Low Instalment Financing In Shops

Flexi Finance is a new-age car loan that successfully deals with the instant monetary need of customers. Financial loan provider like Tata Capital Finance as well as Bajaj Finserv supply Flexi car loans called Bajaj Flexi Finance to their old and relied on customers. Thankfully, there are finances that provide versatile repayment alternatives and also overdraft account facilities. Let us recognize how they are different from term car loans. With a full-flexi funding, you have the advantages of transferring extra funds or withdraw your development repayments any time. The finance amount will certainly be immediately be taken out from the cash parked in your current account based on the funding settlement routine laid out by your bank.

Despite the reason, an individual car loan can assist people in times of requirement. Financial institutions conveniently offer this item as the procedure to obtain it is regularly problem-free. Nevertheless, what people often disregard to think about is the high interest rates normally sustained by personal finances. You can quickly convert your personal funding into a flexi loan by calling your lending institution.

- So, you can seize your finance in advance of timetable to minimize your interest outgo.

- Supplying you with the flexibility to take out funds whenever you require to, a flexi financing is hassle-free and can be paid off much more conveniently.

- Any type of employed or independent individual can get the Flexi-Personal Loan.

- Flexi Funding is a new-age financing that efficiently satisfies the prompt financial requirement of customers.

If you're not sure regarding anything, look for expert guidance before you request any product or devote to any kind of strategy. Westpac's Flexi Car loan is a line of credit where you just pay interest on the amount you utilize. You likewise have 24/7 accessibility to your funds and also can make withdrawals at any time. Read this evaluation to discover even more regarding just how this loan works. Flexi finances supply the center that you can withdraw as much money as needed as well as interest needs to be paid just on the withdrawn cash.

However, ensure to contrast your available alternatives prior to deciding on the appropriate lending for you. Personal funding and also hybrid flexi loan both supply quick as well as simple funding. One can select in between the two, taking into consideration the monetary needs, capabilities, and other essential factors that work the best for the individual. Having full understanding of both kinds of fundings-- exactly how they vary from each other-- can assist the borrower make the appropriate choice and also therefore, manage their finances better. The application procedure for both individual as well as hybrid Flexi car loans are somewhat comparable.

Flexi Car Loan

Take out the funds you need as well as move them to your checking account within 2 hours. Take out funds as well as pre-pay them without paying any type of fee whatsoever. You have the ability to reduce your credit limit as long as it is still over $4,000. To decrease your limit phone call Westpac straight or head to a branch. If you wish to increase your credit limit for your Westpac Flexi Car Loan, you would certainly be best to contact Westpac directly.

Flexi Loans allow you pay cash into your home loan whenever you desire, and also take out that cash whenever you such as. Making home loan overpayments as well as you'll be able to minimize your home mortgage principal, rate of interest, and period. Full Flexi financings are typically connected to an existing or savings bank account to make it simpler to manage your residence financing, suitable for individuals with a variable earnings. When you need funds for a clinical treatment, weddings, travel, or other personal usages, taking a personal funding can be handy.

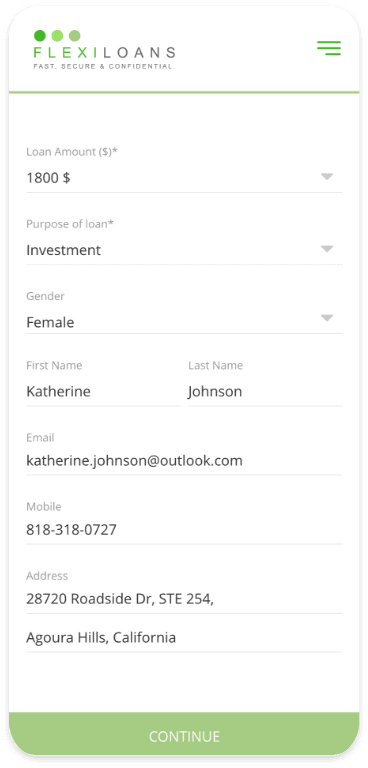

Exactly How To Request Crossbreed Flexi Personal Finances?

With the basic term finance you have certainty knowing how much precisely you have to pay for your home mortgage on a month-to-month basis. While there is absence of versatility to a fundamental term lending, you may have the ability to get a reduced home mortgage rates of interest when contrasted to the semi-flexi car loan or flexi car loan. By enabling you to make development payments on your mortgage quantity, the semi-flexi financing will minimize your finance passion due to the fact that the principal amount has actually been lowered. Plus, choosing a semi-flexi financing permits you to withdraw added sums that you have paid over the set payment timetable.

Individual Car loan-- The disbursal procedure when it comes to an individual financing is quite basic and simple. After the conclusion and approval of the application procedure, the lender licenses the disbursal to the debtor's registered Helpful resources account. 4) No need to issue cheques by capitalists while subscribing to IPO. Simply write the savings account number and check in the application to authorise your bank to make payment in case of quantity. No worries for reimbursement as the money remains in investor's account. Our FlexiLoan is the perfect remedy for participants who call for funds on a regular basis and summarily.

Things You Need To Recognize Before Confiscating Your Mortgage

In conventional individual fundings, the approved finance quantity is paid out in a solitary settlement. At the same time, in a Flexi lending, you can not go beyond a line of credit. It makes sure that you are obtaining only the quantity you require, giving you regulate over your finance. To compute their payment with regular monthly installations, flexi personal car loan debtors can compute their EMIs utilizing the Flexi personal loan EMI calculator. For the computation, one must enter the loan quantity he/she wishes to obtain as well as the possible rate of interest.

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO