low cost auto affordable car insured car insured

PI protection does not pay for the price of your medical costs. In some states, you may additionally be called for to have:: This pays for problems to your vehicle and also clinical costs after an accident with a without insurance or underinsured driver (business insurance).

, these policies are worth it for most drivers. The worth of this insurance coverage depends on Click here to find out more your automobile.

In our point of view, the very best car insurance policy coverage is to obtain full insurance coverage with limits of a minimum of 100/300/100. This provides you a lot of room in case you experience a serious accident. The collision and extensive insurance coverage will certainly additionally care for your automobile if you create an accident. Last Ideas On The Finest Vehicle Insurance policy Although one provider could attract attention to you currently, we encourage you to obtain car insurance policy prices estimate from several companies so you can discover the most effective automobile insurance coverage for you.

car insurance cars cars credit

car insurance cars cars credit

Below are the state minimums for physical injury and residential property damage. Keep in mind that some states additionally need uninsured motorist physical injury, without insurance motorist building damages, as well as individual injury defense insurance policy along with these minimums - car. Make certain you comprehend your state's laws as well as coverage limits prior to purchasing a car insurance coverage plan.

What Does Erie Insurance: Auto, Home, Life And Business Insurance Mean?

$25,000/ $50,000 $10,000 West Virginia $25,000/ $50,000 $25,000 Wisconsin $25,000/ $50,000 $10,000 Wyoming $25,000/ $50,000 $20,000 1New Hampshire does not require its vehicle drivers to bring auto insurance coverage, nonetheless, motorists must have the ability to cover the price of home damages or physical injury as a result of an accident in which they are at mistake.

Comprehensive protection Comprehensive coverage spends for damage to your lorry triggered by things aside from crashes (cheap auto insurance). Example: If a tree branch falls on your auto during a tornado, extensive insurance coverage may cover the damage. Comprehensive insurance coverage generally includes natural catastrophes, vandalism, fires, and various other unusual events. Accident coverage Crash insurance covers the expense to repair or change your own cars and truck if you struck another automobile or things.

A lot of states require you to bring responsibility insurance coverage, but collision insurance is not called for by law. If your automobile is under a car loan, nonetheless, it prevails for lenders to require both thorough as well as accident insurance policy. Medical repayments Clinical protection on an auto insurance plan covers you and also any person else in your automobile at the time of an accident.

When going shopping around for car insurance, look into the details advantages each business uses they may be well worth the included expense. Deductibles are a typical attribute of insurance coverage plans.

How Travelers Insurance: Business And Personal Insurance ... can Save You Time, Stress, and Money.

For instance: If you pick a $500 insurance deductible and enter into a crash that calls for $2,000 out of commission, you would pay the initial $500 and also your insurance policy would pay the continuing to be $1,500. If you have a crash with just $400 in damage, you would have to pay the entire price, as it's lower than the $500 deductible.

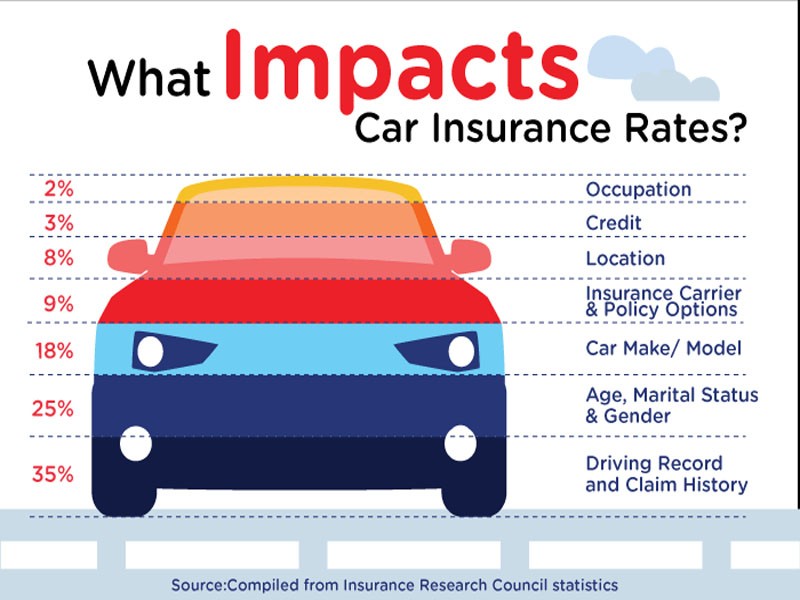

Just how is automobile insurance policy valued? Car insurance policy expenses are somewhat intricate, but it's easy to break down the various variables that identify your prices. Right here are some of the significant elements that enter into guaranteeing a car and its chauffeur: Chauffeur age: Younger chauffeurs generally pay greater than older chauffeurs - cheaper car.

car insurance prices insurance company low cost auto

car insurance prices insurance company low cost auto

Driving history: If you have either a history of mishaps or tickets, you can anticipate to pay more for insurance policy. Chauffeurs with greater debt scores usually obtain reduced rates.

Some insurers use per-mile insurance coverage where you pay less for driving less - cheap. Protection choices: When you choose your deductible as well as coverage degrees, your insurance costs will go up or down with your options.

Getting The Best Car Insurance Companies Of April 2022 - Investopedia To Work

cheap car car insurance vehicle insurance cheapest car insurance

cheap car car insurance vehicle insurance cheapest car insurance

Somebody with an expensive brand-new red cars will probably pay a whole lot more than a similar driver with a monotonous 10-year-old sedan. Discount rates: Every insurer has its very own regulations around discounts. There prevail price cuts for multiple plans at the very same insurance provider, an excellent driving history, a reduced insurance claim history, adding lorry security and also anti-theft functions, automatic repayments, excellent trainees, and also others.

Every insurer has its very own proprietary rates and also formulas for determining what consumers pay. Buying around can help you conserve a little fortune in some situations. car. If you can not manage car insurance policy, you shouldn't just drive without it, as it can be both unlawful as well as a massive threat to your financial resources.

Testimonial Add-on Riders as the Part of the most effective Car Insurance Coverage in India: It is always advised to pay adequate focus to all the add-on cyclists so that you can select the leading automobile insurance coverage policy in India with added benefits. For your comfort, we have listed here a couple of crucial motor Insurance policy motorcyclists.

The responses coming directly from your near as well as dear ones might offer you much better understandings regarding just how its consumer support and also case treatment work. It will certainly assist you to make an enlightened choice. insure. Choices for a Flexible Car Insurance Coverage Protection: While acquiring the top vehicle insurance coverage policy in India, a flexible coverage is constantly substantial.

The Best Car Insurance In 2022 - Benzinga for Beginners

Do not succumb to them; they can be just a catch. You can find a good bargain online when you spend some time out of your busy schedule and also search across the Internet. While contrasting auto insurance plan online, maintain the adhering to factors in your mind: Compare numerous insurance coverage provided by the different insurance providers. vans.

Some care such as commercial autos as well as SUVs, i. e. Sports Energy Automobile, frequently need higher costs as insurance coverage companies obtain a lot of claims on these automobiles. Generally, diesel cars have a 10-15% higher premium than petrol vehicles. Threats Associated With the Area This is based upon the enrollment area.

money cheap car cheaper cars cars

money cheap car cheaper cars cars

If theft or loss of the vehicle is greater in the area where you stay, then the cars and truck insurance costs go up. Dangers Associated With Driver of the Auto The career and age of the driver are thought about. When it comes to multiple drivers of the automobile, you have to pay higher costs.

This is the discount rate that is deducted from your insurance policy premium throughout plan renewal (cheap auto insurance). As a choice, you can go for NCB. Take a look at the Case Settlement Ratio (CSR) Prior to you complete an auto insurance provider, last however not the least, consider the insurance company's previous document of claim settlement. Claim Negotiation Ratio is the moment taken by an insurance provider to work out down the insurance claims from its clients.

A Biased View of Ca Department Of Insurance

Keeping that, here are a couple of ideas that will help you select the top auto insurer in India (car). Take an appearance: Before you choose the top auto insurance provider, you require to assess your vehicle insurance coverage needs. You need to recognize the degree of coverage you are trying to find in addition to any type of particular attachments that you wish to buy.

In addition, you should likewise be mindful of the optimal costs that you can pay for to pay for the plan. Currently that you recognize your cars and truck insurance policy needs, you need to locate authentic motor insurance provider in the market. You can inspect the authenticity of a car insurer by inspecting its IRDA Enrollment Number.

The CSR refers to the total percentage of cases settled by the insurance provider. On the various other hand, ICR refers to the overall percentage of costs utilised by the insurance coverage company against the complete amount of costs gathered. You must seek a company with a greater CSR and also ICR as it illustrates a lesser chance of your claims obtaining denied by the insurance firm - affordable.

You must choose a firm with a faster claim

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO