Not known Factual Statements About Insurance Deductible - Overview, How It Works, And Examples

If the insurance policy holder does not have an at-fault mishap resulting in an insurance claim, the individual has paid even more for car insurance than a person with a greater deductible. When do you pay the deductible for car insurance?

This is just the case as long as the costs drop within the series of the insurance coverage you bought, nevertheless. Last but not least, a lessening insurance deductible may ultimately lead to a decreased deductible or also none whatsoever. This kind of deductible rewards chauffeurs for preventing crashes by decreasing their insurance deductible annually they stay accident-free.

A high deductible will certainly reduce your general insurance coverage rate, however it will boost your out-of-pocket expenses if you sue. insurance. 1 5 concerns to aid you pick the best car insurance policy deductible In figuring out the appropriate deductibles, here are 5 inquiries to take into consideration prior to deciding: How do different insurance deductible degrees impact the insurance premium? This is a good question as no 2 insurer will have the same deductible-premium ratio, as well as states vary on their regulative approach to the topic.

That $800 now appears of the owner's budget. Nonetheless, if the proprietor had a $100 deductible, the out-of-pocket expenditure would certainly be just $100, supplying a savings of $700. Is it far better monetarily to have a reduced deductible and also a greater costs? That depends. A person with a low deductible/higher premium ratio can experience a 10-year duration without submitting an insurance coverage claim.

car insurance cheap auto insurance cheap insurance insurance

car insurance cheap auto insurance cheap insurance insurance

How does a person's driving document affect the option of insurance deductible? The current reasoning is the cleaner the driving document, the better the consideration one must offer to a greater insurance deductible as it will certainly lower costs. here On the other hand, for someone with a less-than-clean driving document, the individual needs to consider taking a lower deductible, in spite of the additional premiums.

When Do I Need To Pay A Deductible On My Car Insurance? Fundamentals Explained

The damage is covered under your accident insurance, and the repair work come out to $7,000. If you have a $500 insurance deductible, you pay $500, then your auto insurance coverage firm pays the remaining $6,500. When do you pay a deductible for car insurance policy? Not all types of cars and truck insurance policy need you to pay a deductible.

An uninsured/underinsured motorist insurance claim might have a deductible, depending on where you live. Uninsured driver protection deductibles have a tendency to be controlled by your state rather of you picking the amount.

Do I pay an insurance deductible if I'm not at mistake? If you are in an accident that is not your fault, you usually won't pay a deductible.

You will certainly require to pay your deductible in this circumstances, but if it's later discovered that you're not at mistake for the mishap, you can get a reimbursement. There are a pair of various other possibilities that may take place: Your insurance provider might decide to go after activity versus the various other motorist's supplier to recover their prices.

If you are unable to recover your insurance deductible from your provider, you can take the other motorist to small claims court for the deductible quantity (accident). Maintain in mind, nonetheless, that the insurance deductible quantity might not worth the moment. Vehicle insurance deductible vs. exceptional Deductibles and also costs are 2 sorts of settlements you make to your auto insurer for protection.

Getting My High Or Low Car Insurance Deductible - Compare.com To Work

How high should my deductible be? The greater your vehicle insurance policy deductible, the lower your costs will be.

If you have enough cash to cover a high deductible in the occasion of a claim, you need to perform. This helps maintain your yearly costs reduced and might potentially save you a great deal of money in the long run, especially if you do not have to file an insurance claim. cheap insurance.

This is due to the fact that the worth of your automobile could be around what you would certainly have to pay out of pocket in case of an insurance claim, making a high deductible expense excessive. You can typically pick from a variety of deductible amounts. cheaper car. There are also some vehicle insurance plan without any deductible, yet they're so expensive that they're usually not worth it.

Our very own study shows that there isn't a significant impact on your premium once you transcend a $750 deductible, so think about maintaining your insurance deductible quantity between $500 and also $1,000. It should be noted that if you finance or rent your automobile, you might not have a selection in the insurance deductible on your auto insurance coverage - perks.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/HowToChooseYourCarInsuranceDeductibleSept.202021-e95559dfe0df4d0fb74b77b657c0bd52.jpg) cars insurers insure auto

cars insurers insure auto

LLC has actually made every initiative to guarantee that the details on this website is correct, however we can not guarantee that it is free of mistakes, errors, or noninclusions. All web content as well as services given on or via this website are supplied "as is" and also "as readily available" for usage.

The Only Guide for How Car Insurance Works - Usnews.com

Your car insurance coverage deductible is usually a collection amount, state $500. If the insurance policy adjuster determines your claim quantity is $6,000, and also you have a $500 insurance deductible, you will get a claim payment of $5,500. Based on your deductible, not every car mishap warrants a claim. If you back right into a tree leading to a tiny damage in your bumper, the price to fix it might be $600.

Deductibles differ by policy as well as motorist, and you can choose your car insurance deductible when you buy your policy.

automobile insure credit score affordable car insurance

automobile insure credit score affordable car insurance

Contrast quotes from the top insurance policy companies. Which Car Insurance Coverage Insurance Coverage Types Have Deductibles? Equally as there are different kinds of cars and truck insurance policy coverage, there are differing deductibles based upon those different kinds of protection. It's important to recognize how much the vehicle insurance coverage deductible is for each and every type, so you'll know what you're expected to pay in the event of an insurance claim.

Liability car insurance policy coverage does not have an insurance deductible. This protection pays your costs if your cars and truck is damaged by something besides a collision with another automobile or things. This can consist of repairing damages from hailstorm, striking a deer or changing a cracked windshield. It also will pay to cover the price of changing taken items.

This insurance coverage spends for repair work to your vehicle when you are at mistake. This could be when your automobile is damaged in a crash with another automobile or a things such as a tree or wall (credit score). This deductible is typically the highest insurance deductible you will certainly have with your car insurance coverage plan.

The Facts About Types Of Deductible In Car Insurance - Digit Revealed

Because situation, you would certainly not pay a crash insurance deductible. Individual injury security coverage pays the medical expenditures for the motorist as well as all passengers in your auto. Without insurance vehicle driver coverage pays your expenses when you are in an automobile crash with a motorist that is at fault however does not have insurance or is insufficiently insured to cover your expenses. low cost auto.

What Is the Ordinary Deductible Price? Because customers pick varying kinds of automobile insurance coverage with various financial restrictions, deductibles can vary dramatically from one vehicle driver to the following. For many vehicle drivers, regular insurance deductible amounts are $250, $500 and also $1,000 (laws). According to Cash, Geek's information, the typical cars and truck insurance policy deductible quantity is about $500.

Your auto insurance policy deductible will certainly vary based on that insurance coverage and the expense of your premium. Typically talking, if you pick a policy with a higher deductible, your premium will be reduced. This can be a wonderful alternative as long as you can pay that higher deductible in the event of a mishap - cheaper car insurance.

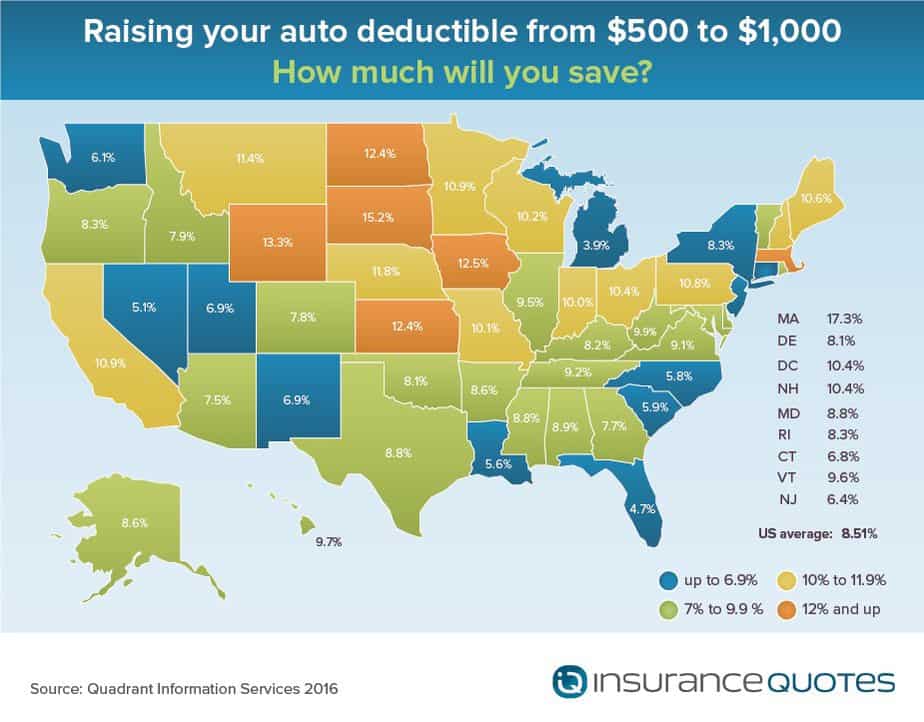

Actually, you can save approximately $108 each year by boosting your insurance deductible from $500 to $1,000. For those with limited budgets, selecting a reduced premium as well as a higher insurance deductible can be a way to ensure you can pay for your car insurance. However, if you can afford it, paying a greater costs might imply you do not need to come up with a great deal of cash

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO