Not known Details About How To Cancel Your State Farm® Insurance Policy

Even if you're not mosting likely to be driving for a while and also you intend to prevent paying for insurance coverage, you can't exactly stop your car insurance coverage (dui). Some companies may allow you to suspend your obligation protection if you're putting your auto in storage as long as your loan provider allows it.

Obligation coverage is the protection that covers the costs of damages or injury you create with your cars and truck, and it's essential if you're going to be driving. Suspending responsibility insurance coverage isn't constantly an option, also if you are putting your automobile in storage space for months: Your lienholder or owner might need you to preserve a certain quantity of insurance coverage, in which instance you could not drop your responsibility protection.

If you choose to operate your automobile while your obligation protection is suspended (or while you have a gap in protection), you won't be financially protected from medical expenses or residential or commercial property damages Browse around this site you cause with your car, and you risk fines and various other effects for driving without insurance. credit score. There is typically no set time limitation on how lengthy you can suspend your obligation protection but you need to restore your coverage prior to you start driving your automobile again

You won't need to spend for protection you're not utilizing, You assume the cost of all obligations if you make a decision to run your lorry without liability coverage, Your automobile is still safeguarded from damages, Motorists with vehicle finances or leased lorries may not be eligible for suspended coverage, You can stay clear of a lapse in coverage, sparing you from a rise in future prices, Insurance suspension is not provided by several car insurance providers, as a whole You 'd most likely be breaking the law by driving without obligation insurance policy, What occurs if you suspend your auto insurance? If you won't be operating your car for 30 days or more, you might have the ability to suspend your responsibility protection, so you won't be spending for that insurance coverage while your automobile is not being used (money).

Not every insurer will certainly enable you to suspend your obligation insurance coverage; this option might only be readily available for vehicle drivers that are placing their autos right into storage space and also will not be driving their vehicles in all. Alternatives to suspending your vehicle insurance, Looking for a way to reduce your automobile insurance rates? Rather than suspending your liability coverage while your car's not in usage, think about other alternatives to reduce your regular monthly car insurance coverage expenses.

Our Auto Policies - Missouri Department Of Insurance Diaries

The process is simple, as well as can be finished online or over the phone - credit score. All you require to do is ask your insurance policy firm regarding the process, indication and also send out a termination letter, as well as obtain a notification of your policy cancellation.

If you own an automobile that you're truly never, ever mosting likely to drive, you may intend to check into comp-only insurance coverage, likewise called cars and truck storage space insurance coverage, which covers the kinds of damage that can happen while your auto is being kept away and not being driven. If you're going to drive your car sometimes, even when a month, you'll need a car insurance policy that consists of obligation coverage.

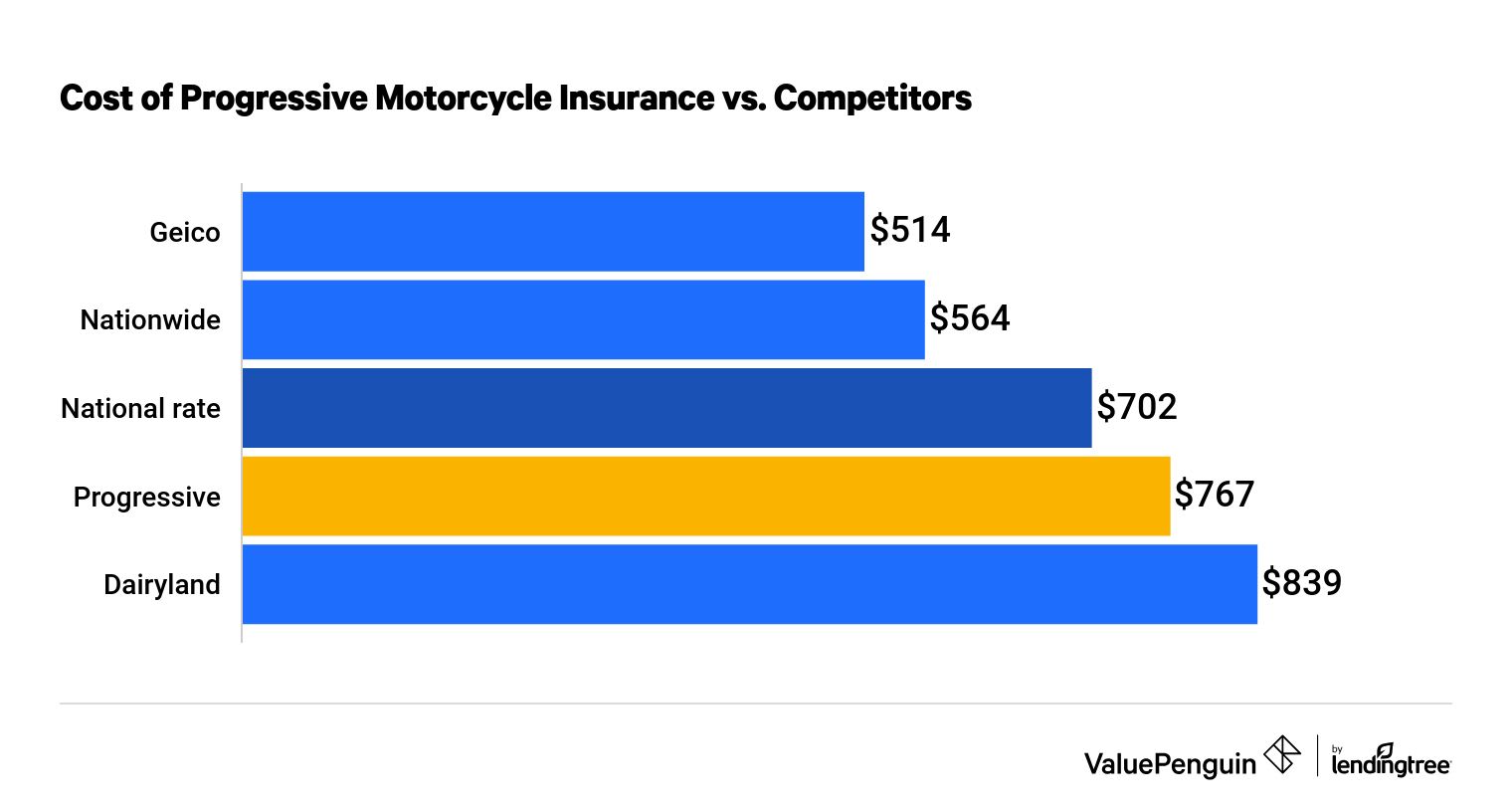

If you're taking into consideration Progressive and State Ranch for car insurance, it aids to understand where each company places for points like ordinary annual rates as well as total efficiency. Eventually, State Farm rates well, as contrasted to most competing insurance firms, while Modern drops towards all-time low of our rankings. There are chauffeurs who could discover the last option makes more feeling. affordable auto insurance.

As a matter of fact, State Ranch places second out of the 9 vehicle insurer we evaluate, while Modern rankings seventh (cheap car insurance). It also tends to be an extra affordable option, with prices that are less than the nationwide standard. When you look at client complete satisfaction metrics, State Ranch also carries out better than Progressive, with high marks for client service and also loyalty.

For those with inadequate credit history, Progressive actually supplies better prices than State Ranch. And if you choose the option to authorize your documents online, Progressive's automobile insurance coverage has a price cut for that.

How Asi And Progressive Insurance can Save You Time, Stress, and Money.

cheap auto insurance cheap car cheap car

cheap auto insurance cheap car cheap car

State Ranch Is Much Better for Client Service, While Dynamic ties for last area when it concerns consumer solution, State Ranch is available in second place, behind USAA (risks). For example, concerning 68% of those with State Ranch stated they were entirely pleased with the ease of speaking to customer support, while concerning 56% claimed the same for Progressive.

State Ranch Is Much Better for Cases Dealing With, When it concerns insurance claims managing, State Ranch again outranks Progressive (auto insurance). While Dynamic once more places 2nd to last in this field, State Ranch is available in fifth location generally. One location we looked at right here was client fulfillment with interactions throughout the cases procedure.

auto risks low cost car insured

auto risks low cost car insured

A higher percentage of participants offered the highest possible ranking to State Ranch when it comes to how insurance claims were settled than those who ranked Progressive. State Ranch Is Better for Client Commitment, Customer commitment is another key indication for client complete satisfaction. As well as in that respect, State Ranch once again outs perform Progressive.

As well as while vehicle drivers were much less most likely to advise State Ranch, contrasted to various other top-level companies, it still appears ahead of Progressive. Which Is Cheaper: Progressive or State Ranch? For the ordinary motorist, State Ranch ($1,169) is going to be a less expensive alternative than Dynamic ($1,334) though Progressive's rates tend to be comparable to the nationwide standard.

How much protection you want will certainly also influence your prices. So while those ordinary prices can be a beneficial starting factor, they might not accurately mirror what you'll pay. A rate quote from the insurance policy company will always provide the most tailored settlement info when looking around for auto insurance.

Some Ideas on Here's When You Will Get Your $400 Car Insurance Refund In ... You Need To Know

However, Progressive's prices are still slightly greater than the nationwide standard. State Ranch Is Less Expensive completely Drivers Firm Average Annual Rate Progressive $1,335 State Farm $1,169 National Average $1,321 If you have a tidy driving record, you likely stand to save more money by opting for State Ranch over Progressive.

As a matter of fact, State Ranch's rates are listed below the national average for these motorists. State Ranch Is Less Expensive After a Crash Company Standard Annual Price Modern $2,237 State Ranch $1,405 National Average $1,873 Once you have an accident on your driving record, State Farm is likely to provide less costly prices than both Modern as well as the national average.

Nevertheless, both State Farm and also Progressive have rates below the nationwide standard for these motorists. State Ranch is the much less expensive option of both. State Farm Is Less Expensive for High Coverage Business Standard Yearly Price Dynamic $1,453 State Ranch $1,256 National Standard $1,397 If you desire a high amount of insurance coverage for your lorry, you'll often tend to get far better rates with State Farm than you would with Progressive.

For those that go this route, State Ranch will typically be cheaper than Progressive in addition to the national typical cost for a minimum insurance coverage plan. Compare Cars And Truck Insurance Coverage Quotes, Break out individualized quotes with one basic type (cheapest car). Powered By, Progressive vs. State Farm Auto Insurance Policy Discounts, Both Modern and State Ranch offer several discounts to qualified chauffeurs.

The offerings aren't always the exact same. State Ranch additionally provides car security discount rates for having attributes like anti-theft gadgets, while Progressive has discounts for obtaining an on the internet quote, going paperless, as well as paying in complete. In our customer study, 41% of State Farm customers stated they were completely satisfied with the price cuts used by the insurance company while 38% offered the very same ranking to Progressive.

Best Commercial Car Insurance Companies

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO