Excitement About How Auto Insurance Rates Have Changed Over The Past Decades

Inquire about team insurance coverage Some business offer reductions to motorists who obtain insurance through a group strategy from their employers, through professional, business as well as graduates groups or from various other organizations (insurance affordable). Ask your company as well as inquire with groups or clubs you belong to to see if this is possible - low-cost auto insurance.

Seek various other price cuts Business offer price cuts to policyholders who have actually not had any kind of accidents or relocating infractions for a number of years (risks). You might also obtain a discount if you take a defensive driving program. If there is a young chauffeur on the plan that is a good trainee, has actually taken a drivers education and learning course or is away at university without a car, you may likewise receive a reduced price.

The vital to savings is not the discounts, but the final cost (cheapest auto insurance). A company that supplies few discount rates may still have a reduced total rate. Federal Citizen Information Center National Consumers Organization Cooperative State Research, Education, and also Expansion Service, USDA - low cost.

cheap auto insurance suvs car insurance vans

cheap auto insurance suvs car insurance vans

Ordinary Vehicle Insurance Rates by Protection Level When it pertains to securing your automobile, we comprehend that everybody's requirements are various. That's why we offer various sorts of auto insurance coverage (cheapest). Having complete insurance coverage assists you stay safe when driving. This is likewise one of the reasons the ordinary price of auto insurance ranges consumers.

cheap insurance laws insurance affordable cheap car insurance

cheap insurance laws insurance affordable cheap car insurance

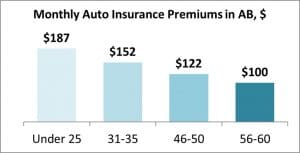

A policy that will pay for home problems up to $50,000 will have a greater premium than one that just pays for fixings up to $25,000. Typical Auto Insurance Rates by Age Your automobile insurance rates will certainly also differ based upon your age (affordable car insurance). cars and truck insurance business commonly consider young vehicle drivers, like teens, to be more of a danger behind the wheel.

Average Cost Of Car Insurance In 2021 - The Zebra - The Facts

car insurance money dui cheapest car

car insurance money dui cheapest car

Average Car Insurance Rates by State The typical vehicle insurance policy rate by state differs. According to the Insurance Coverage Info Institute (III), Iowa has some of the least expensive vehicle insurance coverage in the country at $674, while Louisiana had some of the most costly at $1,443.

At What Age Is Automobile Insurance Coverage Cheapest? Usually, cars and truck insurance coverage premiums cost much more for vehicle drivers who are younger than 25. 5 That implies as a vehicle driver grows older and also obtains more experience on the road, their rates will likely decrease. 6 For some individuals, these prices can begin to increase again after the age of 65 when you're taken into consideration an elderly person (auto insurance).

Which Age Pays one of the most for Cars and truck Insurance? Insurance coverage firms commonly charge extra for drivers that are under the age of 25. vehicle insurance. 7 If you are 50 years or older, you fulfill the AARP member Click here! age demand and also can request coverage with The Hartford (business insurance). Considering that 1984, The Hartford has assisted virtually 40 million AARP participants get the car coverage they need with special benefits and discounts What State Has the Cheapest average car insurance coverage rates? According to III, in 2017, these states had several of the most affordable cars and truck insurance policy prices:8 To discover extra, get a quote from us today.

They'll assist you obtain the auto plans you require, whether it's to assist pay for damages after a crash or to shield you from collisions with uninsured vehicle drivers. liability.

When it comes to factors that influence the typical vehicle insurance coverage expense, there are some variables that you can regulate, at least partly. And also the most noticeable aspect is your age.

Not known Incorrect Statements About What's The Average Cost Of Car Insurance? - Thestreet

cheap insurance insurance affordable suvs insurers

cheap insurance insurance affordable suvs insurers

For instance, vehicle insurance policy is normally at its highest when you are a teen driver, as well as the prices may remain to be high till you are about 25. Also within the 16-25 age array, you'll see these prices go down. liability. At age 20, the average motorist can expect to pay regarding $3300 for complete protection - car.

In this article, we'll check out how ordinary automobile insurance coverage prices by age and also state can change. We'll additionally have a look at which of the finest vehicle insurance policy firms offer excellent discount rates on automobile insurance policy by age and compare them side-by-side. Whenever you purchase automobile insurance, we recommend getting quotes from numerous suppliers so you can compare insurance coverage and rates.

So why do typical auto insurance rates by age differ a lot? Generally, it's everything about threat. According to the Centers for Condition Control and Prevention (CDC), people between the ages of 15 and 19 made up 6 - liability. 5 percent of the population in 2017 yet represented 8 percent of the total expense of cars and truck mishap injuries.

The rate data originates from the AAA Foundation for Web Traffic Security, as well as it makes up any type of crash that was reported to the police. The typical costs information originates from the Zebra's State of Automobile Insurance policy report. The rates are for policies with 50/100/50 obligation protection limits and also a $500 deductible for detailed and collision protection - suvs.

According to the National Highway Website Traffic Safety And Security Administration, 85-year-old men are 40 percent most likely to enter a mishap than 75-year-old men. Taking a look at the table above, you can see that there is a direct correlation in between the crash price for an age team and also that age team's typical insurance coverage costs.

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO