Not known Facts About Adding A Driver To Your Car Insurance - Quotewizard

dui cars cheapest car insurance auto

dui cars cheapest car insurance auto

Having a serious violation like a DUI on your motor vehicle document could increase your cars and truck insurance premium by 88% on average. Teenager male chauffeurs might pay $807 even more for vehicle insurance policy on average contrasted to teen female chauffeurs.

The table listed below displays the average annual and monthly costs for some of the biggest vehicle insurance business in the nation by market share. We have actually likewise computed a Bankrate Score on a range of 0. insurance company.

automobile prices risks vehicle

automobile prices risks vehicle

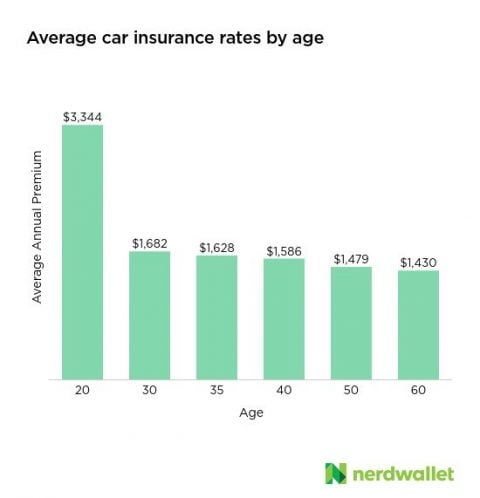

Note that your age will not influence your premium if you live in Hawaii or Massachusetts, as state guidelines restrict vehicle insurance companies from using age as a rating aspect. Furthermore, gender impacts your premium in many states.

Being associated with an at-fault mishap will certainly have an effect on your auto insurance coverage. The amount of time it will certainly remain on your driving record depends upon the severity of the accident as well as state guidelines. As one of the most serious driving occurrences, obtaining a DUI sentence commonly boosts your cars and truck insurance coverage premium greater than an at-fault mishap or speeding ticket.

How a lot does auto insurance coverage expense by credit rating score? This suggests that, in basic, the better your credit score, the reduced your costs - laws., not a credit rating.

Excitement About How Much Does It Cost To Add A Teenager To Car Insurance ...

The vehicle makes as well as designs in the table listed below are the five most popular vehicles in the U.S.Some automobile makes and also designs are taken into consideration much more expensive to guarantee by insurance coverage companies. These shared features can consist of: The high price of these lorries usually come with pricey components as well as specialized expertise to repair in case of a case - prices.

Insurance policy holders that drive fewer miles a year usually get reduced prices (although this gas mileage designation differs by company). How to find the finest vehicle insurance coverage rates, Acquiring automobile insurance policy doesn't need to indicate costing a fortune; there are means to save. Discount rates are just one of the very best methods to decrease your premium. insurance.

Right here are some of the most usual insurance coverage discount rates in the united state Drivers who have no car insurance claims on their document for the past a number of years commonly get approved for cost savings. You can usually minimize your car insurance policy premium when you pack your cars and truck insurance coverage with a residence insurance plan or one more sort of plan provided by your insurance provider, gaining discounts on both policies. For this reason, insurance policy experts may recommend thinking about complete protection vehicle insurance coverage relying on what cars you are guaranteeing as well as what properties you have in your name. If your automobile is financed or leased, it's most likely that you will certainly have to carry complete coverage on your lorry - cheaper cars. Full insurance coverage often refers to higher obligation restrictions as well as more coverage choices, like crash and comprehensive, to cover your lorry's damage.

While full coverage vehicle insurance policy doesn't have a set meaning, it typically describes vehicle insurance that has coverage choices beyond the state minimum restrictions. Most complete coverage vehicle insurance policy will certainly consist of clinical payments insurance coverage, as well as detailed insurance coverage and also crash coverage to insure the lorry (insurance companies). Having this extra coverage does suggest that your auto insurance policy might be a lot more pricey than if you were just bring the minimal responsibility limitations, yet the advantage is that it may decrease your out-of-pocket prices in case of an accident.

Insurers submit new rates with the divisions of insurance policy in the states they serve each year, so your costs may go through increases or reduces that show these brand-new prices. Methodology, Bankrate makes use of Quadrant Info Services to evaluate 2022 rates for all ZIP codes and also providers in all 50 states and also Washington, D.C. automobile.

The Car Insurance Faqs Statements

Just how much does your insurance go up after including a teen is an inquiry we get constantly. If you're a parent of an adolescent motorist after that you know it's costly! We're mosting likely to speak about exactly how pricey it is Homepage as well as give some tips on exactly how to lower your car insurance policy costs for young adolescent chauffeurs.

Allow's chat concerning why it costs so much as well as what you can do to help decrease the amount of auto insurance you pay for your young teenage motorist. 21 is the age where rates will certainly begin to drop.

/auto-and-car-insurance-policy-with-keys-1048031806-6dbe3526b6d84e14aa23d07fbe11c40e.jpg) vehicle vehicle insurance cheap cheaper car insurance

vehicle vehicle insurance cheap cheaper car insurance

By this age, they are older and also a lot more fully grown and also they additionally have years of driving history so the insurance provider can much better recognize just how risky they are and also just how likely they are to have a mishap. Begin the process early, look around. cheap. Just how much Does It Expense To Include a 16 Year Old To Auto Insurance Coverage? As stated above, it can set you back a whole lot of cash to include your 16 year old to your auto insurance coverage.

Take benefit of the couple of price cuts offered to young chauffeurs. This discount rate is not available with as several insurance coverage firms as it used to be. It can still be a sizeable discount as well as it's still a valuable course for your young chauffeur to take.

Just How Much Is Vehicle Insurance Policy For a 17 Year Old? While it holds true that automobile insurance policy for a 17 years of age is extremely expensive, it's not almost as negative as a 16 year old without any driving experience! As you grow older annually your car insurance premiums will continue to go down.

Commercial Auto Insurance Cost - Insureon Fundamentals Explained

There is a difference in expense in between male and female motorists. Young female chauffeurs will certainly cost much less to insure than 17 year old male's.

If a particular risk is not as terrific, then the prices for that insurance policy will be less - insure. When it comes to 17 year old females, the information reveals that they are better drivers than 17 year old males. Ladies tend to enter much less mishaps and also tend to obtain less tickets.

Male drivers, especially young male drivers, have a tendency to have higher prices for vehicle insurance policy. Insurance policy business recognize they will most likely end up paying out cash for the mishap the 17 year old male is going to have, so they charge greater prices - auto insurance.

They can occasionally have good rates for 16 year olds, yet they can also in some cases have poor rates for cars and truck insurance. A person that can look at lots of different firms and find the finest price for your 16 year old.

Yes, you must include all vehicle drivers of your vehicles to your vehicle insurance coverage plan. There is a negative report out there where a lot of representatives are specifying that you don't need to include young vehicle drivers to your car insurance plan.

Some Known Details About Car Insurance Faq - Answers To Your Car Insurance Questions

This is totally incorrect and these agents are setting up these people to have an awful case experience where things are covered. Liberal use is for those people that would certainly drive your automobile that do NOT live in your house and also do not drive your automobile often.

In most cases, if a teenage vehicle driver accidents your vehicle and they are not detailed on your plan as a vehicle driver then there would not be coverage! Should My Teen Get Their Own Insurance Coverage? No, your adolescent vehicle driver ought to not get their very own insurance coverage. They must be guaranteed under your policy (insured car).

Not just is it much more expense efficient to add your young adult to your auto insurance policy however it likewise ensures you have the right insurance coverage. Obtaining your teen their own car insurance plan while they are residing in your home produces all sort of coverage concerns that might affect you at the time of a case - cheap car.

trucks cheapest insurers cheap

trucks cheapest insurers cheap

Some business want certain sorts of plans yet do not desire various other kinds of plans (low cost auto). So some insurer will certainly have actually good pricing for teenager vehicle drivers, since they want that sort of service whereas other

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO