What Is A Reverse Mortgage?

A reverse home mortgage lets you remain in your home as long as you wish, however it additionally means that you have to remain in your house or offer it. You will certainly not be allowed to lease your residence and also travel or relocate right into care without offering your home as well as paying back the loan. This may be a problem for people who want the freedom of being able to choose what they wish to do in their future or that have future itinerary. You can choose to obtain your tax-free money over a longer period of time or entirely.

- The EIR does not identify the quantity of rate of interest that accumulates on the lending equilibrium.

- If the residence is not worth as much as is owed on the finance, the heirs have the choice of settling the funding at the lower of the quantity owed or 95% of the present market price, whichever is less.

- The additional $25,000 would be paid from the FHA insurance coverage that was bought when the HECM finance was originated.

- Regular monthly servicing fees can not surpass $30 for loans with a fixed price or a yearly adjusting price, or $35 if the price adjusts regular monthly.

HUD has demands for homes as well as some restrictions that there would be no other way to figure out compliance without the on-site assessment. If you wish to make a disqualified spouse eligible to remain in the house, you would certainly have to make an application for a new funding under both individuals' names with both spouses on the new loan. Only an appraisal will certainly inform the lending institution exactly what they are collaborating with, yet it ought to be feasible to determine if there are various other similar sales in your area and also the zoning, etc ahead of time.

Your beneficiaries may not have the ability to keep the residence if they can not manage to pay off the loan. If you alter your mind within thirty days, just settle your financing, as well as we'll reimburse the application cost in full. Contact a HUD-approved counselor if you're not sure an offer is genuine. If you owe greater than your house is worth, you have an underwater home mortgage. Victoria Araj is an Area Editor for Rocket Home mortgage and held duties in home mortgage banking, public relationships and more in her 15+ years with the company. She holds a bachelor's degree in journalism with an emphasis in government from Michigan State University, and also a master's degree in public management from the College of Michigan.

When Does The Consumer Have To Settle The Funding?

Private firms supply reverse home loan programs providing greater funding quantities than the HECM lending limitations established by the FHA. You may be able to obtain even more cash from the outset Can You Cancel Timeshare Purchase than with a HECM, but these proprietary reverse lendings don't have federal insurance backing and may be a lot more costly. The majority of consumers select a Residence Equity Conversion Home Mortgage, which is backed by the Federal Housing Administration. A consumer that wishes to vacate a home yet keep it as a rental residential property will require to find a method to repay the reverse home loan. To maintain the residential property, customers might be able to use cost savings to repay the reverse home mortgage or refinance to a forward home loan.

Reverse Mortgage Lenders

By doing this, if the house is not worth as long as the outstanding equilibrium on the funding, the successors are not required to pay more than the residential or commercial property deserves to keep the house. If you understand you are not in your for life home, think about using your reverse mortgage to acquire the ideal house as opposed to utilizing it as a momentary remedy-- one that is not a true remedy in any way. The reverse mortgage is intended to be the last finance you ever before need. Do not fail to remember to include your spouse's age, even if they are not yet 62, as car loan earnings are constantly based on the age of the youngest partner. If you obtain the reverse mortgage, the assessed worth will be developed by an independent assessment carried out by a licensed FHA approved appraiser.

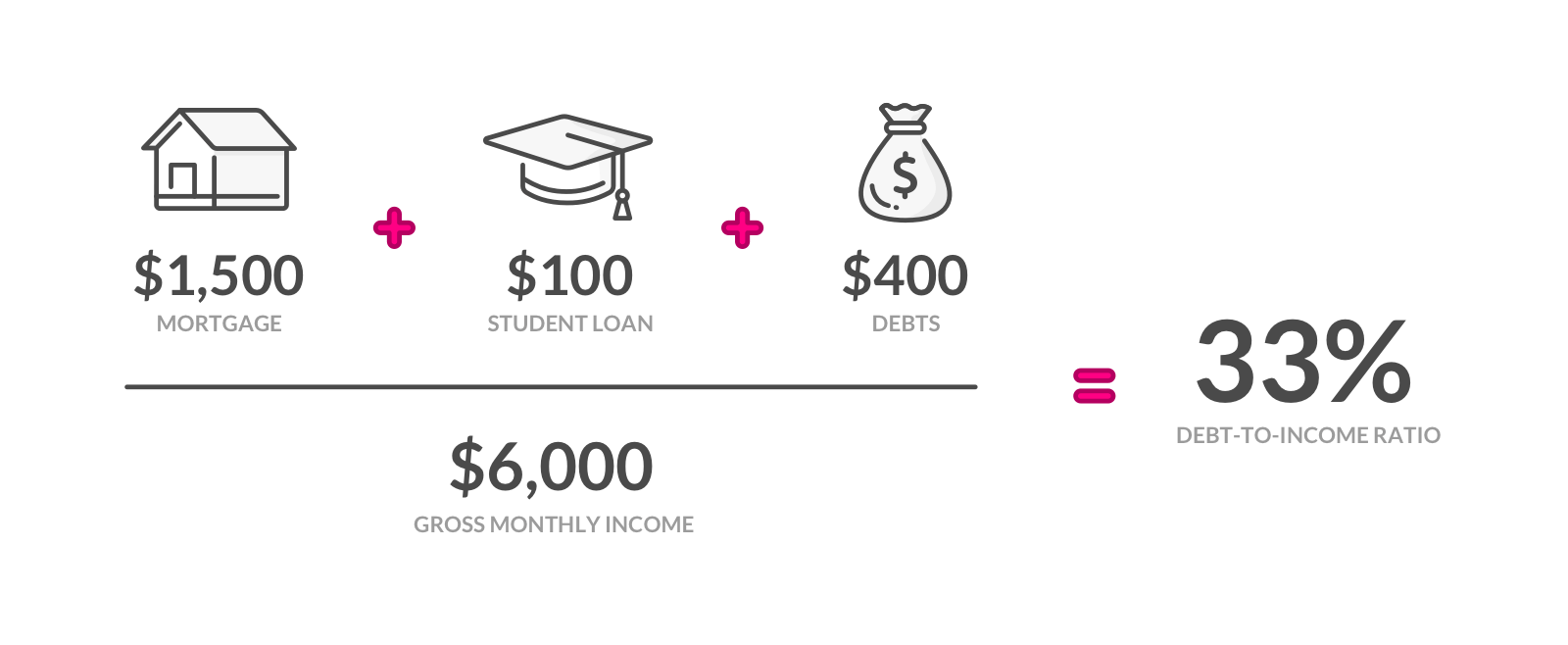

Yet this settlement does not affect the information we publish, or https://www.businesswire.com/news/home/20200115005652/en/Wesley-Fin... the reviews that you see on this website. We do not consist of deep space of firms or economic offers that may be offered to you. The rate of interest on a reverse home loan might be higher than on a traditional "ahead home loan". The home mortgage insurance policy costs is insurance deductible on the 1040 lengthy type. If the total mandatory responsibilities surpass 60% of the major restriction, after that the debtor can draw an added 10% of the primary restriction if readily available. In addition, some programs need routine reassessments of the worth of the building.

Borrowers with jumbo reverse home loans require to talk to their lender to see if they are liable to repay any kind of difference after the house is marketed. To establish your loan profits, your reverse mortgage lender will certainly get an appraisal of your house. They will certainly after that use that car loan to settle your existing home mortgage. The staying funds are what you receive to utilize nonetheless you want, whether that's covering your living expenditures, repaying financial obligation, developing a safeguard or acquiring a residence. If you possess your house cost-free and also clear, you can get the full value of the financing. Like other reverse mortgage, this also features flexible settlement, therefore debtors can pay as long as they select each month, or make no payment in all-- as long as they pay their property taxes as well as various other responsibilities.

Some hail the reverse home mortgage as a reasonable remedy for senior citizens that require money, enabling them to tap into what is likely their most useful asset. Realize that given that the house will likely need to be sold to repay the reverse home loan, these sorts of loans might not be an excellent choice if you intend to leave your residence to your youngsters. You and also any type of other debtors on the reverse home loan must go to least 62 years of age. If you qualify, these programs are a far better option than obtaining one more kind of reverse mortgage.

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO