What Does How To Become A Real Estate Investor Do?

In higher-priced markets such as city centers and popular suburban areas, these can be great initial. They're more affordable, much easier to come by, and constantly in-demand by entry-level retail buyers who desire the neighborhood without the hefty rate tag. Keep in mind these residential or commercial properties typically feature a host of additional expenditures and considerations, such as house owners association costs or board approvals.

These residential or commercial properties resemble single-family residential or commercial properties due to the fact that they're property. However, due to the fact that they're 2 to four-unit properties, there's often substantially more money circulation capacity. how much do real estate agents make per sale. Not only is there a revenue upside to these homes, but if you're preparing to fund them, many banks and loan providers will use more favorable loan terms.

For a lot of new investor, house structures with 5 to 100 units are good bets. In these cases, you will not likely be taking on huge developers or holding companies. At the exact same time, you'll have enough units to create meaningful cash circulation, typically from the first day. While these financial investments can be more expensive if https://blogfreely.net/pothir9tcv/borrowers-earning-more-than-100-000-per-year-should-lower-their-deduction-by you're preparing to rehab or buy and hold, many banks and lenders will gladly consider a first-timer if the numbers make sense.

If you can be that solution, lenders will be prepared, ready and able to help you link the monetary dots. Business spaces can be anything used for organization or commercial functions, such as retail spaces, workplace buildings, industrial parks, warehouses and more. While lots of brand-new investor avoid these residential or commercial properties, done right they can be incredible financial investment chances.

Lock down that area as a property owner and you'll have a consistent earnings stream for years. Oftentimes, you'll even be able to formulate a "net lease" which needs tenants to pay lease as well as real estate tax, upkeep and insurance. This instantly helps best way to get rid of a timeshare you generate favorable capital rapidly and quickly.

Dealing with a property investor-friendly representative and attorney can help your due diligence for finding the very best financial investment opportunities. While you'll wish to do your due diligence no matter which home specific niche you choose, industrial and houses tend to come with concrete benefits and factors to consider. Comprehending these entering will help you identify how to start your search and develop a course to realty investing success.

The Basic Principles Of What Does Reo Mean In Real Estate

For beginners, you'll often produce higher returns more quicklythese areas tend to be larger and command more rental revenue from day one. Central to this revenue are highly certified and. Get a grocer, drug store or significant retail chain in your industrial area, and you might be looking at years and even years of consistent lease paymentsplus the chance for well-structured net leases.

Industrial loans are seen as inherently dangerous, Great site resulting in greater rates and shorter terms. To certify, you'll need to show a compelling service plan, and a strong credit report. You'll require to give a clear plan revealing what happens next, from who's taking on the rehabilitation work and upkeep, to how you're going to make this property cash flow-positive.

For lots of, investing in domestic real estate appear more accessible and obtainable. Beyond that, residential property can be easier. Residential realty tends to come with lower price tags and less money down with funding. how to invest in real estate with little money. There also tends to be less constraints. Another advantage is that uses numerous funding options from banks, lenders, hard cash sources and personal money companies.

Now when you have actually identified the kind of residential or commercial property or properties you wish to buy, you need to figure out how you're going to get these propertiesspecifically, what seller specific niche or specific niches you're going to take advantage of to secure the ideal financial investment residential or commercial properties for your portfolio. For each property niche, there are many ways to come into a property.

The truth is that while that happens, these cut-and-dry deals can typically be few and far between. Comprehending the varied and high-value seller niches can help you guide toward the most profitable handle the most beneficial terms, each and every single time. For the most part, you'll be looking for sellers who are highly encouraged, who do not just want to sell their residential or commercial property but NEED to sell.

The majority of these scenarios include somebody who has a considerable monetary, situational, or property-related issue. Here are a few of those listed below: Most of properties are funded. The owner has a home loan or other financing structure in place and are making continuous payments to please the terms of the loan.

The 6-Minute Rule for How To Start Real Estate Investing

When that takes place, the bank or lender will take definitive actions to get the loan present. If the loan holder does not follow through, then the loan provider can transfer to take ownership of the residential or commercial property. This is called a "foreclosure." Before a home is officially foreclosed on, it gets in a duration of "pre-foreclosure." Throughout this time, the homeowner is being pushed to catch up on payments at the threat of losing their home, investment property or industrial area.

Lots of owners in pre-foreclosure will deal with their bank or lending institution to work out a "short sale." Brief sales are arrangements to offer a residential or commercial property for less than what's owed on it. Banks and loan providers will often concur due to the fact that they don't want a residential or commercial property on their books. If you can get in on these homes, you can quickly leave with a below-market deal.

To get your hands on foreclosure properties, you'll require to research the policies and processes in your state. In numerous states, foreclosures go to auction and anyone can come, show funds and quote. In others, interested buyers can connect to the bank, county or other governing body to take possession of foreclosed homes.

When a bank or lender reclaims a foreclosed residential or commercial property, it's thought about "bank-owned" or "genuine estate owned" (REO). Banks earn money on the interest from residential or commercial property loans, not from the residential or commercial property itself. As an outcome, REO homes are typically priced to move. If you have a clear-cut company plan for financing an REO deal, banks will be eager to talk about next steps.

When a home owner apply for insolvency, they often desire or require to sell any domestic or industrial residential or commercial properties in their name. While it's not always a condition, the 2 typically go hand-and-hand, making an owner particularly motivated and ready to cut an offer. These homeowner are often easy to find through direct-mail advertising lists or through your agent.

Often, those beneficiaries aren't willing or able to look after the property, which makes them a very determined seller - what percentage do real estate agents get. By providing a fast money close, you can frequently engage and activate owners of probate residential or commercial properties. Divorces don't mandate residential or commercial properties be sold. However, in many cases a couple or a judge figures out all assets need to be liquidated and divided.

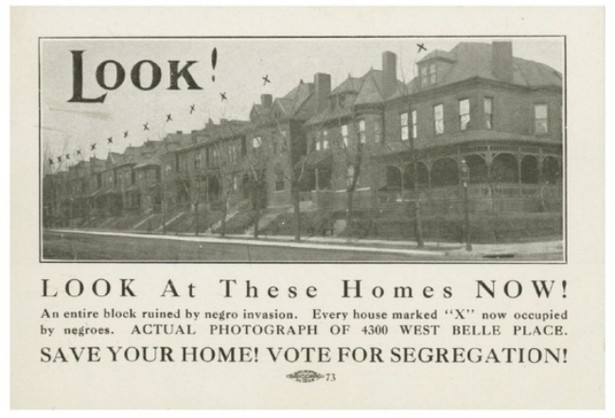

5 Simple Techniques For What Is Redlining In Real Estate

In these scenarios, couples can be extremely motivated to get an offer done so they can complete their divorce and proceed with their lives. If you can be that solution, you can often secure a solid handle a fast close. All homes include real estate tax, paid to regional towns.

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO