The Main Principles Of What Is Ppo Insurance

damage to structures or pieces. extra construction or repair work expenses to satisfy local building regulations. additional building and construction costs if your policy does not pay enough to restore your home. mold elimination. damage from earthquakes. Many policies won't pay for damages or injuries that happen throughout short-term leasings. If you lease your home for short-term accommodations, ask your insurance representative if you're covered. You might require to purchase more coverage. If you're a guest in a short-term rental, your homeowners or tenants policy may cover you if you damage a host's property. Ask your insurance representative before you lease. If you're leasing through an app or site that offers insurance protection, ask your agent if you require it.

Occupants insurance will not pay to fix the home or apartment. The building owner's policy does that. You might not read more need renters insurance coverage if you're still a dependent. Your parents' house owners policy may cover your property, even if you're not living in your home. covers your home and the interior of your unit. It also provides liability security and pays additional living expenditures. can either cover the exterior and interior of your townhouse, or just the interior. The difference depends upon whether the homeowners association has a master policy that covers the exterior. If it does, you can purchase a policy that covers only the interior.

Townhouse insurance coverage likewise covers your individual residential or commercial property and supplies liability and extra living expenditures protection. covers the mobile house, your personal effects, and extra living costs. It also offers liability coverage. is for homes outside city limitations on land used for farming and raising animals. View: What to examine prior to renewing your house insurance coverage Texas law requires insurance provider to charge rates that are fair, reasonable, and appropriate for the dangers they cover. We don't approve rates in advance, but if we find that an insurer's rates are expensive, we can require it to pay refunds to the individuals it overcharged.

The smart Trick of How Much Life Insurance Do I Need That Nobody is Talking About

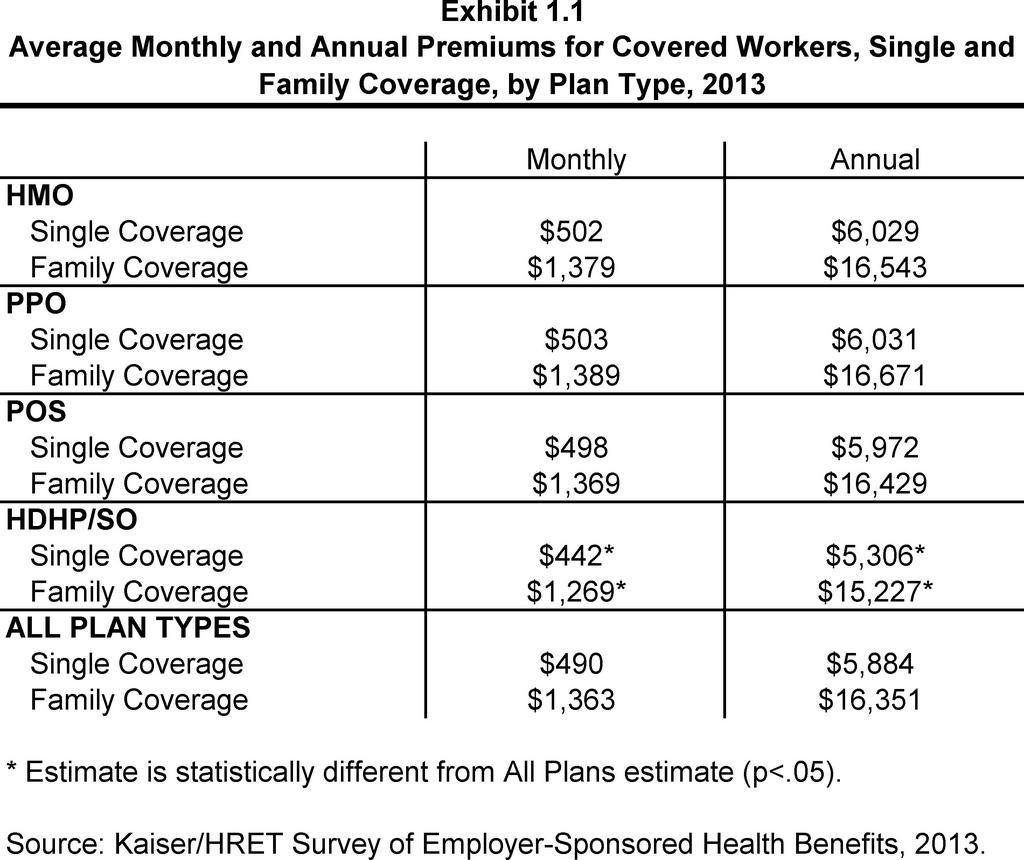

Insurance provider utilize a process called underwriting to decide whether to offer you a policy and just how much to charge you. The quantity you pay for insurance is called a premium - How much does health insurance cost. Each business's underwriting rules are different. This indicates one company might be ready to sell you a policy, even if another business isn't. It also suggests that various business charge various rates. The majority of companies consider these things when choosing your premium: Business can't turn you down just since of your house's age or value, but they can charge you more. Homes with higher replacement costs have higher premiums.

They're lower for houses developed of brick or stone. Premiums are higher in locations that have more storms or criminal activity. Premiums are lower for homes that are close to fire stations. Your premiums may be greater if you have actually had claims in the past. Some companies utilize your credit report to choose what to charge you. Your premiums will be lower if you have excellent credit. A company can't turn you down based only on your credit, nevertheless. To discover out which business utilize credit scores, visit Help, Insure. com. Discover more: How your credit report can affect your insurance coverage rates A lot of business use the Comprehensive Loss Underwriting Exchange (IDEA) to learn your claims history.

A business can charge you more or refuse to offer you a policy based upon the details in your HINT report. Companies can report information to CLUE only if you submitted a claim (How much life insurance do i need). You can challenge wrong information. You can get a totally free copy of the report each year. Call Lexis, Nexis at 866-312-8076. Discover more: How to get an IDEA about your claims history An insurance provider might not: turn you down or charge you more since of your race, color, faith, or nationwide origin. turn you down or charge more because of your age, gender, marital status, geographical location, or disability unless the company can reveal that you're a higher threat for a loss than other individuals it's ready to insure.

The 45-Second Trick For How Much Does Car Insurance Cost Per Month

turn you down or charge you more just since of your credit score. Discounts help reduce https://postheaven.net/bailirgfkx/ask-questions-and-check-out-the-policy-details your premium. Each business decides what discount rates to offer and the amount of the discount. You might be able to get a discount rate if you have: a burglar alarm. an emergency alarm or sprinkler system. an impact-resistant roof. a more recent home or a home in great condition. other policies with the exact same insurance provider (What is insurance). no claims for 3 years in a row. Visit Help, Insure. com to learn what discount rates business use. A company might charge you more or might not offer you insurance if your home appears vulnerable to crime.

Set up a burglar alarm that calls authorities or a security business. Remove hiding locations for burglars and vandals. Keep trees and shrubs cut, particularly around windows and doors. Do not park automobiles on the street. Parking lot on the street are appealing targets for burglars and vandals. Don't leave your garage door open, even if you're at house. It just takes a minute for burglars to grab things from your garage and leave without your noticing. Turn on outside lights during the night or put outdoors lights on timers. Compose an identification number on your home to assist determine products if they're stolen.

Companies might charge you more or refuse to guarantee you based on what they see. To enhance your home's security and appearance: Replace decaying boards, sagging screens, and other damage. Fix cracks in pathways, loose railings, unequal actions, and other things that could cause a mishap. Replace a damaged or worn roof. Keep your yard, trees, and shrubs tidy and cut. Get rid of tree limbs hanging over your house. Repaint if your paint is peeling or faded. If you ask, a business should inform you in composing why it turned you down or didn't restore your policy. You might Go to this website grumble to us if you think a business poorly denied, canceled, or nonrenewed your policy.

The smart Trick of What Is Sr22 Insurance That Nobody is Discussing

A company must offer you 10 days' notification before it cancels your policy. A company might cancel your policy in the very first 60 days if: it learns more about a risk you didn't tell it about which wasn't part of a previous claim. it doesn't accept a copy of a necessary examination report prior to the policy begins. An insurance coverage business might cancel your policy anytime if: you stop paying your premiums. you submit a deceptive claim. continuing the policy violates the law. there's a boost in threat within your control that would raise your premium. If either you or the company cancels your policy, the company must reimburse any unearned premium to you within 15 days after the date of the cancellation.

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO