Home Loan Rates

Residential property involved-- A mortgage loan can be availed by collateralising either a household or industrial residential property. For the previous, the customer need not necessarily use it as an area of long-term residence. Customers have to offer all documented proofs of their revenue from available sources to enhance their possibilities to avail the loan at affordable mortgage interest rate.

An additional alternative is the 15-year term, which is preferred for refinancing. Enhances the on-line process with document as well as property retrieval abilities, including the capability to edit your preapproval letter. Caters to self-service users that intend to look for a mortgage online as well as talk to a https://archerfuzb.bloggersdelight.dk/2022/03/27/what-is-a-variable-price-home-mortgage/ human only as required. Tip 4-- Next, a lender agent will contact you to complete identification, address and residential property verification. Federal Book monetary policy adjustments-- can additionally affect rates, though indirectly.

- Discover why it's so important to timeshares in galveston texas always keep an eye on patterns in rates of interest.

- Mortgage bonds and also 10-year Treasury bonds are similar investments as well as compete for the very same customers, which is why the prices for both move up or down in tandem.

- If your deposit is less than 20 percent, you'll usually get a higher interest rate and also need to spend for home mortgage insurance.

- So their base mortgage rate, calculated with a profit margin lined up with the bond market, is changed higher or reduced for each lending they offer.

Interest rate can help you contrast the 'genuine' expense of two loans. It estimates your complete annual price including interestandfees. Nonetheless, your bank may not offer the very best home mortgage offer for you. And also if you're re-financing, your economic circumstance might have transformed sufficient that your current lending institution is no longer your best choice.

Choosing The Right Type Of Home Loan

The home mortgage rate info on this web page does not contain every one of the information you need, so remember to review bluegreen timeshare cancellation policy your private home mortgage picture before you choose a home loan. This is the first portion rate at which we compute the rate of interest on the home loan. If you're new to HSBC, you could remortgage to us from one more lending institution to locate a better deal, whether you're borrowing the exact same or want to borrow much more. Then, it's time to shop around and also obtain quotes from several lenders before determining which one to utilize. The ordinary rate of interest for the most popular 30-year set home mortgage is 3.1%, according to information from S&P Global.

How Much You'll Pay Will Certainly Depend On The Sort Of Car Loan You Pick

Assumptions, conversions, early renewals and ports of existing CIBC home mortgages don't qualify. CIBC may alter or terminate this offer at any time without notification. Fees revealed for the relevant term are CIBC's special reduced prices and also aren't published rates of CIBC. Offer may be changed, taken out or prolonged at any time, without notification.

Mortgage Loan Pre

Shorter financings have larger regular monthly settlements however reduced overall rate of interest costs. Nevertheless, over the long-term, getting a home can be a good way to raise your total assets. And also when you purchase, you can secure a set rates of interest, which suggests your month-to-month payments are much less most likely to enhance compared to renting out.

For many individuals, it makes sense to make a smaller down payment in order to purchase a home quicker and start constructing house equity. In fact, novice house customers placed only6 percent downon standard. You might be amazed to find that a lender wants to provide you a lower rates of interest in order to keep your organization. So obtain numerous quotesfrom at the very least three different lending institutions to locate the appropriate one for you. Comparison shopping can potentially save thousands, also tens of countless dollars over the life of your funding.

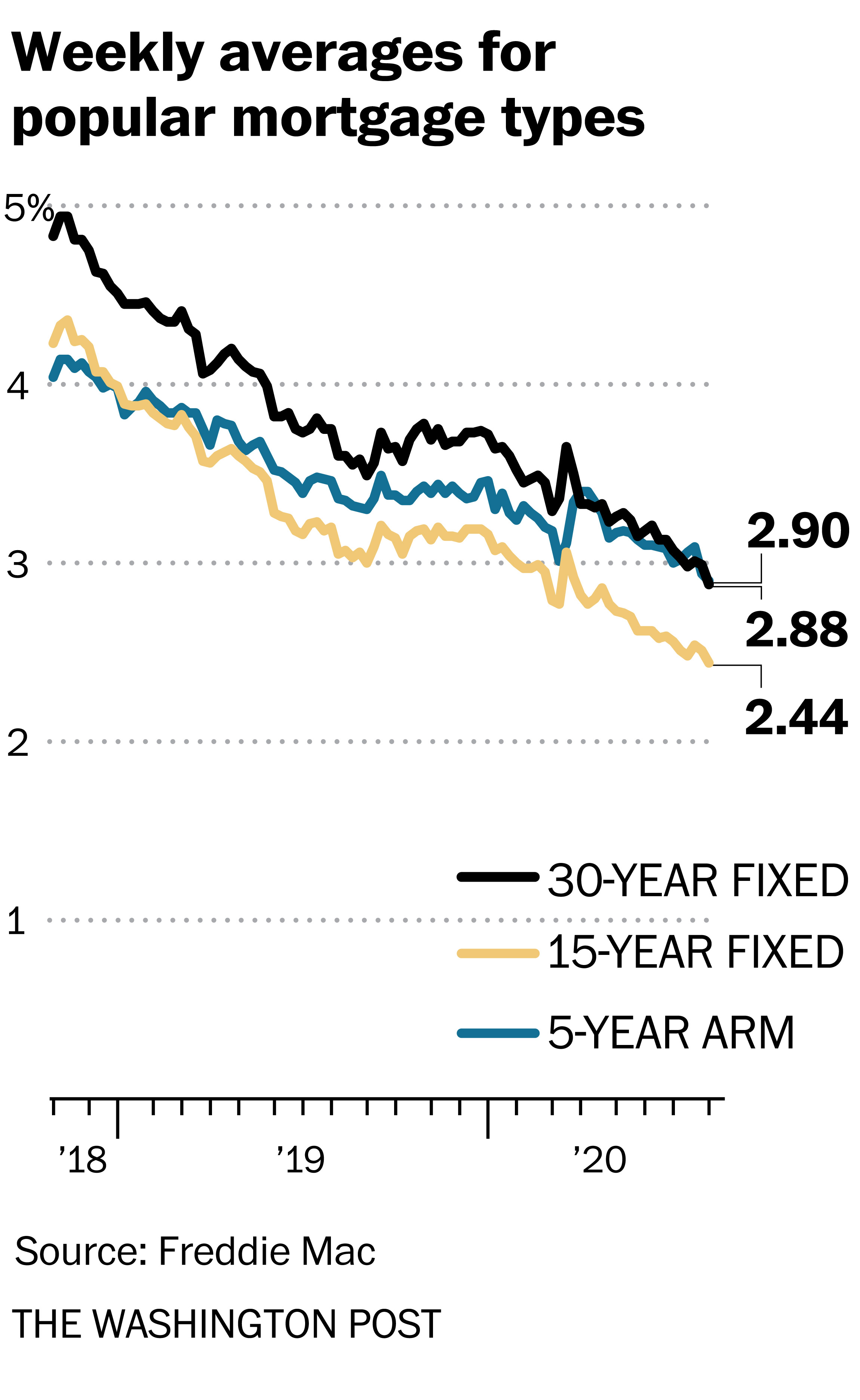

A fixed-rate car loan has one rates of interest over the life of the mortgage, to ensure that the regular monthly principal-and-interest settlements continue to be the exact same until the funding is paid off. A variable-rate mortgage, or ARM, has a rate of interest that can rise or down occasionally. ARMs typically start with a reduced rate of interest for the first couple of years, but that rate can go higher. When Canada Bond Returns increase, sourcing funding to fund home loans becomes even more expensive for home loan lenders and their revenue is lowered unless they elevate home mortgage rates. A set mortgage rate is one that remains the exact same throughout the duration of your mortgage term. A variable home loan price is connected to Prime, which suggests it will change if Prime goes up or down.

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO