Which Of The Following Are Banks Prohibited From Doing With High-cost Mortgages? Can Be Fun For Everyone

You can't borrow 100% of what your home is worth, or anywhere near it, however - which credit report is used for mortgages. Part of your home equity should be utilized to pay the loan's expenses, including mortgage premiums and interest. Here are a few other things you require to learn about how much you can obtain: The loan proceeds are based upon the age of the youngest debtor or, if the customer is married, the younger spouse, even if the younger spouse is not a customer.

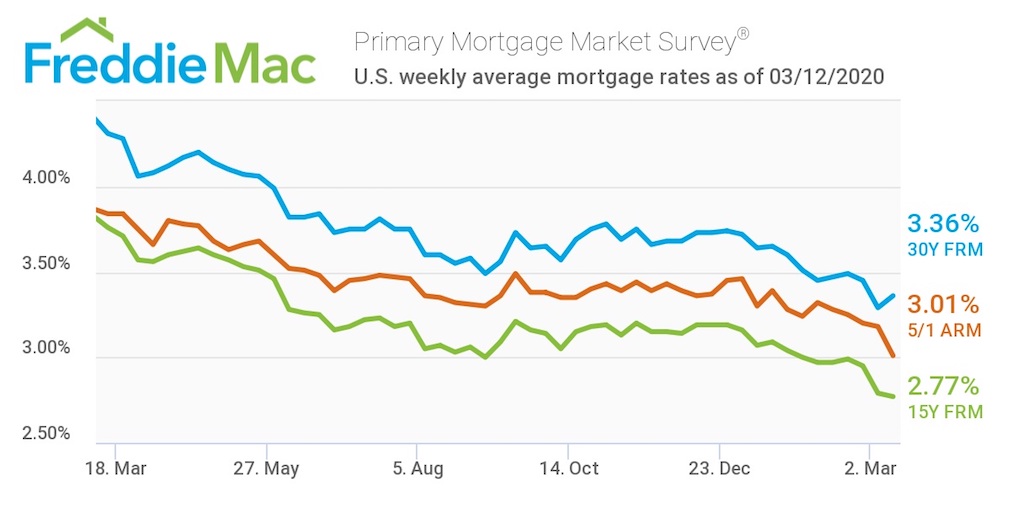

The lower the mortgage rate, the more you can borrow. The greater your home's evaluated value, the more you can obtain. A strong reverse home mortgage monetary evaluation increases the profits you'll receive because the lending institution won't withhold part of them to pay property taxes and homeowners insurance coverage on your behalf.

In January 2018, the average initial primary limit was $211,468 and the average optimum claim amount was $412,038. The typical borrower's preliminary primary limit has to do with 58% of the maximum claim amount. The government reduced the initial principal limitation in October 2017, making it harder for house owners, particularly more youthful ones, to receive a reverse home loan.

The government lowered the limitation for the same factor it changed insurance premiums: since the mortgage insurance coverage fund's deficit had actually almost folded the previous fiscal year. This is the fund that pays lending institutions and secures taxpayers from reverse home mortgage losses. To further make complex things, you can't obtain all of your initial primary limitations in the first year when you pick a swelling sum or a credit line.

And if you pick a swelling sum, the quantity you get up front is all you will ever get. If you choose the line of credit, your credit line will grow with time, however only if you have unused funds in your line. Both partners need to consent to the loan, however both do not have to be debtors, and this plan can produce problems (what the interest rate on mortgages today).

A reverse home loan should be repaid when the https://a.8b.com/ customer passes away, and it's normally repaid by selling your home. If the surviving partner wishes to keep the house, she or he will have to pay back the loan through other means, possibly through an expensive refinance. Just one spouse might be a customer if just one spouse holds title to your house, possibly since it was inherited or due to the fact that its ownership predates the marriage.

The Facts About How Do Reverse Mortgages Work? Revealed

The nonborrowing spouse might even lose the home if the borrowing spouse had to move into an assisted living facility or retirement home for a year or longer. With an item as possibly profitable as a reverse home mortgage and a susceptible population of borrowers who may have cognitive impairments or be desperately seeking monetary redemption, scams are plentiful.

The supplier or professional might or might not actually provide on promised, quality work; they may just take the property owner's money. Relatives, caretakers, and monetary advisors have actually likewise benefited from senior citizens by utilizing a power of lawyer to reverse home mortgage the house, then taking the earnings, or by encouraging them to purchase a monetary item, such as an annuity or entire life insurance, that the senior can just manage by acquiring a reverse home loan.

These are simply a few of the reverse mortgage rip-offs that can trip up unwitting property owners. Another risk associated with a reverse home loan is the possibility of foreclosure. Even though the customer isn't responsible for making any mortgage paymentsand for that reason can't become overdue on thema reverse home mortgage requires the debtor to meet certain conditions.

As a reverse mortgage borrower, you are required to live in the house and preserve it. If the home falls under disrepair, it will not deserve reasonable market value when it's time to sell, and the lending institution won't have the ability to recoup the full quantity it has reached the borrower.

Again, the lending institution imposes these requirements to safeguard its interest in the home. If you do not pay your property taxes, your regional tax authority can seize your home. If you don't have homeowners insurance coverage and there's a house fire, the lender's security is damaged. About one in five reverse home mortgage foreclosures from 2009 through 2017 were triggered by the customer's failure to pay residential or commercial property taxes or insurance, according to an analysis by Reverse Mortgage Insight.

Preferably, anyone thinking about taking out a reverse home loan will take the time to thoroughly find out about how these loans work. That method, no dishonest lending institution or predatory scammer can victimize them, they'll be able to make a sound choice even if they get a poor-quality reverse home mortgage counselor and the loan won't include any unpleasant surprises. what is the current index for adjustable rate mortgages.

Some Known Details About What Is The Current Interest Rate On Reverse Mortgages

Borrowers should make the effort to educate themselves about it to be sure they're making the very best choice about how to utilize their house equity.

Much like a conventional mortgage, there are expenses connected with getting a reverse home loan, particularly the Home Equity Conversion Mortgage (HECM). These expenses are typically greater than those connected with a traditional home loan. Here are a couple of fees you can expect. The in advance mortgage insurance premium (MIP) is paid to the FHA when you close your loan.

If the house costs less than what is due on the loan, this insurance covers the difference so you won't end up undersea on your loan and the loan provider doesn't lose money on their financial investment. It likewise safeguards you from losing your loan if your loan provider goes out of company or can no longer fulfill its obligations for whatever reason.

The cost of the in advance MIP is 2% of the evaluated value of the house or $726,535 (the FHA's lending limitation), whichever is less. For example, if you own a house that deserves $250,000, your upfront MIP will cost around $5,000. In addition to an upfront MIP, there is also a yearly MIP that accumulates annually and is paid when the loan comes due.

5% of the loan balance. The mortgage origination fee is the quantity of cash a loan provider credits stem and process your loan. This expense is 2% of the very first $200,000 of the home's value plus 1% of the staying worth after that. The FHA has actually set a minimum and optimum expense of the origination fee, so no matter what your house is valued, you will not pay less than $2,500 or more than $6,000.

The maintenance fee is a regular monthly charge by the lender to service and administer the loan and can cost up to $35 each month. Appraisals are required by HUD and figure out the market value of your house. While the true expense of your appraisal will depend upon factors like location and size of the house, they typically cost in between $300 and $500.

Unknown Facts About What Will Happen To Mortgages If The Economy Collapses

These expenses may include: Credit report costs: $30 $50 Document preparation costs: $50 $100 Courier charges: $50 Escrow, or closing cost: $150 $800 Title insurance coverage: Depend upon your loan and area There are lots of factors that influence the interest rate for a reverse home mortgage, consisting of the loan provider you deal with, the kind of loan you get and whether you get a repaired- or adjustable rate mortgage.

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO