Get This Report on Florida Car Insurance: Fl Auto Insurance Quote - Progressive

"Business make use of score territories, yet a region in a study like this can mirror higher premiums due to average loss costs because area throughout insurance coverage firms - business insurance. We have not conducted an extensive testimonial of the detail of the technique made use of in this research study, yet it is not unexpected that loss expenses, risk, as well as prices vary in various components of the state." Going back even more and also taking a look at the cost of auto insurance coverage by county, a similarly diverse landscape arises.

Counties with the least pricey insurance coverage prices tend to be in the state's most country, sparsely populated regions, while those counties with the highest prices have a tendency to be one of the most largely occupied in the state (vehicle). As an example, Miami-Dade Area is the largest in the state, with a populace of 2.

"When you consider that Miami-Dade Area is so very populated, with a whole lot of four-lane interstate highways running through it and drivers taking a trip at broadband, you are naturally going to have more crashes than in other parts of the state," Mc, Christian states. "As well as that boosted likelihood of crashes is just one of the factors those drivers pay more for insurance coverage." Mc, Christian additionally explains that Florida's most heavily populated cities and also regions lack comprehensive public transport options seen in other East Coastline metropolises. vehicle insurance.

"In order to get about in Florida you essentially need to do it in a vehicle." When it comes to whether consumers should be worried concerning the disparity of premium expenses throughout the state, James claims no. "Ninety-nine percent of what chauffeurs spend for car insurance is based on the statistical work of actuaries, and also there's no chance to avoid the connection between population thickness and the boosted likelihood of crashes, theft, and also scams," James says.

"Insurance whether it's vehicle or home stands for the risk of where you live, and it's accurate that the threats are different in different parts of the state," Mc, Christian states. "Florida is not just one homogenous entity." SIGHT PRESS LAUNCH.

10 Simple Techniques For Who Has The Cheapest Car Insurance In Florida?

The driver must preserve proof of continuous insurance coverage throughout the registration period. The fines for driving without car insurance in Florida include a reinstatement cost of $150 up to $500 for subsequent violations, as well as the motorist must give evidence of current Florida insurance (suvs). What is Thought About Full Coverage Vehicle Insurance Policy in Florida? According to the Florida Department of Freeway Security and Motor Vehicles, Florida's car insurance policy regulations require all chauffeurs to present proof of liability insurance policy when they register their automobile.

However, Florida additionally has a texting while driving restriction for all motorists. Florida SR-22 Insurance Documents Florida SR-22 insurance policy records are required for vehicle drivers who have been founded guilty of driving without auto insurance policy. An SR-22 form may need to be declared 3 years with the DHSMV, revealing evidence of economic obligation.

Your insurance company can electronically file SR-22 insurance coverage documents to the state of Florida for vehicle drivers that are required to keep and also show legitimate auto obligation insurance coverage. cheap car.

The auto insurance provider also has rideshare insurance policy for policyholders who drive for Uber, Lyft and also various other services (vans). As Florida's tourism-heavy cities are a few of the most preferred in the nation for rideshare solutions, this optional coverage might be beneficial for lots of chauffeurs. Allstate also has a secure driving program called Drivewise.

State Farm has a safe driving program for vehicle drivers under the age of 25 called Steer Clear. The program includes courses, mentoring as well as technique driving hours to assist trainee chauffeurs make automobile costs discount rates. Drivers can also conserve by capitalizing on the Drive Safe & Save, TM program. This usage-based program displays driving behaviors and incentives consumers for safe driving with discount rates approximately 30%.

Getting The Do I Have Enough Auto Insurance In Florida? - The Maher ... To Work

As we discussed, the state of Florida is not recognized for its safe driving problems. The likelihood of obtaining right into a vehicle accident is a lot higher in Florida than in various other states. Due to the fact that of this, USAA's crash mercy strategy might be eye-catching to many vehicle drivers in the Sunlight State. If you remain accident-free for five years, your next at-fault accident will not trigger your vehicle insurance policy costs to raise - car.

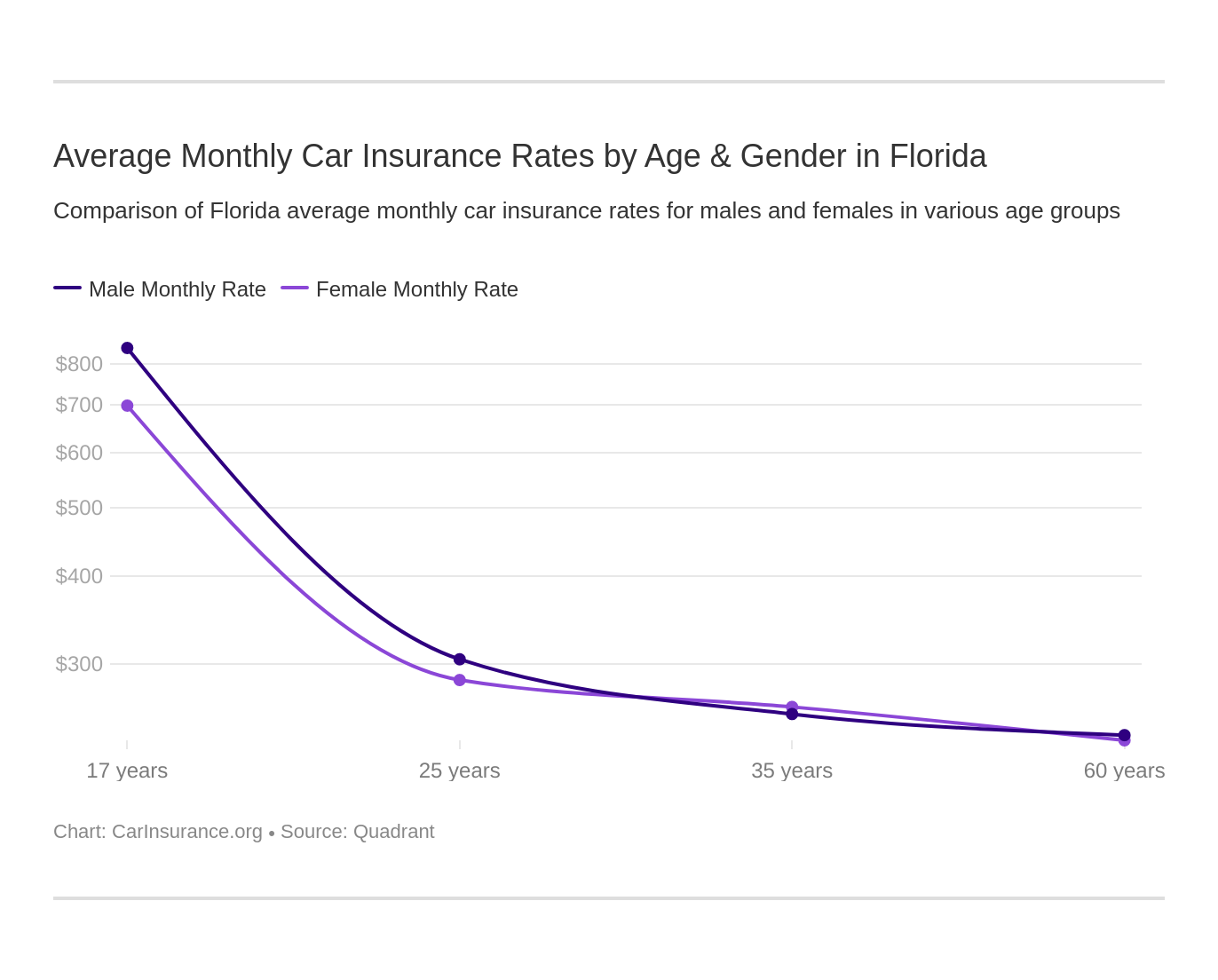

If you're a risky chauffeur such as a chauffeur under the age of 25, an elderly vehicle driver or a person with a DUI/DWI on your driving record Progressive is one minority insurance firms that can still supply you low vehicle insurance coverage prices (insured car). Considering practically 30% of Florida's populace is either between the ages of 16 and 24 or over the age of 65, Progressive may be the best option for several Floridians.

AM Finest provided Progressive an A+ financial rating.

Florida is one of the most lovely states in America with great, pleasant weather condition, numerous miles of open roadways and great deals of coastline to discover. cheaper car insurance. Before jumping into an automobile and also heading to those white sand coastlines, make sure you're getting the best deal on your car insurance coverage by picking one of the 5 finest cars and truck insurance policy firms in Florida.

It pays to do your study and also compare as lots of rates as possible using our contrast device below. It's likewise vital to pick an auto insurer that deals with your specific requirements, whether you're an older motorist, a homeowner or have an inadequate driving history you're attempting to improve.

The 5-Minute Rule for Another Pain Point For Us Motorists: Car Insurance Costs - Cbs ...

In one of the most current 2020 J.D. Power Vehicle Insurance Research study, Allstate claimed the top spot for highest general consumer contentment in Florida. low-cost auto insurance. It was closely followed by Esurance on the list, which is unsurprising due to the fact that Allstate got Esurance in 2011. This reveals that throughout all brand names, Allstate rates extremely in Florida for customer solution contentment.

Individuals undergo hard times and are occasionally not able to pay their insurance policy expenses. Task losses occur, which can lead to repossession as well as poor credit rating. However individuals can also transform those scenarios around and also obtain a brand-new lease on life. The General is a vehicle insurer that understands that.

A few of the tools and also research we took into consideration consist of: We looked into the typical annual premiums of cars and truck insurance provider in Florida and which cars and truck insurance provider had the most effective economic toughness. Poor monetary wellness could result in issues when paying claims in the future, so it's an essential indicator to take into consideration when choosing a cars and truck insurance provider.

We examined for drivers of multiple ages with varying driving backgrounds, including chauffeurs with citations for driving drunk and also crashes within the last 3 years. We also examined for vehicle drivers that had different credit rating in addition to those who lease and those who have their residences. We put via discount rates supplied by over a dozen vehicle insurance firms in Florida.

Numerous cars and truck insurance provider provide discounts, however they generally satisfy chauffeurs who have superb credit score as well as best driving backgrounds. By finding business with a much more diverse food selection of discounts, we're able to assist a variety of different vehicle drivers locate the most effective car insurance policy in Florida. Finally, we contrasted many online industries for car insurance to find one of the most detailed one.

Not known Facts About Cheap Florida Car Insurance- Dairyland® Auto

1 selection as the most advisable vehicle insurer in Florida for the substantial majority of vehicle driver profiles that our research study team checked. What You Need to Learn About Florida Coverages Florida auto insurance coverage regulations are unique due to the fact that Florida is a no-fault state. Make sure to recognize what this suggests (see below for additional information), and think about lugging insurance over the state minimums for more defense (accident).

Put in the time to get at least five cars and truck insurance coverage prices estimate from business in Florida before deciding which one is best for you. Be sure to ask regarding discount rates you qualify for and whether the insurer will increase your rates after you have actually been with them for greater than a year.

Take a look at the areas below to discover out which business supply

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO