The Fundamentals Of Basis Factors

For example, home mortgage lenders that should pay 10 added basis points for loans when selling them might raise by 0.25 or 0.375 percent their provided home mortgage rate to consumers-- possibly you. You'll hear the term "basis factors" frequently used about home loans. While certainly not a big percent quantity, basis points can be extremely essential in home loan circumstances. Because of the size of mortgage, basis points-- although small numbers-- can affect rates of interest and also your prices to finance your residence. When you hear or read about an increase/decrease of 25 basis factors, you must know this means one-quarter of 1 percent. Buying points https://spencerqybe.bloggersdelight.dk/2022/04/22/set-interest-rates-on-mortgages-traditionally-reduced/ to reduce your monthly home loan settlements may make sense if you pick a fixed-rate home loan and intend on possessing the residence after getting to the break-even duration.

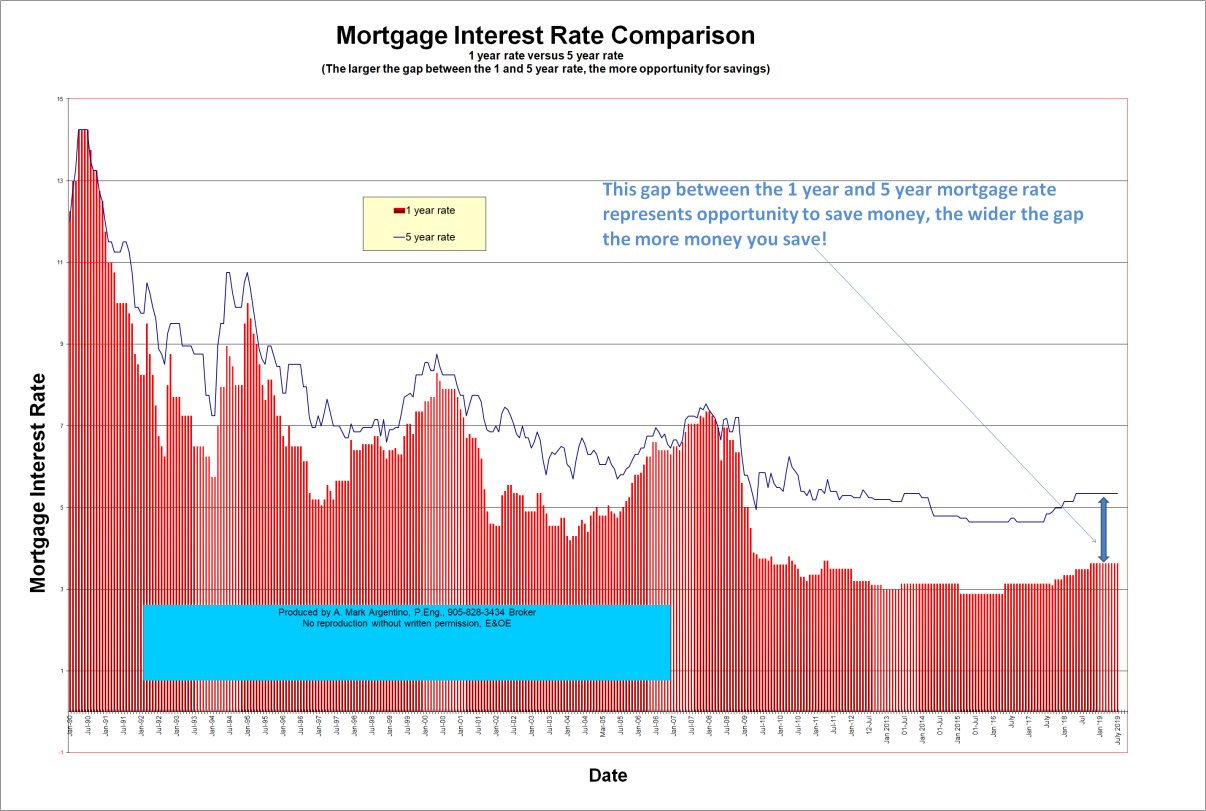

So, if the interest rate on your home loan climbs by 100 basis points-- from 4% to 5%, as an example-- your regular monthly mortgage payment can increase as well. Visit website However, if the rate stop by 100 basis factors-- from 4% to 3%, for instance-- your regular monthly mortgage repayment can decrease in turn. An additional term for covering the source costs with a greater rate is "yield spread premium." These charges are the payment gained by a home loan broker or finance police officer in exchange for locating a funding. A home-buyer can pay an ahead of time fee on their loan to acquire a lower price. The following chart compares the factor costs and month-to-month payments for a funding without factors with financings using points on a $200,000 home mortgage.

- Consult with your very own economic professional as well as tax obligation consultant when making decisions regarding your economic circumstance.

- Use our calculator to estimate the growth of your savings gradually.

- Sarah Li Cain is a self-employed personal financing, credit rating and also real estate author who deals with Fintech startups and also Lot of money 500 monetary services business to enlighten consumers through her writing.

- This may indicate a boost in mortgage rates of interest by one-eighth to one-quarter by Tuesday or Wednesday.

Property buyer has great credit report & believes interest rates on home loans are not likely to head reduced. While a factor generally decreases the price on FRMs by 0.25% it normally lowers the price on ARMs by 0.375%, nevertheless the rate price cut on ARMs is only applied to the initial period of the loan. As pointed out above, each price cut point expenses 1% of the amount borrowed. Price cut factors can be paid for ahead of time, or in many cases, rolled right into the finance.

What Is The Distinction In Between Basis Points And Also Discount Points?

If your financing amount is $100,000, it's merely $1,000 per point. An insurance policy that can be protected by a loan provider in support of a consumer to safeguard the lender in the event of the customer's default. This defines whether a customer will be residing in a residential or commercial property as a proprietor occupant, maintaining the finance as a capitalist, or using the building as a second house.

What Are The Purchasing Factors On A Home Loan?

Since APRs integrate line product expenses, they are often divulged with three decimal locations to be as particular as possible. Basis points can be found in helpful when you're contrasting APRs from loan provider to lending institution. Nonetheless, if your APRs were 4.031 percent and 4.161 percent on the very same four-percent rate quote, you would certainly understand the APR that's 13 basis factors greater will inevitably have greater closing-cost line products. The interest rate for an ARM periodically alters when a monetary index connected to your home mortgage likewise transforms.

In the examples displayed in the table over funding the factors would take the break even point from 49 months to 121 months for the funding with 1 point & 120 months for the car loan with 2 factors. This streamlined approach unfortnately omits the effect of the varying amounts owed on different mortgage. Regardless of our efforts to make all web pages and also web content on Basis seans timeshares Point Home loan website fully available, some web content might not have actually yet been fully adapted to the most strict ease of access standards. This might be an outcome of not having located or recognized one of the most suitable technological solution. We are a full-service mortgage company based in Centennial, CO. We concentrate on supplying digital home loans in Colorado, California, as well as Idaho.Faster. It might depend on if material adjustments took place, such as greater loan-to-value, and so on.

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO