The Fundamentals Of Basis Factors

Residing in the very same home for over 4 years prevails, so acquiring points which break even in 4 years is not a bad concept. Historically most property owners have actually re-financed or relocated homes every 5 to 7 years. Betting that you'll continue to be in place & not re-finance your house for over a decade is typically a poor bet. Discover the most affordable offer at that rate or factor degree & then see what other lending http://simonygxt580.theglensecret.com/mortgage-points-calculator institutions provide at the same price or factor level. As an example you can compare the most effective rate provided by each lending institution at 1 point.

- This site is had by a private firm that uses organization recommendations, information and also other solutions associated with multifamily, industrial real estate, as well as organization financing.

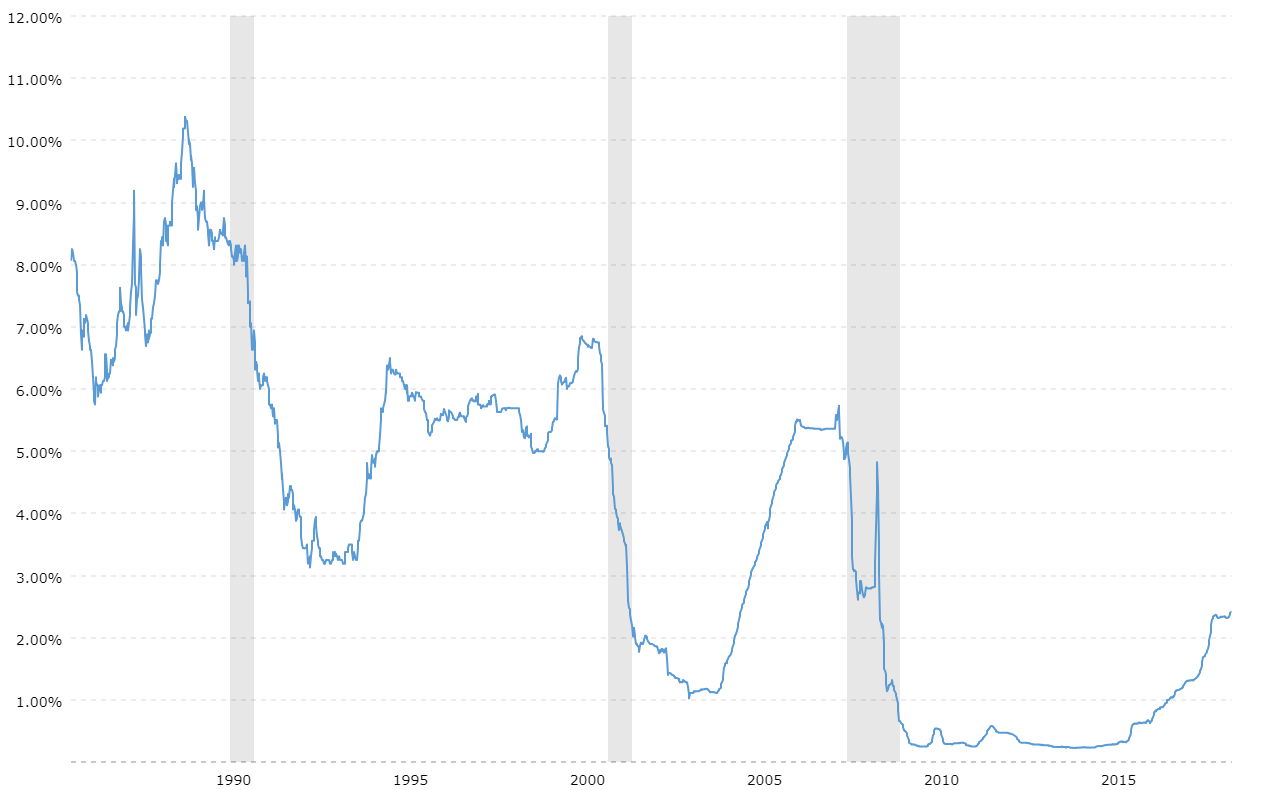

- Basis point walkings happen when rates of interest go up as well as can have a considerable impact on a home mortgage's payment.

- Should the wyndham certified exit reviews present mortgage rate be too high for you to get approved for the home mortgage you want, you can "get" a reduced rate by including discount rate factors, which lower your legal home loan price.

- An ARM has a fixed rate of interest for an initial amount of time, which differs depending upon your financing terms.

We additionally reference original study from other trusted publishers where suitable. You can find out more about the requirements we adhere to in generating accurate, honest material in oureditorial policy. Though the majority of people wish to see their home boost in value, few individuals buy their home purely as an investment. From an investment perspective, if your home triples in worth, you may be unlikely to sell it for the basic factor that you then would need to find elsewhere to live.

What Is A Basis Point?

Though a basis factor may appear like an international term, if you have actually ever before received a price reduction or boost, it's most likely that the origin of that fluctuation was based upon a basis point. Next time you see a bps referenced, simply separate it by 100 and you'll quickly locate the portion equivalent, enabling you to quickly recognize just how it will certainly affect your debt or investment. Rate of interest vary depending on the sort of mortgage you choose.

What Are Home Mortgage Factors?

They might in fact prevent you from receiving the loan. While lenders make loans on residential properties about their cancel a timeshare contract worths, they certify you for fundings based upon your capability to repay. To determine this, many of them look at the loan payment as a portion of your annual earnings. If an interest rate trek indicates that the annual home loan payments will certainly add up to more than 28 percent of your salary, they might not approve the lending. Depending on the type of home loan, an adjustment in basis points could influence the amount of your monthly settlement as well as the total passion. you'll pay on your funding.

Why Do Individuals Use Bps Instead Of Percents?

So, if the rates of interest on your home loan climbs by 100 basis points-- from 4% to 5%, as an example-- your regular monthly home mortgage settlement can climb too. Nevertheless, if the rate come by 100 basis points-- from 4% to 3%, for example-- your monthly home mortgage settlement might drop in turn. Another term for covering the origination costs with a higher rate is "return spread costs." These costs are the payment gained by a home mortgage broker or loan officer for discovering a car loan. A home-buyer can pay an upfront charge on their lending to acquire a reduced rate. The adhering to chart contrasts the point expenses and also regular monthly settlements for a loan without factors with financings utilizing factors on a $200,000 mortgage.

Utilize our calculator to approximate the development of your financial savings over time. Zillow, Inc. holds real estate brokerage licenses in numerous states. Zillow, Inc. holds realty broker agent licenses in multiple provinces. Zillow Team is devoted to making sure digital access for people with impairments. We are continuously working to improve the ease of access of our web experience for every person, as well as we welcome responses and accommodation requests.

Source points are not tax deductible and also numerous lenders have actually changed away from source factors, with several providing flat-fee or no-fee mortgages. Some lenders bill "source factors" to cover costs of making a finance. Some customers pay "discount rate factors" to reduce the car loan's rates of interest. This is an expression of what your rate would be if all shutting prices were integrated right into the rate, as well as Federal Reality In Financing laws need an APR disclosure to show up on all price quotes.

Paying off the house sooner means making even more money from the negative points. When a loan provider offers you negative factors they are betting you will certainly not repay your mortgage soon. The huge issue with funding points is you enhance the car loan's equilibrium immediately. This consequently significantly raises the number of months it requires to break even. If any one of the above are not real, after that factors are likely a poor acquisition.

Welkom bij

Beter HBO

© 2026 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO