How to Save Cash on SR22 Insurance coverage If you need SR22 insurance for the very first time, you possibly have a great deal of concerns. This FAQ should get rid of up a few things for you. While the specific regulations vary in each state, some of the factors that an SR-22 might be mandated for a person are as follows: A vehicle driver is founded guilty of driving without insurance coverage or with a policy that does not fulfill the state's minimum qualifications.

A vehicle driver has repeated website traffic offenses in a brief period of time. sr-22. A chauffeur has actually had his/her vehicle driver's permit suspended or withdrawed as well as intends to have it restored. In some states, the suspension needs to have been mandatory, which might be enforced for violations such as reckless driving, driving intoxicated (DUI) or driving while intoxicated (DWI).

Certifications must be filed with the DMV in the state that has mandated it or the motorist""s existing state of home. dui. This might be completed by mail, but many states have actually executed digital declaring systems. In addition, several firms will submit SR22s in behalf of insurance policy holders, which makes the process very simple.

This charge might need to be paid directly to the state, but it might be feasible to pay the charge via the insurer if they will certainly be submitting it. If the cost is paid by the business, it may be included in the premium, however when shopping for SR22 insurance quotes, it might not be consisted of in the initial quote (sr-22).

Rumored Buzz on How Much Does Sr22 Insurance Cost A Mont - Issuu

If the signed up owner of an automobile is picked for verification, proof must be submitted within six months. If the proof is not submitted and if it does not satisfy the minimum needs or if the owner's real insurance policy is various from that submitted, a certification will certainly require to be acquired.

In enhancement, the lugged in the brand-new state should fulfill the minimum obligation limits of the original state. Some insurance policy carriers do not use declaring for various other states, so it is vital to contact the company to review the information. bureau of motor vehicles. Any kind of driver who is called for to bring a certification must always confirm the details of the SR22 requirement with the DMV in the state mandating the insurance policy and also with his/her service provider.

Just How to Beginning Saving on SR22 Insurance policy Currently You can begin saving money on SR22 insurance right now without also leaving the comfort of your house. The on the internet quote process is straightforward. Enter your ZIP code. Select the year, make and model of your lorry. Respond to a couple of concerns regarding on your own. liability insurance.

After that, the SR-22 doesn't cost you any extra cash, nonetheless, the root cause of needing an SR-22 will certainly in a lot of cases cause an increase in underlying insurance rates. The common duration of needing an SR-22 is 3 years yet that varies by state - sr22. It is necessary to note that any type of relocating infractions while under the SR-22 filing would almost definitely prolong the period for which it's needed.

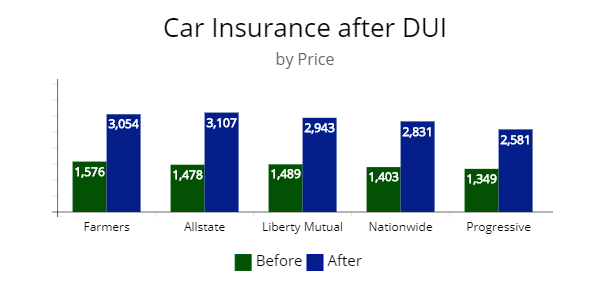

On one end of the spectrum is several smaller sized offenses like speeding tickets that can see an increase of around 30% while the various other extreme would certainly be a drunk-driving relevant mishap which can be closer to 135% boost. Most major business use SR-22 policies to its vehicle drivers yet there are still a couple of that don't.

While not all firms that supply the declaring classification offer it in all states, here's a list of the most significant firms that do offer it in the majority of. GEICO State Farm Esurance Nationwide USAA Farmers insurance AARP Allstate Progressive American Family Members Insurance While one of the most typical kind of certification of monetary obligation is the SR-22, there are variations utilized relying on the state along with the severity of the event for which the SR-22 is bought.

Our How Long Do You Need An Sr-22 After A Dui? - Calle's Auto ... Statements

An additional variant is the FR-44 which is made use of by a couple other states. It is the very same as the SR-22 except a more severe variation. This form calls for the driver to have dual or much more the minimum liability coverage. The intent of the SR-22 and also its variations are to make sure the motorist has insurance coverage whatsoever times as they have actually verified to be a greater risk to those around them.

See the graph below for a complete listing of states and also their corresponding kinds - car insurance.

FOR HOW LONG IS AN SR-22 VALID? Each state has its own requirements for the length of time that an SR-22 must remain in location. As long as you pay the needed costs and also to keep your plan active, the SR-22 will certainly remain effectively up until the demands for your state have been met.

WHAT IS THE DIFFERENCE IN BETWEEN AN SR-22 AND AN FR-44? Many states require a tiny filing cost when an SR-22 is very first submitted (sr22).

At Safe, Auto, we recognize that purchasing auto insurance coverage can be demanding and pricey (insurance companies). You can call a devoted Safe, Auto client solution agent at 1-800-SAFEAUTO (1-800-723-3288) to request an SR-22 be submitted.

Get in touch with your insurance provider to find out your state's present demands and make sure you have adequate protection - insurance companies. Just how long do you require an SR-22? Many states need chauffeurs to have an SR-22to show they have insurancefor regarding three years.

An Unbiased View of Sr22 Filing As Low As $10 A Month! . Low Cost California Sr22 ...

It's still vehicle insurance, with all of the standard insurance coverage alternatives you would have for responsibility, comprehensive, crash, as well as other attachments. An SR-22 is in fact an assurance that the insurance provider makes to the state of The golden state. By sending an SR-22, the insurance company assures that your policy fulfills the state's minimum liability requirements.

Non-owner insurance only applies if you do not have accessibility to a cars and truck within your family. For circumstances, if your roomie has an auto, a non-owner policy might not be readily available. Rather, you might require to be detailed on your roomie's car insurance, and their insurer would provide the SR-22 for you.

As soon as you buy a vehicle, you would after that change your protection to a traditional vehicle insurance coverage. Your vehicle insurance will certainly be much more costly if you have to have SR-22 insurance policy in The golden state. This is not due to the fact that the SR-22 kind sets you back a lot of cash. There's generally a filing cost of around $25 to obtain it sent out to the state.

Most insurance provider keep the additional charge on your plan for three years. As soon as you hit the three-year mark, the surcharge will certainly "diminish" and also not be charged for anymore at the following insurance renewal. This leads to a decrease in your insurance prices as long as you don't have other tickets or activity included.

Speak with your insurer regarding exactly how these fees are dealt with so that you understand what to expect. It's clear that someone with several tickets or crashes is an extra dangerous vehicle driver than someone without that task. Because of this, having to obtain an SR-22 will probably relocate you into a higher-risk classification than you were in previously.

That causes every one of your insurance policy rates to be greater, also without the direct surcharge that originates from the activity itself (bureau of motor vehicles). Your threat group normally lasts 5 years, but a DUI can affect your danger for ten years. That's why SR-22 insurance can be more expensive long after the SR-22 is no more called for as well as the DUI has actually diminished the direct additional charge checklist.

Fascination About How Much Does Washington Sr22 Insurance Cost?

When it diminishes, you can retake the course to restore the bargain (sr-22 insurance). Several insurers give far more than just automobile insurance, such as house owners and occupants protection. When you bring both your automobile as well as house plans with one company, you may receive a multi-policy price cut that reduces the costs on both kinds of insurance policy.

Most insurance firms supply a multi-car discount rate if you have greater than one auto with them. Having multiple cars and trucks on one plan is generally less costly than having a specific plan

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO