7 Simple Techniques For California Drivers Could See Car Insurance Rates Rise - Cbs8

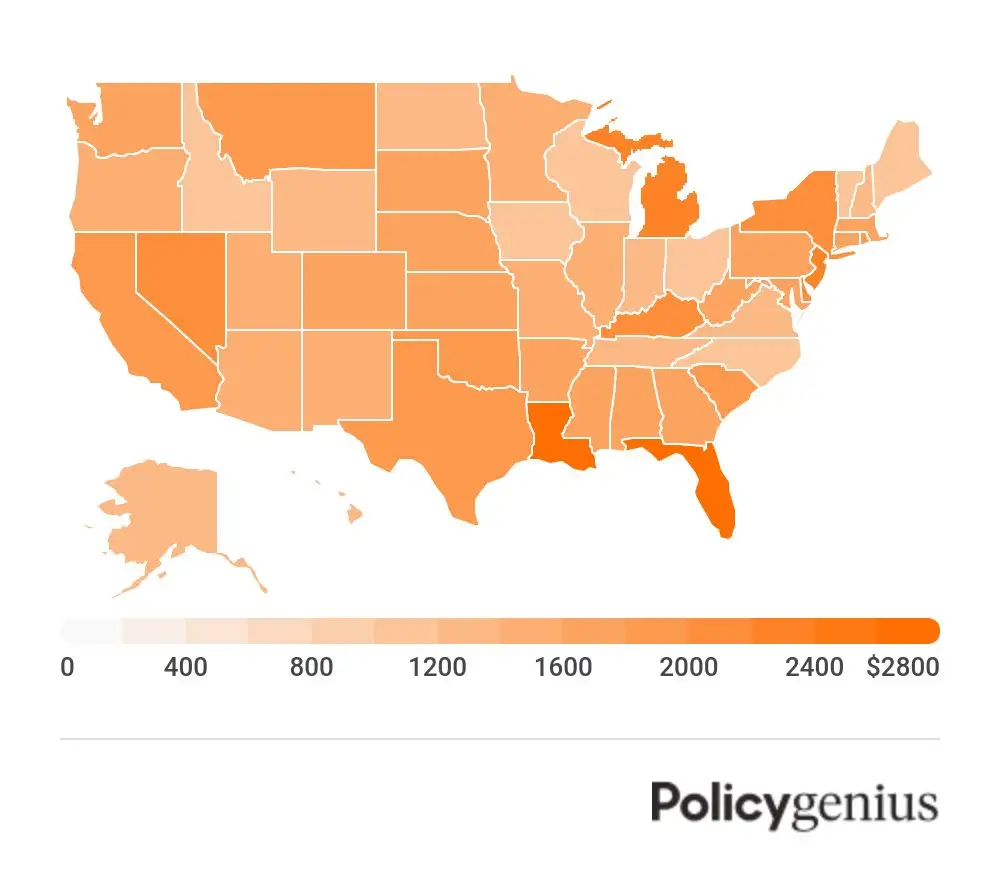

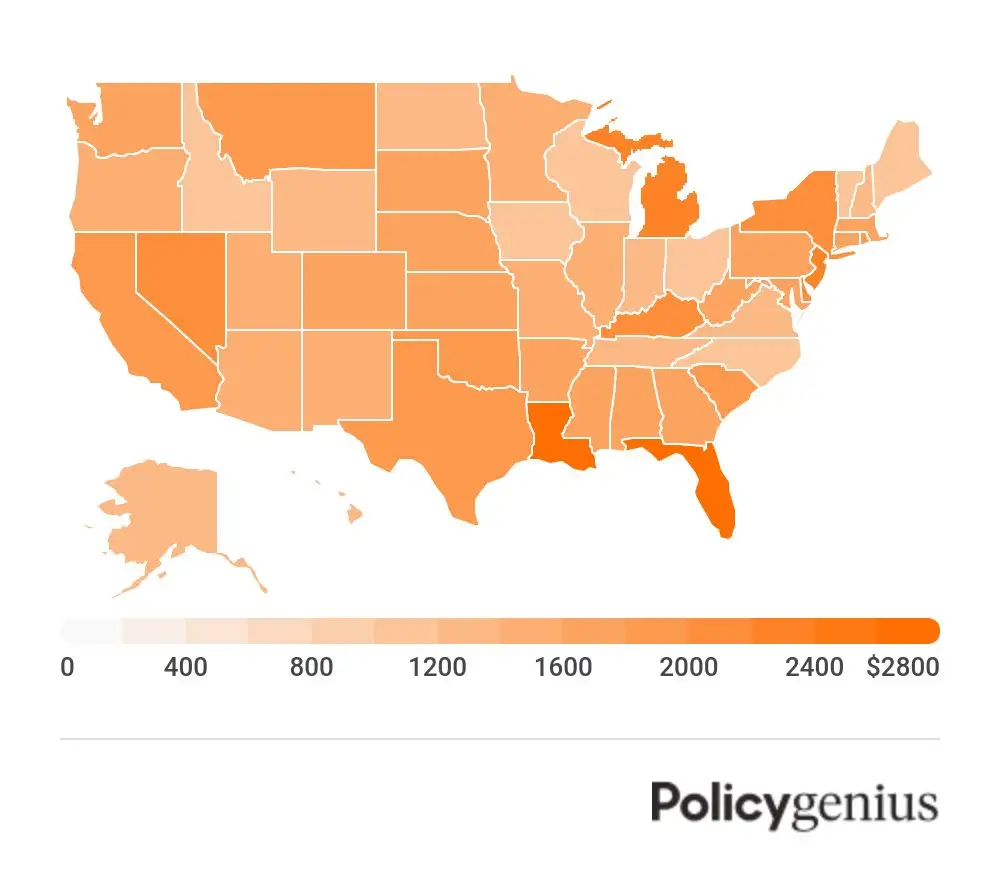

You'll likewise see the average cost of insurance because state to assist you compare. The table likewise includes rates for Washington, D.C. These rate approximates apply to 35-year-old drivers with excellent driving records and credit. As you can see, average car insurance costs vary extensively by state. Idahoans pay the least for cars and truck insurance coverage, while drivers in Michigan shell out the huge bucks for protection.

If you live in downtown Des Moines, your premium will probably be more than the state average. On the other hand, if you live in upstate New York, your automobile insurance coverage policy will likely cost less than the state average. Within states, car insurance coverage premiums can differ extensively city by city. cheapest.

The state isn't one of the most expensive overall. Minimum Protection Requirements A lot of states have financial responsibility laws that need drivers to carry minimum cars and truck insurance protection. You can only bypass coverage in 2 states Virginia and New Hampshire but you are still financially responsible for the damage that you cause.

No-fault states include: What Other Elements Affect Car Insurance Coverage Rates? Your age and your home state aren't the only things that impact your rates (dui). Insurance providers use a variety of aspects to identify the expense of your premiums. Here are a few of the most essential ones: If you have a tidy driving record, you'll discover far better rates than if you have actually had any recent mishaps or traffic violations like speeding tickets.

Others offer usage-based insurance that might conserve you money. If your vehicle is one that has a probability of being stolen, you might have to pay more for insurance coverage.

But in others, having bad credit might trigger the expense of your insurance premiums to rise dramatically. Not every state enables insurance companies to use the gender listed on your motorist's license as an identifying factor in your premiums. In ones that do, female drivers normally pay a little less for insurance than male chauffeurs.

Policies that just satisfy state minimum coverage requirements will be the cheapest. suvs. Additional protection will cost more (prices). Why Do Vehicle Insurance Rates Modification? Looking at average automobile insurance rates by age and state makes you question, what else impacts rates? The answer is that auto insurance coverage rates can change for numerous reasons.

Excitement About How Much Is Car Insurance? [2022 Cost Guide] - Marketwatch

An at-fault accident can raise your rate as much as half over the next three years - suvs. If you were convicted of a DUI or perpetrated a hit-and-run, your rates will increase a lot more. You do not have to be in a mishap to experience increasing rates. In general, car insurance coverage tends to get more expensive as time goes on.

There are a number of other discounts that you might be able to capitalize on right now. Here are a few of them: Lots of companies give you the greatest discount for having an excellent driving history. Likewise called bundling, you can get lower rates for holding more than one insurance coverage policy with the very same company.

Property owner: If you own a house, you might get a homeowner discount rate from a variety of service providers. Get a discount rate for sticking with the same business for numerous years. Here's a secret: You can always compare rates each term to see if you're getting the very best cost, even with your loyalty discount (vehicle).

However, some can likewise raise your rates if it ends up you're not a good driver. Some companies provide you a discount for having an excellent credit score. When browsing for a quote, it's a good concept to call the insurance coverage business and ask if there are any more discount rates that apply to you.

One of the greatest elements for clients looking to purchase car insurance is the cost. Not just do rates differ from business to company, but insurance expenses from state to state differ.

Average rates differ commonly from state to state. Relying on typical car insurance costs to estimate your cars and truck insurance premium might not be the most accurate way to figure out what you'll pay.

, and you might pay more or less than the average motorist for coverage based on your threat profile - credit score. More youthful drivers are normally more most likely to get into an accident, so their premiums are generally higher than average.

The Definitive Guide to Safeco Insurance - Quote Car Insurance, Home Insurance ...

Maintaining the minimum amount of insurance your state requires will allow you to drive lawfully, and it'll cost less than full coverage. It may not provide adequate protection if you're in an accident or your automobile is damaged by another covered incident. Curious about how the typical rate for minimum coverage stacks up against the cost of complete coverage? According to Insurify.

One of the factors insurance providers utilize to identify rates is place. And given that insurance coverage laws and minimum protection requirements differ from state to state, states with greater minimum requirements usually have greater typical insurance coverage expenses.

Most however not all states enable insurance provider to utilize credit report when setting rates (perks). In basic, applicants with lower scores are more likely to sue, so they typically pay more for insurance than motorists with higher credit report. If your driving record consists of mishaps, speeding tickets, DUIs, or other infractions, expect to pay a higher premium - suvs.

Cars and trucks with higher price tags generally cost more to insure. Chauffeurs under the age of 25 pay higher rates due to their lack of experience and increased accident threat. Male under the age of 25 are generally estimated greater rates than women of the exact same age. But the gap shrinks as they age, and females might pay somewhat more as they age.

Due to the fact that insurance business tend to pay more claims in high-risk areas, rates are generally greater. Getting adequate protection may not be cheap, however there are methods to get a discount on your cars and truck insurance.

If you own your house instead of renting it, some insurers will give you a discount on your vehicle insurance coverage premium, even if your house is insured through another company. Aside From New Hampshire and Virginia, every state in the nation needs motorists to maintain a minimum amount of liability coverage to drive lawfully - laws.

It may be appealing to stick with the minimum limits your state requires to save money on your premium, but you could be putting yourself at threat (cheapest car insurance). State minimums are notoriously low and could leave you without appropriate security if you're in a major accident. car. Most experts recommend maintaining enough protection to safeguard your assets.

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO