The Only Guide for Average Cost Of Car Insurance (2022) - Quotewizard

That's since the insurance company's credit reliability must also be taken into consideration. Besides, what good is a plan if the business doesn't have the wherewithal to pay an insurance policy case? To run a look at a particular insurance provider, think about having a look at a website that rates the economic stamina of insurer. The monetary toughness of your insurance provider is very important, however what your contract covers is likewise vital, so make certain you comprehend it (dui).

In general, the fewer miles you drive your auto per year, the reduced your insurance coverage price is likely to be, so constantly ask concerning a firm's gas mileage limits. Usage Mass Transit When you authorize up for insurance policy, the business will typically begin with a set of questions.

Locate out the exact prices to guarantee the various cars you're considering before making a purchase., which is the amount of money you would have to pay before insurance coverage selects up the tab in the occasion of a crash, burglary, or various other types of damages to the vehicle.

Boost Your Credit report Rating A motorist's document is undoubtedly a big factor in identifying vehicle insurance coverage costs. It makes feeling that a motorist that has actually been in a whole lot of crashes can cost the insurance policy company a lot of money.

It's a controversial problem in specific statehouses ... cheaper auto insurance. [] insurance companies will say their research studies show that if you're accountable in your individual life, you're less most likely to file claims." Despite whether that's real, understand that your credit score score can be a consider figuring insurance coverage premiums, as well as do your utmost to maintain it high.

The Basic Principles Of Report: Florida Ranked 2nd-highest For Auto Insurance Costs

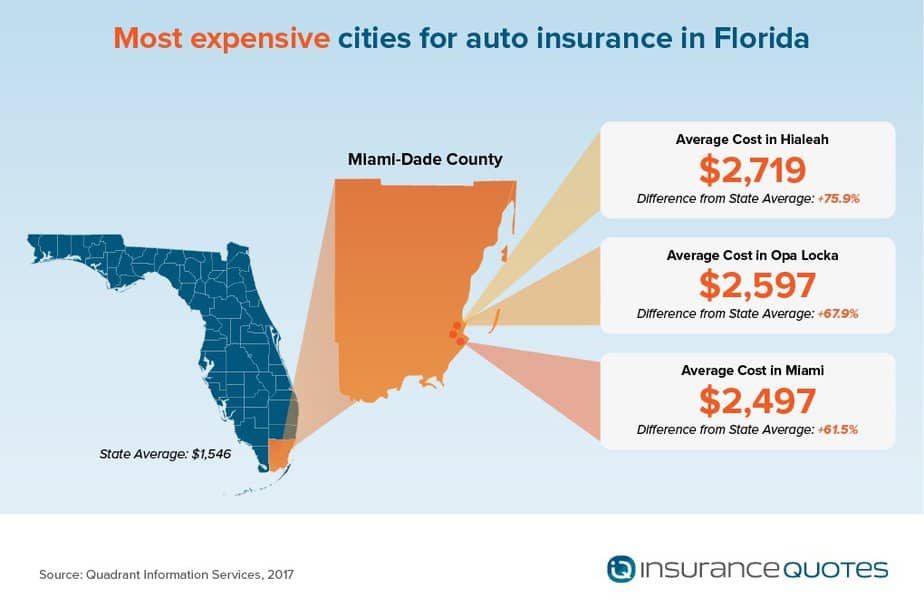

Take Into Consideration Area When Estimating Vehicle Insurance Policy Fees It's not likely that you will move to a various state simply since it has lower cars and truck insurance policy rates. When intending an action, the prospective modification in your automobile insurance policy rate is something you will certainly desire to factor right into your budget plan.

If the value of the automobile is only $1,000 and also the accident coverage costs $500 each year, it might not make good sense to acquire it. 11. Get Discount Rates for Installing Anti-Theft Instruments Individuals have the possible to lower their yearly premiums if they mount anti-theft gadgets. GEICO, for instance, offers a "prospective financial savings" of 25% if you have an anti-theft system in your cars and truck.

Vehicle alarms and Lo, Jacks are 2 sorts of tools you may intend to ask about. If your main inspiration for mounting an anti-theft device is to decrease your insurance premium, take into consideration whether the price of adding the gadget will certainly lead to a substantial adequate savings to be worth the trouble and expense.

Talk to Your Representative It is very important to note that there may be various other price savings to be had in addition to the ones described in this article. As a matter of fact, that's why it commonly makes sense to ask if there are any type of special discount rates the company provides, such as for armed forces employees or workers of a certain firm.

There are several points you can do to reduce the sting. These 15 pointers should obtain you driving in the ideal direction.

No-fault Motor Vehicle Insurance, Hearings Before The ... Can Be Fun For Everyone

Insurance service providers intend to see demonstrated responsible behavior, which is why web traffic mishaps Visit this page as well as citations are variables in determining cars and truck insurance coverage prices. Aims on your permit don't stay there forever, but just how long they stay on your driving record differs depending on the state you live in and the seriousness of the offense - liability.

cheap auto insurance low-cost auto insurance cheapest car insurance prices

cheap auto insurance low-cost auto insurance cheapest car insurance prices

A new sporting activities vehicle will likely be extra pricey than, say, a five-year-old car. If you pick a reduced insurance deductible, it will cause a higher insurance coverage bill that makes picking a greater deductible appear like a respectable deal. Nonetheless, a higher deductible can imply paying even more out of pocket in case of a crash.

What is the ordinary auto insurance cost? There are a variety of factors that affect exactly how much cars and truck insurance policy costs, that makes it challenging to get a precise idea of what the average person pays for car insurance - insurance companies. According to the American Vehicle Association (AAA), the typical price to guarantee a sedan in 2016 was $1222 a year, or approximately $102 per month.

Nationwide not only offers competitive prices, but likewise a variety of discounts to assist our members conserve much more. Exactly how do I obtain car insurance coverage? Obtaining a cars and truck insurance policy price quote from Nationwide has never been much easier. See our car insurance coverage quote area and also enter your zip code to start the auto insurance quote process.

When it comes to factors that impact the typical vehicle insurance policy cost, there are some variables that you can regulate, at the very least partly. As well as the most evident variable is your age.

The Only Guide for What Is The Cost Of Car Insurance For 16-year-old Driver? - Way

business insurance cheapest cheap car insurance affordable car insurance

business insurance cheapest cheap car insurance affordable car insurance

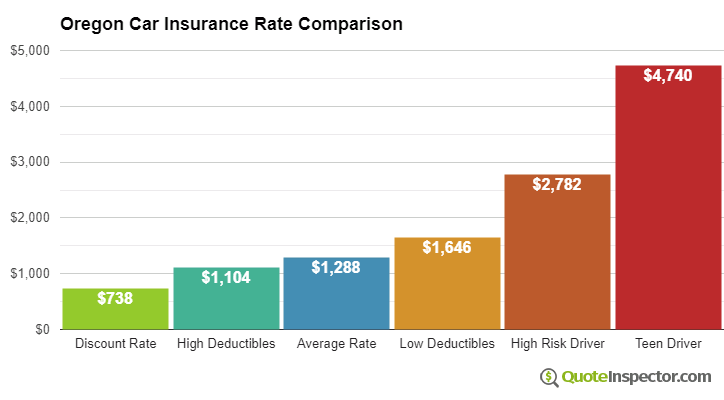

Car insurance policy is generally at its highest possible when you are an adolescent vehicle driver, and the prices may continue to be high up until you are regarding 25. Also within the 16-25 age array, you'll see these rates go down. At age 20, the typical chauffeur can anticipate to pay regarding $3300 for complete coverage.

The average price of automobile insurance policy in the United States is $2,388 annually or $199 per month, according to information from almost 100,000 policyholders from Savvy - auto insurance. The state you stay in, the degree of protection you would love to have, and also your gender, age, credit rating history, and driving history will certainly all element into your premium.

Car insurance coverage have great deals of moving components, and also your costs, or the expense you'll pay for protection, is just among them. Insurance coverage is regulated at the state level, and also regulations on required protection as well as rates are various in every state. Insurer consider various variables, consisting of the state and area where you live, along with your sex, age, driving history, and the level of coverage you would love to have.

Below are the greatest aspects that will influence the price you'll pay for protection, and also what to take into consideration when looking at your automobile insurance policy alternatives. There have been some large changes to vehicle insurance coverage costs throughout the coronavirus pandemic.

Business Expert assembled a checklist of average vehicle insurance prices for every state. These prices were determined as a standard of prices reported by Nerdwallet, The Zebra, Value, Penguin, Bankrate, as well as the National Organization of Insurance Commissioners - laws. Below's a range vehicle insurance policy prices by state. Source: Data from Nerdwallet, Worth, Penguin, Bankrate, The Zebra, as well as the National Organization of Insurance Policy Commissioners.

The Ultimate Guide To How Much Does Car Insurance Cost?

And Also from Service Insider's data, automobile insurer tend to bill ladies much more. Company Insider gathered quotes from Allstate and State Ranch for fundamental insurance coverage for male and female vehicle drivers with a the same profile in Austin, Texas. When switching out only the sex, the male profile was priced estimate $1,069 for coverage per year, while the female profile was priced estimate $1,124 each year for coverage, costing the female vehicle driver 5% more.

In states where X is a gender alternative on chauffeur's licenses consisting of Oregon, California, Maine, as well as soon New york city insurance companies are still determining just how to compute costs. Typical car insurance costs by age, The number of years you have actually been driving will influence the cost you'll spend for coverage. While an 18-year-old's insurance coverage standards $2,667.

dui insurance company cars cheapest car

dui insurance company cars cheapest car

This information was given to Organization Expert by Savvy (cars). Just how automobile insurance policy prices alter with the variety of autos you possess, In some means, it's sensible: the much more automobiles you have on your plan, the greater your car insurance coverage costs. Yet, there are likewise some cost savings when numerous autos are on one policy.

Automobile insurance is less costly in postal code that are more rural, and the exact same holds true at the state degree. Insure. com data shows that Iowa, Idaho, Wisconsin, as well as Maine

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO