Not known Facts About Travel Insurance Faqs - Allianz Global Assistance

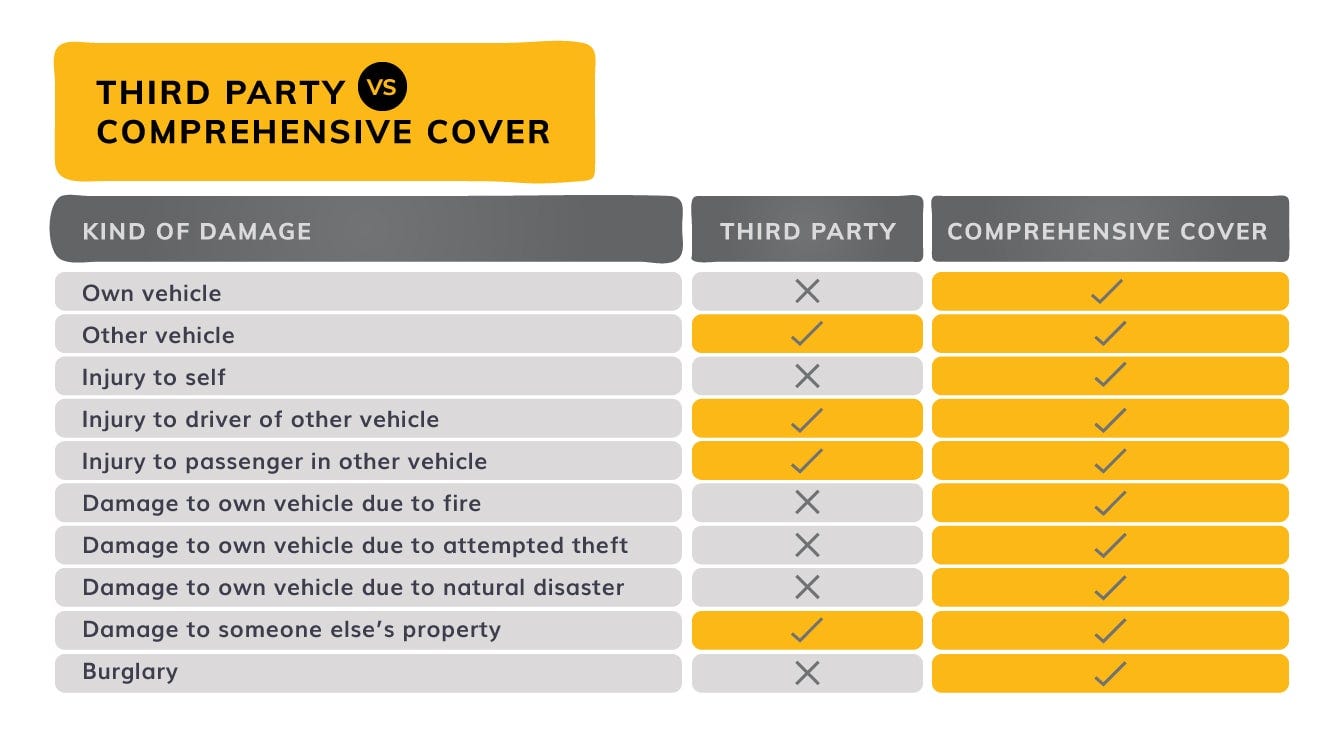

Crash does not spend for anything else, like damages to someone else's automobile or clinical bills. What is thorough insurance? Comprehensive coverage pays to fix damages to your vehicle as a result of anything that's not an accident. For instance, comprehensive would certainly pay for vandalism or hail storm damage. Do I need accident as well as comprehensive insurance coverages? Crash as well as comprehensive are not required by legislation, so you do not need to get them in order to register your automobile. Numerous vehicle funding companies require them, so you might require them in order to certify for a lease or funding. We likewise recommend both insurance coverages if your automobile is worth greater than$3,000 or is less than ten years old, or if you would not have the ability to manage a new car if yours were ruined. So if a liability-only plan prices$ 100 per month, including simply collision would bring the overall cost as much as$200, and adding detailed as well would certainly make the total price$210 monthly. Method To recognize just how including accident as well as thorough protection impacts automobile insurance policy prices, we accumulated rates for four insurance coverage profiles in New york city state: Obligation only Liability and thorough Responsibility as well as collision Full insurance coverage(responsibility, accident as well as detailed )For each protection account, we gathered sample rates from four major insurance firms

for 10 of the very successful vehicles in the country. What is Comprehensive Insurance coverage? Thorough insurance coverage is insurance coverage that shields you in case your automobile is harmed because of something besides an auto collision. Comprehensive protection is usually offered with a deductible quantity(the out-of-pocket cost an insured concurs to pay before any repayment from the insurer kicks in). Because situation, consider the value of your car. If it were damaged or taken, are you able to pay that quantity out-of-pocket to repair or change your lorry? If not, after that detailed insurance policy might be a great investment. Learn a lot more regarding automobile insurance coverage choices here, as well as speak with your local insurance coverage representative to figure out if extensive vehicle insurance policy is ideal for you. What does comprehensive insurance coverage cover? Comprehensive insurance policy covers problems to your car that are the result of theft, all-natural catastrophes or plain misfortune. While crash coverage pays for repairs to your vehicle after a car crash, for the a lot of component, extensive insurance policy safeguards your vehicle while it is parked. You can start comparing totally free cars and truck insurance coverage prices estimate using the tool listed below. Make certain to take into consideration policies with 2 of our premier carriers: USAA as well as State Ranch. USAA: 9. 1 out of 10. 0 In the J.D. Power 2020 U.S. AutoInsurance Fulfillment Research, USAA scored highest in every region of the U.S., showing that customers are pleased with their USAA insurance coverage and service. 8%of the insurance policy market's consumer complaints in 2019. In addition to using first-class customer support, USAA has some of the most affordable cars and truck insurance. Almost the only downside concerning this company is that its vehicle insurance policy policies are not offered to everyone. To be qualified for a policy with USAA you must be.

a member of the military or have a relative that is a USAA participant. Completion result was a general score for each and every supplier, with the insurers that scored the most factors covering the checklist. Right here are the elements our rankings think about: Online reputation: Our research team thought about market share, rankings from sector specialists and also years in business when providing this score. Availability: Auto insurance provider with higher state availability as well as few eligibility demands scored greatest in this category. money. Detailed insurance coverage is a car insurance coverageplan that covers specific problems to your vehicle that are not created by a crash with another auto. It is required on rented automobiles, as well as on vehicles that are currently being paid for by a financing. Comprehensive car insurance coverage is supplementary, meaning it's an optional protection which can be contributed to an insurance coverage. Is there a distinction between extensive protection as well as complete insurance coverage? Yes. Some people mistakenly use these terms interchangeably, yet there is an essential difference, namely that the majority of insurance policy providers do not offer anything called"full insurance coverage. "Simply put, there is no single automobile insurance coverage plan that covers every little thing. As pointed out, extensive insurance is an optional coverage that can be.

added to your state-required liability insurance coverage which gives added defense for mishaps not brought on by an automotive collision. Learn a lot more about comprehensive protection and also obtain a quote today so you can build a personalized plan that's right for you. Key Insights Comprehensive insurance coverage is to offer protection for all the unwelcome crashes that are not covered in your conventional insurance coverage. It gives protection for the problems created due to any kind of kind of synthetic and all-natural tragedies. Thorough cars and truck insurance policy is recommended especially for drivers who have a cars, new cars, or funded cars and trucks.

Some drivers add it to their policy also when they don't need it. On the other hand, some prevent including it to their plan also when they need it one of the most. Price, Force has created this blog site to help you recognize exactly how thorough insurance coverage can conserve a great deal of your money as well as when it can be a waste of cash.

A Biased View of What Does Comprehensive Car Insurance Cover?

What does comprehensive automobile insurance coverage cover? extensive auto insurance policy coverage gives coverage from various sorts of mishaps aside from collisions. Here are some kinds of accidents that extensive cars and truck insurance policy cover: All-natural catastrophes like floodings, storms, hail storm, lightning, wind, and also also the quakes, Somebody swiped your auto, Your automobile obtains captured in the fire, troubles, criminal damage, and explosions, Accident with animals Damages to the windshield as well as glass of the auto (in situation the expenditure of fracture or chip fixing is less than a buck costs, the majority of the business fix the glass at no cost)If some rocks or any items kicked up by or diminishing other vehicles hit your automobile, Trees/limbs or any various other item dropping on your vehicle So prior to deciding to avoid thorough automobile insurance make sure to consider this checklist - auto insurance.

For this reason it is essential to keep our lorries covered from all the added expenditures. What does detailed vehicle insurance coverage not cover? Now comes an interesting area, we understand what comprehensive insurance covers. It is also important to recognize what it does not cover to stay clear of confusion in the future.

Just how much is extensive automobile insurance coverage expense? Since you have decided to add detailed insurance policy to your plan it's time to examine what will be the expense of detailed auto insurance policy coverage? The in our nation is. This number can transform as per the company and also the place of the driver (risks).

Various other than that, there are a great deal of other factors that influence the auto insurance policy rate for any type of vehicle driver. As well as every insurance company takes into consideration variables like the kind of car, the age of the driver, real cash money worth of the vehicle, and so on.

Do you require detailed vehicle insurance policy? Thorough auto insurance coverage is not mandatory for the vehicle driver like the state's minimum need insurance coverage. Although the insurance coverage kind is optional, it is essential for every single chauffeur. And if the driver is preparing to obtain an automobile from loan providers or leaseholders then thorough car insurance could be compulsory - cheap car.

Not known Facts About Why It's Important To Have Comprehensive Car Insurance ...

If you recognize that your auto's actual cost worth is less than the protection amount you will get Visit this link after that there is no point in losing your money. Your insurance firm will never pay you greater than the actual cost value of your car. So the first thing you have to do is inspect your auto's actual cost worth.

The insurance deductible quantity is normally between $500 and also $1500 for every vehicle driver in all the states of our nation. The insurance business will deduct the $800 from your insurance claim money and also after that will certainly send out the cheque.

Insurance provider use this as their insurance coverage. A motorist that knows that she or he will need to compensate to $800 for any type of repair work will drive extra safely - trucks. The chances of mishaps decrease and the company saves money. Exactly how detailed automobile insurance works? It is much better to recognize the process of detailed insurance with an instance.

Now to change the windshield you will need to submit a case. Assume that the replacement price of the windscreen is $3000. Currently your insurance deductible quantity will

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO