Our Sr22 California - What Is It? When Do I Need It? How To Get It? PDFs

For an SR-22 quote, obtain a totally free quote now. United Car Insurance is the cars and truck insurer below to assist you with your auto insurance requires. Offer us a call at 773-202-5000 or get a cost-free quote today. Nevertheless commitments are satisfied, the SR-22 standing will be gotten rid of. At that time, it will be very important to revisit your insurance coverage with United Automobile Insurance policy as well as make certain that you continue to remain covered.

United Automobile Insurance is here for you on the occasion that you require an SR-22 certificate as well as insurance coverage. Negative things can occur to great people, so we understand that having the best group on your side to help you clear any type of blunders is necessary. The most effective way to deal with an SR-22 requirement is to call us earlier instead of later on to stay clear of any kind of higher dangers as well as recognize that you are covered. sr22.

This info is meant for academic objectives and is not meant to replace information gotten via the estimating procedure - driver's license. This info might alter as insurance plan as well as protection adjustment.

After such a conviction, you're thought about a "high-risk" vehicle driver by Wisconsin as well as many insurance coverage suppliers which commonly leads to greater insurance coverage rates. Still, you'll discover companies out there like the General that concentrate on high-risk drivers. bureau of motor vehicles. Speak with your carrier regarding just how much you can anticipate your prices to enhance.

The Greatest Guide To What Is Sr-22 Insurance And What Does It Do? - Investopedia

Or discover one going to file in your place. Contact your insurance firm. If you currently have vehicle insurance policy, contact your agent as well as recommend them of your requirement to file an SR-22. The majority of providers are geared up to submit one. Find an insurance firm. If you don't already have insurance, you'll require to discover a supplier.

You may be needed to file an SR-22 in Wisconsin if your certificate is put on hold or withdrawed for: To get a job-related license or to renew a permit after a permit suspension, To drive under 18 years old without a sponsor, After permit suspension for unpaid problems or being without insurance, What happens if I do not have a vehicle or a license? If you do not have a car but strategy to drive, you're needed to obtain non-owner insurance and submit an SR-22.

If you have an SR-22 from an additional state, you have to preserve it while driving in Wisconsin. What takes place when I don't require SR-22 protection anymore?

Contrast Sr-22 vehicle insurance business, If you're convicted of a crime in Wisconsin that results in the suspension of your permit, you might be called for to file an SR-22 certification. Occasionally described as SR-22 insurance coverage, it's in fact a type filed with the Wisconsin Department of Transport (Wis, DOT). An SR-22 certifies that you contend least the minimal responsibility insurance required by Wisconsin law, as well as it should be filed prior to the state will certainly restore your license.

Our Sr-22 Insurance Illinois - Cheap Auto Insurance Chicago - Aai Statements

Stay present on your costs repayments, restore our policy early as well as drive safely within the regulations to keep in advance of the curve. You're likely going to encounter greater costs, yet that doesn't indicate you necessarily have to settle - sr22. Take your time and also contrast companies to get one that will certainly provide you the coverage you need at a price you can pay for.

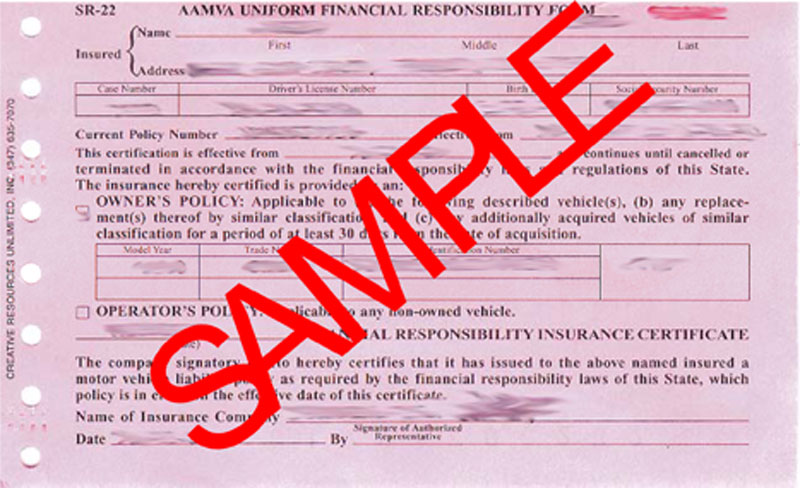

Does your state require you to have an SR22 on data with the electric motor vehicle division? If you do not own a vehicle, are you still obliged to send this record? Let's examine whatever you require to understand about SR22 insurance policy without an automobile. What Is an SR22? Have you had your vehicle driver's license suspended or withdrawed? When it's time to take the required actions to get it back, a significant component of the procedure is acquiring an SR22 type from your automobile insurance policy supplier.

An SR22 declaring is not insurance policy. It's a kind that your insurer makes use of to confirm to the federal government that they will certainly guarantee you up to the legally needed minimal amounts. dui. According to The Equilibrium, courts do not order every ticketed driver to protect an SR22. Laws usually differ by state.

Also if you do not own an automobile, after the court sentences you for a significant relocating offense such as reckless driving or a DRUNK DRIVING, the majority of states still need you to submit an SR22. If you don't intend on driving till the state lifts its arrangement, you may be able to drop your protection.

The 5-Minute Rule for Sr-22 Insurance- What Is It And How Does It Work? - Geico

While it is feasible to secure a policy online, it's frequently best to speak to an online agent. These experts can help you select the ideal protection based on your situation. underinsured. A nonowners policy likewise has particular criteria, such as: You can not own a car. You can not have accessibility to other automobiles in the family, even if they come from somebody else.

This type of SR22 insurance coverage policy is not going to obtain you road lawful. It will obtain you in good standing with the state and also provide you coverage if you're ever in a crash.

Keep in mind, never ever let an auto insurance coverage policy with an SR22 filing run out. This routine is always a poor suggestion since your insurance policy business is bound to alert the state when it terminates your policy.

If you're considered a risky driver such as one who's been convicted of numerous website traffic infractions or has gotten a drunk driving you'll most likely need to end up being acquainted with an SR-22. What is an SR-22? An SR-22 is a certificate of financial obligation required for some motorists by their state or court order.

The Ultimate Guide To Frequently Asked Questions - Insurance Requirements - Nh.gov

Depending on your circumstance and also what state you live in, an FR-44 might take the location of the SR-22. You need to have a quite clear suggestion of when you'll require an SR-22 (ignition interlock).

1 It's up to your automobile insurance provider to submit an SR-22 kind for you. You may be able to include this onto an existing policy, however remember that not every vehicle insurer is eager to supply SR-22 insurance coverage. In this case, you'll have to purchase a new policy.

This could result in your motorist's permit being suspended or withdrawed. You might also have to start the SR-22 process around once more. Additionally, try to recognize any various other specifications that govern your SR-22 - sr22. For instance, you'll intend to figure out if your SR-22 period starts on your driving offense date, the permit suspension day, the date you reinstated your permit, or one more day.

3 The filing treatments for the SR-22 and also FR-44 are similar in many means - insure. Some of the important points they share include4,5,6: FR-44s are generally called for through court order, or you can confirm your demand for one by contacting your neighborhood DMV. Your cars and truck insurance company will submit your FR-44 in your place with the state's car authority.

Some Of Texas Sr22 Insurance - Same Day Coverage

For context, the minimal liability insurance coverage for a normal driver is just $10,000 for bodily injury or fatality of a single person. 7 Where to get an SR-22 If you assume you require an SR-22, get in touch with an insurance representative. They'll be able to guide you via the entire SR-22 declaring procedure and make sure you're fulfilling your state's insurance regulations - credit score.

An SR-22 isn't really car insurance. SR-22 is a kind your insurance provider sends out to the state's DMV revealing that you carry the minimum required Responsibility coverage. Usually, an SR-22 is filed with the state for 3 years. insurance.

You might locate yourself in a circumstance where you're required to send an SR22 to your state. It's absolutely nothing expensive, just a form that states you have actually purchased the vehicle insurance coverage required by your state.

Is an SR22 proof of insurance? Your proof of insurance coverage will be gotten when you give the state with an SR22 kind. You can get the type by calling a car insurance provider in the state where you call for insurance policy. The insurance provider will certainly supply you with the SR22 or they will mail it directly to the state. underinsured.

An Unbiased View of Sr22 Insurance

Oftentimes, submitting an SR-22 insurance policy certificate with the state is the only thing standing in your method of obtaining your drivers license restored. In other cases, there may be extra demands, such as going to a chauffeur's training course or alcohol recognition courses prior to you can

Welkom bij

Beter HBO

© 2026 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO