Indicators on Uninsured Or Underinsured Accidents In Massachusetts You Need To Know

We have assembled a listing of the worst property coverage business in Texas, with the help of inspecting great deals of information concerning these groups containing courtroom documents, truths, and meetings from insurance coverage workers (insure). If you've had property damages, and also your insurance service provider is not appropriately paying your case, you need to identify that they may be now not to your side.

dui cheaper auto insurance risks

dui cheaper auto insurance risks

guarantee what is global life insurance vs. whole life what is ga vs - auto. wholesale in the insurance coverage market exactly how to file a case with farmers why is farmers insurance policy calling me do farmers insurance policy consist of medpay vehicle insurance policy.

When you try to make a claim on your insurance plan, you might find that your insurance company refuses your case or does not pay out the total you are asking for. This web page tells you why an insurance company could make a decision to do this - credit. Your insurance provider may decline to pay your case since: the policy was not effective when what you're asserting for happened the policy is invalid due to the fact that you really did not tell the truth when you applied for insurance policy or stopped working to disclose something which can impact your claim (for policies secured, restored or transformed) the plan is invalid due to the fact that you deliberately or thoughtlessly kept details or misinformed your insurance companies (for plans obtained, restored or transformed) the product is not covered by your plan there is an exclusion clause in the policy which suggests that you can not declare for what's happened you have actually missed out on some of the instalments of your premium you didn't inform your insurance company about a modification in your conditions you haven't followed the cases process appropriately you have not kept to a condition of your policy you have overemphasized the claim and are attempting to declare for more than you should.

Uninsured losses and also your excess Often an insurance claim will not be covered by your policy. A power cut may indicate that your fridge freezer components have to be thrown away yet your policy may not cover the cost of replacing them.

An excess is the fixed quantity of any case, as an example the first 50, that you must pay yourself. If you lose out financially and also you're not insured yet what's taken place is not your mistake, you might be able to take the person or firm who caused your loss to court to recoup your expenditures. vehicle insurance.

Insurance Claim Vs. Paying Out Of Pocket - Dick Law Firm - Truths

If you have difficulty getting your refund, you can take the insurance policy company or chauffeur to court. If your insurance coverage business have actually handled the case, they ought to declare the excess back for you. If you have a no fault crash, a credit hire company can additionally make a claim in your place.

This might be because: you have actually under-estimated the complete value of your insurance claim as well as do not have enough insurance to cover your losses. This is called being your insurance company thinks that you have placed an impractical worth on your case, as well as will only pay you part of it unless you have a plan, the item for which you are declaring was old, and your insurance company will pay you much less than the cost of changing it with a new thing.

If you assume your insurer is acting unreasonably in refusing to pay the total of your claim you should try to negotiate with them to get to an arrangement (suvs). If you're not pleased with what your insurance firm supplies, you can whine utilizing your insurers complaints procedure.

This money, if awarded by a court or court, will have to come from somewhere else. There are a number of manner ins which a hurt individual may collect compenastion over of insurance plan limits. These methods consist of: bringing a accident suit versus even more than one accused recuperating under an umbrella insurance coverage, and also attempting to collect from an accused personally.

Suing Extra Accuseds Occasionally, greater than one party can be held legitimately and monetarily in charge of an accident. In lots of such instances, the different offenders might be stated to be "collectively as well as severally" liable for the whole amount of damages. This would certainly suggest that if there were 2 accuseds and also each had a policy limit of $50,000, both of those offender's policies might likely be used to please a $100,000 judgment.

Little Known Facts About What Is Gap Insurance And What Does It Cover?.

: The manufacturer of a defective item can typically be taken legal action against, and also an instance might be feasible against the representative or also the store that marketed the product.

trucks cheaper auto insurance car cheapest auto insurance

trucks cheaper auto insurance car cheapest auto insurance

The theory here is that the company thinks legal duty for the employee's oversight. Umbrella Policies In particular circumstances, even if there is a single defendant, there may be numerous insurance coverage in play. Some accuseds, particularly business entities as well as huge organizations, might have an umbrella plan that essentially "looks at" every one of the various other insurance policy protection they have - affordable car insurance.

> What if the Various Other Chauffeur Doesn't Have Insurance Policy? If so, obtaining settlement might be much more challenging than you assume. The competent Atlanta automobile accident lawyers at Hasner Regulation PC are here to aid.

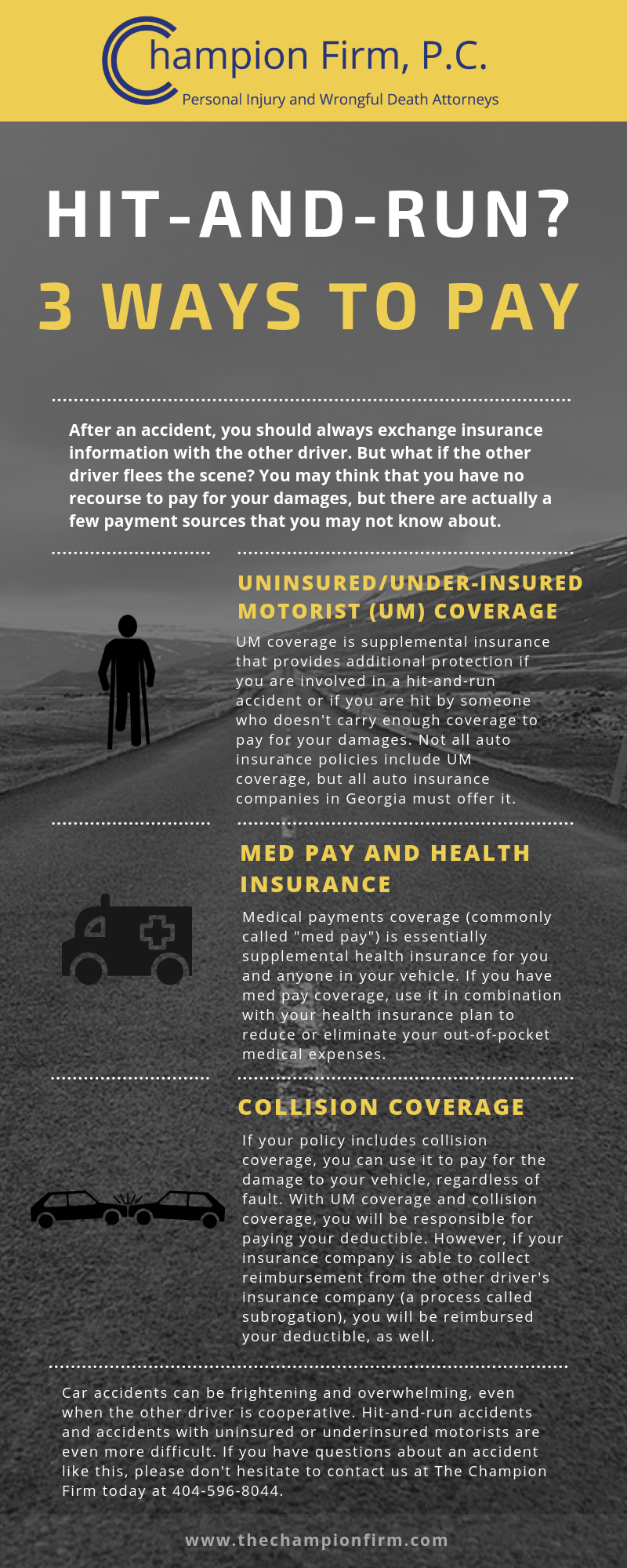

It could be the instance that the at-fault motorist has a policy that conforms with the minimum insurance coverage limitations, however this may not be adequate to completely compensate you for your injuries (vans). Or, a motorist might be accountable for a collision and after that leave the scene. Situations of not enough protection and those with hit-and-runs motorists can be especially complex, so it's finest to connect to an accident attorney if you are associated with either of these kinds of accidents.

The 8-Second Trick For What Happens When Your Car Is Totaled? - Progressive

credit score cheapest auto insurance cheaper car insurance cheaper

credit score cheapest auto insurance cheaper car insurance cheaper

These call for the various other motorist to have actually acted in some reckless way, such as driving drunk. insurance. The damages can get rather huge as well as would certainly be above and also past your normal compensation.

Usually chauffeurs that do not lug insurance policy have few possessions - perks. Hit-and-run cases can also supply a number of obstacles for damaged chauffeurs.

Just How Uninsured and also Underinsured Motorist Coverage Can Assist In order to better protect on your own, you may consider registering in uninsured vehicle driver coverage (UM) or underinsured vehicle driver insurance coverage (UIM). Note that this is optional as well as not required by law. insure. Even more, keep in mind that you have to have this insurance in area prior to the mishap happens in order to be covered.

Especially, they cover: Motorists without auto insurance policy, Vehicle drivers with insurance but not sufficient to cover problems, Struck as well as run motorists that can't be identified, or, Unidentified, without insurance, or underinsured chauffeurs that harm you while you are strolling or biking. car insurance. Currently, there are 2 kinds of UM/UIM insurance coverage that you The original source might have, traditional and add-on.

Let's state that you have $100,000 in insurance coverage as well as the other vehicle driver has a $50,000 at-fault limitation. If the driver creates an accident that leaves you with $200,000 in problems, you would just be qualified to $100,000 under this policy. Here, $50,000 would be based upon the various other driver's policy and $50,000 would originate from your own without insurance protection.

The Buzz on Insurance Policy Limits Not Enough To Cover Claim? - Law ...

With add-on coverage, your policy will pay out up to its maximum regardless of the various other motorist's restrictions. Using the exact same example from above, you would obtain $50,000 based upon at-fault protection from the various other motorist, plus $100,000 from your very own without insurance plan limitation. This would certainly total $150,000 as well as you would be left with $50,000 to handle out-of-pocket.

For that factor, you may consider connecting to an experienced auto accident attorney in Atlanta if you have concerns pertaining to the degree of your protection for these sorts of crashes. cheapest car. Accident and Medical Payments Insurance policy An additional choice that can help in these instances is crash insurance policy. Like uninsured/underinsured coverage, collision is optional.

There is likewise clinical repayments insurance coverage (Med Pay insurance coverage) that is readily available to drivers. This is sometimes described as personal insurance coverage protection (PIP) and also is a type of optional protection that can pay for things like medical

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO