The 28 Passive Income Ideas To Try Today - Make Money Series Statements

If you live in downtown Des Moines, your premium will possibly be greater than the state standard - cheaper car insurance. On the various other hand, if you reside in upstate New york city, your cars and truck insurance coverage will likely cost much less than the state standard - suvs. Within states, automobile insurance policy premiums can vary commonly city by city.

car insured prices trucks auto insurance

car insured prices trucks auto insurance

However, the state isn't one of one of the most pricey overall. Minimum Protection Demands Most states have economic responsibility legislations that call for chauffeurs to carry minimum automobile insurance protection. You can only forego coverage in 2 states Virginia and also New Hampshire but you are still economically accountable for the damages that you create - cheapest.

No-fault states consist of: What Other Aspects Influence Automobile Insurance Fees? Your age and also your residence state aren't the only points that influence your prices - auto. Insurance companies use a selection of factors to determine the price of your premiums. Right here are a few of the most vital ones: If you have a tidy driving document, you'll locate better rates than if you've had any current accidents or traffic violations like speeding tickets. cheaper car insurance.

Others use usage-based insurance policy that might conserve you money. If your vehicle is one that has a probability of being swiped, you might have to pay even more for insurance policy - insurance.

Yet in others, having negative credit can trigger the expense of your insurance coverage premiums to climb substantially. Not every state allows insurers to utilize the gender provided on your chauffeur's permit as an identifying variable in your costs. In ones that do, female vehicle drivers generally pay a little much less for insurance policy than male drivers.

The 7-Minute Rule for Why Is My Car Insurance So Expensive As A Teen With A Clean ...

Why Do Auto Insurance Coverage Rates Change? Looking at ordinary auto insurance policy prices by age and also state makes you wonder, what else impacts prices?

An at-fault crash can elevate your price as much as 50 percent over the next three years. In general, automobile insurance policy tends to get much more pricey as time goes on.

cars prices credit auto insurance

cars prices credit auto insurance

The good news is, there are a variety of other price cuts that you may be able to take advantage of right currently. Here are a few of them: Lots of firms provide you the most significant discount for having an excellent driving history. Called packing, you can obtain reduced rates for holding even more than one insurance coverage plan with the very same business.

House owner: If you own a house, you can get a property owner discount from a number of suppliers. Obtain a discount rate for sticking to the exact same company for multiple years. Below's a trick: You can constantly contrast prices each term to see if you're getting the finest rate, despite your commitment discount - business insurance.

Some can likewise elevate your prices if it transforms out you're not an excellent chauffeur. Some companies give you a price cut for having a good credit report. cheaper. When looking for a quote, it's an excellent suggestion to call the insurance provider as well as ask if there are anymore discount rates that relate to you.

Getting My How Much Will It Cost To Add My Teenager To My North Carolina ... To Work

Being inexperienced behind the wheel of an auto typically leads to higher insurance policy rates, yet some firms still supply excellent prices. Much like discovering insurance coverage for any kind of various other vehicle driver, discovering the very best car insurance for new chauffeurs indicates researching and also comparing costs from service providers. risks. In this write-up, we at the House Media reviews group will certainly provide you an overview of what new motorists can anticipate to spend for car insurance, that certifies as a new driver and also what aspects shape the rate of an insurance coverage plan - affordable car insurance.

That is taken into consideration a new chauffeur? Each state establishes its very own minimum vehicle insurance needs, and also vehicle insurance for new chauffeurs will look the like any other driver's policy. While an absence of driving experience does not change just how much insurance policy you need, it will certainly impact the rate. Below are some instances of individuals that can be taken into consideration brand-new drivers: Teenagers Older individuals without a driving document People that come in to the united state

Auto insurance prices by company Auto insurance coverage for brand-new drivers can differ extensively depending upon where you shop. Below are several popular suppliers' typical annual expenses for full protection insurance coverage for a 24-year-old with a good credit score score as well as an excellent driving record (trucks). Cars and truck insurance for young adults It can be amazing for a teen to begin driving on their own for the very first time, however the cost of auto insurance coverage for new motorists is generally high.

This produces expensive cases and greater rates as a result. Idaho has the least expensive mixed insurance policy premiums. At $711 per year, they pay around 40% less than the remainder of the states. Did You Know? Californians pay a standard of $893 a year for minimum protection. Just like other areas, your individual car insurance coverage rates rely on your ZIP code and also other aspects.

Our The Insurance Press - Volume 34 - Page 4 - Check out here Google Books Result Ideas

There's no true "complete protection" vehicle insurance that covers the cost of every feasible scenario. Individuals usually make use of the term to refer to insurance coverage that cover both your cars and truck as well as the other person's damages in a lot of typical scenarios. "Complete coverage" plans will generally include comprehensive protection and accident protection along with state minimum demands.

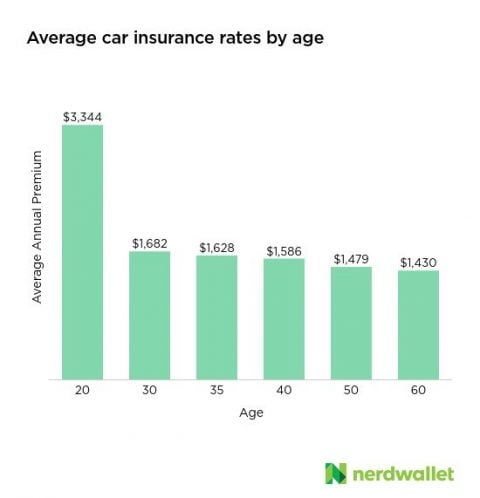

Age: Younger drivers pay even more for cars and truck insurance since they're a lot more likely to obtain right into a mishap. Insurance coverage prices go down as you construct a secure driving background, yet this can take years.

Factors Your Vehicle Insurance Policy Prices Can Increase The Insurance Services Workplace reports an ordinary increase of 20 - 40% of the state's base price after a mishap - insured car. The state's base rate is the ordinary rate prior to any kind of price cuts are used. If you have a one-car plan, your rate will certainly boost 40% (cheapest car insurance).

cars vehicle insurance insurance companies insurance company

cars vehicle insurance insurance companies insurance company

cheap car money insurance dui

cheap car money insurance dui

If there's any type of motivation to comply with the law and avoid speeding, it can be the 22% boost your premiums can experience with just one ticket. This is simply the average.

Texting while driving could affect your prices in some states, relying on if your state considers it a relocating offense. Simple infractions, such as a small speeding ticket, could only affect your rates for 3 years. However, major offenses, such as a DUI, might influence your rates as long as ten years.

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO