Why You Might Not Need Full Coverage Car Insurance - Time Fundamentals Explained

For those factors, you may wish to raise your protection to greater bodily injury liability limits as well as greater residential property damages responsibility limits: $100,000 each, as much as $300,000 a crash for clinical bills for those wounded in a mishap you cause, and also $100,000 for home damages that you cause. For cost-conscious consumers with older automobiles, it might not be worth the cash to guarantee against damage to your auto. cheap car.

If your automobile deserves much less than 10 times the premium that you are paying for these added protections, buying these insurance coverages might not be inexpensive. If you take this route, be prepared to pay for all Additional hints related losses out of pocket."Just how do I lower vehicle insurance coverage prices? Think about following these suggestions to reduce the price of automobile insurance policy without sacrificing coverage (trucks).

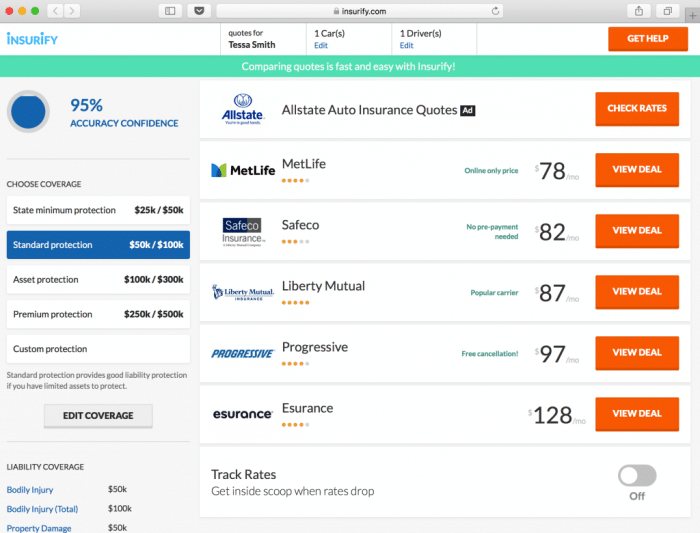

You can call business directly, accessibility info online or collaborate with an insurance coverage representative that can acquire the quotes for you and help you compare."Maintain a tidy driving record as well as check your driving document for precision, take care of any errors. Examine security scores as well as purchase a vehicle that's thought about safe by insurance companies.

Has appeared typically on Greetings America looks, Buying car insurance coverage is like purchasing anything else. You ought to constantly compare prices," Bodge says. "There are many suppliers out there, and also while they commonly consider factors like your age, driving history, sort of vehicle, etc, rates can differ widely from supplier to service provider.""Once you decide on a car insurance policy carrier, this is not your provider forever.

Situation in factor, my partner and also I were with the same carrier for years. We thought that we were obtaining the most effective rate, like we were when we first joined, yet once we searched, we understood we might do a whole lot far better. If your credit report score boosts over time, you can certify for a more favorable automobile insurance policy price".

Cigna Official Site - Global Health Service Company for Dummies

That implies you have a concept of what you'll pay without needing to offer any kind of individual details (cheap car). When getting real quotes from insurance firms, you'll typically have to give at least the following: Your permit number, Vehicle recognition number, Your address, or where the car is maintained when not on the road, Frequently asked concerns while approximating car insurance policy expenses, You've obtained more concerns? We have the responses.

org, Powered by An And Also Insurance policy, She advises consumers when searching for insurance coverage estimates to ask a great deal of concerns, and if you're talking with a broker, allow on your own adequate time on the phone to get the correct descriptions as well as information about your policy. When contrasting car insurance coverage rates, it's vital to consider the rate, see to it the protections match with every quote so you are comparing apples to apples, and have a look at the insurance provider's credibility," Mckenzie states - laws.

credit cheap auto insurance insurers low cost

credit cheap auto insurance insurers low cost

Are your obligation restricts the exact same on each quote? Do you have any additional State insurance coverages on each quote? And also was the MVR (motor car record) operate on each quote, What are the aspects that affect car insurance policy rates? A variety of ranking variables establish just how much you will certainly spend for car insurance policy.

Kind of automobile, Age & years of driving experience, Geographical location, Marriage condition, Driving record, Yearly gas mileage, Credit report, Chosen protection, limits and deductibles, Why some automobiles are less expensive to guarantee than others? Auto insurance firms track which automobiles have the most accidents as well as the most awful injury documents. insurance companies. Those variables impact the price you pay for liability insurance-- which covers the damage you trigger to other as well as not the damages to your auto.

Those aspects increase the cost of crash as well as extensive insurance coverage, which repairs or changes your own automobile - credit. The calculations regarding the danger of a certain car are made independently. For instance, if you are an inexperienced vehicle driver in an automobile with a bad cases record, you are penalized two times.

Full Coverage Car Insurance - The Hartford Can Be Fun For Anyone

That's because statistically, inexperienced motorists crash a lot as well as so they are the riskiest classification of drivers to insure. Auto insurance policy prices reflect this high threat.

All of this aids insurers determine the risk related to insuring your vehicle in that ZIP code, whether you ever have actually made a claim or otherwise. All various other aspects equal, your ZIP code can change your price by numerous dollars. Just how does my marriage standing affect my auto insurance rate? Auto insurer state that married pairs have actually been located to have fewer accidents and claims than solitary drivers do, which is why wedded drivers pay less than single drivers (cheaper car insurance).

There are also other car insurance coverage discounts wedded pairs can anticipate when they incorporate their plans, such as a multi-car price cut, or a multi-policy price cut if they have a tenants or property owners policy with the exact same insurance company. An insurer considers you single if you have actually never ever been married, or are widowed or separated (insurers).

For example, some insurance companies deny anybody with 4 or even more chargeable mishaps in three years, or more than three DUIs in seven years, or greater than 15 factors on the motorist's car record. In general, a small violation such as a speeding ticket can boost your rates, on average, by 25% to 43%.

5% much less, on standard, contrasted to chauffeurs with longer commutes, a Car, Insurance policy. Exactly how does gas mileage influence auto insurance prices? If you drive 12,000 miles a year, or less, your insurance firm will generally think about that to be lower than average, and also you'll likely pay a lower rate than those who drive even more than that.

Our Metlife: Insurance And Employee Benefits Statements

To obtain the very best low-mileage discounts, which have to do with 7% usually, you normally must drive under 7,000 or 5,000 miles every year. Based upon a Los Angeles driver with a complete insurance coverage plan, the expense of a policy when the driver logged 20,000 or even more miles was 12% extra costly than if simply 5,000 miles were driven a year (low cost auto).

We asked Charles, the following concerns about credit report as well as insurance rates: What are the benefits and drawbacks of using a motorist's credit rating when setting car insurance coverage rates? Identifying and also rewarding chauffeurs with great credit habits can generate constant revenue and service security for insurers. A consumer's credit scores background claims a whole lot about them (suvs).

In the long term, insurance firm's growth could be restricted if some consumers are priced out of the market, this can have a plunging result where lower sales cause lower earnings as well as lower ROI. It may be best to take computed risks and make policies offered at budget friendly prices to those with reduced credit report.

Insurance providers are all concerning risk and also numbers, as well as if their research study says that people with inadequate credit rating are frequently poor vehicle drivers, one might make the disagreement that charging higher dangers is practical. Also if it type of feels like the insurance firm is kicking the person with poor credit scores while they're down.

Customers with reduced credit report scores in some cases will not get month-to-month payment, or they may require to pay a huge percentage of the plan up front and also the rest monthly (credit score). In any instance, fair or not, credit ratings usually do have an effect on one's insurance premiums. So, if you desire them to go down, it makes sense to try to make your credit rating rise.

Some Known Details About 15 Tips And Ideas For Cutting Car Insurance Costs - Investopedia

The even more coverage you get, the much more you will certainly pay. If you obtain a bare-bones liability plan that covers only what the state needs, your automobile insurance coverage prices are going to be less than if you got coverage that would certainly repair your very own car, too. Obligation coverage tends to cost even more due to the fact that the quantity the insurer threats is greater - affordable.

Clinical costs as well as multiple-car mishaps can press an obligation claim right into the hundreds of thousands of dollars. If you do not have sufficient obligation insurance coverage, you might be demanded the distinction by any person you injure. Comprehensive and accident damage is impacted by the insurance deductible you choose. The higher the deductible, the less the insurer will have to pay-- and also the reduced

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO