The Buzz on How Much Does A Finance Manager Make

5,6,8 In addition, financing functions might involve a mix of monitoring and examining financial information and helping communicate these findings to management, clients, and other departments within a business in order to assist advise others on various essential decisions. This means that finance specialists need strong important thinking and analytical skills depending on the particular position (How to finance a franchise with no money). 5,6,7 For that reason, regardless of the position or career path you decide to pursue with a finance degree, numbers are just one aspect of the job. AIU uses numerous online degree programs that might fit your career path or interest.

We've put together a list of the most typical and often asked financing interview concerns. If you want to ace your financing interview, then make sure you master the responses to these tough concerns below. This guide is best for anyone speaking with for a monetary analyst jobGuide to Ending Up Being a Monetary Analyst, and it's based upon genuine questions asked at international financial investment banksBulge Bracket Financial investment Banks to make working with choices. In combination with this detailed guide to fund interview concerns (and answers), you might likewise desire to read our guide on how to be a terrific financial analyst, where we outline "The Analyst TrifectaThe Analyst Trifecta Guide." There are 2 main classifications of financing interview questions you will deal with: Behavioral/fit concerns, Technical questions relate more to such as your capability to work with a team, managementLeadership Characteristics, dedication, innovative thinking, and your overall character type.

To help you tackle this aspect of the interview, we have actually produced a separate guide to behavioral interview questionsInterviews. are associated to specific accountingAccounting and financingFinancing subjects. This guide focuses exclusively on technical finance interview questions. for financing interview concerns include: Take a number of seconds to plan your response and repeat the question back to the job interviewer out loud (you buy some time by duplicating part of the concern back at the start of your answer). Use a structured technique to responding to each question. This usually implies having points 1, 2, and 3, for instance. Be as arranged as possible. If you do not know the specific response, state the important things you do know that matter (and do not hesitate to state "I do not know precisely," which is better than thinking or making things up).

The balance sheetBalance Sheet reveals a business's properties, liabilities, and shareholders' equity (put another way: what it owns, what it owes, and its net worth). The income declarationEarnings Declaration lays out the company's incomesSales Profits, expenditures, and earnings. The capital statementCash Circulation Statement shows cash inflows and outflows from three locations: operating activities, investing activities, and funding activities. Cash is king. The declaration of money streamsDeclaration of Money Flows provides a true photo of just how much cash the business is producing. Ironically, it often gets the least attention. You can most likely pick a different answer for this concern, however you need to provide an excellent validation (e.

Rumored Buzz on Who Will Finance A Mobile Home

This is somewhat subjective. A good budgetTypes of Budgets is one that has buy-in from all departments in the company, is reasonable yet aims for accomplishment, has been risk-adjusted to permit a margin of Click here to find out more mistake, and is tied to the business's overall tactical strategyStrategic Planning. In order to accomplish this, the budget requires to be an iterative process that includes all departments. It can be zero-basedZero-Based Budgeting (going back to square one each time) or building off the previous year, but it depends on what kind of company you're running as to which technique is better. It is necessary to have an excellent budgeting/planning calendar that everybody can follow.

If it has gross income, then it can gain from the tax shieldTax Guard of issuing financial obligation. If the firm has instantly consistent capital and has the ability to make the required interest paymentsInterest Cost, then it may make sense to issue financial obligation if it decreases the company's weighted average cost of capitalCost of Capital. WACC (stands for Weighted Average Expense of Capital) is computed by taking the portion of debt to total capital, multiplied by the debt rate of interest, increased by one minus the effective tax rate, read more plus the portion of equity to capital, increased by the needed return on equity.

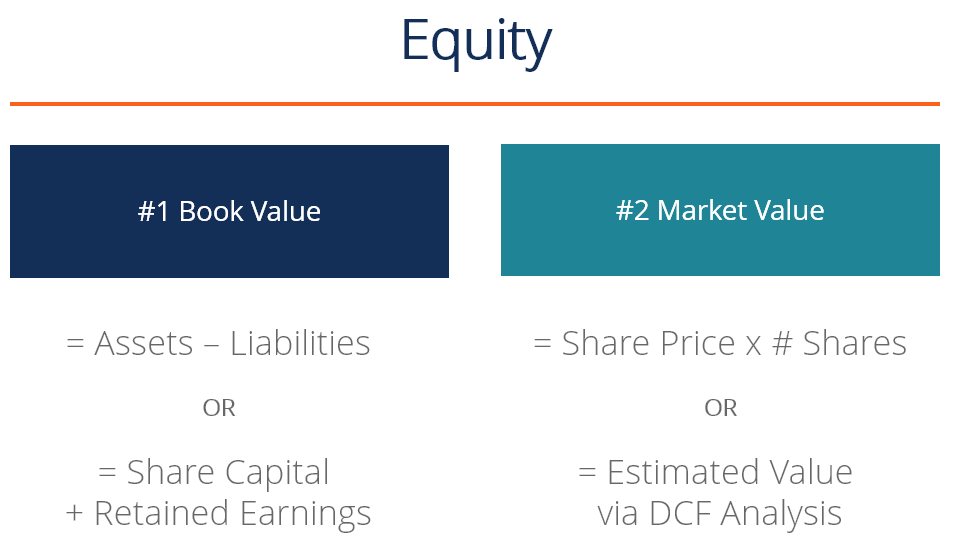

Financial obligation ranks ahead of equity on liquidationNet Possession Liquidation of business. There are benefits and drawbacks to funding with financial obligation vs (What does ltm mean in finance). equity that a business needs to consider. It is not immediately much better to utilize financial obligation funding merely since it's more affordable. An excellent response to the question may highlight the tradeoffs if there is any follow-up required. Learn more about the expense of financial obligationCost of Debt and cost of equityCost of Equity. This concern has 4 parts to it: Part I) What is the effect on the business's EBITDAEBITDA?Part II) What is the effect on the business's Net IncomeNet Income?Part III) What is the effect on the company's capitalMoney Flow?Part IV) What is the effect on the company's valuationEvaluation Methods?Answer: Part I) EBITDAEBITDA increases by the exact amount of R&D cost how to get rid of your timeshare legally that is capitalized.

Part III) CapitalCapital is almost unimpacted nevertheless, cash taxes might be different due to changes in depreciation expense, and for that reason cash flow could be a little various. Part IV) AppraisalAppraisal Methods is basically continuous other than for the cash taxes impact/timing influence on the net present value (NPV)Net Present Worth (NPV) of capital. It is necessary to have strong financial modelingWhat is Financial Modeling concepts. Wherever possible, model presumptions (inputs) should be in one location and noticeably colored (bank designs generally utilize blue font for model inputs). Great Excel models likewise make it simple for users to understand how inputs are equated into outputs.

A Biased View of How Many Years Can You Finance An Rv

g., the balance sheet balances, the cash circulation estimations are proper, and so on). They include enough information, however not excessive, and they have a control panelFinancial Modeling Control panel that plainly shows the crucial outputs with charts and chartsKinds of Charts. For more, take a look at CFI's complete guide to financial modelingFree Financial Modeling Guide. Image: CFI's Financial Modeling Courses. Nothing. This is a trick concern just the balance sheetBalance Sheet and money flow statements are impacted by the acquiring of inventoryInventory.Working capital NetWorking Capitalis generally specified as present possessions minus present liabilities. In banking, working capital is usually defined more directly as present possessions (excluding money )less existing liabilities( excluding interest-bearing debt). By knowing all 3 of these definitions, you.

can offer a really extensive answer. Negative working capital is typical in some markets, such as grocery retail and the restaurant organization. For a supermarket, clients pay in advance, inventory moves fairly quickly, however suppliers often give 1 month (or more) credit. This means that the business gets cash from clients prior to it needs the money to pay providers. Unfavorable working capital signifies performance in services with low inventory and accounts receivable. In other scenarios, negative working capital may indicate a business is dealing with monetary trouble if it doesn't have sufficient money to pay its existing liabilities.

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO