The Best Strategy To Use For How Much Is Sr22 Insurance On Average?

The time frame can range from 2 to 5 years, depending on your state as well as the factor you need an SR-22. The SR-22 will certainly continue to be legitimate as long as your vehicle insurance coverage policy is active.

Your permit will certainly be suspended, as well as this moment structure will not count toward the mandated declaring period. As an example, if you're called for to have the SR-22 for three years but cancel your insurance after one year, after that your certificate will certainly be suspended. As soon as you restore your insurance policy and certificate, the clock begins once again and you'll require to have the SR-22 on apply for one more 2 years.

Does SR-22 insurance policy cover any kind of automobile that I drive? Yes, similar to common auto coverage, SR-22 insurance will cover you in any type of car you drive. Nonetheless, if you do not possess a cars and truck, you have to obtain, which does cover you in any car you drive yet obtains a little bit extra complicated when it comes to whose insurance spends for what if you need to make an insurance claim.

While SR-22 insurance policy generally ends after 3 years, the period can differ based upon your driving document and also the state you live in.

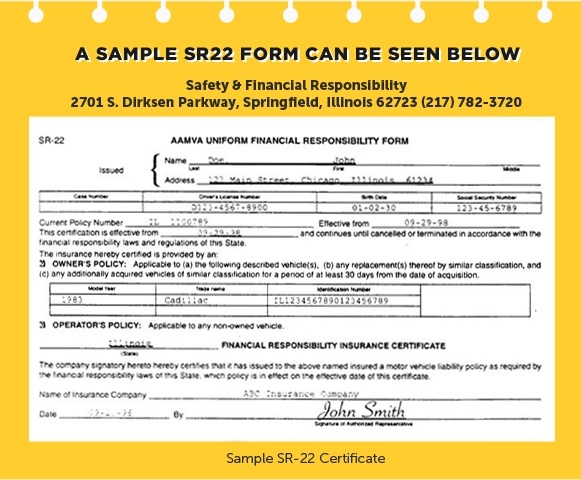

An SR-22 is not an actual "kind" of insurance, yet a kind submitted with your state. This kind offers as evidence your vehicle insurance policy satisfies the minimal responsibility insurance coverage needed by state regulation.

Not known Facts About What Is Sr22 Insurance? Do I Need It? - Getjerry.com

Do I require an SR-22/ FR-44?: DUI convictions Reckless driving Accidents created by uninsured chauffeurs If you require an SR-22/ FR-44, the courts or your state Electric motor Lorry Division will certainly alert you. insurance companies.

Current Consumers can contact our Client Service Department at ( 877) 206-0215. We will examine the insurance coverages on your plan and also start the procedure of submitting the certificate in your place. Is there a charge related to an SR-22/ FR-44? Most states bill a level charge, but others require a surcharge. This is a single fee you need to pay when we submit the SR-22/ FR-44.

A filing fee is billed for every private SR-22/ FR-44 we submit. As an example, if your partner is on your plan and also both of you need an SR-22/ FR-44, then the declaring fee will certainly be billed two times (liability insurance). Please note: The cost is not consisted of in the price quote because the declaring fee can differ.

The length of time is the SR-22/ FR-44 valid? Your SR-22/ FR-44 ought to be legitimate as long as your insurance coverage is active. If your insurance coverage is terminated while you're still required to bring an SR-22/ FR-44, we are called for to notify the correct state authorities. If you do not preserve continual coverage you can shed your driving benefits.

(Mon-Fri, 8am 5pm PST) for a of your SR22 Texas, or load out this type: Discover (sr-22). What it is, that needs it, SR22 Texas Insurance estimates, companies, contrasts, what it covers, just how it works, uniqueness for Texas state, exactly how to get SR22 car insurance coverage, renewal and/or expiry and also a lot a lot more.

Some Known Details About Protect Yourself With Sr22 Liability Insurance From Breathe Easy

While this might be real, there are numerous as to why an individual can be expected to buy an SR22. SR-22 a sort of car insurance coverage. In truth, it is simply a file requested via the (Department of Electric Motor Autos) that has actually to be completed as well as certified by using a qualified car insurer - insurance companies.

It is a main certification by your insurance policy coverage business that you have actually preserved continuous car coverage for the thirty-day duration it is in fact submitted. In case your certificate is suspended because of many web traffic points, you might be requested to submit an SR-22 for 3 years (motor vehicle safety).

In case your permit is in fact suspended because of a DUI, you could have to in addition file an SR22 to obtain your certificate back once again. Without SR22 insurance coverage, you truly your existing license and also. The SR-22 Kind for the SR22 Insurance Coverage Texas, SR22 vehicle insurance policy protection is considered "" insurance policy coverage. auto insurance.

Because of the fact that SR 22 regulations and treatments in between states, car drivers are encouraged to select an insurance business that comprehends their requirements and also might well of SR-22 declaring. Receiving a could cause as well as on top of that your chauffeur's license revocation if you do not know the fees and - liability insurance.

Whole lots of individuals also lorry insurance coverage plan contrasted to their typical plans,,,,,, and are the best insurance policy firms today. You can contact them by filling up in heaven box on this webpage to obtain the most inexpensive costs costs for your SR-22 insurance coverage in Texas.

Excitement About Sr-22 Insurance- What Is It And How Does It Work? - Geico

It truly depends upon which state you stay in as well as the number of infractions you have sustained. That is why the most effective action you can take is to ask for an estimate online. Thinking about that SR22 insurance policy coverage is a type of insurance policy that you will certainly require to get if you have significant website traffic disobediences, having the insurance coverage plan suggests you are a higher risk cars and truck vehicle driver, therefore, it can trigger an increased SR22 insurance policy price (sr22).

Each car insurance protection agency will use an unique price to have an SR-22 form, nevertheless, ensure to understand specifically why they can be unique. auto insurance. The SR22 insurance policy quotes from one certain company contrasted to another could be around 50% higher. Some agencies may have greater SR22 rates or there might be accessory benefits with their protection over the real more economical insurance coverage.

The SR22 Texas certification can be found in three types: Driver's Certificate This insurance coverage covers a vehicle driver throughout the vehicle's procedure including any non-owned auto (sr-22). Whenever the driver does not possess a motor car, an economic commitment requirement may likely exist with the Operator's Certificate. Owner's Certification This particular insurance coverage covers an auto possessed by the automobile driver.

Operator-Owner Certification This certification covers all automobiles had or non-owned by the driver. An SR22 might be gotten by connecting with an excellent service provider that is recognized to develop SR-22 insurance coverage plans for Texas. As soon as settlement is made to the service provider, a broker will likely send out a brand-new request when it come to SR-22 documents for the headquarters - sr22 coverage.

This procedure may take roughly thirty day. Following authorization, the person will receive a duplicate of the SR22 kind from an insurance policy service provider and likewise a letter from the State's Assistant. As promptly as the insurance coverage policy is authorized, it has actually to be maintained for a duration of three years.

Some Ideas on Sr22 Insurance: What Is Sr22 - Magnum Insurance You Should Know

Specs of When you bring an SR22 in one state however transfer to a various state, you need to fulfill the SR22 declaring demand for your previous state, although you no longer stay there. Your insurance protection for the brand-new state has to have liability limits which fulfill the minimums called for by regulation in your coming before state (underinsured).

While you may have a California policy, you'll be able to file an SR22 Texas up until the probationary period ends. Instance B: from a various State to Texas, Need to you be living in The golden state and relocate to Texas, you do not need to submit an SR-22 with Texas (barring any particular problems), as the state of Texas will not need you to lug an SR-22 declaring according to your driving background in California.

, about basic non-owner cars and truck insurance coverage as well as various other non proprietors insurance policy. SR22 Texas auto insurance coverage is equivalent to normal car insurance protection in several methods. The essential distinction is the fact that in comparison to conventional lorry insurance, the provider that gives you an SR22 Bond will certainly be called for by the government to notify the Public Security Texas Division in case your policy finishes.

In Texas, this is for that's harmed in a car crash that is your very own fault, with an optimum quantity of for auto. Clearly, you might purchase far more protection with an SR22 vehicle insurance coverage if you actually desire to do so. Not always! Because you could be getting SR22 car insurance policy protection in the first place (considering that you might have done something to trigger the retraction of your driver's certificate), you'll probably be put in a, as well as will consequently have to pay better than you normally would to continue your insurance coverage. insurance.

You'll

Welkom bij

Beter HBO

© 2024 Gemaakt door Beter HBO.

Verzorgd door

![]()

Je moet lid zijn van Beter HBO om reacties te kunnen toevoegen!

Wordt lid van Beter HBO