From Around the Web: 20 Fabulous Infographics About origination

Developing a digital acquisition approach has actually never been so crucial

Acquiring faithful, rewarding banking clients in today's climate is an interesting challenge. You're marketing luring bargains, as well as visitors are hitting your web site in document numbers. You're speaking with more prospective clients than ever, also in an progressively crowded as well as fragmented market. Nevertheless too many possible customers are dropping out of the procedure. Inadequate are finalising their applications or waiting on final authorization. As well as too many are pulling out before completion of the ceasefire agreement.

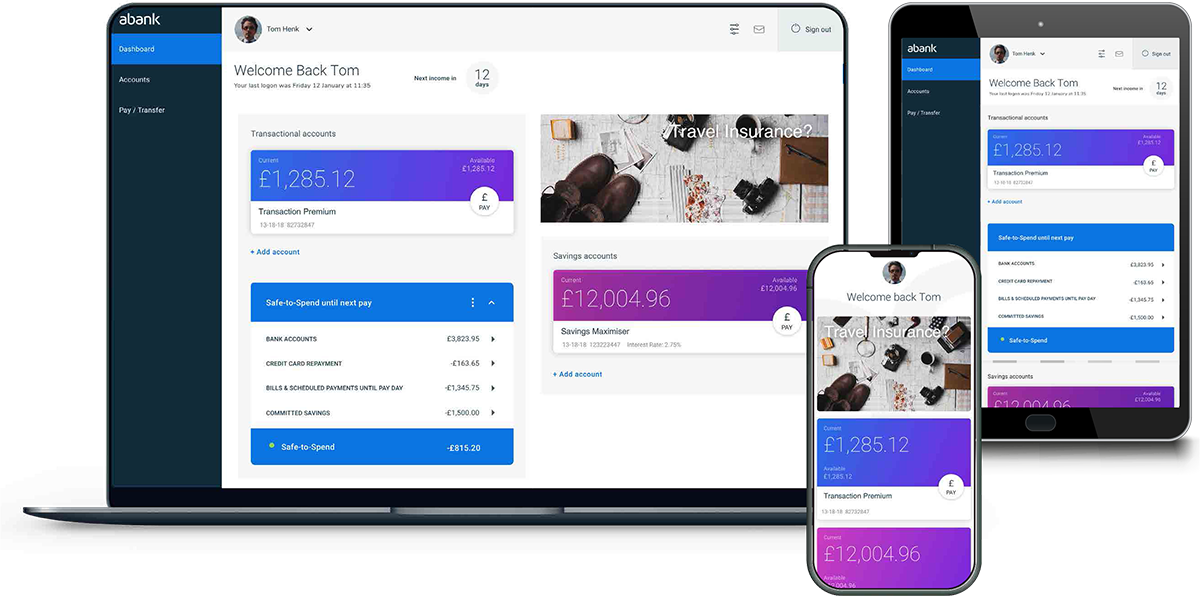

Customers have actually come to be progressively smart when concerns electronic interaction with brand names they recognize as well as count on. And also these brand names recognize the importance of a seamless electronic purchase procedure and also how that can play into the total client experience. What do we imply by purchase procedure? Below we're talking about the process from the very first time a customer researches your brand name online, with to them sending an application online, acquiring approval and totally onboarded as a consumer-- the factor of settlement or down payment.

Below we lay out just how financial institutions can increase the success of their digital acquisition method.

5 means banks can boost digital acquisition

1. Marry up all relevant groups and also review software abilities

Digital Acquisition in the banking industry is complex. Converting website site visitors to customers is a lot more than having a excellent Interface (UI) on your site. You have actually probably already got a quick, user-friendly front end, yet you have actually crunched the numbers, and it's simply not converting. Your UI/Digital Group have done their finest, but they're just dealing with one piece of the challenge. They're possibly not aware of the intricacies other groups encounter-- assimilation with back-end and also exterior systems for identity checking and debt choices, to gathering and also reviewing consumers' supporting documentation, to name just two.

Departments throughout your organisation will certainly need to work together to create a decent on the internet acquisition process. At this phase it's likewise worth completing a gap evaluation to identify discomfort factors as well as technical voids. More recently numerous organisations are adopting Open Financial to allow consumers to promptly offer providers accessibility to your financial information to accelerate application times. Do you have the pertinent source ability in home to efficiently deliver your digital approach or would it be beneficial to generate a expert financial modern technology partner?

2. Find out where your customers are leaving on the trip

Employee your business analysts to deep study the analytics of your ecommerce site. They'll have the ability to see drop off factors at each phase of the application. Possibly there's a pest in the application, probably the questions postured aren't pertinent or confusing. Ensure you are just asking inquiries appropriate for the application-- numerous organisations find they can decrease their application procedure considerably by simply getting rid of unneeded information capture. In order to enhance your digital purchase method, you require the realities regarding what is failing-- servicing assumptions is likely to lead to lost initiatives from your team as well as not resolve the issue.

You need to guarantee your digital acquisition strategy allows registering for a brand-new financial providers or opening up added accounts conveniently yet with enough suitable friction to assure applicants you are respecting their data and adhering to water-tight safety procedures.

3. Place on your own in the applicant's footwear

While you analyse where in the process you are losing important consumers, spend some time yourself to comprehend your organisation's site. Sometimes when financial organisations are developing their websites, associates take off their 'human being' hat as well as just focus on the commercials. Slipping into this mentality breeds poor electronic experiences. We are often drawn into the trivialities of just how an task must look from a company view rather than how it could feel for a customer to finish. Ensure you also look for an account using your internet site-- not with examination data-- as a real consumer to really comprehend the experience. Consider your target market when completing this action. If your goal to attract older customers with a larger share of budget, an on the internet application which is gamified with tiny font is not likely to interest them. If your target market is more youthful, you could take into consideration including some added worth devices on your site to push them with the application refines these could be calculators, product overviews, personal finance administration widgets, and so on.

For a seamless customer experience, customers who have actually efficiently onboarded electronically should not be informed that they need to wait to receive qualifications or short-lived credentials before they can log in to check out and handle their accounts. For some processes-- such as waiting for a debit card as well as PIN in the message independently after producing an account-- there are inevitable delays.

4. Can you safely recognize a prospective customer digitally?

Consumers looking for an account online do not intend to visit a branch or call a handling team to confirm their identity-- this interrupts the great digital experience they have thus far had with you. Keep in mind-- this might be the first dealing a potential customer has had with your brand. As monetary organisations expand their electronic onboarding solutions, considering exactly how tighter assimilation of identity onboarding and also ongoing verification can enhance safety and also lead the way for even more versatile risk-based authentication method is crucial. If financial institutions obtain digital identity right, they stand to understand benefits in streamlined sales procedures as well as customer onboarding, reduced losses from scams and also governing penalties, and also the capacity for brand-new profits generating identity-based services and products. Extra significantly, they can keep their central duty as moderators of trust fund as well as remain appropriate in the transforming electronic economic situation.

5. The work proceeds after your consumer has actually effectively onboarded

Digital Acquisition is complicated due to the fact that it is the best marital relationship between your bank's as well as consumers' demands and also wishes. It's not almost completing a form or having a showy internet site. Consumers desire problem complimentary, appealing and gratifying experiences on the course to them understanding their economic objectives. They want their desire house, not to have to fill in their employment information 3 times. You have to convert the consumer by providing a fast decision; while collecting other beneficial information for cross/upselling. Nonetheless, you likewise require to meet your https://www.sandstone.com.au/en-gb/ regulatory as well as compliance demands, threat as well as credit scores administration standards and cover operational needs.

In recap

Digital Acquisition is intricate due to the fact that it is the excellent marriage between your bank's and clients' requirements and also desires. It's not practically completing a kind or having a fancy internet site. Customers want headache cost-free, appealing as well as fulfilling experiences on the path to them understanding their economic goals. They want their desire home, not to have to fill in their work information three times. You have to convert the client by giving them a quick decision; while collecting various other helpful info for cross/upselling. Nevertheless, you additionally need to fulfill your governing as well as conformity requirements, threat and also credit rating management standards and also cover operational needs.

Sandstone Technology

Concordia Works, 30 Sovereign St, Leeds LS1 4BA, United Kingdom

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO