The Facts About How Much Does State Farm Charge You For Sr-22 Insurance? Uncovered

The normal length of time is for 3 years however might be as many as 5. insurance. If a vehicle driver is needed to preserve an SR22, the certification should suggest that the corresponding insurance coverage covers any cars that are registered under the chauffeur's name and all vehicles that the chauffeur regularly runs.

If that very same chauffeur, nonetheless, possesses an auto or has routine access to a car, he would certainly need to file a non-owners SR22 certificate. This provides the driver coverage whenever he is allowed to drive a car not his own. The price of an SR22 varies in between insurer.

Insurance firms that do supply SR22 coverage tend to do so at a high cost. SR22 insurance customers additionally certainly pay greater premiums for their minimum obligation insurance coverage (liability insurance).

When initially bought to obtain an SR22, a person will likely initially call their existing auto insurer. Once that takes place, it, however, informs the supplier to the reality that a significant event has taken place. The insurance coverage firm will certainly proceed to access the DMV document to explore why the driver needs the certificate.

Sr22 Insurance - Budget Insurance - Tucson, Az Things To Know Before You Buy

If the plan is terminated, the chauffeur will be compelled to find an alternate choice. A chauffeur is not required to get an SR22 from their existing auto insurance firm.

Normally, a chauffeur is needed to have an SR22 on data for 3 years after a license suspension due to DUI - underinsured. The original certification will certainly stay on data with the DMV as long as either the vehicle insurer or the chauffeur does not cancel the policy. There is no requirement to re-file yearly.

After dealing with apprehension, court days, and also irritating demands from the DMV, the last thing they intend to do is haggle with an insurance policy agent. The bright side is that there are choices. Agencies are around that can assist you find the very best rates for SR22 insurance coverage. Relax Insurance Policy is the SR22 Leader in The Golden State (sr-22).

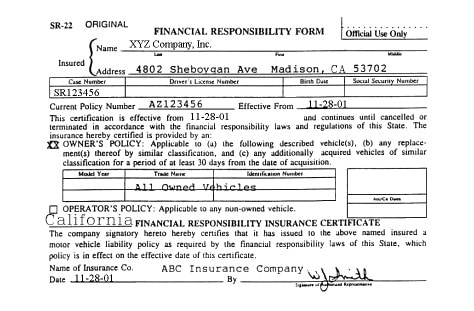

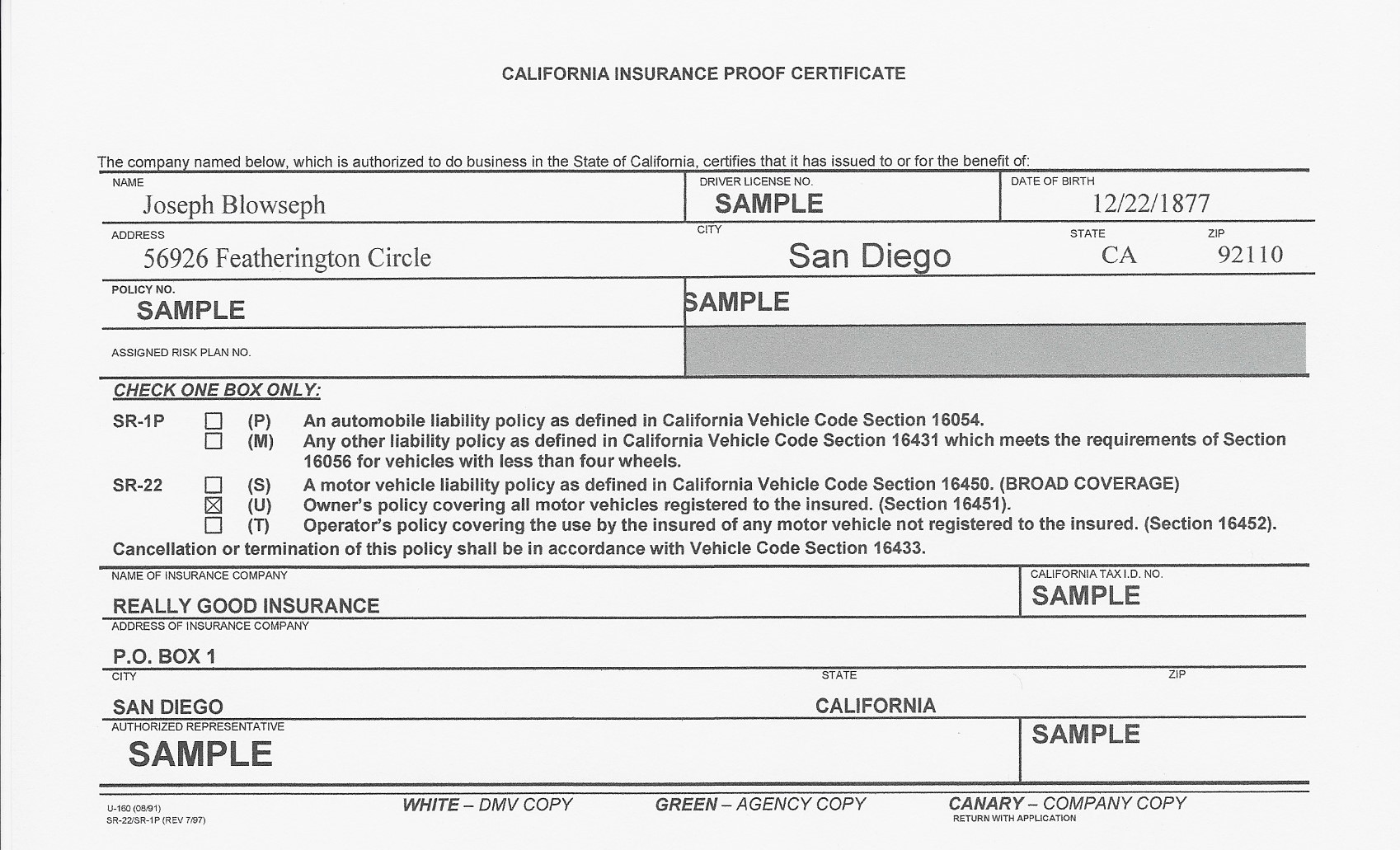

It is not insurance policy or protection, but a method your state ensures your car insurance coverage is energetic. Trick Takeaways An SR22 is a kind your vehicle insurance company sends out to the state so you can abide with court- or state-ordered requirements.

How Much Does Sr22 Insurance Cost A Month? - Idswater.com for Beginners

SR22s can be filed with both typical insurance coverage policies and non-owner insurance. This file confirms that you have actually met your monetary obligation for having the minimum liability insurance coverage.

You'll need to have an SR22 kind from your insurer if your permit has been suspended or withdrawed as well as your opportunities have been restored. If your insurance undergoes any kind of significant modifications or terminations, your insurance coverage provider will certainly notify the state. You might need to maintain an SR22 for a collection duration, such as 3 years.

You contact your insurance company, and also they ought to release you the type once you have purchased the minimum quantity of vehicle insurance. You'll need to keep the minimum quantity of insurance coverage as well as make sure you have an existing SR22 form through set by the state you reside in.

The SR22 can set you back about $25 in filing charges. Your insurance coverage premium will enhance as a result of the violation. Generally, a DUI-related SR22 might cause an increase in insurance expenses by in between 20% as well as 30%. An SR22 provided for without insurance driving is around $30 and also can depend upon your credit history.

Not known Factual Statements About Suspended Driver's License? You May Need An Sr-22 - State ...

If you do not have an auto but have to submit an SR22 as a result of a sentence, you'll need to ask your representative concerning a non-owner policy. These plans cover your driving when you drive another person's lorry or a rental and also price less than insuring a vehicle. If you switch insurance firms while you have an SR22, you'll need to declare a brand-new SR22 before the first plan runs out.

This type tells the state regarding the modification. Getting the filing removed might minimize your rates on your insurance policy. Exactly how Do I Learn if I Still Need SR22 Insurance Policy? You'll require to call the company that released the first demand to figure out if the filing is still necessary. The firm will be either the state DMV or the court system.

In some states, if you cancel your SR22 filing early, you may be required to reactivate the duration over once more, also if you were just a couple of days from the day it was readied to end - motor vehicle safety.

An SR-22 isn't in fact auto insurance policy. SR-22 is a type your insurance coverage company sends to the state's DMV showing that you lug the minimum needed Obligation coverage (credit score). Normally, an SR-22 is submitted with the state for 3 years.

The smart Trick of An Option To Buying - Feb 2002 - Page 58 - Google Books Result That Nobody is Discussing

These level fees have a tendency to be economical, though as reduced as $15 oftentimes. The actual price of an SR-22 in Florida or in any various other state originates from the greater cars and truck insurance policy rates you might pay as a result of the driving infraction that triggered the SR-22 declaring. This is also more accurate when it pertains to the expense of FR-44 insurance coverage due to the fact that it is tied to a DUI sentence.

If that chauffeur creates a crash, though, his ordinary cars and truck insurance policy price leaps to $2,699 per year. That's $768 annually, or 40%, even more than what he would pay with a tidy document - coverage. With a DUI on his record, our example motorist paid approximately $2,821 annually for a full-coverage car insurance plan $890 annually greater than what a driver with a tidy record pays.

Where can I get economical SR-22 insurance policy in Florida? GEICO supplies the most inexpensive SR-22 insurance policy in Florida, according to our data. It additionally provides the most affordable FR-44 insurance in the state. This is based on GEICO providing our example motorist with a DUI or an at-fault mishap on his document the least expensive automobile insurance prices of the business we checked.

Your prices might differ. dui. In this instance, the typical annual quote our sample driver with an at-fault crash received from GEICO was $742 for a full-coverage plan. That's almost $1,000 each year less expensive than the typical quote we received from State Farm, as well as a tremendous $3,721 more affordable than Allstate's ordinary quote.

What Is Sr-22 Insurance And What Does It Do? - Allstate - Truths

Florida's minimum vehicle insurance demands are: An SR-22 proves that your car insurance coverage satisfies these minimal demands. The length of time is SR-22 required in Florida? You will need to have an SR-22 on documents with the state for 3 years. That is how much time most states need risky motorists to file SR-22s, though some need it for longer - insurance.

What are the FR-44 insurance policy requirements in Florida? You need to submit an FR-44 kind with the state if you are founded guilty of driving under the influence (DUI) in Florida.

That claimed, exactly how long you require to maintain an FR-44 filed with the state depends upon your particular circumstance. What is the distinction between SR-22 as well as FR-44 in Florida? The distinction in between SR-22 and FR-44 in Florida is that the state requires you to file an FR-44 if you're founded guilty of driving under the influence, while it requires you to file an SR-22 for various other offenses, like negligent driving or triggering a mishap without insurance.

LLC has actually made every initiative to make sure that the information on this site is right, however we can not assure that it is complimentary of inaccuracies, errors, or noninclusions. All content as well as services provided on or with this website are provided "as is" and also "as readily available" for usage. Quote, Wizard - sr-22. com LLC makes no representations or warranties of any kind of kind, share or indicated, as to the operation of this website or to the details, material, materials, or items consisted of on this site.

The Ultimate Guide To Sr 22 Insurance : How Much Does It Cost

Details Regarding Exactly How to Obtain Affordable SR22 Insurance Policy Quotes Under $7/Month (Mon-Fri, 8am 5pm PST) for a or fill out this form: Components, SR-22 is a kind which proves to the protection offered by an insurance provider. It can additionally vouch for the posting of personal public bonds. In the latter instance, it vouches for the minimal liability coverage for the vehicle driver or the car enrollment.

In certain states it is needed that an SR-22 is brought by the motorist or in the automobile which is signed up. This is a demand if the licensee has already been

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO