Getting My Understanding Commercial Auto Insurance In Florida To Work

This pays for building and clinical damages in the event that an accident is caused by a vehicle driver without adequate insurance policy. 7 percent in 2015, according to the Insurance policy Details Institute, this is protection you might want to consider.

Your car endured $3,000 in damages from the mishap. The various other driver's residential property damage obligation would certainly spend for that. The advantage of a no-fault system is that you can obtain medical repayment coverage right now. You don't need to file an insurance claim with another automobile insurance provider as well as go back and forth keeping that business.

Florida calls for that you seek coverage from your PIP plan before wellness insurance, and also some people take advantage of the system. PIP asserts fraudulence is not unusual, and the Insurance policy Research Council located that Floridians declare regarding 50 percent much more on their injuries than the across the country standard.

As we simply pointed out, Florida requires motorists to carry a minimum of $10,000 in PIP, but that's likewise the optimum they can carry (credit). Florida also does not need people to buy Med, Pay, numerous individuals just have PIP. Picture you triggered a severe mishap as well as the various other motorist asserted $20,000 in clinical bills.

The Ultimate Guide To How To Get Discount Auto Insurance In Florida - First Time Driver

The state minimum needs for BI in Florida are: This insurance coverage spends for the various other vehicle driver's medical costs when you are at fault in a mishap. Your BI needs to at the very least cover $20,000 per crash. This functions similarly to home damages responsibility and also is provided on a first-come, first-served basis.

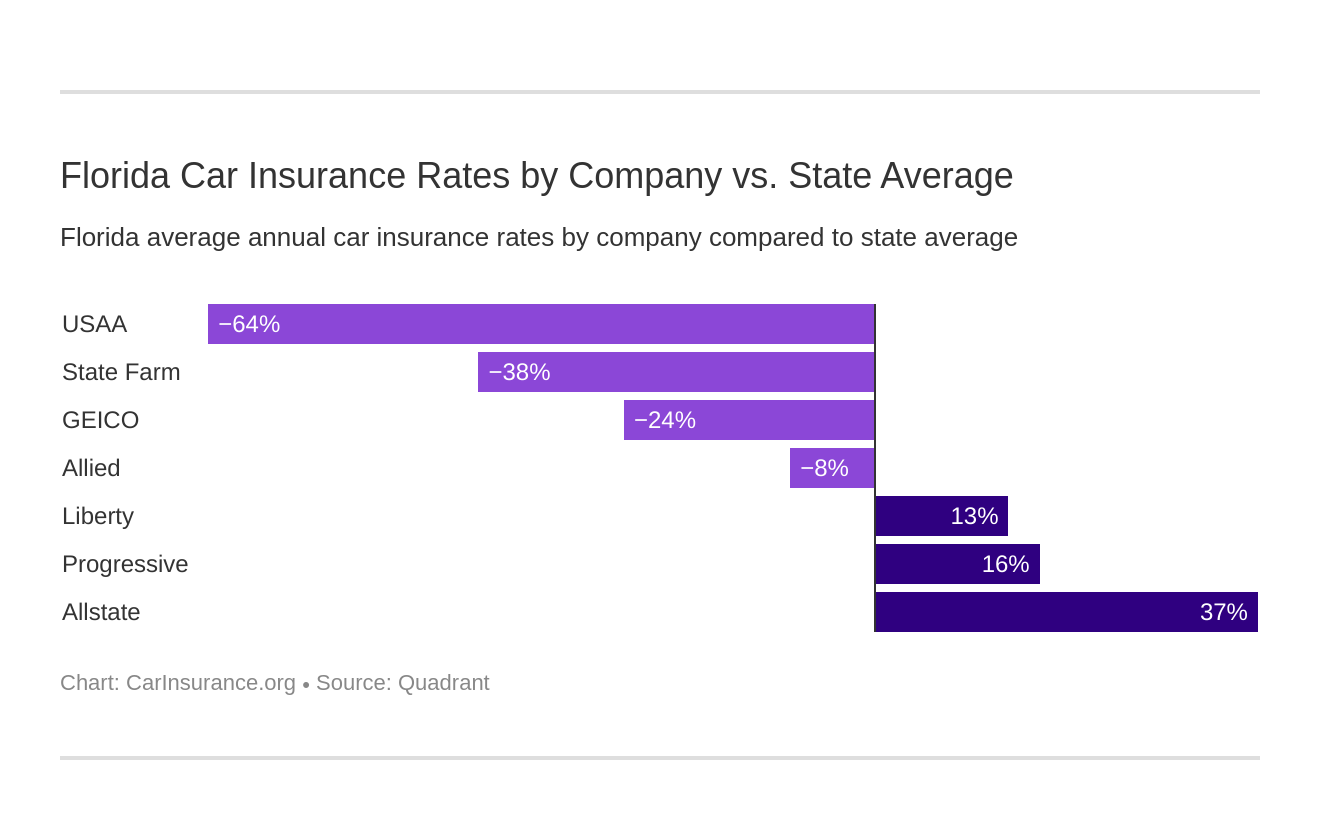

Florida Automobile Insurance: Recap Florida vehicle insurance coverage is both costly and difficult. There are numerous respectable firms that supply affordable prices on vehicle protection in the Sunshine State. The ideal insurance company for you, however, depends mostly on your motorist profile as well as various other aspects. So the company with the very best rates for your next-door neighbor may not provide the most effective prices for you.

Method In an effort to offer accurate as well as honest details to consumers, our specialist evaluation team accumulates information from dozens of automobile insurance suppliers to formulate positions of the finest insurance providers. Firms receive a score in each of the adhering to classifications, in addition to an overall heavy score out of 5. money.

A minimum responsibility policy is the most inexpensive insurance coverage option because it's the most affordable amount of security you need to legally drive in your state. Paying a couple of hundred dollars monthly for insurance coverage may seem attractive, it might not be the ideal option for your requirements due to the fact that this plan is implied primarily to shield other chauffeurs as well as their building - cheaper auto insurance.

The smart Trick of Automobile Insurance - Florida Department Of Financial ... That Nobody is Talking About

It's very recommended that you consider a full-coverage plan if your automobile is brand-new or expensive. Financed as well as rented automobiles will likely be called for to have full-coverage protection. Auto insurance coverage for young drivers in Florida Sadly for drivers in their teens and very early twenties, finding inexpensive auto insurance coverage might be hard.

Insurance companies charge young vehicle drivers significantly higher prices compared to their older equivalents. Our analysis showed that the typical 18-year-old motorist in Florida obtained monthly costs that were nearly 3 times more pricey than the typical 30-year-old. bar_chart 16 year old bar_chart 18 year old bar_chart twenty years old Just how to get the most affordable car insurance coverage as a teen Teens searching for insurance coverage may definitely face some problem locating economical vehicle insurance, yet there are a few ways they can conserve: Your moms and dads having actually someone classified as a risky driver on their insurance plan will likely boost their prices, but this choice is much cheaper than having your own plan - insurance affordable.

That does not imply that insurers don't appreciate your prowess behind the wheel. bar_chart 50 year old bar_chart 60 years of age bar_chart 70 years of age How to obtain the most affordable auto insurance coverage as a senior Seniors can locate low-cost auto insurance coverage by: Some insurance providers have a discount rate menu especially catered in the direction of retired chauffeurs or those age 55 and older.

Cheapest vehicle insurance provider for speeding Having a document of speeding will likely cause insurance provider to mark you as a riskier vehicle driver. This can lead to your vehicle insurance rates potentially increasing. auto. Our study located that State Ranch is the most inexpensive option for motorists who have actually been captured speeding.

The Ultimate Guide To Auto Insurance Data: Florida Rates Among Nation's Highest

You may find better coverage at a small or regional firm, like Star Casualty, Acceptance or Responsive. This is just one of the very best ways to reduce auto insurance coverage. All big insurance providers have a vast array of discount rates, a few of which you might already receive. You can obtain savings for being a member of an affiliate organization, being under or over a specific age or driving below a particular mileage.

Insurance premiums are calculated based upon an analysis of risk. The riskier of a driver you are, the higher your quote will likely be. Having even one accident on your document can considerably increase your premium, which is why it's so vital to preserve great driving habits. Lots of big insurance firms use car, renters, life and house insurance policy.

Chauffeurs that live in one of these states file mishap claims with their own insurance policy company, regardless of who is at fault. If the mishap results in death, injuries or disfigurement, you preserve your right to take legal action against the other chauffeur for payment.

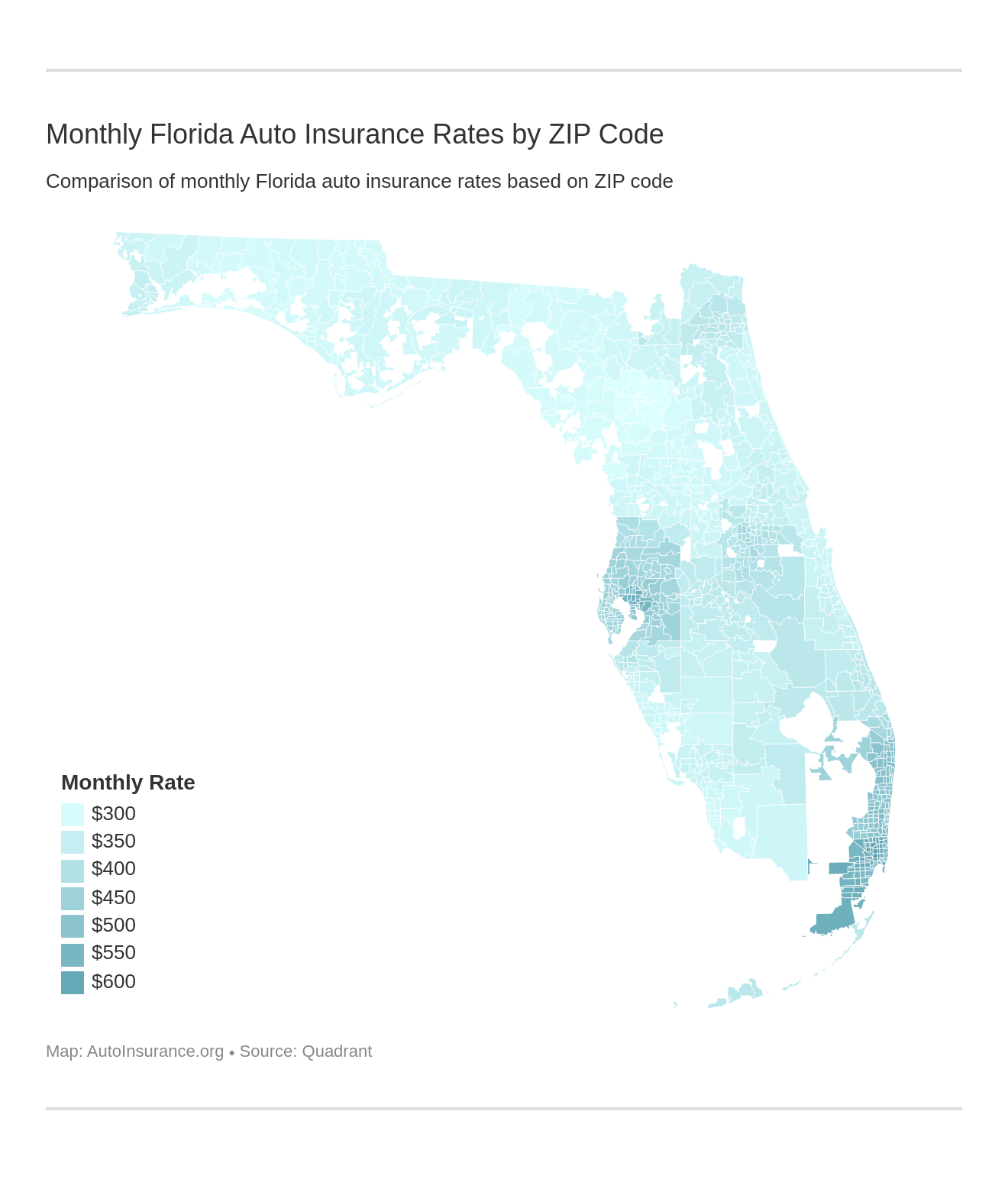

Florida is one of the densest states with a flourishing visitor market, making the roads packed. According to the Insurance Policy Details Institute, Florida has the greatest number of without insurance motorists, at 20.

A Biased View of Travelers Insurance: Business And Personal Insurance ...

Quote, Wizard - low cost. com LLC makes no representations or guarantees of any kind, reveal or suggested, regarding the procedure of this website or to the information, material, products, or products included on this site. You specifically agree that your usage of this site goes to your sole danger.

Pichai Pipatkuldilok/ Eye, Em, Getty Images If you are asking yourself just how much cars and truck insurance is in Florida, the short solution is: a little greater than the nationwide standard. As holds true in any kind of various other state in the U.S., though, your exact premium will certainly be computed according to several variables.

What's the Typical Cost of Car Insurance Coverage in Florida? If you stay in Florida, according to data supplied by, The, Zebra. com, Nerdwallet. com, as well as Cars and truck, Insurance policy. credit. com, you're going to be paying a higher car insurance coverage price than many various other Americans. Whereas the typical nationwide insurance price total up to $889.

What's the Average Costs in Florida by Age Brace? As opposed to things like life insurance, auto premiums are higher the younger you are.

The Single Strategy To Use For Automobile Insurance - Florida Department Of Financial ...

59How Does One's Marital Condition Impact Premiums in Florida? One advantage that people that live in Florida have when it comes to insurance coverage premiums is that wedded drivers in this state pay $81 much less on car insurance coverage every year, whereas the ordinary nationwide discount for wedded pairs in the U.S

The minimum needed automobile insurance policy coverage limitations in the state, according to Value, Penguin.

Not much behind Allstate when it involves consumer contentment in the survey scores was State Ranch, which, interestingly enough, is the least expensive insurance company that was included in the study - insurance company. Resources made use of: This material is produced as well as maintained by a 3rd event, and imported onto this page to aid customers supply their email addresses.

9 Easy Facts About Car Insurance - Florida - Costs, Laws And Facts Explained

You may find better protection at a small or regional firm, like Star Casualty, Approval or Responsive. cars. This is just one of the very best methods to save money on car insurance policy. All large insurers have a wide variety of discounts, some of which you may currently receive. You can get financial savings for being a participant of an affiliate organization, being under or over a specific age or driving listed below a certain gas mileage.

Insurance coverage costs are determined based on an analysis of danger. Several large insurance providers supply automobile, occupants, life and also residence

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO