<h1 style="clear:both" id="content-section-0">What Does How Do Insurance Companies Make Money Mean?</h1>

But be mindful that short-term medical insurance might have limits that routine medical insurance does not have, such as caps on yearly benefits paid. Medicare is a federal medical insurance program for Americans above the age of 65. It supplies free or heavily cost-reduced health care to eligible enrollees. There are 4 parts to Medicare that cover various healthcare services:Part A for inpatient (medical facility) care, for which the majority of people pay no premiums Part B, for outpatient care, like physician's workplace sees. In 2021, Part B has a regular monthly premium of $148. 50.Part C, which is likewise called Medicare Advantage, and enables you to buy into private health insurance.Part D, for prescription drug protection. gov or your state exchange.

Medicaid is a federal and state health insurance coverage program for low-income families and individuals. Medicaid has eligibility requirements that are set on a state-by-state basis, however it is mainly created for those with low earnings and low liquid possessions. It is likewise developed to help households and caretakers of kids in requirement. You can generally examine if you get approved for Medicaid through health care. gov or your state exchange. The Kid's Health Insurance coverage Program( CHIP) is a federal and state program that is similar to Medicaid, however particularly developed to cover kids listed below the age of 18. Like Medicaid, you can usually see if you qualify and use on Healthcare.

gov or your state's exchange. All private health insurance coverage plans, whether they're on-exchange or off-exchange, work by partnering with networks of health care companies. However the way that these plans work with the networks can vary considerably, and you wish to make sure you understand the distinctions between these plans.HMO plans are the most limiting type of plan when it comes to accessing your network of companies.If you have an HMO plan, you'll be asked to pick a main care doctor( PCP) that is in-network. All of your care will be collaborated by your PCP, and you'll require a recommendation from your PCP to see a professional. HMO strategies usually have less expensive premiums than other kinds of private medical insurance plans.PPO plans are the least limiting type ofplan when it pertains to accessing https://jaspertcoq571.substack.com/p/h1-styleclearboth-idcontent-section?r=17p23j&utm_campaign=post&utm_medium=web your network of providers and getting care from outside the strategy'snetwork. Normally, you have the choice in between choosing between an in-network physician, who can you see at a lower cost, or an out-of-network medical professional at a greater expense. You do not require a referral to see a professional, though you might still choose a medical care doctor( some states, like California, may need that you have a medical care doctor). PPO strategies typically have more expensive premiums than other types of private health insurance plans.EPO prepares are a mix in between HMO plans and PPO plans. Nevertheless, EPO plans do not cover out-of-network physicians. EPO strategies generally have more costly premiums than HMOs, but less costly premiums than PPOs.POS strategies are another hybrid of HMO and PPO strategies.

You'll have a primary care company on an HMO-style network that can coordinate your care. You'll likewise have access to a PPO-style network with out-of-network choices( albeit at a greater expense). The HMO network will be more inexpensive, and you will need to get a referral to see HMO professionals. POS strategies normally have brenda can't take it all more expensive premiums than pure HMOs, but more economical premiums than PPOs. Find out more about the differences between HMOs, PPOs, EPOs, and POS strategies. Some individuals get puzzled due to the fact that they believe metal tiers describe the quality of the strategy or the quality of the service they'll receive, which isn't true. Here's how health insurance prepares approximately divided the costs, arranged by metal tier: Bronze 40% customer/ 60%.

insurer, Silver 30 %consumer/ 70% insurance company, Gold 20 %customer/ 80 %insurance company, Platinum 10 %customer/ 90 %insurer, These are top-level numbers across the entirety of the plan, taking into account the deductible, coinsurance, and copayments, as dictated by the specific structure of the strategy, based on the expected typical use of the plan. These portions do not take premiums into account - What is insurance. In basic, Bronze strategies have the least expensive month-to-month premiums and Platinum have the highest, with Silver and Gold occupying the price points in between. As you can see from the cost-sharing split above, Bronze plan premiums are less expensive because the consumer pays more out of pocket for healthcare services.

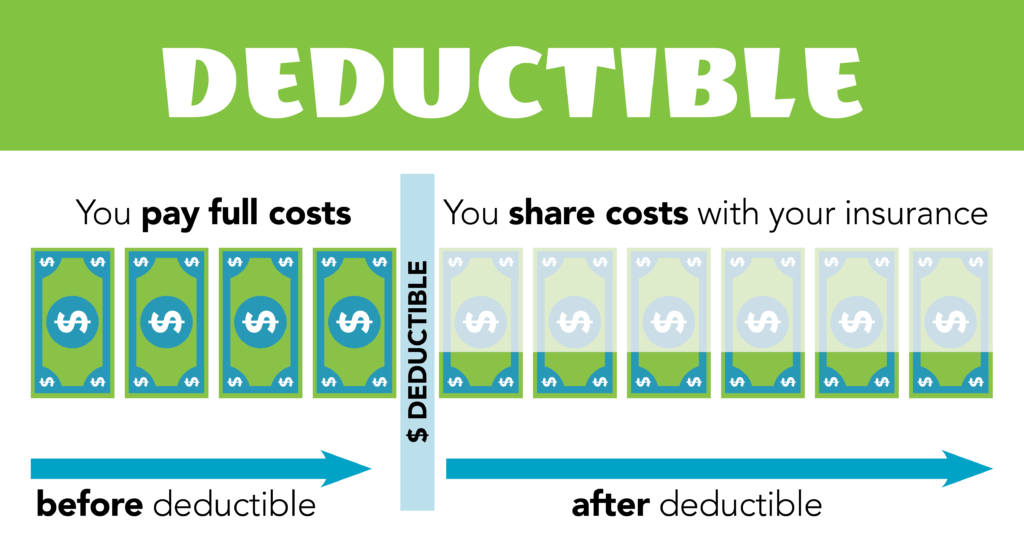

If you frequently make use of health care services, you'll probably end up paying more out-of-pocket if you pick a Bronze strategy, despite the fact that it has a lower premium. If you qualify, you can use a medical insurance premium aid to help you pay for a strategy in a greater tier, ultimately conserving you money. Catastrophic prepares have really high deductibles often, the deductible is the very same as the out-of-pocket max which suggests they're really just helpful for avoiding a mishap or serious health problem from causing you to enter into severe debt. Catastrophic strategies are only readily available for individuals under 30 or people with a challenge exemption. You can not utilize an aid on catastrophic strategy premiums, but, for many years during which the medical insurance required was active, catastrophic strategies did count as qualifying health care. When you go shopping for a health insurance plan, it is necessary to know what the key functions are that decide how much you're actually going to pay for health care. Each month, you pay a premium to a health insurance company in order to access a health insurance coverage plan. As we'll enter into in a 2nd, while your monthly premium may be just how much you pay for health insurance, it's not comparable to just how much you pay on health care services. In reality, selecting a plan with lower premiums will likely mean that you'll pay more out-of-pocket if you require to see a physician. A deductible is just how much you require to pay for healthcare services out-of-pocket before your health insurance coverage kicks in. In most plans, once you pay your deductible, you'll still need to pay copays and coinsurance until you hit the out-of-pocket max, after which westland financial services the strategy spends for 100 %of services. Keep in mind that the deductible and out-of-pocket optimum describe two various ideas: the deductible is just how much you'll pay for a covered treatment before your insurance coverage begins to pay, and the out-of-pocket optimum is the overall quantity you'll pay for care consisting of the deductible. A copayment, frequently reduced to simply" copay," is a fixed amount that you pay for a specific service or prescription medication. Copayments are one of the manner ins which health insurance companies will divide expenses with you after you strike your deductible. In addition to that, you may have copayments on particular services prior to you hit your deductible. For instance, lots of medical insurance plans will have copayments for doctor's sees and prescription drugs before you hit your deductible.

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO