The Greatest Guide To What Health Insurance Pays For Gym Membership?

Also, understand that whatever you choose will timeshare exit company affect other protection limitations. For instance, an other structures policy is typically 10% of whatever residence protection you have. This indicates that if you purchase $400,000 in dwelling coverage, your other structures limitation will be $40,000. Homeowners insurance can be expensive, so before selecting a plan, look around to find the very best deal based upon your needs. It can be useful to speak with an insurance coverage agent, checked out consumer reviews and examine online insurance coverage prices quote to find business with the most affordable rates. Here are some other methods to save money on home insurance: Inquire about offered discount rates: Some business use affordable policy rates if you're over a certain age, if your home is in a gated neighborhood, if you Get more info bundle with your automobile insurance or if you belong to a house owner's association.

Make your home much safer: Some service providers use a discount if you install fixtures that make your home safer, such as smoke alarms or a security system, that reduce the likelihood that damage or theft will occur in the first place. It depends upon the nature of the claim. A fire claim where you are discovered responsible will likely increase your premium by a substantial quantity, whereas a medical claim won't. Simply just how much a claim raises your premium varies on the provider and the nature of the claim. There are also more issues when you make the same type of claim twice.

Though your premium will increase if you are found at fault, it's likewise possible for your monthly bill to increase even if you're not discovered to be liable. This is since your home from then on is considered riskier to insure than other homes. Is home insurance coverage needed by law?No, states do not need house owners to get insurance when they buy a house. However, if you choose to get a home loan, many lending institutions will need you to have some insurance coverage. Just how much coverage do I need?To identify how much coverage you should acquire, refer back to your house inventory.

Likewise consider the place of your home, and evaluate threats based upon weather, fires and other occasions that could possibly harm or destroy your house. You can constantly choose to increase your coverage after purchasing a plan. Is home insurance tax deductible?For the most part, house insurance coverage is not tax-deductible. Nevertheless, there are a few deductions you can claim as a homeowner. These include: Home mortgage points, Home loan interest, Real estate tax, Medical house improvement reductions, Rental reductions, Office deductions, Energy effectiveness reductions What home insurance discount rates exist? There are a couple of methods to get home insurance discount rates. Discount rate options include things like: Bundling your home insurance coverage policy with another policy (such as car).

Ensuring home improvements. Residing in a gated community. Setting up a security system. What are the most typical losses?When choosing just how much insurance protection to get, it assists to understand what losses are the most common. In 2018, 34. 4% of home insurance coverage losses were wind and hail associated, 32. 7% were fire or lightning associated and 23 (How does life insurance work). 8% were water damage or freezing claims. Just 1% of claims were associated with theft, and less than 2% of losses were liability claims. As a homeowner, you must also understand what insurance coverage claims are most typical in your area. For instance, the most typical home insurance claims in Florida are related to cyclones, wind damage, water damage and flooding.

The 6-Minute Rule for Who Owns Progressive Insurance

When you acquire insurance, talk with a representative about the specific risks in your location and inquire about separate insurance plan you might need, like flood or earthquake coverage. We invite your feedback on this article. at inquiries@thesimpledollar. com with comments or concerns.

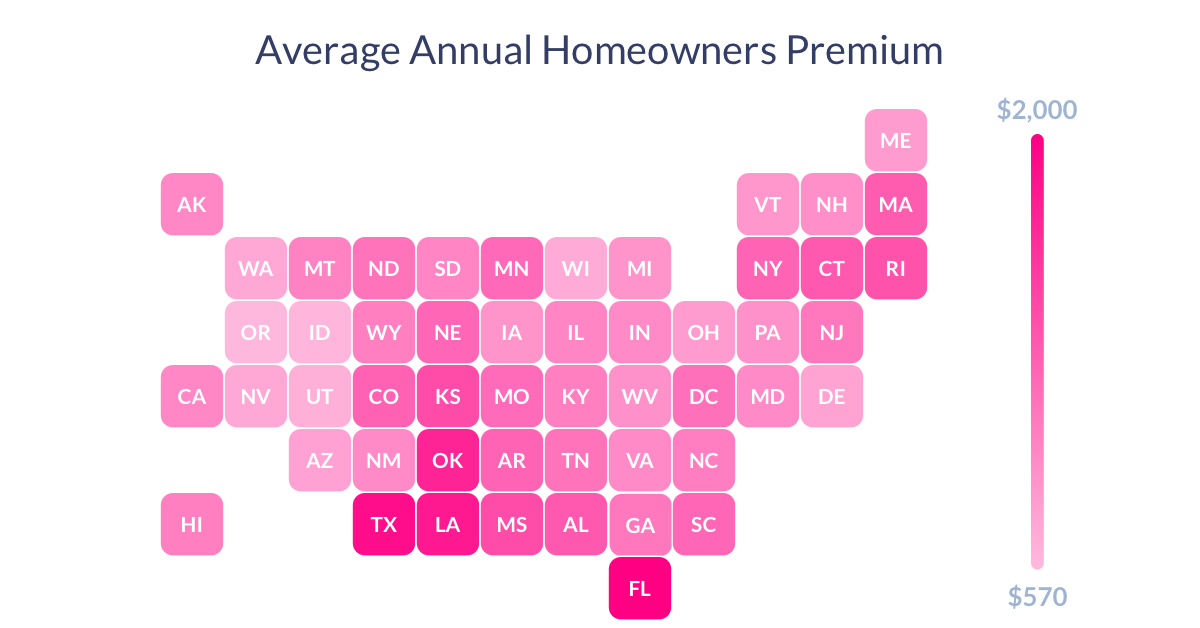

The average house insurance coverage premium ranges from $675 a year to $1,950 a year depending greatly on area. The most typical factor house insurance premiums vary so much is based on the possibility of a natural disaster (cyclones, wildfires, twisters, etc). More recent homes constructed my timeshare expert reviews after 2010 and older homes built prior to 1970 have lower premiums than houses built in between 1971-2009. If you're a property owner, you know that little is better and valuable than the investment of your house. The very best way to protect this financial investment is with a solid house owners insurance coverage policy that assists you repair or replace your home in case of a fire or other unanticipated situation.Homeowners insurance coverage premiums differ greatly depending on how much your home is worth, where you live, the risk factors you face, your chosen deductible, and more. In addition, states with.

bigger cities often have higher premiums as home worths are higher in those locations. Lastly, state requirements for insurance coverage vary, which can likewise influence premium expenses. HI$ 326DE $497OR$ 589VT$ 614UT$ 651NH$ 684NJ$ 727ID$ 730AK$ 740OH $744NV $769NC $828WV $834WA $861DC$ 891CT$ 909ME$ 916IN $986AZ $1,001 RI $1,014 WI $ 1,063 IA $1,064 CA $1,067 PA $1,071 GA $1,090 WY $1,240 MD $1,264 SC $1,280 AL $1,380 TN $1,393 MA $1,395 NY$ 1,462 MO $1,465 NM $1,501 KY$ 1,554 IL $1,595 MS $1,610 ND $1,615 MN $1,792 AR $1,848 MT $1,931 SD $1,942 TX $1,944 KS $2,021 VA $2,055 CO $2,086 MI $2,298 LA $2,361 NE $2,623 OK $2,736 FL $3,276 Living at a home near the coast can be lots of people's dream, but be prepared to pay more for homeowners insurance coverage if the location is likewise at threat to be affected by hurricanes or storms. In this list, Louisiana, Florida and Texas are examples of locations where extreme storms take place frequently, increasing the typical property owners insurance coverage cost.$ 1,968 average yearly premium$ 1,951 typical annual premium $1,893 average yearly premium$ 1,885 typical annual premium $1,584 typical yearly premium, On the contrary, living in a state where natural dangers are less regular generally means lower house insurance rates. Standard homeowners insurance will still offer coverage for typical dangers like rain, fire or smoke, and non-weather associated occasions such as theft. How to get health insurance. $677 average yearly premium $692 average annual premium$ 730 typical annual premium $755 typical yearly premium $779 average yearly premium, Older houses have older heating, pipes, and electrical systems, putting them at greater danger for fire or unexpected flooding. These factors can raise premiums for older houses. 1970 $1,9611980$ 2,0181990 $1,970200 $1,8782010$ 1,741 Typical.

Throughout tiers$ 1,914 Some insurance coverage companies use consu...

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO