Unknown Facts About Ca's Best Earthquake Insurance For Renters - Cea

The typical expense of renters insurance coverage is concerning $15 to $20 per month1. Take an appearance at the details below to locate out just how your home or apartment or condo occupants insurance coverage cost is identified. What elements effect just how much tenants insurance expenses?

2 What insurance coverage company you have Just how much insurance coverage you require The even more things you have, the even more protection you require (affordable renter's insurance). That extra insurance coverage is crucial, yet it will include a higher premium. The sort of protection you pick The kind of coverage you purchase will naturally affect the quantity you pay.

3 The amount of your insurance deductible The bigger your insurance deductible, the reduced your rate. Average expense of occupants insurance by state Different states feature various environments and financial fads. Both have an effect on the difference in between states' ordinary tenants insurance price. The greater the chance of a natural catastrophe and/or high criminal activity prices will certainly contribute to greater typical rates.

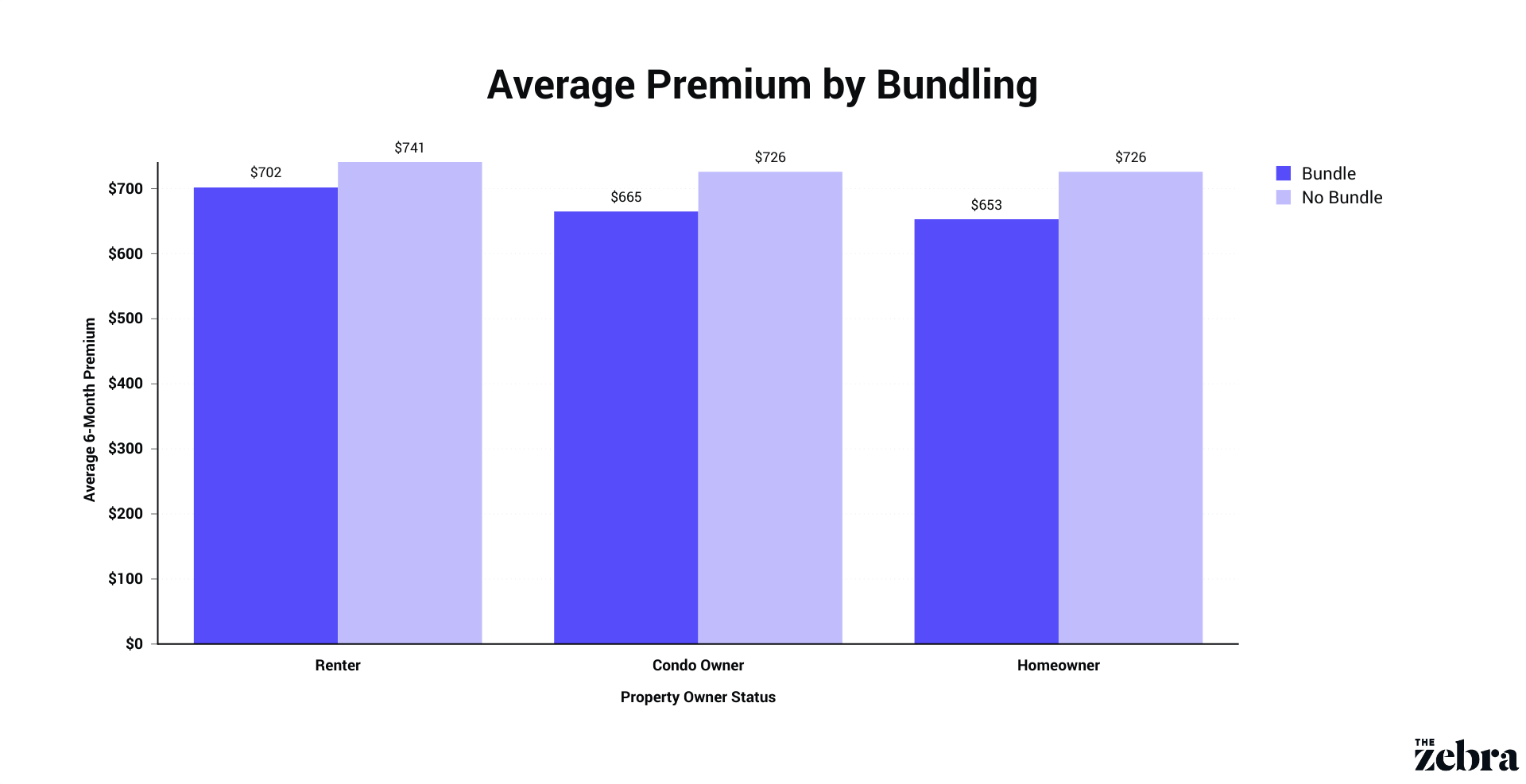

renters insurance bundle cheapest price rental

renters insurance bundle cheapest price rental

This will certainly assist you establish if you require to acquire added insurance policy to keep these products protected. Renters insurance coverage is a liable option that can aid prevent you from paying out of pocket for sure sorts of damages. Discover more about Nationwide's renters insurance options as well as start your quote today.

renter vehicle insurance vehicle insurance cheapest credit

renter vehicle insurance vehicle insurance cheapest credit

The average renters insurance cost in the united state is $168 each year, or regarding $14 monthly, according to Geek, Purse's latest rate evaluation. This price quote is based upon a policy for a hypothetical 30-year-old lessee with $30,000 in personal residential or commercial property coverage, $100,000 in responsibility insurance coverage as well as a $500 insurance deductible. apartment insurance.

The place of your house is a major consider the expense of your occupants insurance - property insurance. Check just how much you can expect to pay for occupants insurance coverage in your state listed below. These are the 5 most pricey states for tenants insurance policy: Louisiana: $262 per year, or $22 each month, generally.

About Great American Insurance Group - Specialty Property ...

Mississippi: $228 per year, or $19 monthly, usually. Kansas: $225 annually, or $19 per month, generally. Alabama: $222 annually, or $19 monthly, on average (affordable renters insurance). These are the 5 most inexpensive states for tenants insurance coverage: Wyoming: $101 per year, or $8 per month, on average. Iowa and Vermont (tie): $110 each year, or $9 each month, usually.

If you live in among the nation's 25 biggest cities, you can locate the typical cost of tenants insurance policy in your city below. cheap renters insurance. Atlanta is one of the most expensive at $269 each year generally (concerning $22 per month), while Columbus is one of the most budget friendly at $137, or concerning $11 monthly, typically.

Where you live, If your home remains in a region susceptible to natural disasters like cyclones, wildfires or twisters, you'll most likely pay even more for occupants insurance. You may likewise pay more info even more if your community has a high criminal offense rate or your residence doesn't have a fire station or hydrant close by.

Having a case on your record can increase your premium even more than 20%, a Geek, Pocketbook evaluation found. Research studies have actually shown that those with poor credit report are more likely to submit cases, so insurance providers have a tendency to bill them a lot more.

There are a variety of means to save on your renters insurance policy, yet these are the most usual price cuts. Multipolicy. If you purchase both tenants insurance and another plan (such as auto insurance) with the very same company, you may obtain a discount on one or both policies. Claim-free. Renters with no current cases are typically qualified for discount rates.

Do not see your state listed below? Inspect back quickly we're adding a lot more occupants insurance coverage tales all the time.

Renters Insurance Guide - Coverage.com - Truths

Exactly how much does occupants insurance coverage cost in each state? Given that your neighborhood and also structure type can affect your premiums, it stands to reason the expense of your insurance policy varies substantially throughout state lines. Maintain in mind, however, prices obtains more granular than that, and the cost of an insurance coverage can likewise vary substantially across any kind of provided state, depending your insurance provider and what they use.

cheapest renters insurance liability renter's insurance landlord property management

cheapest renters insurance liability renter's insurance landlord property management

Tenants insurance cost elements that are established by your choices: Just how much protection you want: More insurance coverage costs more cash. If you agree to approve reduced payouts in the occasion of a case, after that your costs will be lower. And also if you want to wager that your whole vintage guitar collection isn't covered, after that you'll conserve some money upfront.

Just how high (or reduced) you want your insurance deductible to be: That's the quantity of money you pay out of pocket before your protection kicks in. The higher your insurance deductible, the lower your costs.

Replacement price renters insurance coverage pays a whole lot more if you need to submit a case, yet it additionally costs extra. What influences the price of occupants insurance coverage? Since your conditions are normally set, it's your choices concerning coverage that enable you to have some control over the rates you'll get - renter's.

renter's landlord coverage home insurance option

renter's landlord coverage home insurance option

Coverage for personal effects that is swiped when you're far from house. If a protected event provides your home unliveable, your policy will likewise pay added living costs so you can remain in a resort during repairs. Check out to get more information what renters insurance coverage does and also does not cover. What is the cheapest renters insurance coverage you can acquire? The most affordable occupants insurance will have the least amount of protection.

How a lot does added protection expense?

Do I Need Renter's Insurance And How Much Does Renter's ... Can Be Fun For Everyone

These additions can be as reduced as a few more dollars a month, or in many cases, even much less than that (affordable insurance). Learn more concerning preferred renters insurance riders, floaters, and also recommendations. Just how can you get discounts on renters insurance policy? You can reduce your insurance coverage rate by increasing the variety of security as well as protection attributes in your home.

An additional significant means to save: boost your credit rating. This takes time, yet as your score gets higher, you can get far better occupants insurance coverage prices. property management.

Your property manager has insurance coverage for damages to the building and security for suits filed against the landlord however that insurance coverage does not cover tenants. Who requires renters insurance coverage? Anybody who rents an apartment, condominium or even a home; Former house owners who might be scaling down to a house; University student not covered by parent's property owners policy.

These natural calamities are not generally covered by a tenants insurance coverage policy. If you think you may be subject to these threats, ask your insurance representative or business if your policy fully secures you or whether you require to purchase extra insurance coverage.

Some insurer could just supply this insurance coverage via the purchase of additional protection. Some insured things might be covered if they are swiped by somebody that burglarizes your automobile or if they are harmed while not on your building. rental. An occupants insurance plan also covers your individual legal responsibility (or liability) for injuries to others and/or their home while they get on your home.

Testimonial your specific circumstance with your insurance policy expert. The common tenants policy does not cover certain things of high value, nonetheless, a precious jewelry drifter or fine arts drifter can be included that will specifically name high value products and guarantee them at specified amounts.

Average Renters Insurance Cost - The Facts

Occupants have an unique set of insurance coverage requirements. affordable. Insurance can cover their clinical costs and any kind of resulting legal action.

Take a minute to examine several of the coverages1 we provide prior to obtaining

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO