Reverse Mortgages May Be Handy In Retired Life If You Mind The Threats

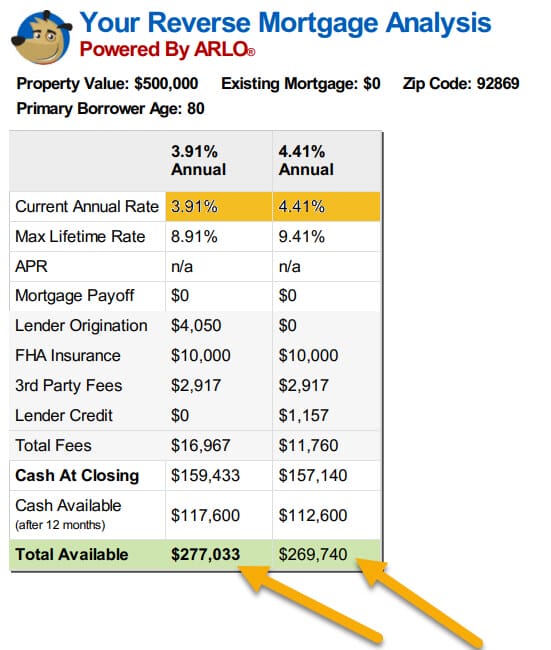

These are another month-to-month cost coming your way with a reverse mortgage. A reverse mortgage works like a routine home loan in that you have to use and also obtain approved for it by a lender. They'll make use of a bunch of information regarding you as well as your residence-- from your age to the worth of your residential property-- to determine how much they can lend you.

- The loan provider's threat is factored into the interest rates, repayment problems as well as credentials process.

- For individuals residing on a moderate retired life income these financings can allow unexpected one-off expenditures to be met, such as having to change a roof covering or other major repairs, or having major surgery.

- You are not required to make any month-to-month repayments in all, so you can not miss out on any type of.

- You've quit some future liberty when you obtained the reverse home loan.

- Raised equity-- Over the previous years, home equity has actually expanded as home values have actually risen.

If you do not have a present personal report, Experian will supply a cost-free copy when you send the details requested. Furthermore, you may acquire a cost-free duplicate of your report once a week with April 2022 at AnnualCreditReport. Personal credit scores report conflicts can not be submitted with Ask Experian. To contest details in your individual credit score record, just comply with the guidelines provided with it. Your personal credit rating report includes proper get in touch with info consisting of a website address, toll-free phone number and mailing address. Selling your house at a profit and relocating to a smaller, less pricey room can be the solution to your budget concerns.

My Lender Told Me I Would Certainly Need To Complete Repair Services To My Home Prior To They Will Provide Me A Reverse Home Mortgage, Should I Do It?

Lenders require clients to obtain the thumbs-up from accountants, financial consultants as well as lawyers. " We need to aid Australia become aware that the home is the very best area to live as well as part of their retired life funding - it can be both those points during retired life," states Funder. " Australian retirees own over $1 trillion in home equity, as well as we require to find means to allow them to access that to money their retired life," claims Family Resources president Josh Funder. The amount you can borrow is a function of your age and the value of your residence.

You Might Shed The House To Repossession Prior To You Exercise Another Choice

Many are making use of offered proceeds to fund lasting care and also age in place home renovations. The high expenses of reverse mortgages are not worth it Article source for lots of people. You're far better off marketing your house and transferring to a less costly area, keeping whatever equity you have in your pocket as opposed to owing it http://donovanvmcc989.fotosdefrases.com/why-a-reverse-mortgage-is-a-bad-concept to a reverse home mortgage loan provider. As opposed to a reverse home loan, you will need to make month-to-month settlements, as well as loan providers will evaluate your revenue as well as credit history when evaluating your application. craigslist timeshare Unlike typical mortgage repayments, rate of interest settlements on reverse mortgages aren't tax obligation deductible.

You can utilize the money you receive from a reverse home loan to do this. This suggests that neither your nor your successors are directly liable for any kind of amount of the mortgage that exceeds the worth of your residence when the financing is repaid. Another typical reverse home mortgage misconception is that if someone dies, their spouse is compelled to leave. The enduring spouse is under no commitment to vacate or make any settlements till they move or offer the home. The MoneySmart web site has an useful reverse home loan calculator that demonstrates how much of your house you'll have after different finance durations based upon elements such as age, residence value, rates of interest as well as costs.

A reverse home loan is a car loan that permits you to get cash from your residence equity without needing to surrender your home. Relying on a number of aspects, including you and your spouse's age and also the assessed value of your house, you can obtain approximately 55% of the present value of your home. Nevertheless, reverse home mortgages are generally released for a lot less than this. Closing expenses, upkeep costs, homeowners insurance coverage and also property tax bills could stress your already stretched budget.

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO