The Car Insurance Premiums Rise By £68: How To Save When ... Ideas

As well as don't stress this is specifically what car insurance coverage is for. The excellent news is that accidents do not stay on your document permanently.

Cars and truck insurance firms usually only take the past three-to-five years of your record right into account while calculating your prices. That implies that, after a specific quantity of time has actually passed, an accident will "diminish" your record, and will not be a factor in your insurance premiums any longer, as long as you have actually kept a clean Find more info driving document in the time given that the crash. trucks.

It can be a bargain for chauffeurs who agree to pay a little added for comfort. Not every person is qualified for crash forgiveness it's usually just readily available to vehicle drivers that already have a clean driving history. That indicates, actually, that the motorists who would certainly most need crash forgiveness might not qualify.

The price of the claim - Not all claims are evaluated the exact same; a small fender bender might not raise your costs yet a significant crash where a car is amounted to probably will, Your driving history - If you've gone numerous years with no crashes or violations, your insurance company might not raise your rates for a small accident - insurance.

The Ultimate Guide To Why Did My Auto Insurance Costs Go Up Even When I Didn't File ...

Your insurance policy firm may be more most likely to elevate your prices if you were the at-fault chauffeur Will my prices rise after a no-fault mishap? Your car insurance policy can also action in in instances where you're not at mistake. If you're in a crash triggered by one more vehicle driver, or your parked car is struck, you might still need to sue with your insurance company, which may work with the at-fault chauffeur's insurance to cover your losses (cheapest car).

vehicle insurance risks car insured suvs

vehicle insurance risks car insured suvs

Look around for brand-new insurance policy, Purchasing around for new cars and truck insurance policy protection is just one of one of the most dependable methods to conserve cash on insurance policy expenses. If your current insurance company notifies you that your prices are increasing, it could be worth obtaining some quotes from various other insurance firms to see if you can be obtaining the very same protection for much less. credit score.

3. Wait it out, As we discussed above, accidents don't stay on your document permanently. If you've just filed a claim for an at-fault crash, your rates may increase, once a few years pass that mishap will certainly no more affect your rates. Make certain to do every little thing you can to maintain a clean driving document going forward so you will not have to file any type of more at-fault claims or have insurance claims filed versus you.

Have vehicle insurance sets you back gone up in 2022? Our research likewise reveals a quarterly rise in the cost of auto insurance.

The smart Trick of Why Does My Car Insurance Keep Going Up? - The Balance That Nobody is Discussing

With more people functioning from home and also less commuters, it stands to reason that there could be fewer crashes. As well as police forces throughout the UK reported a 26% drop in the number of road accidents they participated in - car insurance.

/accident-forgiveness-car-insurance-a0bdbc7fad5d46a9b1a41fbfb56c3d82.gif) low-cost auto insurance suvs dui cheaper auto insurance

low-cost auto insurance suvs dui cheaper auto insurance

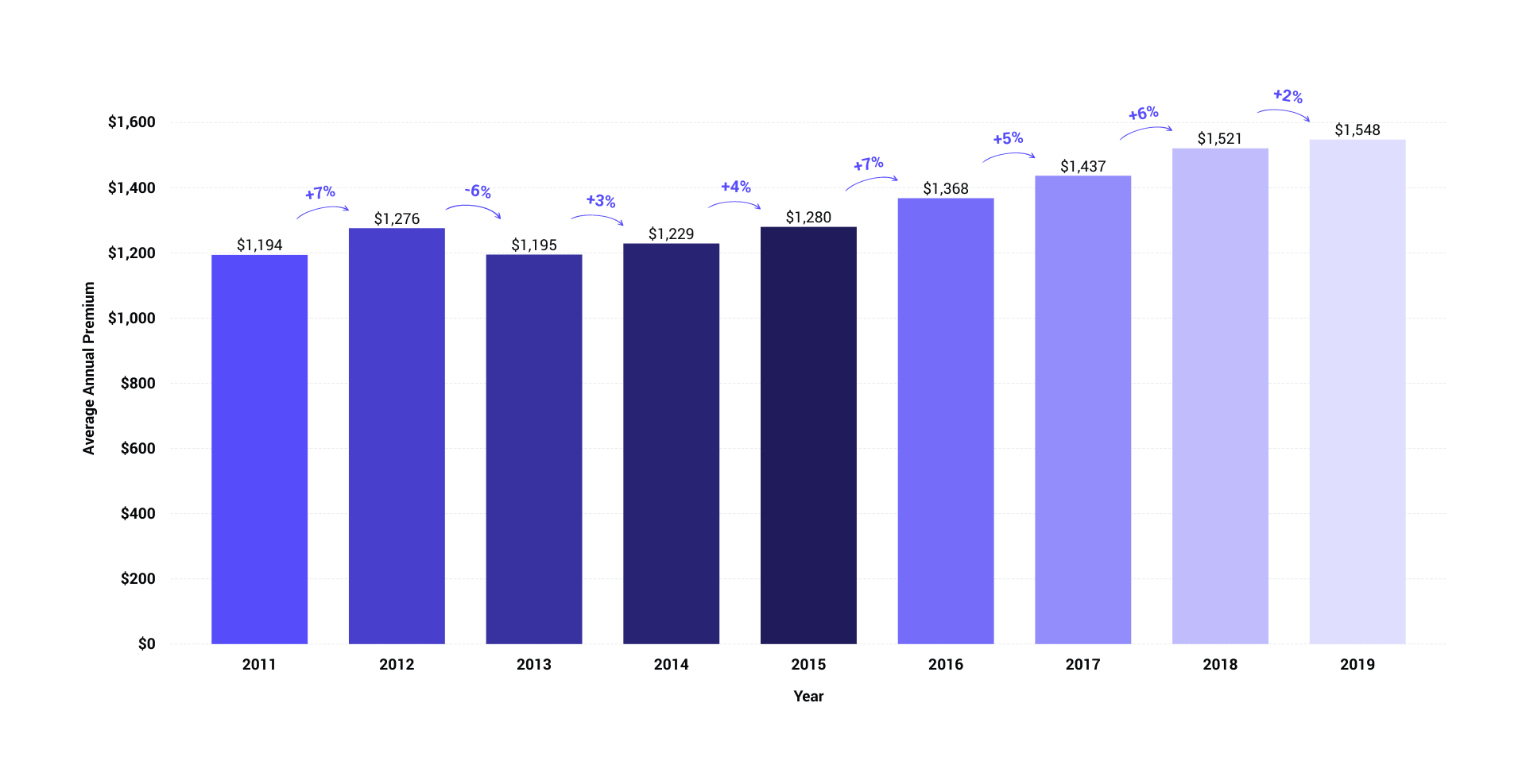

Exactly how have car insurance policy costs transformed over the previous couple of years? Cars and truck insurance coverage costs began to sneak up throughout 2019 as well as 2020 - low cost.

These figures see automobile insurance policy increases throughout the UK. Some people might still find that their auto insurance coverage costs have in fact gone down.

cheaper auto insurance laws insurance insured car

cheaper auto insurance laws insurance insured car

Compare vehicle insurance policy estimates Male drivers pay even more than women Male drivers saw their rates climb much less than ladies. Their auto insurance coverage costs were 2% (13) even more than last quarter.

Rumored Buzz on Why Did My Car Insurance Go Up For No Reason? - Cover

They're presently still paying greater than women for their insurance coverage, at 487, on standard - vehicle insurance. Male vehicle drivers 'riskier' to insurance providers The EU Gender Regulation means insurance companies can not exercise insurance rates based upon whether a motorist is male or female. There are other risk elements that indicate men can have greater premiums.

accident accident cheap auto insurance vans

accident accident cheap auto insurance vans

This generally makes for higher-value claims in the occasion of a crash. Cheapest rate on record for 17-year-olds It's widely understood that more youthful chauffeurs often tend to have much greater insurance policy costs than older, experiences motorists.

With fewer new young motorists on the road, there's a lowered risk of mishaps entailing 17-year-olds. This in turn could minimize the typical auto insurance policy cost for that age group.

cheapest car insurance cheapest car cheaper auto insurance cheapest car

cheapest car insurance cheapest car cheaper auto insurance cheapest car

While this isn't always the case - and also it one of the a lot more common auto insurance policy myths - at a nationwide degree there could be some truth to it. According to our research, automobile insurance prices tend to dip below the 1,000 mark as soon as chauffeurs reach the age of 24. low-cost auto insurance.

What Does If I'm The Victim Of A Hit And Run, Will My Car Insurance Rates ... Do?

According to our fuel cost index, gas costs have gotten on the up since May in 2015. Petroleum prices 1. 63 per litre, and also diesel costs 1. 76, typically (costs proper since April 2022). This is a boost of 35p per litre for fuel and also 36p per litre for diesel.

New guidelines 'make the market extra competitive' Louise O'Shea, CHIEF EXECUTIVE OFFICER, says: "It's fretting that so lots of people thought the prices modifications that came into impact in January would certainly ensure them a cheaper price, and I have no uncertainty they had quite a shock when they got their revival notice and it was greater - cheap insurance.

"Data proves that there still is the need to go shopping about. Yes, prices have boosted. But it's likely that there another insurer can supply a much better price for the cover you require, as the marketplace is extra affordable than ever before." * Study accomplished by One Poll in behalf of Overwhelmed.

Right here are some reasons cars and truck insurance coverage premiums increase. Relocating to a suburb with a higher criminal offense price, altering just how frequently you drive or even car parking your vehicle differently can lead to raised costs; Impacts most things you acquisition, and also automobiles are no exemption. It's common for insurance companies to increase the rate of premiums to show the price of cars.

Little Known Questions About Why Did My Car Insurance Go Up.

It's a good suggestion to contrast plans when taking out or restoring automobile insurance, as it might save you cash. Why does my automobile insurance coverage appear pricey compared to others?

Conversely, Comprehensive insurance policy protects your car in accidents and from climate events, yet it will cost you extra; If you have actually taken out auto insurance policy extras such as hire vehicle or roadside assist, they may come at an added expense; If you've had a number of run-ins with the law when it comes to driving or have made claims in the past, your premiums are usually going to cost even more than a person with a tidy record; The extra typically you drive your cars and truck, the higher your costs is likely to be; Costs being paid month-to-month versus every year might be much more convenient, but you may be struck with an extra fee to do this; If you agree for a lower excess (the amount you pay in the occasion of a crash), the costs you pay will generally be greater; and Your close friend might live in a location that's considered less risky for vehicle theft as well as may pay less for vehicle insurance than you do. cheap.

Naturally, individual factors such as your location, where you park your car as well as how old you are additionally affect exactly how much you pay for vehicle insurance coverage. Maintain in mind that insurance policy is based on your private conditions as well as can't always be contrasted to what others are paying. Discover a lot more concerning how vehicle insurance policy is computed.

Our free comparison service is easy to make use of and also allows you compare a series of costs, bonus, cover choices

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO